Why Business Owners Need Flexible Financial Tools

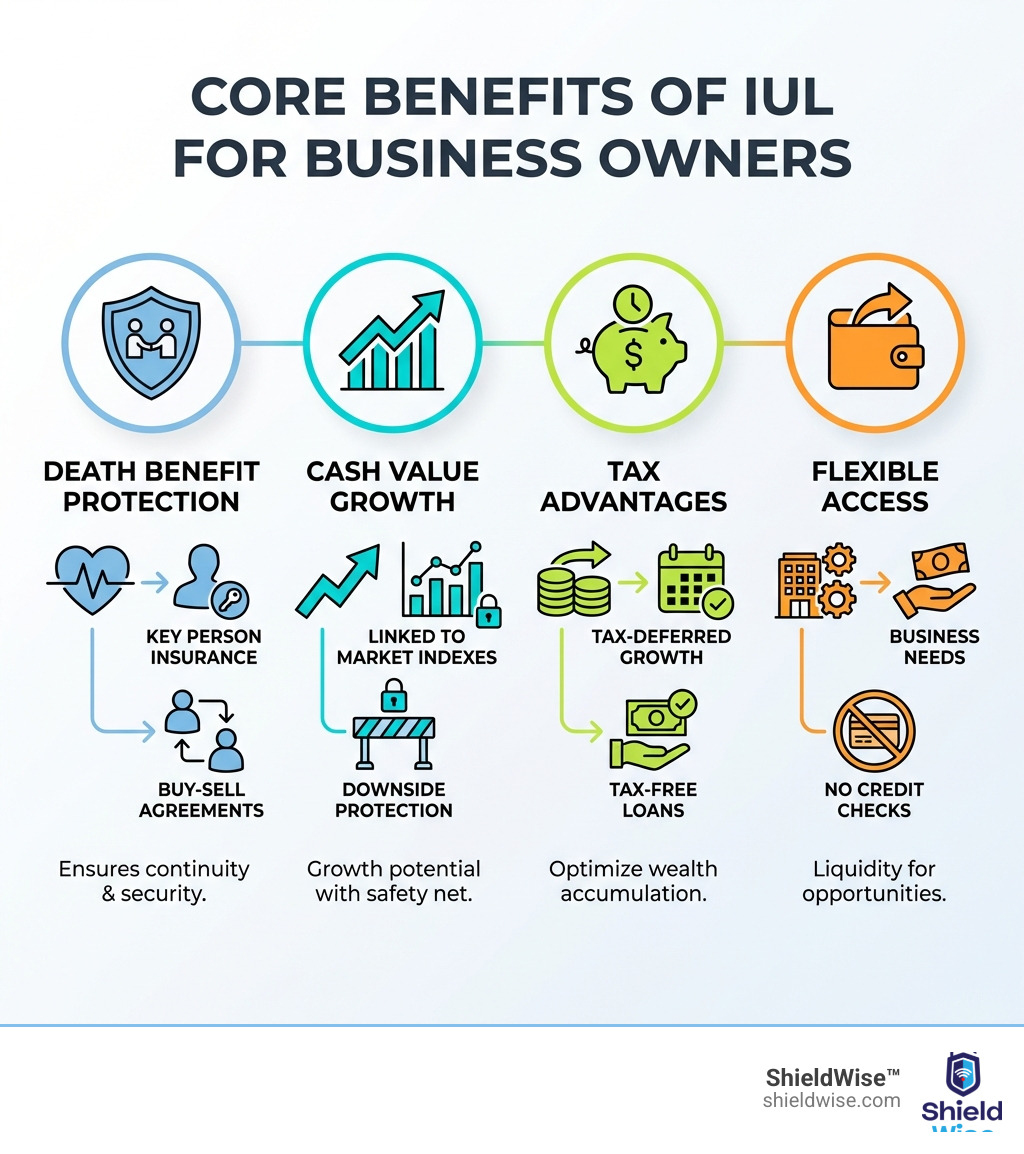

More entrepreneurs are asking how business owners use indexed universal life (IUL) insurance, seeking strategies that extend beyond a simple death benefit. Business owners face unique financial pressures, from protecting their company’s future to funding growth and planning a smooth exit. IUL has emerged as a versatile tool that can address multiple business needs simultaneously.

