Why Understanding How Cash Value Grows in Universal Life Insurance Matters

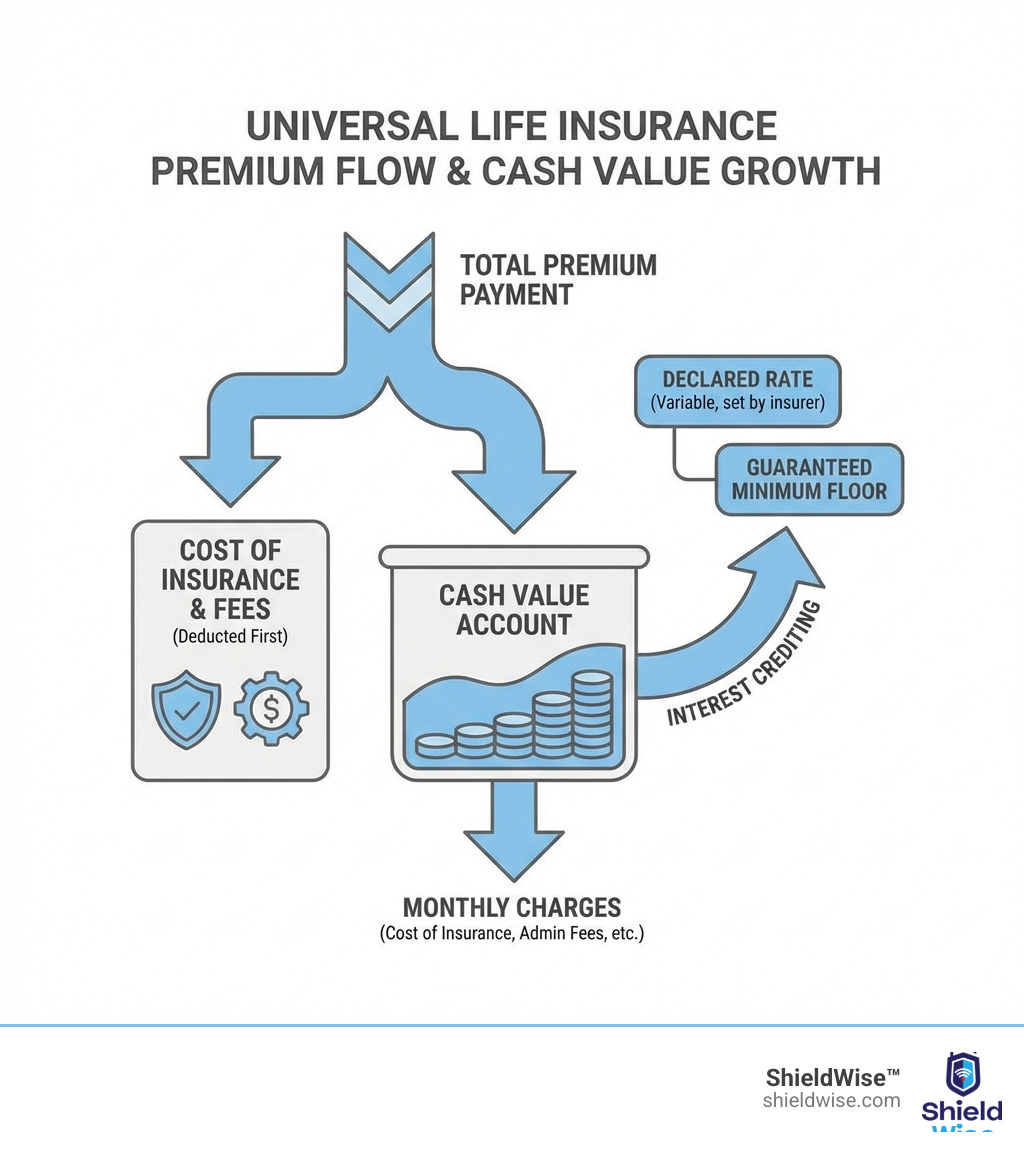

How cash value grows in universal life insurance depends on three key factors:

- Premium allocation – After your insurer deducts policy costs and fees, the rest of your premium goes into your cash value account.

- Interest crediting – Your cash value earns interest based on rates set by your insurer, with a guaranteed minimum.

- Policy costs – Monthly charges for insurance coverage and administrative fees are deducted from your cash value, impacting net growth.

Universal life insurance offers permanent coverage with built-in flexibility. Unlike whole life policies with fixed premiums or term policies with no savings component, UL lets you adjust your premium payments and death benefit. But that flexibility comes with responsibility—understanding how your cash value grows is essential to keeping your policy active and maximizing its potential.

