The Cap Rate Explained: Your Starting Point

When you’re exploring investing, whether it’s commercial real estate or advanced financial tools like Indexed Universal Life (IUL) policies, understanding what is a cap rate is essential. It’s a crucial metric that helps investors quickly estimate the potential return and risk of an asset.

For a quick overview, here’s what a cap rate means:

- Definition: The capitalization rate (cap rate) is a financial metric used to estimate the potential rate of return on an investment property.

- Calculation: You calculate it by dividing a property’s Net Operating Income (NOI) by its current market value or purchase price.

- Purpose: It helps investors compare the profitability and perceived risk of different income-producing properties.

- Context: While widely used in commercial real estate, the term “cap rate” also applies in a unique way to IUL policies, where it defines the maximum interest you can earn.

Think of the cap rate as a snapshot that provides a simple number to compare investments, showing how much income an asset is expected to generate relative to its cost. This is useful for quickly evaluating opportunities side-by-side.

However, a cap rate isn’t the whole story. It’s a starting point for deeper analysis. In commercial real estate, it doesn’t account for future growth or debt. For IULs, it’s a limit—a ceiling on your potential gains.

This guide will explain the cap rate, showing you how it works in its traditional real estate context and, more importantly, what it means for your IUL policy’s growth potential.

Understanding the “Cap Rate”: From Real Estate to Insurance

One financial term that appears in surprising places—from commercial real estate to Indexed Universal Life (IUL) insurance—is the “cap rate.” To understand how it works in your IUL, let’s first look at its original use in real estate.

The Cap Rate in Commercial Real Estate

In commercial real estate, the capitalization rate, or cap rate, is a shortcut for estimating an investment property’s potential return. It’s calculated by dividing the property’s annual income after expenses (Net Operating Income or NOI) by its current value.

Cap Rate (%) = Net Operating Income (NOI) / Property Value

For example, a building valued at $1,000,000 that generates $100,000 in NOI has a 10% cap rate. This figure represents the unlevered return—the return if purchased with cash. Generally, a higher cap rate suggests higher potential return but also higher risk, while a lower cap rate indicates a safer, more valuable asset. Investors use this metric to quickly compare properties. For a deeper dive, you can check out this helpful guide: Capitalization Rate explained.

