Why Understanding IUL Matters for Your Financial Future

What is IUL and why is it a popular topic in financial planning? Indexed Universal Life (IUL) insurance is a type of permanent life insurance that combines a lifelong death benefit with a cash value component. This cash value grows based on the performance of a stock market index, like the S&P 500, without direct market investment. It offers a balance between growth and safety by providing downside protection with a guaranteed floor (usually 0%) and limiting gains with a cap.

Key Features of IUL:

- Permanent Coverage: A death benefit that lasts your entire life.

- Index-Linked Growth: Cash value growth is tied to a market index, with a floor and cap.

- Flexible Premiums: You can adjust premium payments within certain limits.

- Tax Advantages: Cash value grows tax-deferred, and policy loans are typically tax-free.

- Downside Protection: Your cash value is protected from market losses by the floor.

If you’re planning for your family’s future, you may have heard about IUL and its promises of “tax-free retirement income” or “market gains without the risk.” While it sounds appealing, it’s crucial to separate the facts from the marketing hype.

IUL can be a powerful tool for the right person, but it’s also one of the most complex insurance products available. It’s not a “set it and forget it” policy and isn’t suitable for everyone. Before committing, you need to understand how it works, its costs, and if it aligns with your financial goals.

This guide will provide a clear, honest look at indexed universal life insurance. We’ll explain how the cash value grows, what caps and floors mean, and when IUL makes sense. You’ll gain the knowledge needed to make a confident decision for your financial future.

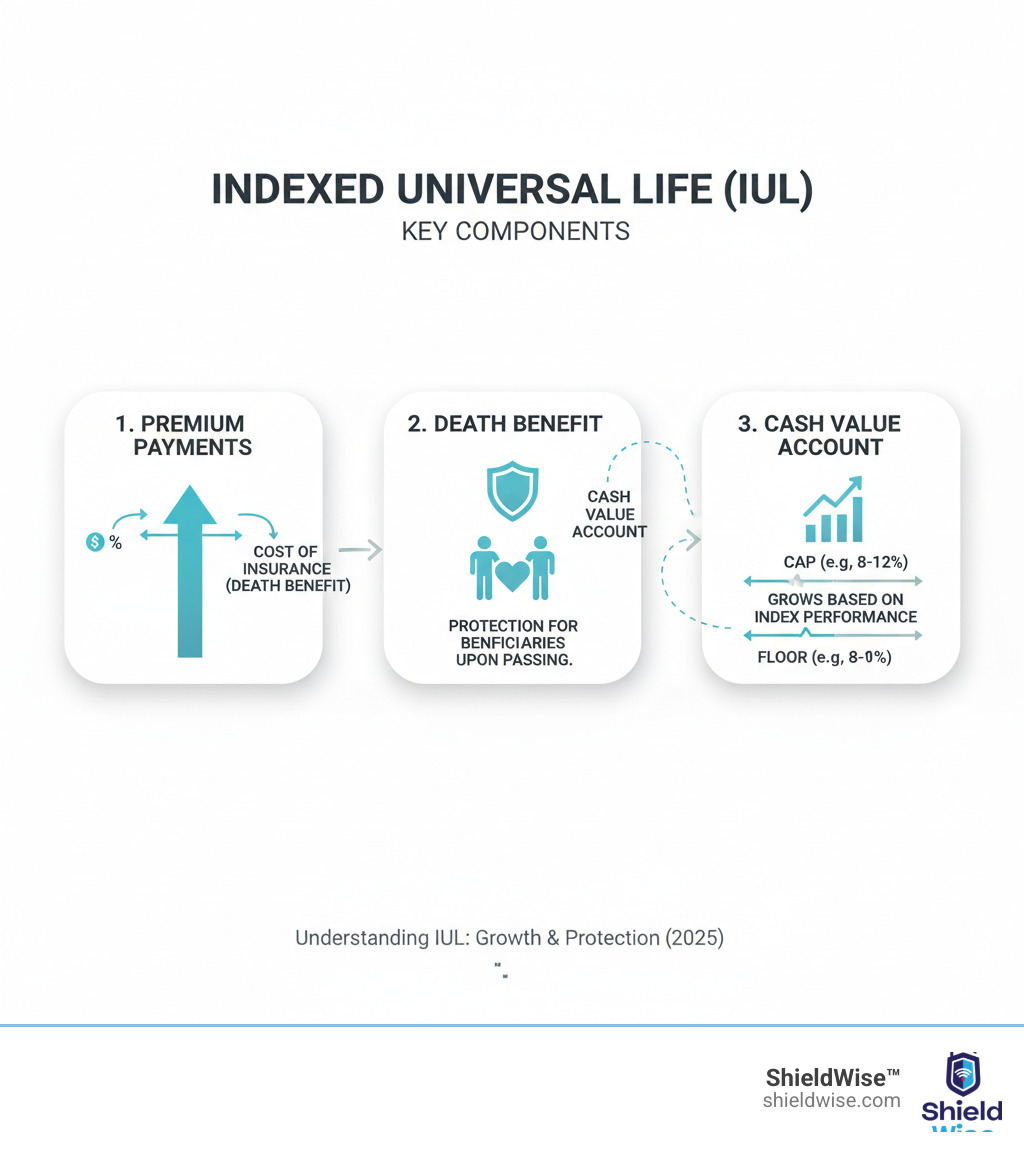

What is IUL and How Does It Work?