The growth process isn’t automatic. Your insurer credits interest, but they also deduct monthly charges. Paying too little in premiums can cause your cash value to shrink, while paying more can accelerate growth. This can determine whether your policy becomes a powerful financial tool or lapses when you need it most.

At ShieldWise, we guide families and retirees through the complexities of universal life insurance, helping them avoid costly mistakes and make informed decisions. We provide clear explanations without sales pressure, so you can decide if UL fits your goals.

How Cash Value Grows in Universal Life Insurance: The Core Mechanics

Universal life insurance (UL) is a type of permanent life insurance with lifelong coverage and a savings component known as cash value. This cash value can grow over time, offering financial flexibility. Let’s break down how it works.

When you pay a premium, the money is allocated to several areas. First, a portion covers the “cost of insurance” (COI) for the death benefit. This cost typically increases with age. Next, administrative fees cover the insurer’s operating costs.

After these deductions, the remainder of your premium is deposited into your policy’s cash value account. Here, your money starts to earn interest. This interest is crucial to how cash value grows in universal life insurance. Over time, consistent payments and favorable interest rates can lead to significant accumulation, creating a financial resource you can access while alive.

Think of your premium as a pie: one slice covers the insurance (COI), another covers administrative fees, and the rest goes into your cash value to grow with interest.

The Role of Interest Rates in Cash Value Growth

The interest rate credited to your UL policy’s cash value is a primary driver of its growth. Unlike whole life insurance, which often has a fixed rate, universal life policies offer more dynamic interest crediting.

The interest rate, or “crediting rate,” is determined by your insurance company, influenced by its investment performance and market rates. While the rate can fluctuate, UL policies almost always include a guaranteed minimum interest rate. This means your cash value will still earn a certain amount even in poor market conditions, providing a safety net. Your insurer invests a portion of your premiums, and you won’t pay taxes on the money earned from this tax-deferred growth. The guaranteed minimum ensures you’ll always earn at least a certain amount from this investment.

If your insurer invests well and market rates are favorable, the interest you earn can increase, accelerating your cash value accumulation. This is a key difference in how UL policies grow compared to more rigid options. For a deeper dive, you can explore our Universal Life Insurance Guide 2026.

Understanding How Policy Costs and Fees Impact Growth

While interest helps your cash value grow, understand how policy costs and fees reduce it. These charges are deducted from your cash value, lowering the net amount available to earn interest.

The “Cost of Insurance” (COI) is a major factor, covering the mortality risk the insurer takes. It’s based on your age, health, and the death benefit amount. The COI is usually based on the “net amount at risk”—the death benefit minus your cash value. As your cash value grows, the net amount at risk decreases, which can lower the COI. However, as you age, the underlying mortality rates increase, often leading to a rising COI over time.

Beyond the COI, UL policies have administrative charges for policy management. Some policies may also have surrender charges, which are fees applied if you cancel your policy in the early years. These charges help recoup the insurer’s upfront costs. All these fees reduce the cash value left to compound, so it’s crucial to understand a policy’s fee structure.

The “Universal” Advantage: How Flexibility Affects Your Cash Value

The “universal” in universal life insurance refers to its flexibility in premiums and death benefits. This flexibility directly influences how cash value grows in universal life insurance.

Unlike whole life’s fixed premiums, UL policies let you adjust payments within certain limits. You have a “minimum premium” to keep the policy active and a “maximum premium” to avoid adverse tax consequences (becoming a Modified Endowment Contract, or MEC). This allows for “overfunding” (paying more) or “underfunding” (paying less or skipping payments if cash value is sufficient).

You can also often adjust your death benefit, increasing or decreasing it as your needs change. This adaptability is invaluable for Illinois families with evolving financial needs. However, each adjustment impacts your cash value growth and policy health.

How Flexible Premiums Affect How Cash Value Grows in Universal Life Insurance

Premium flexibility plays a huge role in how quickly your cash value accumulates. If you pay more than the minimum premium (overfunding), the excess goes directly into your cash value account after policy charges. This can significantly accelerate growth, especially in the early years, creating a substantial financial cushion.

This cushion provides a unique advantage: once your cash value is large enough, you can use it to cover future premiums. During periods of financial strain or in retirement, you could reduce or stop paying out-of-pocket premiums, letting the policy sustain itself. This is incredibly valuable for long-term financial planning.

However, this flexibility carries risk. If you consistently pay only the minimum, or if interest rates are low and charges increase, your cash value could deplete. If it drops too low to cover monthly charges, your policy could lapse, ending your coverage. This is a critical consideration, as highlighted in our guide on Universal Life Cash Value and Flexibility.

