What is Indexed Universal Life (IUL) Insurance?

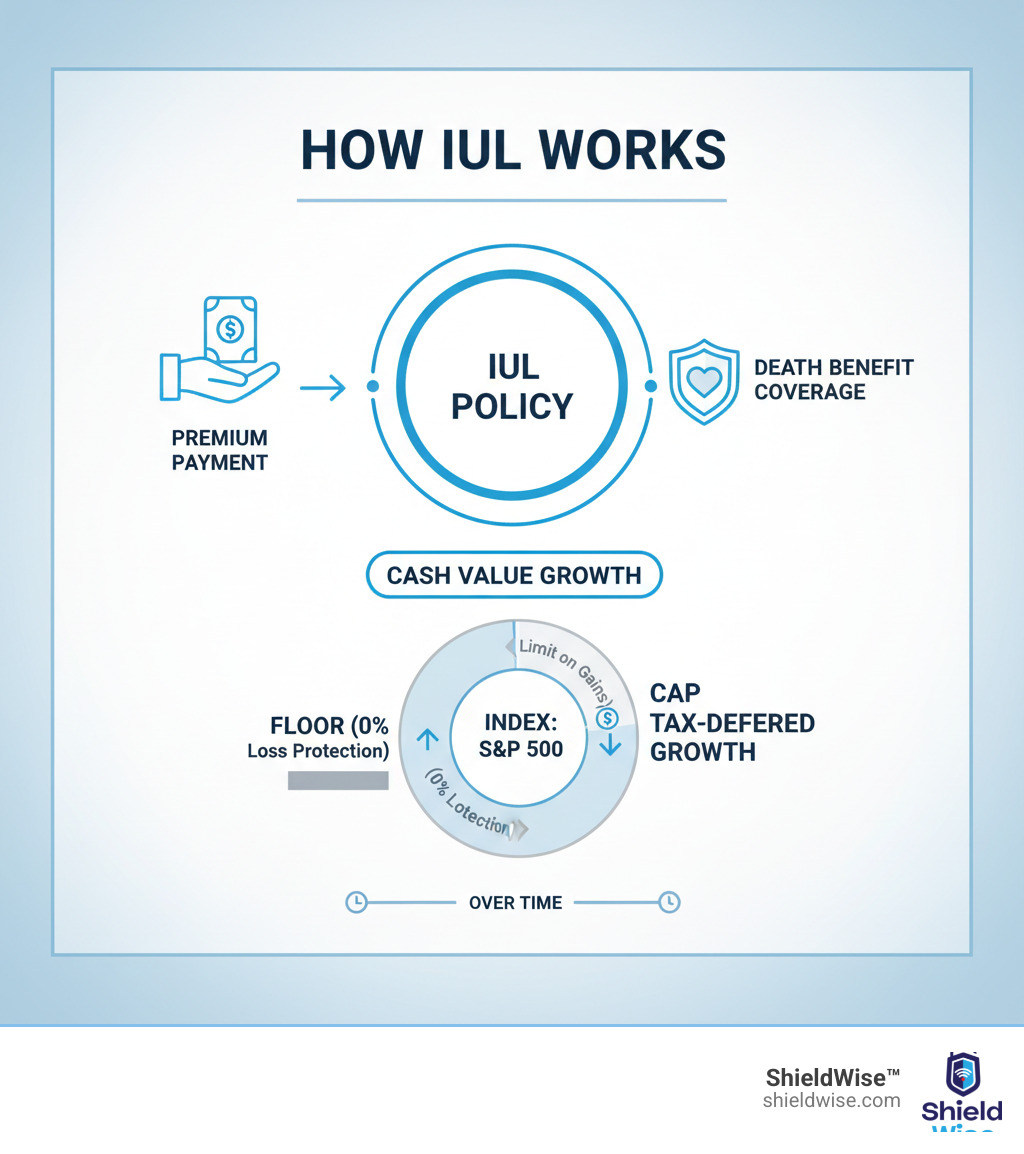

An Indexed Universal Life (IUL) insurance policy is a type of permanent life insurance that includes both a death benefit and a cash value component. This cash value grows based on the performance of a stock market index, like the S&P 500. Unlike investing directly in the market, IUL policies offer downside protection with a guaranteed floor (typically 0%) but also limit potential gains with a cap rate.

