Why You Might Be Considering a Policy Change

How to move from term life to universal life is a decision many policyholders face when their term coverage is nearing its end or their financial needs have changed. Here’s the basic process:

Quick Answer: Converting Term to Universal Life

- Check your term policy for a conversion rider (usually allows conversion before age 65-75)

- Contact your insurance company to request conversion paperwork

- Choose your coverage amount (can convert all or part of your policy)

- Complete the application (typically no medical exam required)

- Review and sign the new universal life policy documents

- Begin paying new premiums (will be higher than term rates)

The conversion itself is free, but your premiums will increase significantly—often 5-10 times your current term rate—because universal life provides lifelong coverage and builds cash value.

Most term policies include a conversion option that lets you switch to permanent coverage without a new medical exam, which can be valuable if your health has declined. The key is to act before your conversion deadline expires, which is typically 10-20 years into your term or before you reach age 65-70, depending on your insurer’s rules.

At ShieldWise, we’ve guided countless families through insurance transitions, including helping them understand how to move from term life to universal life when their protection needs evolve beyond temporary coverage. Our mission is to cut through insurance complexity and provide clear, unbiased guidance you can actually use.

Understanding Term-to-Universal Life Conversion

So, what exactly is a term-to-universal life insurance conversion? In simple terms, it’s your policy’s superpower! Many term life insurance policies come with a built-in “conversion rider” or option. This fantastic feature allows you to exchange your temporary term policy for a permanent life insurance policy, such as Universal Life (UL), without needing to undergo a new medical exam or health underwriting.

