Why Planning for Funeral Expenses Matters Now

Ways to pay for funeral and burial costs include life insurance policies, pre-need plans, dedicated savings accounts, government assistance programs, veterans benefits, crowdfunding, and personal loans. Here’s a quick overview of the most common options:

| Payment Method | Best For | Key Advantage |

|---|---|---|

| Life Insurance / Final Expense Insurance | Pre-planning | Tax-free payout, no medical exam options |

| Payable on Death (POD) Account | Avoiding probate | Immediate access to funds for beneficiaries |

| Prepaid Funeral Plan | Locking in prices | Guarantees current costs, eases family decisions |

| Veterans Benefits | Military families | Free burial in national cemeteries, allowances |

| Crowdfunding | Urgent need | Quick community support |

| Government Assistance | Low-income families | FEMA, state programs, victim compensation |

| Personal Loan | Last resort | Immediate funds (but high interest rates) |

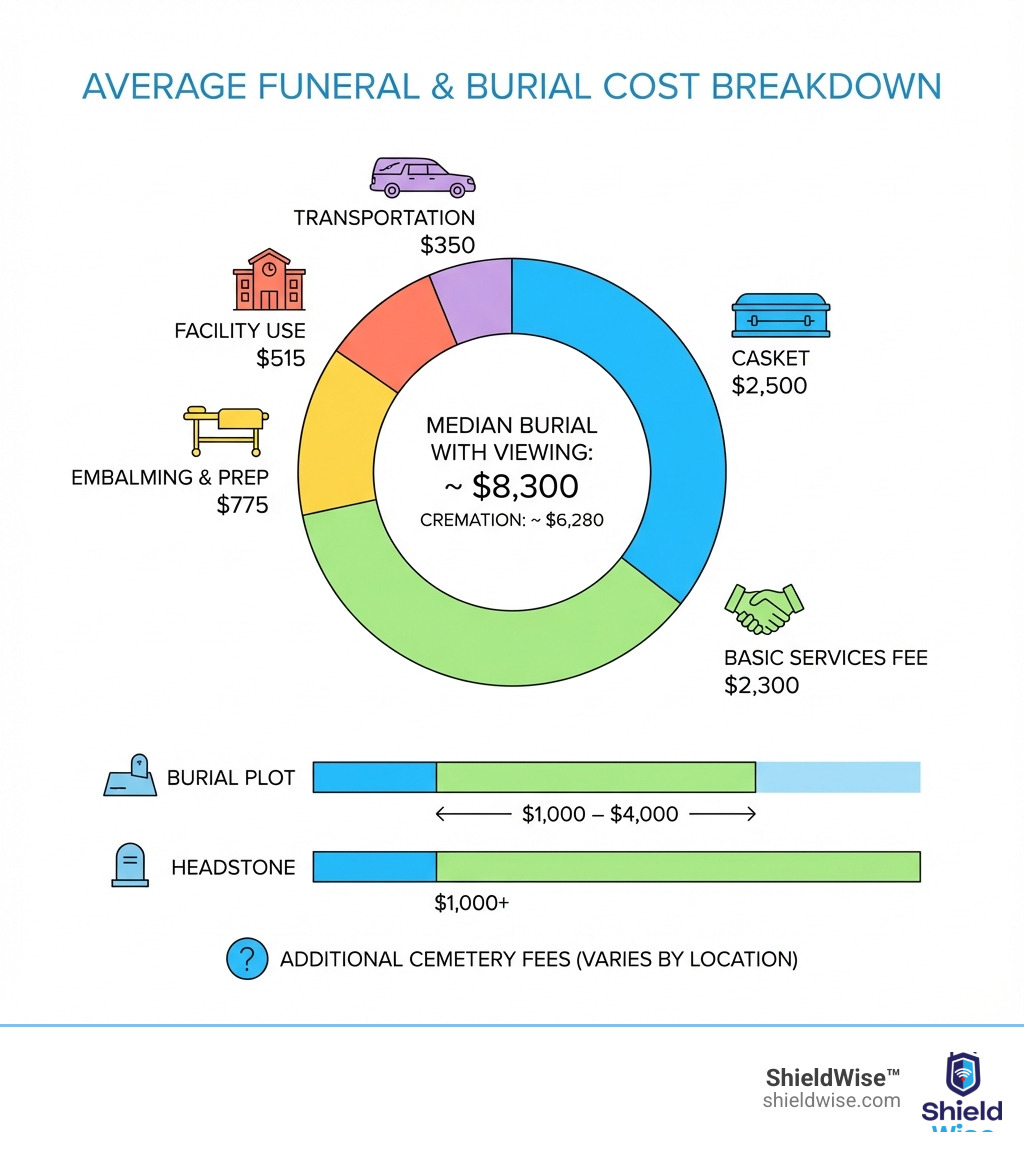

The loss of a loved one brings profound emotional pain—and often an unexpected financial burden. According to the National Funeral Directors Association, the median cost of a funeral with viewing and burial is about $8,300, while cremation services average around $6,280. For many families, especially those on fixed incomes, these costs can quickly become overwhelming.

You’re not alone if you’re worried about how to cover these expenses without draining savings or burdening your family. The good news? There are more options than you might think—from insurance and savings strategies to government programs and creative alternatives like green burials or body donation.

At ShieldWise, we’ve spent years helping families understand their options for ways to pay for funeral and burial costs through clear, unbiased guidance on final expense insurance, Medicare, and long-term financial planning. Our goal is to help you make informed decisions without the confusion or sales pressure.

Understanding the Financial Landscape of Funerals

Before exploring ways to pay for funeral and burial costs, it’s helpful to understand what goes into the bill. Funeral costs can vary significantly based on the type of service, merchandise selected, and location. Knowing the typical expenses helps us plan more effectively and avoid overspending during an emotional time.

A comprehensive funeral pricing checklist, like those recommended by the FTC, typically includes several key components:

