Why Determining How Much Universal Life Insurance Do Families Need Matters More Than You Think

How much universal life insurance do families need depends on your financial obligations and long-term goals. While you can’t know the exact dollar amount, you can make a solid estimate. Here’s a quick guide:

Common Coverage Calculation Methods:

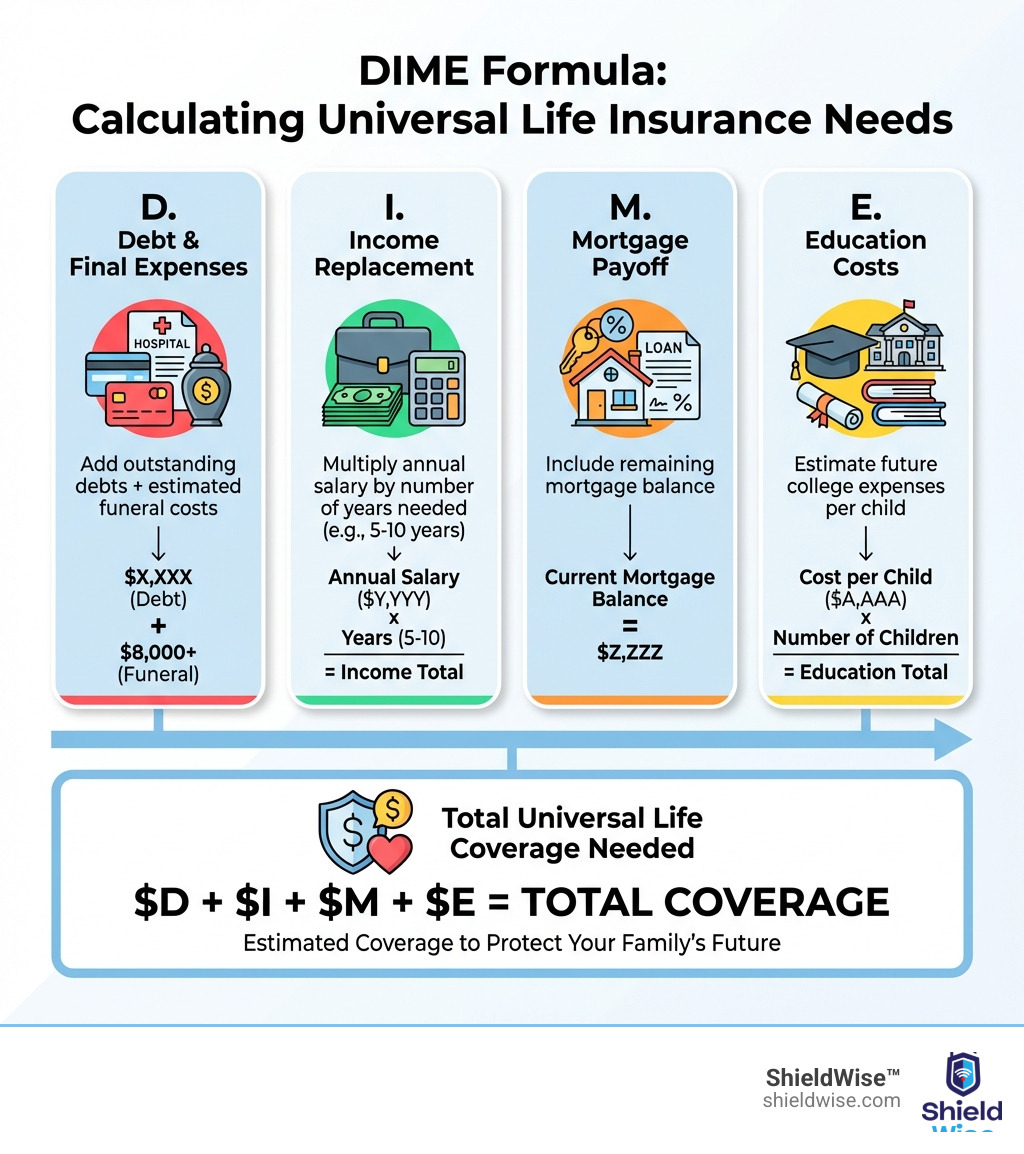

- DIME Formula – Add your Debt + Income replacement (5-10 years) + Mortgage balance + Education costs

- Income Multiplier – 10-15 times your annual income, plus $100,000 per child for college

- Needs-Based Analysis – Total financial obligations (debts, funeral costs, income replacement) minus liquid assets

Typical Coverage Ranges:

- Average new policy in 2023: $206,000

- Stay-at-home parent: $250,000–$400,000

- Working parent: Often $500,000–$1 million+

Universal life insurance offers permanent protection, builds cash value, and gives you flexibility to adjust premiums and death benefits. This flexibility is powerful, but it means choosing the right coverage amount requires careful thought.

