Why Planning Ahead for Your Parents’ Final Expenses Matters

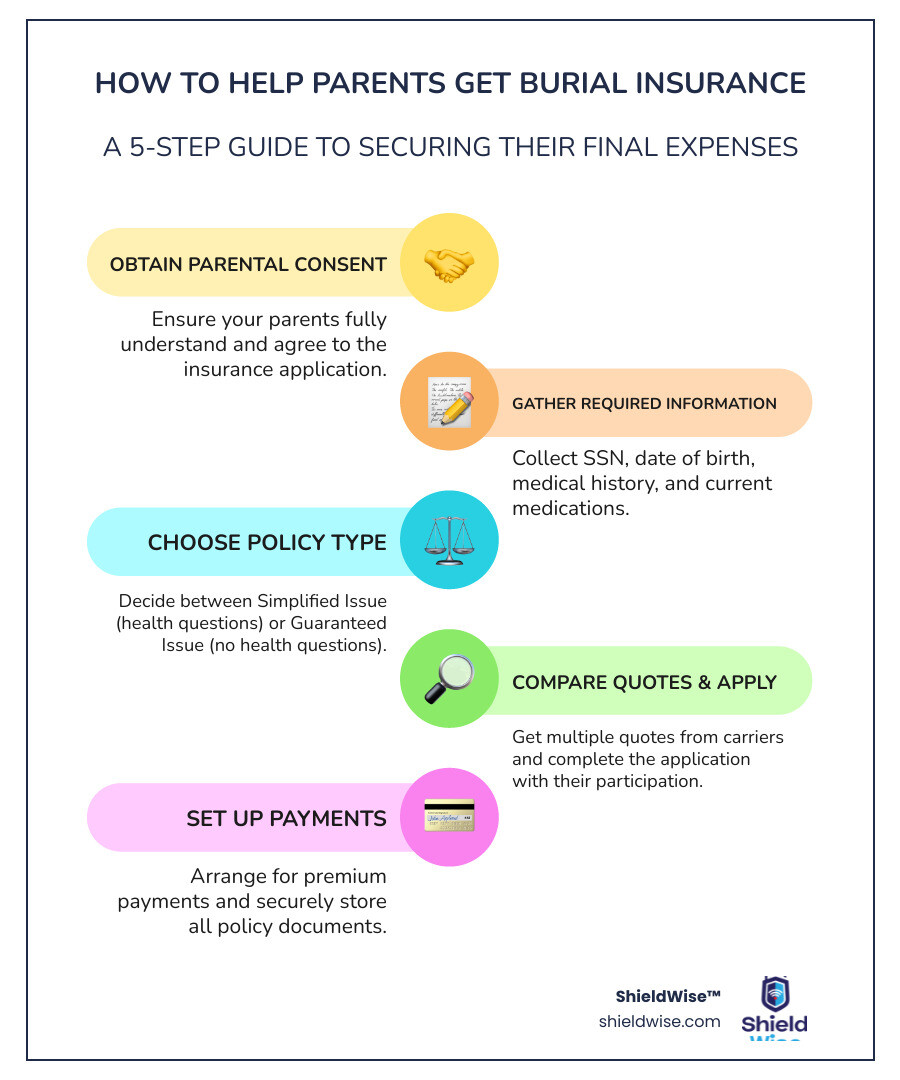

How to help parents get burial insurance starts with understanding that you can purchase coverage on their behalf, but only with their full knowledge and consent. The process is straightforward:

- Get your parents’ permission – They must participate in the application and sign all documents.

- Gather required information – Social Security number, medical history, and current medications.

- Choose between policy types – Simplified issue (health questions, no exam) or guaranteed issue (no health questions, higher cost).

- Compare quotes from multiple carriers – Coverage typically ranges from $5,000 to $50,000.

- Complete the application together – Your parent answers health questions; you can be listed as owner and payer.

- Set up payment – Monthly premiums typically range from $30 to $100 depending on age and coverage.

You cannot buy burial insurance for your parents without their knowledge—even with power of attorney. Insurance companies require the insured person (your parent) to sign the application themselves.