So what is IUL exactly? At its core, Indexed Universal Life (IUL) is a type of permanent life insurance that lasts your entire life, unlike term insurance which covers a set period. It’s designed to provide both a death benefit for your family and a cash value account that can grow based on a stock market index.

When you make a premium payment, the money is split. Part covers the cost of insurance and administrative fees. The rest goes into your cash value account, where it can grow based on an index like the S&P 500. This growing cash value can be accessed during your lifetime through policy loans or withdrawals, offering a source of funds for retirement, college tuition, or other needs.

IUL policies are also known for flexible premiums. Within policy limits, you can often adjust how much you pay and sometimes even adjust the death benefit. For a more detailed breakdown, An overview of IUL from Investopedia offers a thorough look at the mechanics.

The Dual Components: Protection and Growth

IUL serves two main purposes in your financial plan:

- Death Benefit Protection: This is the primary function of any life insurance. If you pass away, your beneficiaries receive a tax-free payout to cover expenses, replace income, or provide financial security.

- Cash Value Accumulation: This is the policy’s living benefit. A portion of your premiums funds this account, which grows on a tax-deferred basis. This means you don’t pay taxes on the growth annually, allowing it to compound more effectively over time.

This dual nature makes IUL a versatile financial tool, offering protection for today and potential financial flexibility for tomorrow.

How Your Money is Handled (Without Direct Investment)

A crucial point to understand is that your cash value is not directly invested in the stock market. You don’t own any stocks. Instead, the insurance company uses options strategies tied to an equity index like the S&P 500. The performance of that index determines the interest credited to your account.

This indirect method provides the downside protection IUL is known for. If the index goes up, your cash value is credited with interest (up to a limit). If the index goes down, you’re protected by a floor (typically 0%), so you don’t lose money from market drops. This protection comes at the cost of limited gains, which are determined by caps and participation rates. How insurers credit interest is based on a specific formula, creating a middle-ground approach between aggressive investing and the fixed returns of traditional insurance.

The Engine of Growth: Understanding IUL Cash Value Mechanics

The cash value component’s growth mechanism is tied to market indexes like the S&P 500 or Nasdaq-100, offering a blend of growth potential and principal protection. Understanding the technical terms that govern this growth is crucial before committing to a policy.

Caps, Floors, and Participation Rates Explained

Three key terms define your potential returns: caps, floors, and participation rates. These are the guardrails on your policy’s growth.

- Floor Rate: This is your safety net, the minimum interest your cash value can earn. Most policies have a 0% floor, meaning your cash value won’t lose money due to poor market performance. If the index drops 20%, your account is credited with 0% for that period.

- Cap Rate: This is the maximum interest your cash value can earn. If your policy has a 10% cap and the index gains 25%, your interest credit is limited to 10%. Caps typically range from 8%-12% but can vary.

- Participation Rate: This determines what percentage of the index’s gain is credited to your policy (up to the cap). An 80% participation rate on a 10% index gain results in an 8% credit.

Some policies also use a spread, which is a percentage deducted from the index gain before interest is credited. These different crediting methods vary by policy. To learn more about the benchmark that drives this growth, see this guide to Understanding the S&P 500.

A Real-World Example: IUL Performance in Up and Down Markets

Let’s see how an IUL might perform in volatile markets. In 2022, the S&P 500 fell by 18.1%. An IUL policy with a 0% floor would have protected the cash value from any loss, earning 0% interest for the period.

In 2023, the market recovered with a 24.2% gain. An IUL with a 10% cap would have been credited with 10% interest—a solid return, but far less than the full market gain. This illustrates the trade-off: you sacrifice some upside potential for complete downside protection from market volatility.

A hypothetical scenario for 2022-2023 with an 11% cap might yield an average growth rate of around 5% annually. This rate might seem modest, but it accounts for zero losses during a major downturn. Whether this trade-off is right for you depends on your risk tolerance.

Crucially, these examples don’t include the impact of fees. Policy costs are deducted from your cash value and can significantly reduce your net growth, a topic we’ll cover in more detail later.

IUL Pros and Cons: A Balanced Look at the Benefits and Risks

Understanding what is IUL involves weighing its trade-offs. It’s essential to know what you’re gaining and what you’re giving up before deciding if it’s the right fit for your financial strategy.