Adjusting Your Death Benefit and Its Impact

Adjusting your death benefit also influences cash value growth. You generally have two options for how your death benefit is structured:

- Option A (Level Death Benefit): The death benefit remains level. As your cash value grows, the “net amount at risk” (the difference between the death benefit and cash value) decreases. Since the COI is based on this amount, a growing cash value can help keep your COI lower, allowing more of your premium to fund cash value growth.

- Option B (Increasing Death Benefit): The death benefit is the stated face amount plus the accumulated cash value. As your cash value grows, your total death benefit increases. This sounds appealing, but it means the net amount at risk stays level or increases, leading to a higher COI and less cash value accumulation.

Choosing between Option A and B depends on your goal. For maximizing cash value, Option A is often better. For a growing death benefit, Option B is preferred, though it may require higher premiums. Understanding this trade-off is key, as discussed in Universal Life for Families and Protection.

Understanding the Risks, Guarantees, and Tax Benefits

While universal life insurance has compelling benefits, it’s important to understand its risks, guarantees, and tax advantages. The dynamic nature of UL means cash value growth isn’t set in stone, so monitoring your policy is crucial.

The primary risk is policy lapse. This can happen if your cash value is depleted and can no longer cover monthly charges. This can be caused by paying insufficient premiums, low interest rates, or a rising Cost of Insurance (COI) as you age. Unlike whole life, UL requires active management to ensure the cash value remains sufficient to keep the policy in force.

However, UL policies have important safeguards. They offer a guaranteed minimum interest rate, ensuring your cash value will never earn less than a specified percentage. This acts as a crucial floor. Many UL policies also offer “no-lapse guarantees,” which keep the policy in force for a set period (or for life) as long as a minimum premium is paid, regardless of cash value performance.

Beyond these features, universal life policies have significant tax advantages, making them powerful financial planning tools.

Are There Guarantees for Cash Value Growth?

Yes, universal life policies include guarantees that are vital for understanding how cash value grows in universal life insurance. The most prominent is the guaranteed interest rate floor. This means your cash value will always earn at least a minimum rate (typically 0% to 3%), regardless of market performance. This protects your cash value from stagnating due to interest rate drops alone.

Some UL policies also offer secondary guarantees or no-lapse guarantees. These ensure your policy won’t lapse, even if the cash value hits zero, as long as you pay a specified minimum premium. This provides the permanence of whole life with the flexibility of UL. It’s important to distinguish these guarantees from projections. Policy illustrations show various scenarios, including a guaranteed scenario (minimum interest, maximum charges) and a projected scenario (based on current rates). We advise clients to understand both, focusing on guarantees for long-term security. This terminology is consistent with guidance from state insurance regulators (for example, see this overview of the types of cash value life insurance).

The Tax Implications of How Cash Value Grows in Universal Life Insurance

One of UL’s most attractive features is its favorable tax treatment, which improves how cash value grows in universal life insurance as a long-term savings vehicle.

Earnings within your cash value account grow on a tax-deferred basis. You don’t pay taxes on the growth annually, allowing your money to compound more efficiently. Taxes are typically only due if you withdraw more than you’ve paid in premiums (your “cost basis”) or if the policy is surrendered for a gain.

You can also access your cash value through policy loans without immediate taxes. Loans are generally income tax-free if the policy remains in force. You can also make tax-free withdrawals up to your cost basis. Withdrawals of gains, however, can be taxed as ordinary income.

Be aware of the “Modified Endowment Contract” (MEC) rules. If a policy is overfunded too quickly per IRS guidelines, it becomes an MEC. While MECs still offer tax-deferred growth, loans and withdrawals are taxed less favorably and may be subject to a 10% penalty if you are under 59 ½. Careful planning is essential to maximize your policy’s tax advantages.

How UL Compares to Other Cash Value Policies

Understanding how cash value grows in universal life insurance becomes clearer when compared to other types of cash value life insurance. While all permanent policies offer a cash value component, the growth mechanisms and flexibility vary significantly.

Universal life policies stand out for their adaptability. Unlike whole life insurance, which has fixed premiums and guaranteed, predictable cash value growth, UL allows you to adjust your premiums and death benefit. This means your cash value growth in a UL policy is more dynamic, influenced by interest rates and your premium payments.

For example, while a whole life policy might guarantee a 2-4% annual growth rate, a universal life policy might offer a higher current crediting rate or link its growth to a market index (as with Indexed Universal Life), offering higher potential returns with different levels of risk. Term life insurance, by contrast, offers no cash value at all, providing only pure death benefit protection for a specific period.

At ShieldWise, we offer a range of permanent life insurance options. Choosing the right one depends on your financial goals, risk tolerance, and need for flexibility.