Here’s how business owners commonly use IUL:

- Fund buy-sell agreements to ensure smooth ownership transitions when a partner dies

- Provide key person insurance to protect the business from the financial loss of a critical employee

- Create executive bonus plans that attract and retain top talent with tax-advantaged benefits

- Access cash value through policy loans for emergency liquidity or business expansion

- Build tax-deferred wealth while maintaining flexible access to funds

- Plan business succession by equalizing inheritances among heirs and minimizing estate taxes

IUL combines permanent life insurance protection with a cash value component that grows based on market index performance—without direct market risk. The policy offers flexibility in premiums and death benefits, tax-advantaged growth, and the ability to access funds when opportunities or challenges arise. For business owners juggling multiple financial priorities, this combination of protection, growth potential, and liquidity makes IUL worth understanding.

At ShieldWise, we’ve guided business owners and their families through complex insurance decisions for years, including evaluating how business owners use indexed universal life to protect their enterprises and build long-term wealth. Our mission is to cut through the complexity and help you determine if IUL fits your specific business and personal goals.

Understanding Indexed Universal Life (IUL) as a Business Tool

For business owners, life insurance often means personal protection. But modern policies like Indexed Universal Life (IUL) are also powerful financial instruments that can support your business’s growth, stability, and long-term vision.

What is IUL and How Does It Work?

Indexed Universal Life (IUL) is a type of permanent life insurance that offers a lifelong death benefit as long as premiums are paid. It also has a cash value component with growth potential. Unlike other policies, an IUL’s cash value growth is tied to the performance of a market index, like the S&P 500. Your money isn’t directly in the stock market; instead, the interest credited is linked to the index’s performance. This allows you to participate in market gains without exposing your principal to market losses.

This blend of coverage and market-linked growth makes IUL appealing to business owners, providing a death benefit and a cash reserve you can access. Learn more in our guides on What is IUL? and How Does IUL Work?.

The Mechanics of Cash Value Growth

The growth of IUL cash value is often misunderstood. It’s not a direct investment but an indirect participation in market gains, managed by these mechanisms:

- Index Crediting: Interest is credited based on a market index like the S&P 500. Calculation methods vary, so it’s important to understand your policy’s specific method.

- Floor (0% Protection): A key advantage is the ‘floor,’ typically 0% or 1%. If the market index is negative, your cash value won’t lose money due to market performance, protecting your principal.

- Cap (Upside Limit): To balance the floor, policies have a ‘cap rate,’ the maximum interest your policy can earn in a year. If the index gains 15% and your cap is 10%, you’re credited 10%.

- Participation Rate: Some policies have a ‘participation rate,’ which is the percentage of the index’s gains credited to your cash value. An 80% participation rate on a 10% index gain results in an 8% credit (subject to the cap).

These features offer market-linked growth with a safety net. If the market drops, your cash value is protected from the fall. Learn more in our article on How Cash Value Works in Indexed Universal Life.

IUL vs. Other Insurance: Term and Whole Life

Let’s see how IUL compares to Term and Whole Life insurance for business use.

| Feature | Term Life Insurance | Whole Life Insurance | Indexed Universal Life (IUL) Insurance |

|---|---|---|---|

| Duration | Temporary (fixed term, e.g., 10, 20, 30 years) | Permanent (lifelong) | Permanent (lifelong) |

| Cash Value | None | Guaranteed, fixed rate growth | Market-indexed growth (caps/floors), potential for higher returns |

| Cost | Most affordable initially | Higher, fixed premiums | More flexible, generally less than whole life, more than term initially |

| Flexibility | Limited (fixed death benefit, fixed premiums) | Limited (fixed death benefit, fixed premiums) | High (adjustable premiums, adjustable death benefit) |

| Growth Potential | None (pure death benefit) | Modest, guaranteed growth | Market-linked growth potential with downside protection |

| Access to Funds | None | Loans/withdrawals against guaranteed cash value | Loans/withdrawals against market-linked cash value |

| Primary Use | Income replacement, covering specific debts | Estate planning, guaranteed wealth transfer | Business planning, retirement income, liquidity, wealth accumulation |

Term life provides temporary coverage for a specific period and is the most affordable option for a large death benefit. It’s ideal for needs that expire, like a business loan, but has no cash value.