Key Features of IUL Insurance:

- Permanent Coverage: Provides lifelong protection as long as premiums are paid.

- Death Benefit: Pays out to beneficiaries upon the policyholder’s death.

- Cash Value Growth: Accumulates tax-deferred based on index performance.

- Downside Protection: A guaranteed floor (usually 0%) protects against market losses.

- Flexible Premiums: Allows you to adjust payments within certain limits.

- Cap on Returns: A maximum interest rate (often 8-12%) limits upside potential.

IUL insurance was first introduced in 1997 as an alternative to traditional whole life and variable life insurance. It was designed for those who wanted more growth potential than fixed-rate policies offered but with less risk than direct market investments.

IUL is not basic life insurance. It is a hybrid financial product that combines insurance protection with a savings component tied to market performance, using guardrails that limit both risk and reward.

The Two Core Components of an IUL

An IUL policy has two main parts: a death benefit and a cash value account.

The death benefit provides lifelong coverage. As long as the policy is in force, a pre-determined, generally income tax-free sum is paid to your beneficiaries upon your death. This provides financial stability for your loved ones.

The cash value is where the “indexed” feature operates. A portion of your premiums, after costs, goes into this account. It grows on a tax-deferred basis, meaning you don’t pay taxes on the gains annually. This cash value can be accessed later through loans or withdrawals.

How is an IUL Different from Other Life Insurance?

-

Permanent vs. Term: An IUL is permanent insurance, designed to last your entire life. Term life insurance covers a specific period (e.g., 10-30 years) and typically does not build cash value.

-

Market-linked growth vs. Fixed rates: Whole life insurance offers a fixed, guaranteed growth rate. Traditional universal life grows based on an interest rate set by the insurer. An IUL links its cash value growth to a stock market index, offering higher return potential than fixed-rate policies but with caps and floors to manage risk.

-

Flexibility vs. Rigidity: IUL policies generally offer more flexibility than whole life. You can often adjust premium payments and the death benefit as your needs change. Whole life policies typically have fixed premiums and benefits.

How Does an IUL Policy Work?

When you pay a premium on an IUL policy, the money is divided to cover several items. A portion pays for the Cost of Insurance (COI), which is the charge for your death benefit protection. This cost typically increases as you age.

Next, the insurance company deducts administrative fees for policy management. Some policies also have a premium load, which is a percentage taken from each payment. Costs for any optional riders are also deducted.

Whatever remains is allocated to your cash value account. This is the portion that grows based on the performance of a stock market index. If funded properly, this cash value can become a significant asset over time. For a deeper dive into these mechanics, check out how IULs work.

The Indexing Mechanism: Caps, Floors, and Participation Rates

The “indexed” part of IUL means your cash value growth is tied to a stock market index like the S&P 500. However, your money is not directly invested in stocks. Instead, the insurer credits interest to your account based on the index’s performance, using a derivative strategy with built-in guardrails.

These guardrails are key to understanding an IUL:

-

The cap rate is the maximum interest you can earn. If the index gains 20% but your policy has a 10% cap, your account is credited with 10%. Caps typically range from 8% to 12% and can be adjusted annually by the insurer.

-

The floor rate is your safety net, usually set at 0%. If the market crashes, your cash value won’t lose money from market performance. You’ll earn 0% for that period, protecting your principal from downturns.

-

The participation rate determines what percentage of the index’s gain you receive (up to the cap). For example, with an 80% participation rate on a 10% index gain, you’d be credited with 8%.