How Cap Rates Function in an IUL Policy

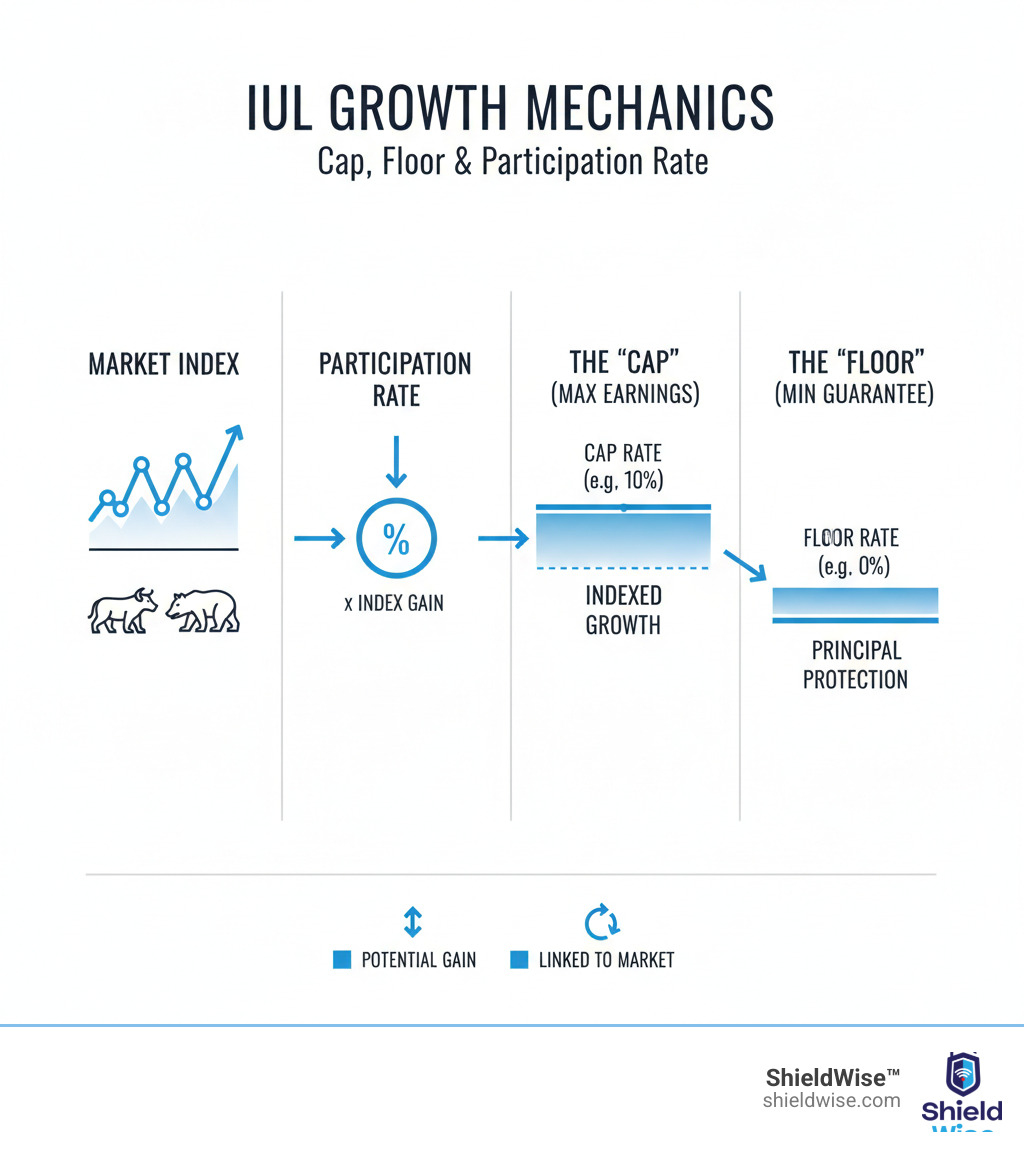

In an Indexed Universal Life (IUL) policy, the term “cap rate” has a different but equally crucial role. It’s not about property income; instead, it sets the maximum credited interest your policy can earn based on the performance of a linked market index, like the S&P 500.

Your IUL’s cash value grows by tracking an index without direct market investment, offering both growth potential and a safety net. The cap rate is the ceiling on that growth. For example, with a 10% cap rate, if the index gains 15%, your policy is credited 10%. If the index gains 8%, you get the full 8%.

This upside limit is the trade-off for a powerful benefit: zero-percent floor protection. If the market index drops, your cash value doesn’t lose money; it simply earns 0% for that period, protecting your principal. Most IULs also feature an annual reset, which locks in any gains each year, so they aren’t affected by future downturns.

In short, an IUL cap rate defines the maximum interest your cash value can earn in a year, shaping your policy’s long-term growth potential.

What is a Cap Rate and How Does It Impact Your IUL’s Growth?