The median cost of a funeral in the United States now exceeds $7,800, and many families also face unexpected medical debt and legal fees. Burial insurance—also called final expense insurance—is a small whole life policy designed to cover these costs, typically offering $5,000 to $25,000 in coverage with fixed premiums and simplified approval.

At ShieldWise, we guide families through the process of how to help parents get burial insurance. We provide unbiased education on policy types, carrier comparisons, and application requirements to help you protect your family from financial stress. The key is starting the conversation early, understanding your options, and choosing coverage that fits your parents’ health and your family’s budget.

How to Help Parents Get Burial Insurance: A Step-by-Step Guide

Helping your parents secure burial insurance is a thoughtful act that provides peace of mind, ensuring their final wishes are honored without creating a financial burden for the family. Before diving into the specifics, let’s cover some fundamental principles.

First, the concept of “insurable interest” is crucial. To purchase a policy on someone else’s life, you must have an insurable interest, meaning you would face a financial loss upon their death. For adult children, this interest is the responsibility for their parents’ final expenses. This legal requirement prevents taking out policies on strangers.

Second, parental consent is mandatory. You cannot get burial insurance for your parents without their active involvement and signature on the application. Even a power of attorney does not grant this right. Attempting to bypass their consent is insurance fraud with severe legal consequences.

The application process for burial insurance is generally straightforward. It typically involves answering a few health questions, but no medical exam is required. Once approved and the first premium is paid, coverage begins.

For a comprehensive approach to planning, explore our End of Life Planning Checklist for Seniors and Families.

Can I buy burial insurance for my parents?

Yes, absolutely! Many insurance providers allow adult children to purchase policies for their parents. The key legal requirements are consent and insurable interest, as discussed above.

When you purchase the policy, you can be listed as the policy owner and payer. This gives you control over the policy, ensuring premiums are paid. Your parent will be the insured individual, and a designated beneficiary (which could be you) will receive the death benefit. Being the owner, payer, and beneficiary offers the most control and can help prevent the policy’s cash value from affecting a parent’s potential Medicaid eligibility.

What information do I need from my parents to start?

Gathering this information upfront will make the application process much smoother:

- Full Legal Name and Date of Birth

- Social Security Number (SSN)

- Current Address: Your parents must reside in a state where the policy can be issued, such as Illinois, and be in the USA during the application.

- Contact Information: Phone numbers and email addresses.

- Health Information: Your parents must answer health questions accurately. This includes medical history, current medications, and lifestyle questions (e.g., smoking).

- Mental Capacity: Your parent must have the mental capacity to understand and sign a legal contract.

Can I buy burial insurance for my parents without their consent?

No, you cannot buy burial insurance for your parents without their explicit consent. It is illegal and constitutes insurance fraud. Insurance companies require the insured person’s signature on the application. For policies with health questions, your parent must answer them personally and honestly to ensure the policy is valid. While discussing end-of-life plans can be sensitive, approaching it with empathy and explaining how it relieves financial stress can help.

Understanding Burial Insurance Policies and Costs

Burial insurance (or final expense insurance) is a type of whole life insurance designed to cover end-of-life costs like a funeral, burial, or cremation. Unlike traditional life insurance, its focus is not on income replacement but on these more immediate expenses.

To dig deeper into this coverage, please visit our page What is Burial Insurance?. For more on typical expenses, explore More info on the Cost of Funeral Insurance.

What are the different types of burial insurance policies?

You’ll primarily encounter two main types: simplified issue and guaranteed issue. Understanding the differences is key to choosing the right fit.

| Policy Type | Health Questions | Medical Exam | Waiting Period | Cost (relative) | Best For |

|---|---|---|---|---|---|

| Simplified Issue | Yes (few) | No | Often none (or short, 3-6 months) if approved | Moderate | Parents with minor or well-managed health issues who want lower premiums and immediate (or near-immediate) coverage. |

| Guaranteed Issue | No | No | Typically 2 years (graded death benefit) | Higher | Parents with significant health conditions or those who prefer not to answer health questions, prioritizing guaranteed acceptance. |

- Simplified Issue Policies: These policies require answering a few health questions but no medical exam. If your parents are in reasonably good health, they can often qualify for immediate coverage with no waiting period, making this the most cost-effective option.