Insurers also use different interest crediting methods (e.g., point-to-point, monthly averaging) to calculate gains, which can lead to different results.

Accessing Your Cash Value

One of the main advantages of an IUL is the ability to access your cash value during your lifetime.

The most common method is through policy loans. You borrow against your cash value, and these loans are generally tax-free as long as the policy remains active. An outstanding loan balance will reduce the death benefit. If the policy lapses with a loan, the loan amount could become taxable income.

You can also make withdrawals, which reduce both your cash value and death benefit. Withdrawals up to the amount of premiums you’ve paid are typically tax-free; gains withdrawn beyond that are taxed as income.

Be aware of surrender charges. If you cancel the policy in the early years (often the first 10-15), the insurer will deduct substantial fees from your cash value. This makes an IUL a long-term commitment. For more details, you can review the IRS rules on life insurance proceeds.

The Main Benefits of IUL Policies

An IUL’s main appeal is its unique combination of protection, growth opportunity, and flexibility. It attempts to offer a balance between the safety of fixed-rate products and the growth potential of market-linked investments.

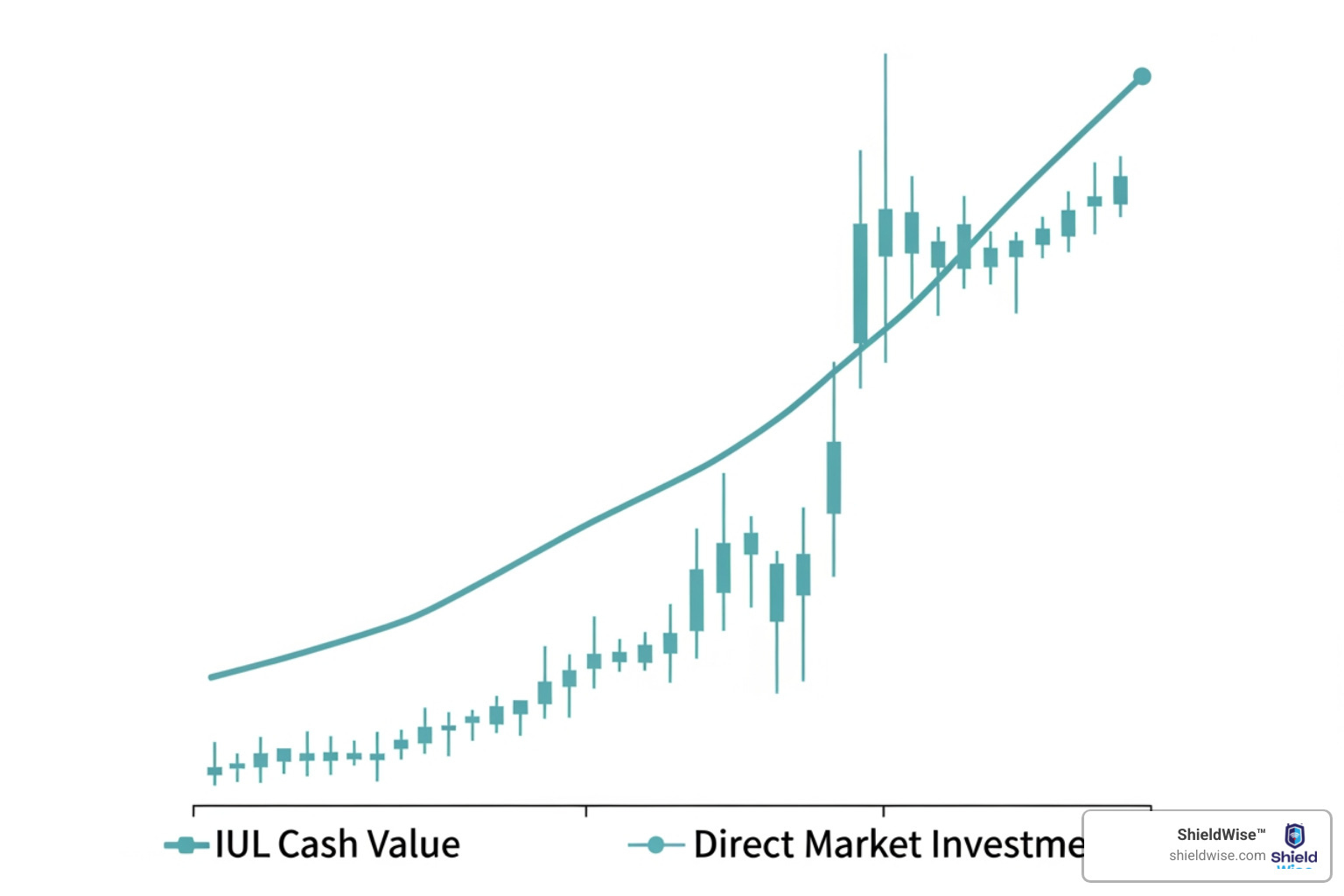

Growth Potential with a Safety Net

With an IUL, your cash value is linked to a market index like the S&P 500, offering the potential for higher returns than the modest rates of traditional whole life insurance. You might see returns of 8%, 10%, or whatever your cap rate allows in strong market years.

The key feature is the 0% floor. When the market has a down year, your cash value doesn’t lose money due to that market performance. You simply earn 0% for that period, protecting your principal. This downside protection provides peace of mind that direct market investments cannot offer. Additionally, your cash value grows tax-deferred, allowing it to compound more efficiently over time.

Tax Advantages and Flexibility

IUL policies offer several powerful tax benefits that improve their value in a financial plan.

-

Tax-Free Death Benefit: Your beneficiaries receive the full policy amount, generally without owing income tax.

-

Tax-Free Policy Loans: You can borrow against your cash value, and these loans are not considered taxable income as long as the policy remains in force. This can be a useful way to supplement retirement income or cover large expenses.