- Basic Services Fee: This non-declinable fee, which averages around $2,300, covers the funeral director and staff’s time for services common to all funerals. This includes planning, securing permits, preparing notices, sheltering remains, and coordinating with third parties.

- Casket Costs: Often the most expensive item in a traditional funeral, caskets average slightly more than $2,000. However, prices can range from $2,000 for standard models to over $10,000 for high-end designs made of mahogany, bronze, or copper.

- Embalming Fees: Averaging about $775, embalming is a process for preserving the body. Embalming is generally not legally required in Illinois unless certain conditions are met, such as public viewing or transportation across state lines without refrigeration. We’ll discuss this further below.

- Transportation Costs: This covers the use of a hearse, other funeral vehicles, and staff for transportation, typically around $350.

- Other Funeral Home Charges: These can include facility use for viewing or ceremonies (averaging $515), preparation of the body (if not embalmed), and administrative fees.

- Cash Advances: These are fees for goods and services the funeral home purchases from outside vendors on your behalf, such as flowers, obituary notices, clergy fees, or pallbearers. The funeral home must disclose if they add a service fee to these costs.

- Cemetery Fees: If choosing burial, these costs are separate from the funeral home. A burial plot alone can range from $1,000 to $4,000. Additional cemetery costs include opening and closing the grave, perpetual care fees for maintenance, and the cost of a headstone or grave marker, which can exceed $1,000.

- Cremation Costs: While often less expensive than traditional burial, cremation still involves costs. The median cost of a funeral with viewing and cremation is about $6,280. Direct cremation, which involves cremation immediately after death without a funeral service, can range from roughly $600 to $3,000.

Understanding this breakdown helps us make informed decisions and compare options. For a more detailed look at what to expect, the FTC offers a comprehensive Funeral Costs and Pricing Checklist.

Planning Ahead: Proactive Ways to Pay for Funeral and Burial Costs

Planning for final expenses in advance is a compassionate gift to your loved ones. Pre-planning alleviates the emotional and financial burden on grieving family, allowing them to focus on healing instead of hurried decisions and unexpected bills.