Whole life offers lifetime protection with a cash value that grows at a guaranteed, fixed rate. It’s stable but less flexible and often more expensive than IUL.

IUL combines lifelong coverage with market-linked cash value growth and significant flexibility in premiums and death benefits. This adaptability is a major draw for entrepreneurs with changing business needs. Learn more in our Universal Life Term Versus Permanent guide.

How Business Owners Use Indexed Universal Life for Growth and Continuity

Business owners are constantly thinking about the future—growth, stability, and ensuring their legacy. How business owners use indexed universal life extends far beyond traditional personal insurance, becoming a strategic asset for these very goals.

Funding Buy-Sell Agreements for Seamless Transitions

If a business partner unexpectedly passes away, a buy-sell agreement funded by life insurance can prevent forced liquidation or unwanted new partners. This legally binding contract ensures business continuity by providing a clear path for ownership transfer. Funding this agreement with indexed universal life insurance (IUL) is highly advantageous.

When an owner passes, the IUL policy’s death benefit provides immediate, tax-free liquidity to purchase the deceased owner’s share from their heirs, allowing the business to operate smoothly. IUL offers a secure way to fund these agreements, rather than relying on savings or loans.

Common structures include:

- Cross-purchase agreements: Each owner holds a policy on the other partners.

- Entity-purchase plans: The business owns policies on each owner.

The policy’s cash value also provides flexibility for buyouts due to retirement or disability, making IUL a crucial tool for securing a business’s future.

Protecting Your Business with Key Person Insurance

Losing a key individual—a founder, top salesperson, or lead engineer—can disrupt operations and cause significant financial loss. Key person insurance, for which IUL is an excellent fit, protects against this. The business takes out a policy on a critical employee and receives the death benefit if that person dies.

This cash influx can:

- Cover lost revenue and profits.

- Fund the recruitment and training of a replacement.

- Pay off business debts or stabilize operations.

The death benefit from an IUL policy serves as key person insurance, helping a business remain stable during uncertain times. Furthermore, the policy’s cash value can serve as collateral for business loans, providing additional financial leverage.

Attracting and Retaining Top Talent with Executive Bonuses

To attract and retain top talent, an executive bonus plan funded with IUL is a highly effective strategy. Under a Section 162 plan, the business pays the premiums on an IUL policy owned by a key employee. These premiums are a bonus to the employee and generally tax-deductible for the company.

This arrangement offers a win-win:

- For the employee: They receive a valuable asset with lifelong protection and a cash value that can supplement their retirement income tax-efficiently. Learn more about Retirement strategies and Using Life Insurance in Retirement Planning.

- For the business: It’s a powerful retention tool, and the premium payments can be a tax-deductible expense.

The business rewards valuable employees, fostering loyalty, while the employee gains financial security.

Leveraging IUL for Financial Strength and Flexibility

Beyond protecting against unforeseen events, how business owners use indexed universal life also involves strategically building financial strength and maintaining flexibility for future opportunities or challenges.

Open uping Tax-Advantaged Growth and Access

A compelling feature of IUL for business owners is its tax advantages, which are invaluable for tax-efficient growth and access.

- Tax-Deferred Growth: Cash value grows tax-deferred, allowing for more efficient compounding.

- Tax-Free Policy Loans: Properly structured policy loans are generally income-tax-free, providing flexible funds without a taxable event.

- Tax-Free Death Benefit: The death benefit is typically paid to beneficiaries income-tax-free.