-

No Required Minimum Distributions (RMDs): Unlike a 401(k) or traditional IRA, an IUL does not force you to take distributions at a certain age. You control when and how you access your funds.

-

Flexibility: IULs allow for flexible premium payments and an adjustable death benefit. Once sufficient cash value is built, you may be able to reduce or skip premiums. You can also potentially lower your death benefit if your coverage needs decrease over time.

Potential Drawbacks and Risks of IUL

While IUL policies have benefits, they are not suitable for everyone. Understanding the potential downsides is critical before making a long-term financial commitment.

First, IUL policies are complex. The interplay of caps, floors, participation rates, crediting methods, and various fees can be difficult to understand. Unlike simple term life, an IUL is a sophisticated financial instrument that requires careful management.

These policies are not “set it and forget it.” They need regular monitoring to ensure performance is on track and that premiums are sufficient to cover rising internal costs. Insurers can and do change non-guaranteed elements like cap rates, which can affect future growth.

An IUL is a long-term commitment, with surrender periods often lasting 10-15 years. Cashing out early will result in significant surrender charges, which can lead to a loss of principal. The most serious risk is policy lapse. If cash value growth doesn’t keep pace with internal costs and you don’t pay more in premiums, the policy can terminate, resulting in a loss of coverage and potentially creating a tax liability if loans were outstanding.

What is an IUL policy’s biggest risk?

The biggest risk in an IUL isn’t a market crash, thanks to the 0% floor. The real danger lies in the policy’s internal fees and charges that can erode your cash value over time.

IULs have multiple fees: premium expense charges, administrative fees, and the Cost of Insurance (COI). The Cost of Insurance, which pays for the death benefit, is particularly important because it increases as you get older. A manageable charge at age 40 can become a significant drain on your cash value at age 70.

If the interest credited to your account doesn’t outpace these rising costs, your cash value will shrink. This is why underfunding an IUL is so dangerous. If the cash value is depleted, the policy will lapse, and all premiums paid could be lost.