Consider the costs: the average funeral is over $8,000, plus mortgage balances, debts, income replacement, and college tuition. The total can easily reach $500,000, $1 million, or more depending on your family’s situation.

At ShieldWise, we guide families to determine how much universal life insurance do families need based on real financial obligations—not sales quotas. Our approach is to understand your needs, compare your options, and choose coverage that protects your family without overextending your budget.

Understanding Universal Life Insurance for Families

Universal life (UL) insurance is a type of permanent life insurance designed to provide lifelong coverage, typically until age 95 or 120. Unlike term life, which covers a specific period, UL is there for the long haul as long as premiums are paid.

One of its defining features is flexibility. You can often adjust your premium payments and death benefit as your life circumstances change. For families in Illinois, this adaptability is a significant advantage, allowing you to fine-tune your policy to match evolving needs.

At the heart of a UL policy is its cash value component. A portion of each premium pays for the cost of insurance and fees, while the rest is added to the cash value. This value grows over time on a tax-deferred basis, often based on an interest rate set by the insurer with a guaranteed minimum. This can be a valuable financial tool, providing funds you can access through policy loans or withdrawals. To learn more, check out our guide on Universal Life Cash Value and Flexibility.

What is Universal Life and How Does It Differ from Other Policies?

Understanding the core differences between policy types is crucial when figuring out how much universal life insurance do families need. Let’s break down universal life compared to term and whole life.

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Coverage Duration | Temporary (specific term: 10, 20, 30 years) | Permanent (lifelong, fixed premiums) | Permanent (lifelong, flexible premiums) |

| Premium Flexibility | Fixed for the term | Fixed and guaranteed | Flexible; can adjust within limits |

| Death Benefit | Fixed | Fixed or increasing | Flexible; can adjust within limits |

| Cash Value Growth | None | Guaranteed, builds steadily, often pays dividends | Variable, based on interest rates (with minimums) |

| Complexity | Simple, straightforward | More complex than term | Most complex due to flexibility and cash value options |

Term life insurance is like renting; it provides coverage for a specific period (e.g., 10, 20, or 30 years). It’s great for temporary needs, like covering a mortgage. For example, a healthy 35-year-old might find a 10-year, $250,000 term policy for an affordable monthly premium.

Whole life insurance is permanent, and the premiums and death benefit are typically fixed for life. It also builds cash value at a guaranteed rate.

Universal life offers permanent coverage but with added flexibility. You can adjust premiums and the death benefit as your needs change, which is helpful for families with unpredictable finances. For a deeper dive, explore our article on Universal Life Term Versus Permanent.

The Primary Benefits and Drawbacks of Universal Life

Every financial tool has its pros and cons, and universal life is no exception. We believe in providing a clear picture so you can make the best decision for your family.

Benefits of Universal Life Insurance:

- Premium Flexibility: You can adjust your payments. If your income fluctuates, you can pay more when times are good to build cash value, and potentially pay less if the cash value is sufficient to cover policy costs.

- Adjustable Death Benefit: You can often increase or decrease the death benefit to match your changing financial obligations without needing a new policy.

- Cash Value Access: The cash value grows tax-deferred, and you can access it through loans or withdrawals for emergencies, college tuition, or to supplement retirement income.

- Lifelong Coverage: As a permanent policy, it ensures your loved ones receive a death benefit no matter when you pass away, as long as the policy is in force.

Drawbacks of Universal Life Insurance:

- Complexity: Flexibility requires more active management than a simple term policy. You need to monitor the cash value to ensure it’s sufficient to keep the policy active.

- Potential for Lapse: If the cash value doesn’t grow as expected or you consistently underpay premiums, your policy could lapse, resulting in a loss of coverage and all premiums paid.

- Interest Rate Risk: Cash value growth is tied to interest rates. If rates are low, your cash value might not grow as quickly as anticipated, potentially requiring higher premiums to maintain coverage.

- Higher Costs: Universal life is generally more expensive than term life for the same death benefit due to its cash value component and lifelong coverage.

How Much Universal Life Insurance Do Families Need?

This is the million-dollar question, sometimes literally! Determining how much universal life insurance do families need is about a careful, needs-based analysis, not a guess. The goal is to ensure your family is protected without over-insuring. We want to cover your financial obligations, account for future expenses, and replace your income while considering your existing assets.

While the average new life insurance policy in 2023 was for $206,000, this figure often doesn’t reflect the unique needs of families in Illinois. Many experts recommend at least 10 times your annual income, but several factors can change that number.