- Hedging Against Future Tax Increases: IUL can provide tax-free income via policy loans, acting as a strategic hedge against future tax hikes. This is relevant when exploring Affordable Insurance Solutions for Retirees.

This combination of tax-advantaged savings, loans, and death benefit makes IUL a powerful tool for wealth accumulation.

How business owners use indexed universal life for liquidity and expansion

Liquidity is critical for any business, and IUL provides ready access to capital. The cash value in an IUL policy is a liquid asset that can act as an emergency fund or a source of capital for expansion.

- Emergency Fund: Policy loans can provide rapid funds to cover unforeseen expenses like equipment failure or a drop in sales, keeping your business afloat.

- Seizing Opportunities: The cash value can provide quick capital to acquire a competitor, invest in new technology, or expand into a new market.

- Flexible Loan Repayment: Unlike bank loans, IUL policy loans have no fixed repayment schedule. You can repay on your own terms, though interest accrues and an outstanding loan will reduce the death benefit.

- No Credit Checks: Since you’re borrowing against your own cash value, policy loans don’t require credit checks, making them a swift source of capital. Learn more at How IUL Loans Work.

This quick, flexible, and tax-advantaged liquidity makes IUL an invaluable asset for financial agility.

Securing Your Legacy: IUL in Succession and Estate Planning

Business owners often pour their heart and soul into building their enterprises. Ensuring its successful continuation and passing on their wealth in a way that respects their wishes and minimizes family strife is a critical concern. How business owners use indexed universal life plays a pivotal role in legacy planning.

How business owners use indexed universal life for family business transitions

Transitioning a family business to the next generation requires balancing finances and family harmony. IUL can be a strategic tool in this process. For instance, if only one child is in the business, an IUL policy’s death benefit can provide a substantial, equitable inheritance to non-business heirs. This prevents forcing the sale of the business to pay out shares and helps maintain family harmony. For more on family protection, visit Universal Life for Families and Protection.

Estate Equalization and Tax Minimization

IUL can directly address complex estate planning issues for business owners.

- Equalizing Inheritances: An IUL’s tax-free death benefit can ensure non-business heirs receive an inheritance equivalent to the business’s value, preventing disputes. This is a key use in estate and succession planning.

- Funding Estate Taxes: For large estates, the death benefit provides liquidity to pay estate taxes without forcing heirs to sell business assets.

- Wealth Transfer: IUL facilitates an efficient, tax-advantaged transfer of wealth, preserving your legacy. It’s a forward-thinking tool for long-term wealth strategies, as noted by sources like Insurance News Net.

Is IUL the Right Move for Your Business? Key Considerations

While IUL offers a compelling array of benefits for business owners, it’s not a one-size-fits-all solution. Understanding its nuances, potential risks, and how to structure it effectively is crucial.

Understanding the Risks and Common Misunderstandings

IUL is a sophisticated product with important considerations:

- Policy Costs & Fees: IUL policies have fees (cost of insurance, administrative, surrender charges) that can impact cash value growth, especially early on. Understand your policy’s fee structure.

- Performance is Not Guaranteed: While the floor offers downside protection, the cap and participation rate mean cash value growth will vary. It is not a guaranteed investment.

- Policy Lapse Risk: A policy can lapse if underfunded, meaning the cash value can’t cover policy costs. This can result from low premiums or poor index performance. Proper funding and regular reviews are essential. Maximizing contributions can strengthen a policy and help prevent a lapse.

- Complexity: IUL can be complex. Working with a knowledgeable professional is crucial. For a comprehensive overview, see our What is an IUL? Complete Guide.

Common misunderstandings include viewing IUL as a direct stock market investment (it’s not) or expecting uncapped returns (there are caps). We believe in transparency and helping you understand the practicalities.

Structuring Your Policy for Maximum Flexibility

IUL’s flexibility is a great strength for business owners, allowing you to adapt the policy to your evolving financial situation.

- Adjustable Premiums: You can often adjust premium payments within limits, offering flexibility during fluctuating business cycles. Pay less when cash flow is tight or more to accelerate cash value growth.