Can You Lose Money in an IUL Policy?

Yes, you can absolutely lose money in an IUL policy, even with the 0% floor.

The floor protects you from losses tied to negative index performance, but it does not protect you from the policy’s ongoing fees. Think of your cash value as a bucket with a small hole in the bottom representing fees. The 0% floor prevents the market from taking water out, but the leak from fees is constant.

In years where the market is flat or returns are low, you might earn 0% or very little interest. However, the Cost of Insurance and administrative fees are still deducted every month. Over several years of low returns, this can cause your cash value to decline steadily.

This problem is magnified if the policy was sold with overly optimistic return projections that don’t materialize. Furthermore, if you surrender the policy early, surrender charges can take a large portion of your cash value, easily resulting in you getting back less than you paid in. Proper funding and realistic expectations are essential to mitigate these risks.

How IUL Compares to Other Life Insurance Options

To understand what is an IUL, it’s helpful to compare it to other common types of life insurance. Each is a tool designed for different financial jobs.

This table provides a quick comparison:

| Feature | Indexed Universal Life (IUL) | Term Life Insurance | Whole Life Insurance | Universal Life (UL) |

|---|---|---|---|---|

| Policy Duration | Permanent | Temporary (e.g., 10, 20, 30 yrs) | Permanent | Permanent |

| Cash Value Growth | Linked to market index (caps/floors) | None | Fixed, guaranteed rate | Insurer-declared fixed rate |

| Premium Flexibility | Yes (within limits) | No (fixed) | No (fixed) | Yes (within limits) |

| Death Benefit Flex. | Yes (adjustable) | No (fixed) | No (fixed) | Yes (adjustable) |

| Cost | Generally more expensive than term, comparable to or more than whole/UL | Significantly less expensive | Generally more expensive | Generally less expensive than IUL |

| Market Risk | Low (0% floor, caps) | None | None | None |

| Complexity | High | Low | Moderate | Moderate |

As the table shows, IUL occupies a unique space, offering permanent protection with a distinct approach to cash value growth that balances market potential with safety.

IUL vs. Universal Life

People often confuse IUL and traditional Universal Life (UL) because IUL is a type of UL policy. The key difference is how cash value grows. In a traditional UL, the cash value earns interest at a rate declared by the insurance company, which can change periodically. In an IUL, growth is linked to a stock market index like the S&P 500, offering higher return potential but with caps to limit gains and a floor to prevent losses.

What is an IUL’s role in long-term financial planning?

While 401(k)s and IRAs should be the primary retirement savings vehicles for most people, an IUL can serve as a valuable supplement, especially for those who have maxed out contributions to other tax-advantaged accounts.

- Contribution Flexibility: IULs don’t have the same strict annual contribution limits as 401(k)s, allowing for additional savings.

- Tax Treatment: Contributions are made with after-tax dollars, but the cash value grows tax-deferred. Most importantly, you can access the cash value through policy loans, which are generally tax-free as long as the policy remains in force. This can provide a source of tax-free income in retirement.

- Market Risk Exposure: An IUL’s 0% floor protects your cash value from market losses, a feature your 401(k) doesn’t have. The trade-off is that caps limit your upside potential.

- Death Benefit Inclusion: Unlike a pure investment account, an IUL bundles a death benefit with its cash value component, providing protection for your loved ones.

Who Is an IUL Policy Best Suited For?

An IUL is not a one-size-fits-all solution, but it can be an excellent tool for individuals with specific financial profiles and long-term goals.

An IUL may be a good fit if you:

- Have long-term financial goals, as the policy’s benefits are most impactful over several decades.

- Are a high-net-worth individual looking for a tool for estate planning, wealth transfer, or charitable giving strategies.

- Have already maximized contributions to traditional retirement accounts like 401(k)s and IRAs and are seeking another vehicle for tax-advantaged growth.