- Guaranteed Issue Policies: Acceptance is guaranteed for parents within the age requirements (typically 50-85), with no health questions or medical exam. This is ideal for those with significant health conditions. The trade-off is higher premiums and a graded death benefit waiting period.

Guaranteed issue policies are a lifeline for parents with pre-existing conditions. For details on how health impacts eligibility, see our Final Expense Health Eligibility Complete Guide.

How much coverage and what is the typical cost?

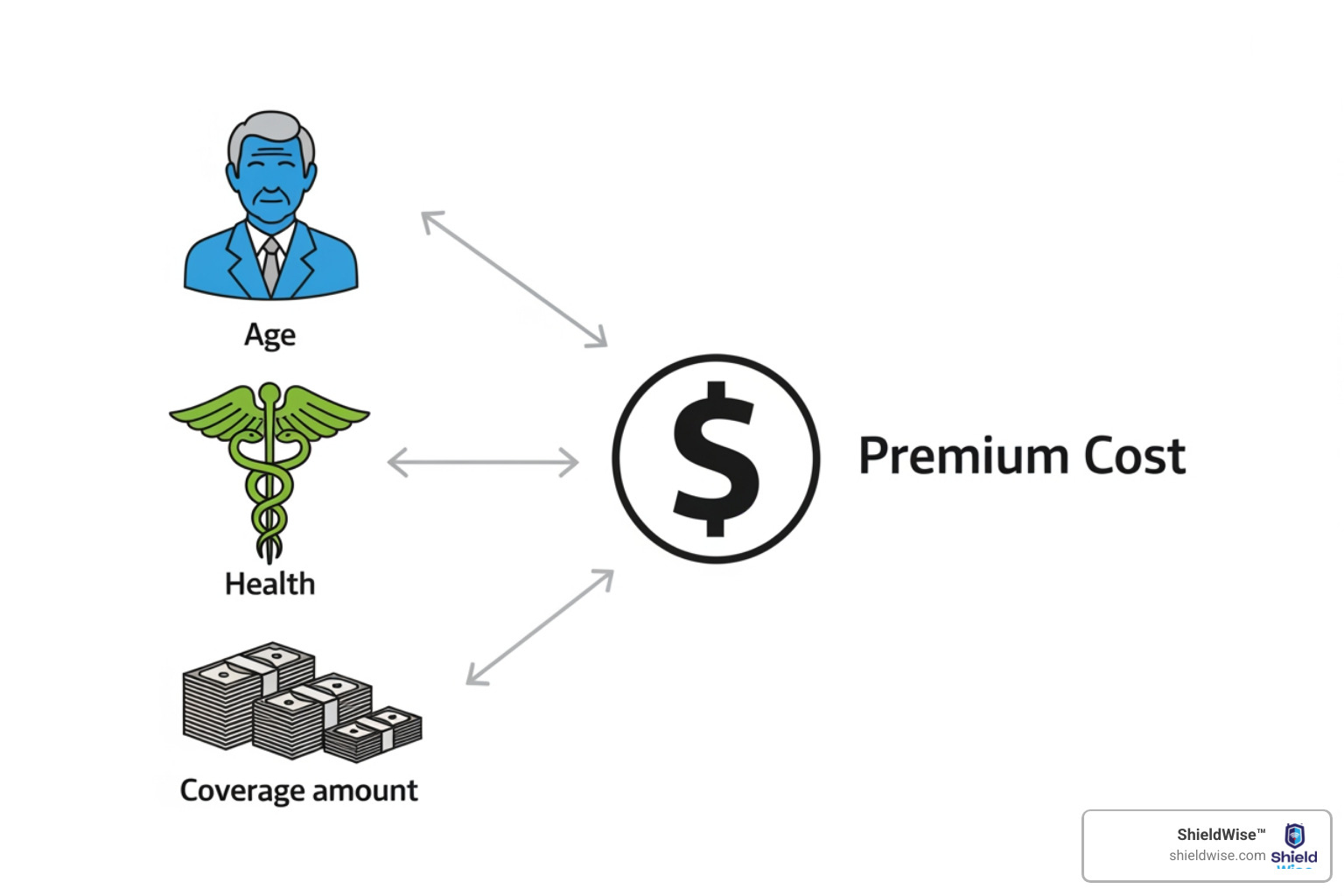

Funeral costs are substantial and rising. According to the National Funeral Directors Association, the median cost for a funeral with burial was $7,848 in 2021, while cremation costs averaged around $6,280. Burial insurance policies are designed to cover these costs, with coverage amounts typically ranging from $5,000 to $25,000. Monthly premiums generally fall between $20 and $100, influenced by age, gender, health, and coverage amount.

For example, a 75-year-old woman might pay around $88 per month for a $10,000 policy, while a 75-year-old man could pay about $113 for the same coverage. These are general estimates.

Is there a waiting period for burial insurance?

Many burial insurance policies, especially guaranteed issue plans, include a waiting period, also called a “graded death benefit.” Here’s how it typically works:

- During the Waiting Period: If your parent passes away from natural causes (usually in the first two years), the beneficiary receives a refund of premiums paid, plus interest, instead of the full death benefit.

- Accidental Death: The full death benefit is usually paid for accidental death, even during the waiting period.

- After the Waiting Period: The full death benefit is paid for any cause of death.

Simplified issue policies for healthier applicants may have no waiting period, but guaranteed acceptance policies almost always do. It’s crucial to understand this feature to avoid surprises. For more information, check out our guide on Life Insurance for Seniors No Waiting Period.

Weighing Your Options: Is Burial Insurance the Right Choice?

Deciding if burial insurance is right for your parents involves weighing its pros and cons against other options. For a broader understanding of all related costs, please see our resource on End of Life Expenses.

What are the pros and cons of purchasing burial insurance for parents?

Pros of Burial Insurance:

- Peace of Mind: Reduces stress for the whole family, allowing loved ones to grieve without financial worries.

- Covers Costs: The death benefit is paid to the beneficiary to use as needed for funeral costs, medical bills, or other debts.

- Easy Qualification: Accessible for parents with pre-existing conditions, as many policies require no medical exam.

- Fixed Premiums: Premiums are fixed for life and never increase, which makes budgeting predictable.

- Lifetime Coverage: As whole life insurance, coverage lasts a lifetime and won’t expire with age (as long as premiums are paid).

- Builds Cash Value: Builds a small cash value over time that can potentially be borrowed against.

Cons of Burial Insurance:

- Smaller Death Benefit: Offers a smaller death benefit ($5,000-$25,000) not designed for income replacement.

- Higher Cost per Dollar of Coverage: Can be more expensive per dollar of coverage than traditional life insurance, especially guaranteed issue policies.

- Potential Waiting Periods: Guaranteed issue policies usually have a 2-year waiting period for non-accidental death.

- Not Always Necessary: May be redundant if parents have sufficient savings or another life insurance policy for final expenses.

How does burial insurance compare to other ways of planning for final expenses?

Burial insurance offers a unique balance of accessibility and flexibility:

- Burial Insurance vs. Pre-paid Funeral Plans: Burial insurance pays a flexible cash benefit to your chosen beneficiary to use for any final expense. It’s portable if your parents move or change plans. Pre-paid funeral plans are contracts with a specific funeral home for set services. They are less flexible, and funds can be at risk if the funeral home closes or you move. The FTC’s Funeral Rule offers some protection, but rules vary by state.

- Burial Insurance vs. Savings Accounts/Wills: A burial insurance payout is immediate and bypasses probate. Funds in savings or a will are often delayed by probate. While a Payable-on-Death (POD) account helps, savings can be depleted by medical costs before death, whereas an insurance benefit is guaranteed.

- Burial Insurance vs. Traditional Life Insurance: Burial insurance has a smaller benefit, simple underwriting, and is designed for final expenses. Traditional life insurance (term or whole) offers larger benefits for income replacement but has stricter underwriting. Term life also expires (often around age 80), making it unreliable for final expenses, whereas burial insurance is permanent.