Secure Your Legacy with Insurance

Life insurance is one of the most common and effective ways to pay for funeral and burial costs. A life insurance policy provides a tax-free death benefit to your beneficiaries, which can be used to cover funeral expenses, outstanding debts, or other financial needs.

- Final Expense Insurance (Burial Insurance): This whole life insurance is designed for end-of-life costs, with policies typically from $5,000 to $25,000 (some up to $50,000). Premiums are fixed for life as long as they are paid. Many policies offer simplified underwriting (a few health questions, no medical exam). Guaranteed issue policies require no health questions, making them accessible for those with significant health issues, though they are more expensive and may have a two-year waiting period for non-accidental deaths. The payout goes directly to your beneficiary to use for any purpose. At ShieldWise, we specialize in Final Expense Insurance to provide peace of mind. For a deeper dive, see our guide, What is Burial Insurance?.

- Payout Timelines: While a traditional life insurance payout can take 30-60 days, final expense policies are often designed for quicker payouts. However, it’s crucial to inform your beneficiaries about the policy and where to find the necessary documents (like the death certificate) to expedite the process. Our How Burial Insurance Works Guide provides more details.

- Using Life Insurance in Retirement Planning: Beyond covering funeral costs, life insurance, especially whole life or indexed universal life (IUL) policies, can play a strategic role in your broader financial plan. They can build cash value over time, which you might access in retirement, creating a dual-purpose financial tool. Learn more in our article on Using Life Insurance in Retirement Planning.

Establish Dedicated Savings and Trusts

Setting aside funds specifically for funeral expenses is another proactive approach, offering direct control over your money.

- Payable on Death (POD) Accounts: Also known as Totten Trusts (ITF), Transfer on Death (TOD), or Revocable Pay on Death (POD), these bank accounts allow you to designate a beneficiary who can access the funds immediately upon your death by presenting a death certificate. This is a safe and reliable way to ensure funds are available without going through probate, which can tie up money for months. We recommend naming a trusted family member or executor as the beneficiary. While generally not advisable, some individuals name two beneficiaries to split funds. It’s crucial to avoid naming a funeral director as a beneficiary. Check with your bank about Illinois-specific rules regarding account activity to prevent dormancy.

- Funeral Trusts: These are legal arrangements where you place funds in a trust specifically for your funeral expenses. These trusts are managed by a trustee, and upon your death, the funds are released to cover the costs.

- Revocable vs. Irrevocable Trusts: A revocable trust can be changed or canceled at any time. An irrevocable trust, however, cannot be altered without the trustee’s permission. Irrevocable trusts are often used in Medicaid planning, as up to $6,000 in a funeral plan can be discounted if you are assessed for Medicaid at a later date, helping with spend-down requirements.

- Joint Savings Accounts: You can establish a joint savings account with rights of survivorship. This means the co-owner automatically inherits the funds upon your death, providing quick access. However, ensure you trust the co-owner implicitly, as they would also have access to the funds during your lifetime.

- End of Life Planning Checklist: To ensure all aspects of your final wishes are covered, including financial arrangements, we encourage you to use an End of Life Planning Checklist for Seniors and Families.

Evaluate Pre-Need and Prepaid Funeral Plans

Pre-need plans allow you to make funeral arrangements and pay for them in advance directly with a funeral home. This can be appealing for locking in current prices and ensuring your specific wishes are honored.

| Feature | Life Insurance / Final Expense | Payable on Death (POD) Account | Prepaid Funeral Plan |

|---|---|---|---|

| Control of Funds | Beneficiary receives funds, can use as needed. | Beneficiary has immediate access, discretion. | Funds typically held by funeral home or trust. |

| Probate Avoidance | Yes (if beneficiary named). | Yes. | Yes. |

| Price Locking | No (payout is fixed, but expenses may rise). | No (funds grow with interest, but expenses may rise). | Yes (often locks in specific service prices). |

| Portability | Highly portable. | Portable (bank account can be accessed anywhere). | Limited (issues if you move or funeral home closes). |

| Flexibility | High (beneficiary can use for anything). | High (beneficiary can use for anything). | Low (funds tied to specific services/funeral home). |

| Medicaid Impact | Generally not counted if irrevocable. | May be counted as an asset. | Can be excluded for Medicaid spend-down. |

- Prepaying at a Funeral Home: When you prepay, you enter a contract with a specific funeral home. This can be beneficial for locking in prices, protecting against future inflation, and sparing your family from making difficult decisions under duress.