Common Methods for Calculating How Much Universal Life Insurance Do Families Need

Several methods can help estimate your family’s needs:

-

The DIME Formula: This is a comprehensive approach:

- Debt: Sum all debts (credit cards, car loans) plus final expenses (funerals average over $8,000, according to the National Funeral Directors Association).

- Income: Calculate 5 to 10 years of income replacement.

- Mortgage: Add the outstanding balance of your mortgage.

- Education: Estimate future college costs for your children.

Summing these gives you a solid estimate for your coverage needs.

-

The “Income Multiplier” Rule: A simple rule of thumb is to multiply your annual income by 10 to 15. Some suggest adding $100,000 per child for college.

-

The Standard-of-Living Method: This method calculates the amount needed to generate an annual income for your family to maintain their lifestyle, often by multiplying their required annual income by 20.

-

The Human-Life Approach: This calculates needs based on your lifetime earning potential, discounted to its present value. It’s more complex but aims to replace your total economic contribution.

While online calculators can help simplify the process, we always recommend a personalized discussion to tailor these calculations to your exact situation.

Factoring in Your Family’s Specific Financial Obligations

Beyond formulas, we need to consider the details of your family’s financial life:

- Final Expenses: As mentioned, funeral costs average over $8,000. More statistics are available from the National Funeral Directors Association. This is an immediate cost a policy can cover.

- Outstanding Debts: Your mortgage, car loans, and credit card balances shouldn’t become a burden for your loved ones.

- College Savings: Factoring in current and future tuition costs ensures funds are available for your children’s education.

- Childcare Costs: The surviving parent might face new, substantial childcare costs.

- Lifestyle Maintenance: Life insurance should allow your family to maintain their quality of life without significant financial hardship.

Detailing these obligations provides a clearer picture of how much universal life insurance do families need.

Special Considerations: How Much Universal Life Insurance Do Families Need for a Stay-at-Home Parent?

The financial value of a stay-at-home parent is enormous. Their contributions—childcare, household management, transportation—would amount to a six-figure salary if you had to hire replacements. If a stay-at-home parent were to pass away, the surviving spouse would face significant new costs.

These are real financial expenses, not just inconveniences. That’s why we often recommend a life insurance policy with a minimum coverage of $250,000–$400,000 for a stay-at-home parent, depending on the family’s needs and the age of the children. This coverage ensures the family can afford to replace these invaluable services, maintaining stability during a difficult time. To understand more, read our article on Universal Life for Families and Protection.

Key Factors That Influence Your Coverage and Costs

Once we’ve determined how much universal life insurance do families need, the next step is understanding what influences its cost. Several factors impact your premiums:

- Age: The younger and healthier you are, the lower your premiums will be.

- Health Status: Your current health and medical history are key. Pre-existing conditions may lead to higher premiums.

- Gender: Women tend to live longer, which often results in slightly lower premiums.

- Lifestyle: Risky hobbies can increase your rates.

- Tobacco Use: Smokers pay significantly higher premiums, often two to three times more than non-smokers.

- Coverage Amount: A higher death benefit means a higher premium.

- Policy Type: Universal life is generally more expensive than term life but can be more affordable than whole life for similar coverage.

The Different Types of Universal Life Insurance

Universal life isn’t a single product; it’s a family of policies. Understanding these is key to choosing the right fit.

- Guaranteed Universal Life (GUL): This type offers a guaranteed death benefit and premiums for life, provided you pay them. It prioritizes certainty and lifelong protection with minimal cash value focus.

- Indexed Universal Life (IUL): IUL links cash value growth to a stock market index, like the S&P 500. It offers potential for higher growth than traditional UL, with caps to limit gains and floors (often 0%) to prevent losses from market downturns. For more details, see our What is an IUL Complete Guide.

- Variable Universal Life (VUL): VUL allows you to invest the cash value in subaccounts similar to mutual funds. It offers the highest growth potential but also the most risk, including the possibility of losing principal. VUL is considered a security and is sold with a prospectus.

The choice depends on your risk tolerance and financial goals.

Enhancing Your Policy with Common Riders

Riders are optional add-ons that customize your policy to fit your family’s needs.

Here are some popular options:

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit if diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premium payments if you become totally disabled and cannot work.

- No-Lapse Guarantee Rider: Ensures your policy won’t lapse, even if the cash value drops, as long as you pay a specified minimum premium.

- Guaranteed Insurability Rider: Lets you purchase additional coverage at future dates without a new medical exam.

- Family Riders: Can add coverage for your spouse or children under your main policy.

By strategically adding riders, we can create a policy that’s precisely custom to your family’s protection needs.