Universal Life vs. Other Permanent Life Insurance Options from ShieldWise™

Let’s look at how Universal Life stacks up against other permanent life insurance options that our clients in Illinois consider:

| Feature | Universal Life (UL) | Whole Life Insurance | Indexed Universal Life (IUL) |

|---|---|---|---|

| Premium Flexibility | Highly flexible; can adjust payments | Fixed and guaranteed | Highly flexible; can adjust payments |

| Cash Value Growth | Interest-rate based; guaranteed minimum | Fixed, guaranteed rate; often pays dividends | Linked to market index (e.g., S&P 500) with caps and floors |

| Risk to Cash Value | Moderate; tied to declared interest rates | Low; guaranteed growth | Moderate; protected by floor, limited by cap |

| Control Over Growth | Limited control; insurer declares rate | No control; insurer sets guaranteed rate and dividends | Indirect control; choose index, participation rates, caps |

| Potential Returns | Moderate | Low to moderate (with dividends) | Moderate to high (market-linked, with protection) |

| Complexity | Moderate | Low | Moderate to High |

As you can see, the core difference lies in the balance between flexibility, risk, and potential return. Universal life offers a middle ground, providing more flexibility than whole life. Our page on Universal Life Term Versus Permanent further elaborates on these distinctions.

For clients seeking guaranteed, predictable growth and fixed premiums, whole life insurance might be a better fit. Its cash value grows at a steady, guaranteed rate, and participating policies may also pay non-guaranteed dividends. However, it typically comes with higher initial costs and less flexibility.

Indexed Universal Life (IUL), which we offer at ShieldWise, is a popular variant that links cash value growth to a market index, like the S&P 500. It often includes a guaranteed floor (e.g., 0%) to protect against market losses and a cap on potential gains. This offers a balance of market-linked growth with downside protection. Each option has its place, and we help our Illinois clients find the best fit for their unique financial landscape.

Frequently Asked Questions about UL Cash Value Growth

We often receive questions from our clients in Illinois about how their universal life policy’s cash value truly works. Here are some of the most common inquiries:

What happens to the cash value when I die?

This is a common point of confusion. In most universal life policies, when the insured person dies, the cash value generally reverts to the insurance company. Your beneficiaries will receive the policy’s death benefit, but typically not the cash value in addition to it. The cash value essentially helps fund the death benefit over time. However, there’s an exception with Option B (Increasing Death Benefit) policies. In this structure, the death benefit is usually the face amount plus the accumulated cash value, meaning your beneficiaries would receive both. It’s crucial to understand your specific policy’s death benefit option.

Can my cash value decrease?

Yes, your cash value can decrease. While universal life policies have a guaranteed minimum interest rate, several factors can cause the actual cash value to decline. If you consistently pay premiums that are too low to cover the rising cost of insurance and administrative fees, your cash value will be drawn down. A prolonged period of low interest crediting rates, especially if your policy doesn’t have a strong no-lapse guarantee, can also slow growth to a crawl or cause a decrease. Furthermore, taking policy loans or making withdrawals directly reduces your cash value. It’s important to monitor your policy’s performance regularly to ensure it’s on track.

How long does it take to build significant cash value?

Building significant cash value in a universal life policy takes time and consistent funding. In the very early years of a policy, typically the first 2-5 years, cash value accumulation is often slow. This is because a larger portion of your initial premium payments goes towards covering the higher initial costs of setting up the policy, including commissions, administrative fees, and the initial cost of insurance. However, with consistent premium payments, especially if you overfund the policy, the cash value growth accelerates over time due to compounding interest. The longer your policy is in force and adequately funded, the more substantial your cash value can become.

Securing Your Financial Future with Universal Life

Understanding how cash value grows in universal life insurance empowers you to make informed decisions about your financial future. Universal life offers a unique blend of permanent life insurance protection and a flexible, tax-advantaged savings component. Its adaptability allows you to tailor coverage and premium payments to your evolving life circumstances.

The tax-deferred growth of cash value, with the potential for tax-free loans and withdrawals, positions universal life as a powerful tool for long-term wealth accumulation. However, this flexibility demands diligence. Proactive management and a clear understanding of your policy’s mechanics—including interest rates, costs, and premium choices—are essential to ensure your policy performs as expected and avoids lapsing.

At ShieldWise, we believe in providing clear, jargon-free guidance to our clients in Illinois. We are here to help you steer the complexities of universal life insurance, compare plans from trusted carriers, and secure the right coverage that protects your family and aligns with your financial goals. Explore our comprehensive Universal Life Insurance resources to learn more and see how universal life can fit into your financial strategy.