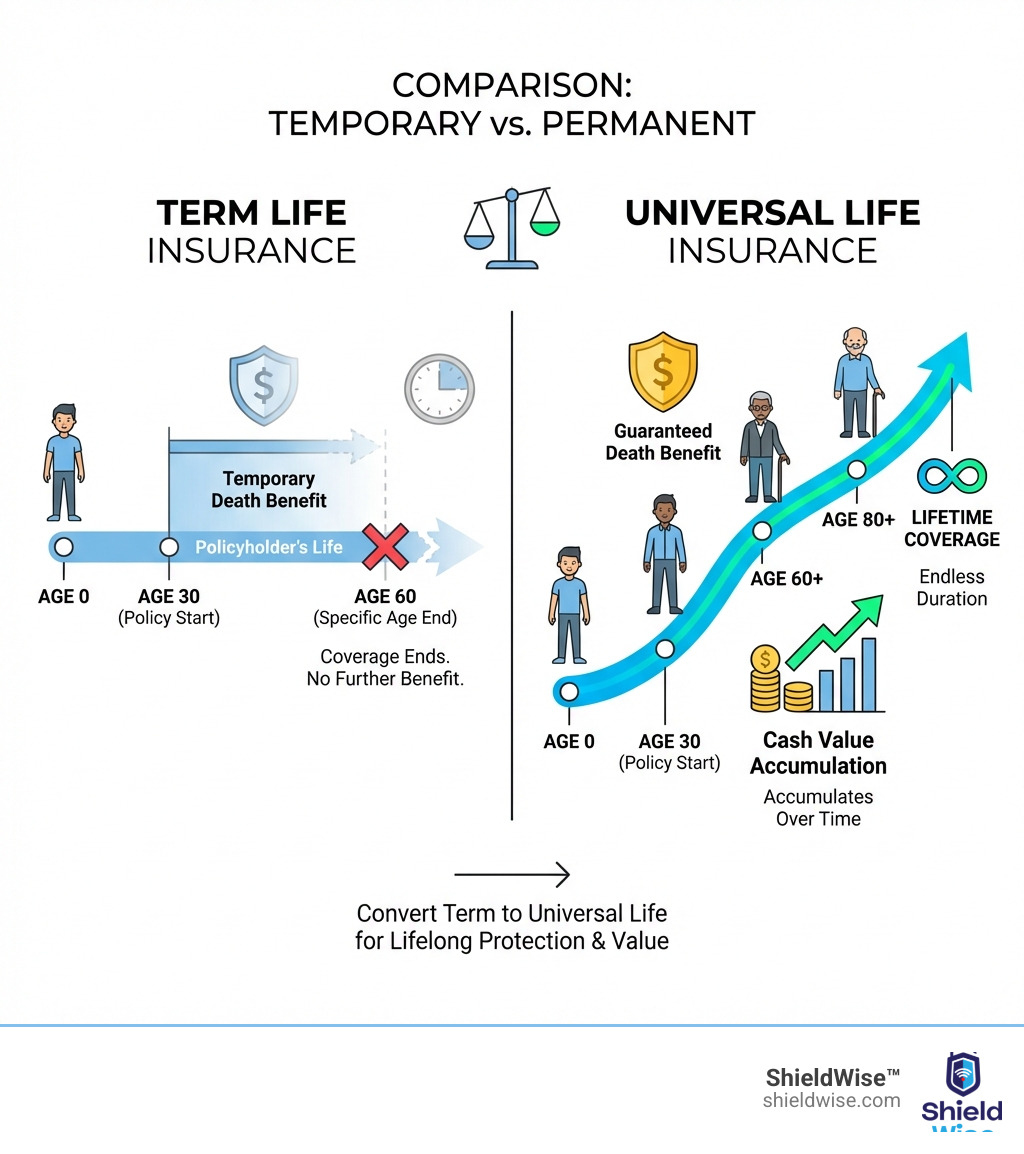

Think of it this way: your term policy was like renting a house for a set period. It served its purpose, providing protection for a specific number of years, perhaps while your children were young or you had a mortgage. But now, your needs have changed, and you’re considering buying a home that offers long-term stability and the potential for equity growth. That’s what converting to Universal Life can feel like.

Universal Life insurance offers lifelong coverage, meaning it won’t expire as long as premiums are paid and the policy maintains sufficient cash value. This provides your loved ones with protection throughout your entire lifetime, a significant shift from the limited duration of term insurance. The conversion option is particularly valuable because it allows you to lock in your original health rating from when you first purchased your term policy, even if your health has changed since then. This can translate to more favorable premiums than if you were to apply for a brand-new permanent policy with current health conditions.

We understand that navigating these options can feel like deciphering ancient scrolls. That’s why we’ve put together a comprehensive guide to understanding Universal Life insurance. For a deeper dive into UL, check out our Universal Life Insurance Guide 2026.

Benefits of Converting to Universal Life

Converting your term life insurance to Universal Life can open up a treasure chest of benefits, especially if your financial landscape and long-term goals have evolved. Here’s why many policyholders choose this path:

- Lifelong Coverage: The most fundamental benefit is permanent protection. Unlike term insurance that expires, Universal Life ensures your beneficiaries receive a death benefit no matter when you pass away, as long as the policy remains in force. This provides enduring peace of mind.

- Cash Value Accumulation: A significant perk of Universal Life is its cash value component. A portion of your premium payments goes into this account, which grows over time on a tax-deferred basis. This cash value isn’t just a number on a statement; it’s an asset you can access during your lifetime. You can typically borrow against it or make withdrawals, offering a flexible financial resource for emergencies, educational expenses, or supplementing retirement income. Curious about how this works? Learn more about How Cash Value Works in Indexed Universal Life.

- Premium Flexibility: Universal Life policies are known for their flexibility. Within certain limits, you may be able to adjust your premium payments. If your financial situation fluctuates, you might be able to pay less (or more) into the policy, as long as the cash value can cover the policy’s internal costs. This adaptability can be a lifesaver during unexpected financial shifts.

- Death Benefit Flexibility: Some Universal Life policies also allow for adjustments to the death benefit. You might be able to increase or decrease it to align with your changing protection needs.

- Guaranteed Acceptance (No New Medical Exam): This is a huge advantage, especially if your health has declined since you first purchased your term policy. When you convert, your insurer typically waives the need for a new medical exam, basing your eligibility and initial health rating on your original term policy application. This guarantees you coverage you might otherwise struggle to obtain.

- Estate Planning: Universal Life insurance can be a powerful tool for estate planning. The death benefit is generally paid out income tax-free to your beneficiaries and can help cover estate taxes, equalize inheritances, or provide funds for specific legacies. For example, if you have accumulated significant wealth, a UL policy can help your heirs manage federal estate taxes that apply to estates worth more than $13.99 million for a single person in 2025.

Drawbacks and Costs of Converting

While the benefits are compelling, it’s important to approach conversion with open eyes. Like any significant financial decision, there are potential drawbacks and costs to consider when you move from term life to universal life:

- Higher Premiums: This is typically the most noticeable change. Universal Life premiums are significantly higher than term life premiums for the same death benefit. Why? Because UL offers lifelong coverage and builds cash value, making it a more robust and complex product. While the conversion process itself usually has no direct fee, your ongoing premium payments will definitely jump.