The Advantages of an IUL Policy

IUL policies are chosen for several key benefits, particularly for those with long-term goals who want a mix of protection and growth.

- Market-Linked Growth Potential: Offers the potential for higher returns than traditional whole life insurance by linking cash value growth to a stock market index.

- Downside Protection: The 0% floor protects your cash value from losses during market downturns, providing a valuable safety net.

- Tax Advantages: Cash value grows tax-deferred, and policy loans are generally tax-free, making it an attractive tool for supplemental retirement income.

- Flexible Premiums: You can adjust premium payments, and sometimes even skip them if there’s enough cash value to cover policy costs.

- No Contribution Limits: Unlike 401(k)s and IRAs, there are no federally mandated limits on how much you can contribute, which is ideal for high earners.

- Permanent Death Benefit: Provides a lifelong, tax-free death benefit to your beneficiaries.

The Disadvantages and Risks to Consider

It’s equally important to understand the potential drawbacks and risks associated with IUL policies.

- Complexity: IULs are complicated. Understanding the crediting methods, fees, and various moving parts can be challenging.

- Capped Returns: While you’re protected from losses, your gains are limited by a cap. In strong bull markets, your returns will be significantly lower than direct market investments.

- Internal Costs and Fees: These policies have substantial costs, including the cost of insurance (which rises with age), administrative fees, and premium charges. These fees can erode cash value, especially in low-return years.

- Policy Lapse Risk: If the cash value doesn’t grow enough to cover rising costs, or if the policy is underfunded, it can lapse. This results in a loss of coverage and potential tax penalties.

- Requires Active Management: IUL is not a “set it and forget it” product. It requires regular reviews to ensure it’s performing as expected.

- Surrender Charges: Canceling the policy in the first 10-15 years often results in significant surrender charges, meaning you could get back less than you paid in.

IUL in Your Financial Strategy: How It Fits

An IUL policy is a specialized tool, and its effectiveness depends on how it fits into your broader financial strategy. It’s not a one-size-fits-all solution.

IUL vs. Other Permanent Life Insurance

IUL is one of several permanent life insurance options, each with different features:

- vs. Whole Life: Whole life offers guaranteed premiums, death benefit, and cash value growth. It’s simple and predictable but has lower growth potential. IUL offers more flexibility and higher growth potential but is more complex and has capped returns.

- vs. Standard Universal Life (UL): Standard UL also has flexible premiums, but its cash value earns a fixed interest rate set by the insurer. IUL adds the index-linked component for potentially higher returns.

- vs. Variable Universal Life (VUL): VUL is higher risk, as your cash value is directly invested in sub-accounts similar to mutual funds. You can lose principal. IUL’s 0% floor protects your principal from direct market losses.

IUL occupies a middle ground, offering more growth potential than fixed-rate policies with less risk than VUL.

IUL as a Supplement to Retirement Planning

IUL is often used as a supplement to retirement savings, especially after maxing out traditional accounts like 401(k)s and IRAs. Here’s why:

- No Contribution Limits: Unlike 401(k)s and IRAs, IULs have no annual contribution limits, making them useful for high-income earners.

- Tax-Advantaged Access: Cash value grows tax-deferred, and policy loans can provide tax-free supplemental income in retirement.

- No RMDs: IUL cash value is not subject to Required Minimum Distributions (RMDs), giving you more control over your funds.

- Risk Management: The 0% floor protects your principal from market downturns, a feature many find appealing for long-term savings.

It’s crucial to view IUL as a supplement, not a replacement for a 401(k) or IRA. For most people, traditional retirement accounts are better primary savings vehicles due to lower fees and uncapped growth. IUL is best suited for those who have already maximized other options and seek additional tax-advantaged strategies.

Navigating the Fine Print: Costs, Taxes, and Key Regulations

The complexity of what is IUL is most apparent in its costs and tax rules. Understanding these details is essential to ensure your policy performs as expected and you receive its intended benefits.

Understanding the Costs and Fees

IUL policies have several internal charges that are deducted from your cash value and impact your net growth. These include:

- Cost of Insurance (COI): The charge for the death benefit, which increases as you age. This can become a significant drain on cash value in later years.

- Premium Load: A percentage taken from each premium payment to cover sales commissions and administrative costs.

- Administrative Expenses: Flat fees for policy maintenance and record-keeping.

- Surrender Charges: Substantial fees if you cancel the policy within the first 10-15 years, which can result in getting back less than you paid in.

- Rider Costs: Additional fees for optional benefits like long-term care provisions.

Your policy’s growth must outpace these fees to build meaningful cash value. In years with 0% returns, fees are still deducted, which can cause your cash value to shrink and potentially lead to a policy lapse.