- Portability Issues and Risks: The main drawback of prepaid plans is portability. If you move to another state (or even a different part of Illinois) or die far from the funeral home, the plan might not be honored, or the new funeral home might not accept the original agreement. Additionally, if the funeral home goes out of business, your funds could be at risk, depending on state laws.

- State Law Protections: Illinois, like other states, has laws governing the prepayment of funeral goods and services. These laws often require the funeral home to place a percentage of your prepayment into a state-regulated trust or to purchase a life insurance policy with the death benefits assigned to the funeral home. It’s crucial to understand these protections before signing any contract.

- Cancellation Policies: Always review the contract’s cancellation policy. Can you get a full refund if you change your mind? What if you move? These are important questions to ask.

- Planning Your Own Funeral: The Federal Trade Commission (FTC) provides valuable guidance on Planning Your Own Funeral, emphasizing the importance of understanding what you’re paying for and how the money is handled.

At-Need Solutions and Financial Assistance

Sometimes, despite our best intentions, a death occurs without pre-arranged funding. In these difficult moments, several ways to pay for funeral and burial costs become available, though they often require immediate action.

Accessing Immediate Funds After a Death

- Using Existing Life Insurance: If the deceased had a life insurance policy, the death benefit is the primary source of funds. While payouts typically take 30-60 days, many funeral homes will accept assignment of a portion of the policy’s proceeds directly from the insurer, allowing them to proceed with services without immediate upfront payment from the family.

- Estate Funds and Probate Delays: Funds held in the deceased’s personal bank accounts or other assets within their estate might be available, but these are usually tied up in probate. Probate in Illinois can take months, or even a year, delaying access to funds. Since most funeral homes require upfront payment, families often end up paying out-of-pocket and waiting for reimbursement from the estate.

- Employer or Union Survivor Benefits: Inquire with the deceased’s former employer or union. Many organizations offer death benefits, survivor benefits, or group life insurance policies that can help cover funeral expenses.

- Social Security Lump-Sum Payment: The Social Security Administration provides a one-time lump-sum death payment of $255 to an eligible surviving spouse or child. While a small amount, every bit can help.

Tapping into Community and Government Support

When personal funds are insufficient, external assistance can provide crucial support.

- Crowdfunding: Online platforms like GoFundMe for funerals have become popular ways to pay for funeral and burial costs. Families can quickly raise funds from friends, family, and even sympathetic strangers. Most sites are free to use, though they may charge processing fees on collected amounts.

- Family Contributions: Don’t hesitate to ask for help from friends and family. A collective effort can significantly ease the financial burden.

- FEMA Disaster Assistance: If the death was related to a federally declared disaster, the Federal Emergency Management Agency (FEMA) may offer financial assistance. For instance, FEMA’s COVID-19 funeral assistance program has offered up to $9,000 per funeral for COVID-19 related deaths, available until September 2025.

- State and Local Programs (Illinois Specific): In Illinois, the Department of Human Services (IDHS) offers funeral and burial benefits for eligible individuals. These programs are typically for low-income residents and can help cover basic cremation or burial costs. Eligibility requirements and assistance amounts vary, so contact your local IDHS office or refer to the Illinois Department of Human Services Funeral & Burial Benefits for specific details. Illinois Legal Aid also provides information on Applying for funeral and burial costs from IDHS.

- Victim Compensation Programs: If the death resulted from a violent crime, victim compensation programs in Illinois may reimburse families for funeral and burial charges. This assistance is available even if no one is arrested or convicted for the crime, with reimbursement amounts ranging from $10,000 to $100,000 across different states. You can find more information through the National Association of Crime Victim Compensation Boards.