- Flexible Death Benefit: The death benefit can also be adjusted (within IRS guidelines) to match your changing protection needs.

- Adapting to Business Cycles: This flexibility makes IUL well-suited for businesses experiencing growth or contraction. The policy can be customized to your financial capacity and objectives. Our Universal Life Cash Value and Flexibility resource provides more insights.

Questions to Ask Your Financial Professional

Choosing the right IUL strategy requires expert guidance. When you speak with a financial professional, come prepared with these questions:

- What are the specific cap rates, floor rates, and participation rates for the IUL policies you recommend, and how have they performed historically?

- How do the fees and charges of this IUL policy impact its long-term cash value growth?

- Given my business’s current cash flow and projected growth, how should we structure premiums to ensure the policy remains healthy and doesn’t lapse?

- How does this IUL strategy integrate with my overall business succession plan and personal estate planning goals?

- What are the tax implications of accessing the cash value through loans or withdrawals for my business and personal situation?

- Can you provide illustrations showing the policy’s performance under different market scenarios (e.g., average, conservative, and poor index performance)?

- How will this IUL policy help me mitigate risks associated with changes in business ownership and maximize business value prior to a sale?

- When is IUL a suitable choice for a business owner compared to other financial tools or insurance products like term or whole life insurance, given my specific needs?

- How can this IUL policy be used to address potential tax increases in retirement, particularly for a business owner?

Frequently Asked Questions about IUL for Business Owners

We often hear common questions from business owners exploring IUL. Let’s address some of the most frequent ones.

Can my business pay for my life insurance premiums?

Yes, in certain situations, your business can pay the premiums. This occurs under specific arrangements:

- Business-Owned Policies: For key person insurance or some buy-sell agreements, the business owns the policy, pays the premiums, and is the beneficiary.

- Executive Bonus Plans (Section 162): The business pays the premium as a bonus to the employee, which is generally tax-deductible for the company.

- Split-Dollar Arrangements: These are more complex setups where the employer and employee share policy costs and benefits.

The tax implications can be intricate, so always consult a tax professional.

Are IUL premiums tax-deductible for a business?

Generally, premiums are not tax-deductible if the business is a beneficiary (e.g., key person insurance). An exception is:

- Executive Bonus Plans: Under a Section 162 plan, premium payments are considered compensation and are typically tax-deductible for the business. The employee owes income tax on the bonus.

While premiums may not be deductible, the death benefit is typically received income-tax-free. Always consult a tax professional for your specific situation in Illinois.

What happens to the cash value if the stock market goes down?

Thanks to the policy’s ‘floor’ (typically 0% or 1%), your cash value is protected from losses due to a decline in the linked stock market index.

- Principal Protection: If the linked index drops, your cash value will be credited with 0% interest for that period. You won’t gain, but you won’t lose principal due to market performance.

- No Direct Market Losses: This provides a safety net not found in direct stock market investments.

- Missed Gains During Recovery: While protected from losses, the cap rate may limit gains during a strong market recovery. The long-term goal of IUL is consistent, protected growth.

This downside protection offers peace of mind, knowing your accumulated cash value is safeguarded from market crashes.

Conclusion

How business owners use indexed universal life insurance is a testament to its flexibility and comprehensive benefits. From ensuring business continuity through buy-sell agreements and protecting against the loss of key personnel, to attracting top talent with executive bonus plans and providing crucial liquidity for expansion or emergencies, IUL is a multifaceted financial tool.

It serves as a powerful instrument for legacy planning, enabling smooth family business transitions, equalizing inheritances, and minimizing estate taxes. With its tax-advantaged growth and access to cash value, IUL offers a strategic way to build wealth while providing lifelong protection.

At ShieldWise, we understand the unique challenges and aspirations of business owners. We’re here to provide clear, jargon-free guidance to help you steer the complexities of IUL and determine if it’s the right solution to open up your business’s full potential.

Ready to explore how IUL can support your business goals? Explore Universal Life Insurance solutions with us today.