The 7-Pay Test and Modified Endowment Contracts (MEC)

To prevent life insurance from being used purely as a tax shelter, the IRS created the 7-Pay Test. You can find the technical details in the U.S. Code. In simple terms, if you fund your policy with too much premium too quickly (exceeding a specific limit in the first seven years), it becomes a Modified Endowment Contract (MEC).

Once a policy becomes a MEC, it loses its favorable tax treatment. Loans and withdrawals are taxed as ordinary income, and if you are under age 59½, you’ll also face a 10% penalty. This is avoidable with proper policy design and funding.

Key Tax Questions for What is IUL

The tax treatment of IUL is a major selling point, but the rules are specific.

- Tax-Free Death Benefit: Your beneficiaries receive the death benefit free of federal income tax.

- Tax-Deferred Growth: Your cash value grows without being taxed annually, allowing for faster compounding.

- Policy Loans and Withdrawals: Loans are generally tax-free, provided the policy remains in force and is not a MEC. However, if the policy lapses with an outstanding loan, the loan amount (up to the gain) becomes taxable income. Withdrawals are tax-free up to your cost basis (total premiums paid); amounts above that are taxed as income. The IRS provides guidance on the taxation of policy loans and withdrawals.

- Tax Consequences of Lapse or Surrender: If you surrender your policy or it lapses, any gain above your cost basis is taxed as ordinary income in that year. This can result in a significant and unexpected tax bill.

These rules highlight why IUL policies require consistent funding and active management to avoid negative tax consequences.

Frequently Asked Questions about IUL

As you determine if what is IUL is right for you, some common questions arise. Here are clear answers to help you make an informed decision.

Who is an IUL policy best suited for?

IUL is a specialized tool that works best for specific individuals, including:

- High-net-worth individuals who have already maxed out their 401(k) and IRA contributions and seek additional tax-advantaged growth.

- Business owners using it for succession planning, key person insurance, or executive benefits.

- Long-term planners who understand IUL is a decades-long commitment and have the patience for cash value to grow.

- Those who value a balance of risk and reward, wanting market-linked growth potential with downside protection.

Conversely, if you need cheap, short-term coverage or a simple, hands-off product, term life or whole life insurance may be a better fit.

Can you lose money in an IUL policy?

This is a nuanced question. While the 0% floor protects your cash value from direct market losses, you can lose money in other ways:

- Fees and Charges: The cost of insurance, administrative fees, and other charges are deducted monthly. During periods of low returns, these fees can erode your cash value.

- Policy Lapse: If the policy is underfunded and the cash value can’t cover the rising costs, it can lapse. You would lose your coverage and could face a tax bill on any gains.

- Surrender Charges: If you cancel the policy in the early years (typically the first 10-15), you will face significant charges and likely get back less than you paid in premiums.

So, while your principal is safe from market crashes, the policy can lose value if not funded and managed properly.

What is IUL’s role in a financial plan?

IUL should be viewed as a specialized tool within a broader financial strategy, not the foundation. Its primary roles include:

- Supplemental Retirement Income: After maxing out 401(k)s and IRAs, IUL can provide an additional source of tax-advantaged income through policy loans.

- Tax-Advantaged Wealth Accumulation: It offers a way for those in higher tax brackets to grow money tax-deferred.

- Estate Liquidity: The tax-free death benefit provides immediate cash to beneficiaries to cover estate taxes or other final expenses.

- Diversification: It offers a middle ground between the safety of fixed-income products and the risk of direct market investments.

Crucially, IUL is not a primary investment vehicle. It is life insurance first. Be wary of anyone pitching it as a replacement for a traditional retirement account. The right role for an IUL depends on your specific goals and how it complements your existing financial plan. If you’re weighing your options, ShieldWise can help you compare different types of coverage.

Securing Your Financial Future with the Right Information

So, what is IUL in summary? It’s a sophisticated form of permanent life insurance that blends a death benefit with a cash value account linked to a market index. It offers a balance of safety and growth, with a floor to protect against losses and a cap that limits gains. While not for everyone, it can be a powerful tool in the right financial plan.

An IUL policy demands consistent funding, regular monitoring, and a long-term commitment. The fees are significant, and the policy requires active management to avoid potential pitfalls like a lapse. Its suitability depends on your unique situation: your income, retirement savings, risk tolerance, and long-term goals. If you’re a high-income earner who has maxed out other retirement accounts and values downside protection, an IUL may be worth considering.

Navigating these complexities is easier with professional guidance. A qualified advisor can help you understand policy illustrations and compare IUL against other options to find the right fit.

At ShieldWise, we’re committed to providing clear, honest information to help you protect your family and build a secure future. We cut through the jargon so you can compare options from trusted carriers and find the right coverage with confidence.

Ready to take the next step? Explore your life insurance options with Shieldwise and see how simple finding the right protection can be when you have the right guidance.