Finding the Best Burial Insurance Policy for Your Parents

Once you and your parents decide burial insurance is the right path, the next step is finding the best policy for their needs and your budget.

How can I compare rates from different burial insurance providers?

Comparing rates effectively is crucial to finding value. Here’s how to approach it:

- Use Online Comparison Tools: Platforms like ShieldWise streamline this process. You can Compare Final Expense Quotes to get instant quotes from multiple carriers side-by-side.

- Speak with an Independent Agent: An independent agent works with multiple providers and can shop for policies based on your parents’ specific health and needs.

- Get Multiple Quotes: Always get at least 2-3 quotes to ensure you’re seeing a competitive range of prices.

- Review Policy Details: Look beyond the premium. Compare the death benefit, waiting periods, and other policy details. A slightly higher cost may offer better terms.

How can I ensure I’m choosing the best policy when I help parents get burial insurance?

Making the “best” choice means aligning the policy with your parents’ unique circumstances:

- Assess Parents’ Health Honestly: Serious health conditions may require a guaranteed issue policy, while healthier parents can get a more affordable simplified issue policy.

- Determine Your Budget: Choose a sustainable monthly premium that you and your parents can comfortably afford long-term.

- Calculate Needed Coverage Amount: Estimate funeral costs, add other potential debts (medical bills, legal fees), and include a buffer for inflation. Balance this total with an affordable premium.

- Read the Fine Print: Review the policy terms, paying close attention to waiting periods, exclusions, and any optional riders.

- Check Financial Strength Ratings: Choose insurers with strong financial ratings (A- or better from AM Best) to ensure they can pay claims. You can Check a company’s rating with AM Best.

- Consider Customer Service: Research customer reviews and satisfaction ratings to gauge the provider’s claims process and service.

Frequently Asked Questions about Buying Burial Insurance for Parents

Here are answers to some of the most common concerns.

What happens if my parents have pre-existing health conditions?

This is a common concern, and burial insurance is designed to address it.

- Guaranteed Issue Policies: For significant health conditions, these policies guarantee acceptance without health questions. They typically have higher premiums and a 2-year waiting period for death from natural causes.

- Simplified Issue Policies: For mild or well-managed conditions, your parents may still qualify for a simplified issue policy, which is more affordable and may offer immediate coverage.

- Honesty is Crucial: Always answer all health questions truthfully. Misrepresentation can void the policy.

How much coverage should I get for my parents’ burial insurance?

To determine the right coverage amount:

- Estimate Costs: Research funeral costs in your area (average burial is ~$8,000-$10,000; cremation ~$6,300).

- Add Other Debts: Include potential medical bills, legal fees, or credit card debt.

- Factor in Inflation: Add a buffer for rising costs.

- Balance with Budget: Choose a coverage amount with a premium that is affordable long-term.

A common coverage amount is $10,000 to $25,000, which is often sufficient to cover funeral costs and other immediate needs.

Who can be the beneficiary of the policy?

The beneficiary receives the death benefit. Common choices include:

- The Child Purchasing the Policy: This is a common choice, ensuring the person paying for the policy has the funds to cover expenses.

- Another Sibling or Family Member: You can name one or more siblings or split the benefit.

- A Trust: For complex estate plans, a trust can be named as the beneficiary to manage the funds.

Naming the parent’s estate is generally not recommended, as the funds will go through probate, causing delays. Always keep the beneficiary designation clear and up-to-date to prevent disputes and ensure quick access to the money.

Conclusion: Taking the Next Step to Protect Your Family

Helping your parents get burial insurance is a profound act of love and financial responsibility. It ensures their dignity, honors their wishes, and shields your family from unexpected financial strain. By understanding policy types, comparing costs, and having open conversations, you can provide peace of mind.

Burial insurance offers a predictable solution for covering final expenses. At ShieldWise, we empower families with clear guidance. We help you compare plans from trusted carriers in Illinois, get instant online quotes, and simplify securing the right coverage. Don’t let uncertainty add to future grief. Take the next step to protect your loved ones and handle End of Life Expenses responsibly.

Get your free final expense insurance quote today and find the policy to safeguard your parents’ legacy.