Honoring Service: Veterans’ Funeral and Burial Benefits

For eligible U.S. veterans and their families, significant benefits are available to help with funeral and burial costs.

- Burial in National Cemeteries: Veterans can be buried in a national cemetery at no charge for the gravesite or marker. While space is limited, we recommend obtaining a predetermination of burial eligibility if this is a desired option.

- Burial and Plot Allowances: The Department of Veterans Affairs (VA) offers burial allowances to help defray costs. These tax-free cash payments vary based on the circumstances of the veteran’s death:

- Up to $2,000 for service-related deaths.

- Up to $300 for non-service-related deaths, plus an additional plot allowance of up to $807.

- Up to $807 allowance and an $807 plot allowance if the veteran was hospitalized by the VA at the time of death.

- Headstones and Markers: The VA provides a government headstone, marker, or medallion for the grave of any eligible veteran in any cemetery, free of charge.

- Presidential Memorial Certificates: These are engraved paper certificates signed by the current President, honoring the deceased veteran.

- For complete details on eligibility and how to apply, visit the VA burial benefits details.

Considering a Funeral Loan as a Last Resort

When all other avenues are exhausted, a funeral loan might seem like a viable solution. These are typically personal loans that can cover immediate funeral costs, with repayment over time.

- Interest Rates and Repayment Terms: Funeral loans often come with high interest rates, ranging from 5% to 36%, with an average around 15%. This can significantly increase the total cost of the funeral. Repayment terms vary, but it’s crucial to understand the monthly payments and total interest accrued.

- Financial Risks: Taking on additional debt during a period of grief can exacerbate financial stress. We strongly advise against borrowing money for funeral costs unless it is an absolute last resort, and you have a clear plan for repayment.

- When It Might Be Suitable: A funeral loan might be considered if there are no other immediate funds available, and you anticipate a life insurance payout or estate funds that will cover the loan within a short, manageable period, allowing you to pay it off quickly to minimize interest.

Smart Strategies to Control and Reduce Funeral Expenses

Beyond finding ways to pay for funeral and burial costs, we can also employ smart strategies to control and reduce the expenses themselves. Being an informed consumer is your best defense against overspending.

Know Your Rights: The FTC Funeral Rule

The Federal Trade Commission’s (FTC) Funeral Rule is a powerful tool designed to protect consumers. It ensures transparency and prevents funeral homes from pressuring you into unnecessary purchases.

- Right to Itemized Pricing: Funeral homes must provide you with a written, itemized price list (General Price List) when you inquire about arrangements in person. This allows you to compare costs for specific services and merchandise.

- Getting Prices by Phone: You have the right to get accurate price information over the phone. This enables you to comparison shop without visiting multiple funeral homes.

- Buying Only What You Want: Funeral homes cannot require you to purchase a package that includes items you don’t want or need. You can select only the goods and services you desire.

- Providing Your Own Casket: You have the right to purchase a casket from a third-party dealer (online or a local store) and have it delivered to the funeral home. The funeral home cannot refuse it or charge you an extra fee for using it.

- Embalming Not Required by Law: As we touched on earlier, no federal law requires embalming. While some states may require it or refrigeration if the body isn’t buried or cremated within a certain timeframe, refrigeration is often an acceptable alternative. Funeral homes cannot tell you embalming is required by law unless it is for specific circumstances (e.g., public viewing).

- For full details on your consumer protections, refer to The FTC Funeral Rule explained.

Choose Lower-Cost Disposition Options

Choosing simpler disposition methods can significantly reduce costs.

- Direct Cremation: This is often the least expensive option. The body is cremated shortly after death without embalming, viewing, or a formal funeral service. An inexpensive unfinished wood box or alternative container is used, rather than a traditional casket. The cremated remains are then returned to the family.

- Direct Burial: Similar to direct cremation, direct burial involves immediate burial of the body without embalming, viewing, or a formal service. It typically uses a simple container and can be significantly less expensive than a traditional burial.