- Want permanent life insurance but desire more growth potential than fixed-rate policies offer, combined with the downside protection of a 0% floor.

- Are a business owner who could use an IUL for key person insurance, executive compensation plans, or to accommodate a fluctuating income with flexible premium payments.

Important Questions to Ask Before Purchasing

Before committing to an IUL, it is crucial to ask detailed questions. A trustworthy advisor should provide clear, transparent answers. Here are some of the most important questions to ask:

- What are the current cap and participation rates, and what have been their historical ranges?

- How often can the insurer change these rates, and are there any guaranteed minimums?

- Can you provide a detailed breakdown of all fees (premium loads, administrative fees, cost of insurance, surrender charges, rider costs)?

- What happens if I miss premium payments? What is the risk of the policy lapsing?

- Can I see illustrations based on different return assumptions, including low, average, and high scenarios?

- What is the guaranteed minimum interest rate for the fixed account (if applicable)?

- How is the interest crediting method calculated (e.g., point-to-point)?

- What are the tax implications of loans versus withdrawals? What happens if the policy becomes a Modified Endowment Contract (MEC)?

- What is your experience with IUL policies, and what ongoing support will you provide?

Frequently Asked Questions about IUL Insurance

Here are concise answers to some of the most common questions about IUL policies.

What happens if the insurance company changes the cap rates?

Insurance companies can, and often do, adjust cap and participation rates annually based on market conditions and their own costs. A lower cap rate will reduce your future growth potential, even in a strong market. This is why monitor your policy’s performance over time and understand the historical range of rates for your policy before you buy.

Are IUL policies good for young people?

Generally, an IUL is not the best primary tool for young people. For pure death benefit protection, term life insurance is significantly cheaper and allows a young person to get the high coverage amount they need while focusing on other financial goals. An IUL may become a consideration for younger individuals only after they have a high income, have already maxed out other retirement savings vehicles (like a 401(k) and IRA), and are looking for supplemental, tax-advantaged growth.

What are the costs associated with IUL insurance?

IUL policies have several layers of fees that impact your cash value. These include:

- Premium Loads: A percentage taken from each premium payment.

- Administrative Fees: Monthly or annual charges for policy management.

- Cost of Insurance (COI): The charge for the death benefit, which increases as you age.

- Surrender Charges: Fees for canceling the policy in the early years (typically 10-15 years).

- Rider Costs: Additional fees for any optional benefits you add.

The total cost depends on your age, health, and coverage amount. The following table shows average annual premiums for a $500,000 IUL policy for non-smokers in excellent health.

| Issue Age | Men | Women |

|---|---|---|

| 20 | $2,584 | $2,221 |

| 30 | $3,612 | $3,210 |

| 40 | $5,942 | $5,182 |

| 50 | $10,132 | $8,564 |

| 60 | $18,309 | $15,752 |

As the table illustrates, these policies represent a significant financial commitment that increases substantially with age.

Securing Your Financial Future

So, what is an IUL? It’s a sophisticated financial tool that blends lifelong life insurance protection with the potential for tax-advantaged cash value growth tied to a market index.

An IUL balances protection and growth, offering a 0% floor to prevent market-based losses while capping upside gains. This unique structure can be powerful, but it’s not a simple product. Its complexity, fees, and rising internal costs mean it requires careful consideration and active monitoring.

An IUL is a long-term commitment where the true value is realized over decades. It is best suited for those with specific goals, such as supplementing retirement income after maxing out other accounts or for advanced estate planning.

Figuring out if an IUL is right for you can be overwhelming. At ShieldWise™, we provide clear, jargon-free guidance to help you make confident decisions. Our digital marketplace allows you to compare plans from trusted carriers and get instant quotes to secure the right coverage for your family’s future.

The question isn’t whether an IUL is good or bad—it’s whether it’s right for you. We’re here to help you find the answer. Ready to explore your options? Find out if an IUL is right for you and take the next step toward securing your financial future.