- Policy Fees and Charges: Universal Life policies come with various internal fees and charges that can impact cash value growth. These might include mortality charges, administrative fees, and surrender charges. Surrender charges, in particular, are important to note; they typically apply during the first 5-15 years if you surrender the policy.

- Complexity: Universal Life insurance, especially certain types like Indexed Universal Life (IUL) or Variable Universal Life (VUL), can be more complex than straightforward term or even whole life policies. Understanding how cash value grows (which might be tied to market indexes in IUL or investment sub-accounts in VUL) and how fees impact your policy requires a bit more homework. We aim to simplify this, and our article on Universal Life Cash Value and Flexibility can help clarify some aspects.

- Cash Value Growth Time: While UL builds cash value, it’s not an overnight process. It can take several years for the cash value to accumulate significantly, especially in the early years when policy fees are higher. If immediate access to a large cash sum is your primary goal, it might not materialize as quickly as you’d hope.

- Interest Rate Risk (for some UL types): Traditional Universal Life policies have cash value growth tied to interest rates, which can fluctuate. While some UL policies offer guarantees, others may see their cash value grow slower in low-interest-rate environments. This is a factor to consider in your long-term financial planning.

Universal Life: Key Features for Conversion

When considering how to move from term life to universal life, it’s crucial to understand what makes Universal Life stand out from other permanent options, particularly Whole Life. While both offer lifelong coverage and cash value, UL provides a distinct level of flexibility that appeals to many.

Here’s a comparison of key features, helping you understand the nuances:

| Feature | Universal Life (UL) | Whole Life |

|---|---|---|

| Premium Structure | Flexible premiums; you can often adjust payment amounts and frequency within certain limits. | Fixed, level premiums that are guaranteed not to increase. |

| Death Benefit | Flexible; can often be increased (with new underwriting) or decreased. | Fixed, guaranteed death benefit. |

| Cash Value Growth | Grows based on interest rates set by the insurer, which can fluctuate. Some policies have a guaranteed minimum interest rate. | Grows at a guaranteed, fixed rate, plus potential non-guaranteed dividends (from mutual companies). |

| Guarantees | Death benefit is guaranteed as long as premiums are paid or cash value covers costs. Minimum interest rate may be guaranteed. | Premiums, death benefit, and cash value growth are all guaranteed. |

| Flexibility | High. Allows for changes to premiums and death benefits to adapt to life changes. | Low. Policy structure is fixed and cannot be easily changed. |

| Best For | Individuals who want lifelong coverage with flexibility to adjust their policy as their financial situation changes. | Individuals who want lifelong coverage with predictable costs and strong guarantees, and prefer a “set it and forget it” approach. |

The Step-by-Step Guide on How to Move from Term Life to Universal Life

Ready to take the plunge? Converting your term policy to Universal Life doesn’t have to be daunting. Here’s our step-by-step guide on how to move from term life to universal life smoothly:

Step 1: Review Your Current Term Policy for a Conversion Rider

First things first, dust off your existing term life insurance policy documents. You’re looking for a “conversion rider” or a clause that explicitly states your option to convert. Most modern term policies include this feature, often at no additional cost.

Pay close attention to two critical details:

- The Conversion Deadline: This is the absolute last day you can exercise your conversion option. It’s often defined by a specific number of years from your policy’s start date (e.g., within the first 10 or 15 years of a 20-year policy) or a maximum age limit (e.g., before you turn 65 or 70), whichever comes first. Missing this deadline means you forfeit the guaranteed conversion privilege, and you’ll likely have to go through full underwriting for any new permanent policy.

- Insurer Guidelines: Your policy documents or a quick call to your insurance provider will clarify the specific types of permanent policies available for conversion. While many offer Universal Life, some might have restrictions or specific UL products they allow for conversion.

Understanding these details is your first crucial step.

Step 2: Assess Your Needs and Determine Your Coverage Amount

Before you convert, take a moment to reflect on your current and future financial needs. Your life has likely changed since you first bought your term policy, and your insurance needs might have shifted too.

- Financial Needs Analysis: Consider your current debts (mortgage, loans), dependents’ needs (education, ongoing care for special needs children), income replacement for your family, and any long-term goals like leaving an inheritance or covering final expenses.