- Simple Disposition: Both direct cremation and direct burial fall under “simple disposition” options, focusing on the immediate and respectful handling of remains without elaborate services.

- Alternative Containers: For cremation, funeral homes must offer an inexpensive alternative container instead of requiring a casket.

- Renting a Casket for Viewing: If you desire a viewing before cremation, some funeral homes offer caskets for rent, which can be a cost-effective alternative to purchasing a new one.

- Understanding these options is part of managing your What Are Final Expenses? effectively.

Explore Alternative and Eco-Friendly Funerals

Beyond traditional options, alternative and eco-friendly funerals offer both cost savings and a unique way to honor a loved one.

- Green Burials: These focus on minimizing environmental impact. They typically forgo embalming chemicals, use biodegradable shrouds or caskets, and involve burial in natural settings. Green burials are often less expensive than traditional burials due to the absence of embalming, expensive caskets, and burial vaults. The Green Burial Council defines and promotes these practices.

- Home Funerals: A home funeral involves the family taking care of some or all aspects of the funeral at home, rather than relying solely on a funeral home. This can include preparing the body, holding a vigil, and arranging transportation. Home funerals are legal in most states in the U.S. (all but nine). While Illinois allows home funerals, research specific state and local legal requirements regarding death certificates, transportation, and disposition to ensure compliance. This option can significantly reduce funeral home service costs.

- Body Donation to Science: Donating a body to a medical school or research institution is perhaps the most cost-effective option, as it typically eliminates all funeral and burial expenses. The accepting organization usually covers the cost of cremation after the body has been used for research, and the cremated remains are often returned to the family, usually within two years. This is a profound way to contribute to medical advancement while also alleviating financial burdens.

Frequently Asked Questions about Funeral Costs

As we steer the various ways to pay for funeral and burial costs, some common questions often arise.

What happens if a family has absolutely no money for a funeral?

If a family truly has no funds for a funeral, local government agencies, such as the Illinois Department of Human Services (IDHS) or county social services, may offer assistance for what is sometimes called an “indigent burial” or “pauper’s grave.” These programs provide basic cremation or burial services, ensuring a dignified disposition. You would need to contact your local county coroner or medical examiner’s office, as they often handle arrangements for unclaimed or unfunded remains and can guide you to available resources.

Is embalming legally required?

No, embalming is generally not legally required in Illinois or by federal law (the FTC Funeral Rule explicitly states this). There are specific circumstances where a funeral home might require it, such as for an open-casket viewing or if the body is not buried or cremated within a certain period. However, refrigeration is often an acceptable alternative to embalming. You have the right to decline embalming if it’s not mandated by state law for your chosen disposition method.

How quickly does life insurance pay out for funeral expenses?

Life insurance policies typically pay out within 30 to 60 days after the insurer receives all necessary documentation, including the official death certificate. While this isn’t immediate, it’s usually much faster than waiting for funds tied up in probate. Some funeral homes may allow you to assign a portion of the death benefit directly to them to cover their costs, but the full payout to the beneficiary still follows the standard timeline. For those prioritizing quick access to funds, dedicated final expense or burial insurance policies are designed with simpler claims processes in mind. Our How Burial Insurance Works Guide explains this in more detail.

Conclusion: A Thoughtful Plan Protects Your Loved Ones

Navigating the financial aspects of loss is undeniably challenging, but as we’ve explored, there are numerous ways to pay for funeral and burial costs. From proactive planning with life insurance and dedicated savings to at-need solutions like government assistance and veterans’ benefits, options exist to fit various circumstances.

The most important takeaway is the power of planning. By considering these options in advance, communicating your wishes, and setting aside funds or securing appropriate insurance, you can significantly reduce the emotional and financial stress on your loved ones during an already difficult time.

At ShieldWise, we believe that understanding your choices is the first step toward peace of mind. We’re here to provide clear, jargon-free guidance to help you protect your family and secure the right coverage. Don’t let uncertainty add to the burden of grief. Take control of your final wishes today.

Ready to explore your options? Compare Final Expense Quotes with us and find a plan that works for you and your family.