Choosing and Managing Your Policy Wisely

Selecting the right universal life policy is a significant step, but it’s not a “set it and forget it” decision. Effective policy management and choosing a reliable partner are crucial to ensure your policy performs as intended. This can even be part of a larger strategy, such as Using Life Insurance in Retirement Planning.

How to Choose the Right Insurance Company

When entrusting your family’s future to a company, reliability is paramount. Here’s what to consider:

- Financial Strength Ratings: This is the most important factor. You want a provider that is financially strong enough to pay claims decades from now. Check ratings from independent agencies like AM Best or S&P Global Ratings. You can check ratings directly with AM Best.

- Customer Service Reviews: Look for companies with a reputation for excellent support for inquiries, claims, and policyholders.

- Policy Offerings: Ensure the company offers the type of UL (GUL, IUL, VUL) and riders that suit your needs.

- Claims Process: A transparent and efficient claims process is vital for your beneficiaries.

At ShieldWise, we partner with trusted, financially sound carriers to provide you with a wide range of options.

Understanding the Risks: Underfunding and Policy Lapse

The flexibility of universal life is a double-edged sword. It places responsibility on the policyholder to ensure the policy remains funded. The biggest risk is policy lapse.

A policy can lapse if it is not funded adequately. This can happen if:

- Cost of Insurance Increases: The internal cost of insurance (COI) rises as you age. If your cash value growth or premium payments don’t cover these rising costs, the cash value will deplete.

- Low Interest Crediting: If interest rates credited to your cash value are lower than projected, your cash value may not grow fast enough to keep pace with the COI.

- Depleting Cash Value: If the cash value drops too low to cover the policy’s costs, the policy could lapse. This means your coverage ends, and you lose the money you’ve paid into it.

This is why regular policy reviews are critical. We work with our Illinois clients to periodically review their policies, ensuring they remain on track to meet their goals and avoid any surprises.

Frequently Asked Questions about Universal Life Insurance

We hear many great questions from families in Illinois about universal life insurance. Here are some common ones:

When is universal life insurance a good choice for a family?

Universal life is an excellent choice for families with:

- Long-Term Needs: If you need coverage for your entire lifetime, such as for estate planning, leaving a legacy, or providing for a dependent with special needs.

- A Desire for Flexibility: If your income fluctuates or you anticipate needing to adjust your coverage or premiums over time.

- Estate Planning Goals: The death benefit can help cover estate taxes or ensure equitable distribution of assets.

- Supplemental Retirement Goals: The cash value can be accessed later in life to supplement retirement income.

How does the cash value in an Indexed Universal Life (IUL) policy work?

In an IUL policy, cash value growth is tied to a stock market index, like the S&P 500, without direct investment in the market.

Here’s the basic structure:

- Cap Rate: The maximum interest your cash value can earn in a given period (e.g., 10%).

- Floor Rate: The minimum interest, which protects you from market losses (often 0% or 1%).

- Participation Rate: The percentage of the index’s gain that is credited to your policy (up to the cap).

This structure offers the potential for higher growth than standard UL, with downside protection. For a full breakdown, see our guide on How Cash Value Works in Indexed Universal Life.

Can I lose money in a universal life insurance policy?

Yes, it is possible to lose money, primarily in two ways:

- Policy Lapse: If you underfund the policy (pay too little in premiums) and the cash value depletes to cover costs, the policy can lapse. If this happens, you lose your coverage and all premiums paid.

- Investment Risk (VUL): With a Variable Universal Life (VUL) policy, the cash value is invested in subaccounts subject to market fluctuations. If these investments perform poorly, you can lose principal, which could lead to a lapse.

Additionally, outstanding policy loans reduce the death benefit, and if the policy lapses, the loaned amount may be subject to income taxes. Careful management is key to avoiding these pitfalls.

Conclusion

Determining how much universal life insurance do families need is a thoughtful process, not a quick guess. We’ve explored various calculation methods, from the DIME formula to income multipliers and needs-based analysis, all designed to give you a clear picture of your family’s financial requirements. We’ve also highlighted the unique benefits of universal life—its permanent coverage, cash value growth, and remarkable flexibility—along with the crucial factors that influence its cost and the risks associated with underfunding.

Universal life insurance can be a powerful and flexible tool for families in Illinois, offering lifelong protection and a valuable cash asset. But its complexity means a personalized approach is essential. At ShieldWise, we believe in clear, jargon-free guidance. We’re here to help you steer your options, compare plans from trusted carriers, and secure the right coverage that protects your family’s future without overextending your budget.

Don’t leave your family’s financial security to chance. Take the next step to understand your needs and explore solutions that fit your life.