- Partial Conversion: A popular and flexible option is to convert only a portion of your term policy. For example, if you have a $500,000 term policy, you could convert $250,000 to a Universal Life policy and keep the remaining $250,000 as term insurance. This creates two separate policies and allows you to manage premium costs while still securing some lifelong coverage. Many insurers have minimum coverage requirements for both the converted UL policy and any remaining term portion, so check those details. This flexibility is a key reason why Universal Life is often chosen by families looking for adaptable protection. Learn more about how UL supports families with our Universal Life for Families and Protection guide.

- Full Conversion: If your needs dictate comprehensive lifelong coverage, or if your budget allows for the higher premiums, a full conversion of your entire term policy might be the right choice.

Step 3: Contact Your Insurer and Complete the Application

Once you’ve reviewed your policy and assessed your needs, the next step is to initiate the conversion.

- Reach Out: Contact your current insurance provider or an agent. They will confirm your eligibility, explain the Universal Life options available to you, and provide a quote for your new UL policy’s premiums based on your chosen coverage amount.

- Conversion Paperwork: Your insurer will supply the necessary application forms. The good news? You typically won’t have to answer new health questions or undergo another medical exam. This is the “guaranteed acceptance” benefit in action, locking in your original health rating.

- New Premium Calculation: The new Universal Life premiums will be based on your age at the time of conversion, the chosen death benefit amount, and your original health rating. While the health rating is a benefit, premiums increase with age, so converting sooner rather than later can often be more cost-effective.

- Beneficiary Forms: You’ll also need to designate or confirm your beneficiaries for the new Universal Life policy.

- Submit and Pay: Once all forms are completed and signed, submit them to your insurer. After processing (which usually takes about a week), you’ll begin paying the updated Universal Life premiums.

For a general understanding of the process, you can also consult external resources on How to Convert Term Life Insurance to Permanent.

Key Factors to Consider Before Converting

Deciding to move from term life to universal life is a significant financial step. Before you make the leap, we recommend weighing several key factors. This isn’t just about insurance; it’s about aligning your coverage with your evolving life:

When does it make sense to move from term life to universal life?

This is the million-dollar question, and the answer often lies in your changing life circumstances and financial priorities. Converting to Universal Life makes strong sense if:

- You Have Lifelong Dependents: If you have a child with special needs or another dependent who will rely on your financial support indefinitely, a term policy’s expiration date can be a ticking clock of anxiety. Universal Life offers the guarantee of a death benefit to fund a trust or provide ongoing care, ensuring their protection no matter what.

- Your Health Has Declined: This is arguably one of the most compelling reasons. If your health has worsened since you purchased your term policy, obtaining new permanent coverage with a medical exam could be difficult or prohibitively expensive. The conversion option allows you to secure lifelong coverage at your original (and likely better) health rating, bypassing new underwriting.

- You Have Long-Term Financial Goals (Beyond the Term): Maybe you’ve paid off your mortgage and your kids are grown, but you still want to leave a legacy, cover final expenses, or ensure funds for your spouse. Universal Life provides this long-term security.

- You Desire a Cash Value Asset: If you’ve maximized contributions to other tax-advantaged retirement accounts like Roth IRAs and 401(k)s, the cash value component of a Universal Life policy can offer an additional, tax-deferred savings vehicle. This cash value can be accessed later in life to supplement retirement income or cover unexpected costs. Explore how life insurance fits into your golden years with our insights on Using Life Insurance in Retirement Planning.

- You Need Estate Planning Tools: For individuals with substantial assets, Universal Life can be a crucial component of estate planning. The tax-free death benefit can provide liquidity to cover estate taxes (which, for some, can be a significant concern – you can find more information on Estate Tax information from the IRS) or facilitate wealth transfer to beneficiaries.

- Your Budget Has Increased: While UL premiums are higher, if your income has grown and your budget can comfortably accommodate these costs, converting offers improved benefits and long-term value that you may not have been able to afford previously.

What are the alternatives to a full conversion?

A full conversion to Universal Life isn’t the only path, and it’s certainly not for everyone. We encourage you to explore alternatives that might better suit your specific situation:

- Partial Conversion: As we discussed, converting only a portion of your term policy to Universal Life is a popular strategy. This allows you to secure some lifelong coverage and cash value, while keeping the remaining (and cheaper) term coverage for a specific period, or letting it expire if those temporary needs have passed.

- Purchasing a New Term Life Policy: If your temporary coverage needs still exist, but you’re not ready for permanent insurance, you could purchase a new term life policy. However, you’ll undergo new underwriting, and premiums will be based on your current age and health, which will likely be higher than your original term policy.

- Purchasing a New Universal Life Policy: If your health is still excellent, you might compare the costs of converting your existing term policy versus applying for a brand-new Universal Life policy. Sometimes, a new policy might offer different features or a better premium if your current insurer’s conversion options are limited or less competitive. However, this does involve a new medical exam.

- Final Expense Insurance: If your primary goal is simply to cover end-of-life costs (like funeral expenses, which had a median cost of $8,300 in 2023), a smaller, guaranteed issue final expense policy might be a more affordable and straightforward alternative than a full Universal Life conversion. These policies are designed specifically for this purpose and often have less stringent underwriting. For those nearing or in retirement, our Affordable Insurance Solutions for Retirees can offer valuable insights.

- Laddering Policies: Instead of one large policy, some people opt for a “laddering” strategy, where they have multiple, smaller term policies with different expiration dates. This allows coverage to decrease as specific financial obligations (like a mortgage or children’s education) are fulfilled. You could also combine a smaller UL policy with a term policy for a hybrid approach.

Frequently Asked Questions About Term-to-Universal Conversions

Can I convert only a portion of my term life policy?

Absolutely! This is one of the most flexible aspects of a term-to-universal conversion. You don’t have to convert the entire death benefit of your term policy. Many policyholders choose to convert only a portion, creating a scenario where they have:

- A new Universal Life policy for a specific amount (e.g., $250,000).

- The remaining portion of their original term policy (e.g., another $250,000 from an initial $500,000 policy).

This strategy allows you to secure permanent coverage for your most enduring needs (like final expenses or a legacy for a lifelong dependent) while managing the higher premiums associated with Universal Life. You can let the remaining term portion expire when its temporary purpose is fulfilled. Just be aware that insurers often have minimum coverage requirements for both the new UL policy and the remaining term policy.

How much more will I pay if I convert to permanent insurance?

There’s typically no direct fee to convert your policy. However, your premium payments for the new Universal Life policy will be significantly higher than what you were paying for your term coverage. This increase is due to Universal Life providing lifelong coverage and building cash value.

Here’s why premiums increase:

- Age at Conversion: Your new UL premiums are calculated based on your age at the time of conversion. Since you’re older than when you bought your term policy, the cost of insurance naturally increases.

- Original Health Rating: While your age changes, the good news is that your health rating (the classification of your health, e.g., “preferred best,” “standard”) from your original term policy is usually preserved. This means if your health has declined, you won’t be penalized with higher rates than someone of your current age with similar health to your original rating.

- Lifetime Coverage & Cash Value: These features are valuable, but they come at a price.

For perspective, a 40-year-old female with few health conditions might pay around $35 per month for a $500,000, 20-year term life policy. If that same person were to convert to a $500,000 permanent policy (like Universal Life), their monthly premium could jump to $300-$600 or more, depending on the specific UL product and insurer. This significant difference highlights the importance of budgeting before making the change.

What happens if I miss my conversion window?

Missing your conversion window is like missing the last train home – it can leave you stranded! If the conversion period specified in your term policy expires, you typically lose the ability to switch to Universal Life (or any other permanent policy) without going through a full new underwriting process.

This means:

- New Medical Exam: You’ll likely need to undergo a new medical examination and answer extensive health questions.

- Current Health Matters: Your eligibility and premiums will be based entirely on your current age and health status. If your health has declined, you could face much higher premiums, limited coverage options, or even be denied coverage altogether.

- Loss of Guaranteed Acceptance: The invaluable benefit of converting without a new medical review is gone.

That’s why we always emphasize checking your policy documents for the conversion deadline and acting well before it arrives. Don’t let this valuable option slip away!

Secure Your Financial Future

Navigating life insurance can feel complex, but understanding how to move from term life to universal life empowers you to make informed decisions about your family’s financial security. Whether you’re looking for lifelong protection, the flexibility of cash value, or a strategic tool for estate planning, Universal Life insurance offers compelling benefits when your term policy’s purpose has evolved.

At ShieldWise, we believe in clear, jargon-free guidance. We’re here to help you weigh the pros and cons, assess your unique needs, and find the right solutions for your long-term financial well-being. Don’t leave your future to chance—take control of your insurance strategy today.

Explore Universal Life Insurance Options and connect with our experts to discuss how Universal Life can fit into your life plan.