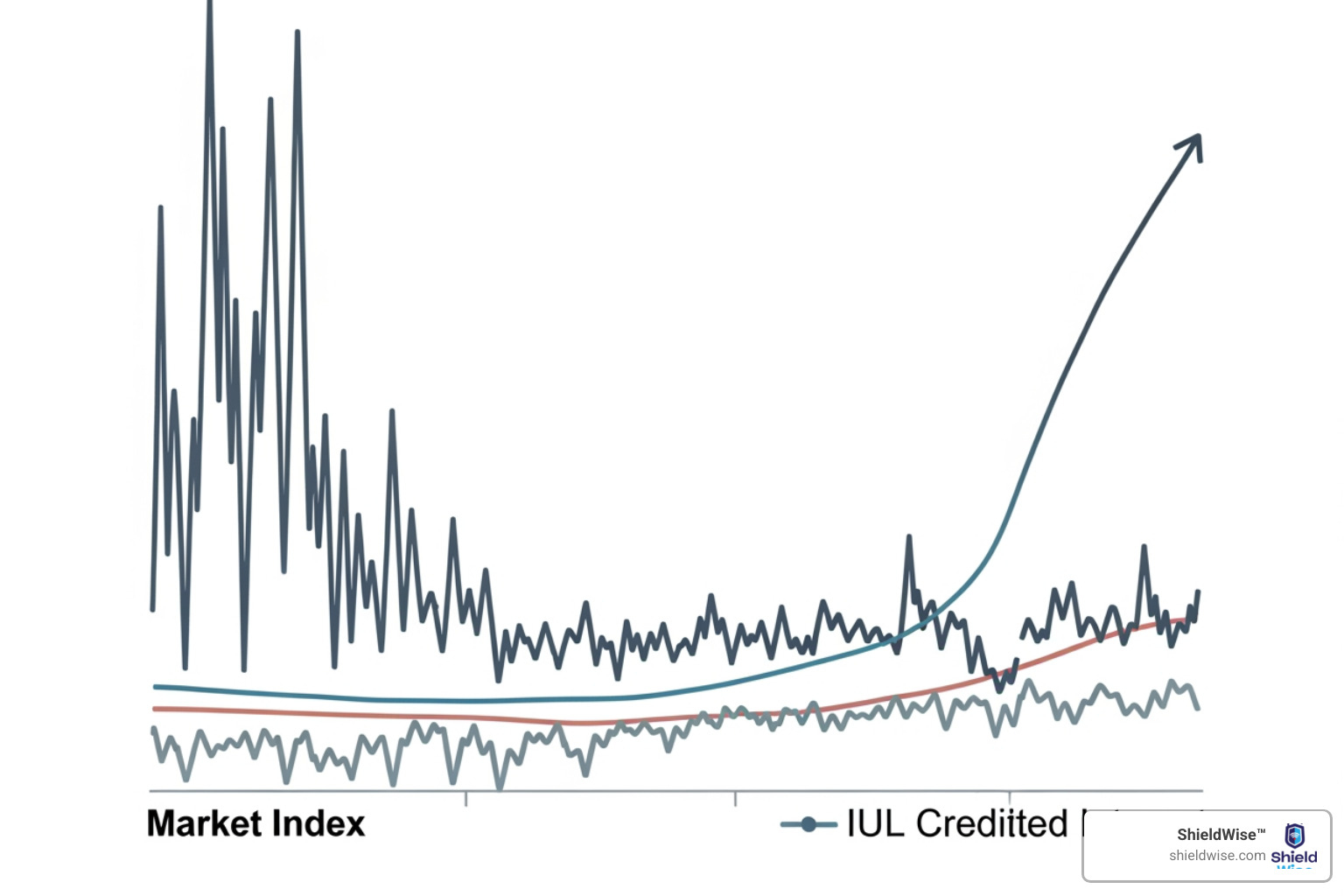

Now that you understand what is a cap rate in both contexts, let’s focus on how this ceiling affects your IUL policy’s cash value. The cap rate is your policy’s growth governor, making the IUL’s structure of market-linked growth and downside protection possible. The cap is essentially the cost of that protection.

Your IUL’s cash value grows through index-linked gains. Your policy tracks an index like the S&P 500, and interest is credited based on its performance, creating a unique balance between risk and reward. Using an annual point-to-point method, the carrier compares the index’s value on your policy anniversary to where it was a year prior. If it went up 15% and your cap is 10%, you get 10%. If it went up 7%, you get 7%. If the index dropped 20%, you get 0%, and your principal remains intact.

This is different from direct stock ownership, where your account balance would shrink in a down market. With an IUL, you simply pause growth for that year, protected by the 0% floor. The annual reset feature then locks in your gains and starts the next year fresh.

What is a ‘Good’ Cap Rate for an IUL?

Unlike real estate, there’s no single “good” cap rate for an IUL. It depends on the entire policy. While industry averages often range from 8% to 13%, a high cap rate isn’t the only factor to consider.

Carrier differences are significant. A policy with a 12% cap might not be better than one with a 10% cap if the latter has lower fees or stronger guarantees. When reviewing policy illustrations, projected returns are based on assumed, non-guaranteed cap rates. The actual rate can change annually, though your contract will state a minimum guaranteed cap.

Also, watch for the high cap versus high participation rate trade-off. A policy might offer a high cap but only let you participate in a portion (e.g., 80%) of the index’s gains.

Evaluating the overall policy is key. A lower cap from a financially strong carrier with low fees may be a better long-term choice than the highest available cap rate. At ShieldWise™, we help you compare these nuances to make an informed decision.

Cap Rates vs. Participation Rates and Floors

Your IUL’s cap rate works with two other key features:

- Participation Rate: This determines what percentage of the index’s gain you “participate” in. A 100% participation rate (common in modern IULs) means you get the full gain, up to the cap. A 70% rate on an 8% gain would yield 5.6%.

- Floor Rate: This is your safety net, almost always set at 0%. If the index has a negative return, your cash value is credited 0% interest, protecting it from market losses.

Here’s how they work together, assuming a 10% cap, 100% participation, and 0% floor:

- Index gains 14%: You are credited 10% (the cap).

- Index gains 6%: You are credited the full 6% (below the cap).

- Index loses 18%: You are credited 0% (the floor), and your principal is safe.

Some policies also use a spread (or asset fee), which is a percentage subtracted from the index gain before the cap is applied. It’s important to know if your policy includes one.

This combination of cap, participation, and floor allows IULs to offer consistent, protected growth. Understanding how they interact is key to setting realistic expectations for your policy.

Comparing IUL Cap Rates to Other Financial Metrics

It’s easy to get confused by financial terms, especially since “cap rate” in an IUL is fundamentally different from a real estate cap rate or other metrics like Return on Investment (ROI). Understanding these distinctions is essential for making informed financial decisions.

| Metric | What It Measures | How It’s Used | Impact of Debt |

|---|---|---|---|

| IUL Cap Rate | The maximum interest rate that can be credited to an IUL policy’s cash value based on the linked index’s performance. | To define the upper limit of market-linked growth, providing an element of predictability and risk management within the policy. It’s a key factor in projecting potential cash value accumulation while benefiting from a 0% floor. | Not directly impacted by policy loans or premiums; it’s a feature of the crediting method. |

| Real Estate Cap Rate | The unlevered rate of return expected on an income-producing commercial property. | To quickly compare the profitability and perceived risk of similar commercial properties, helping investors assess market value and determine reasonable purchase prices. It’s a “snapshot” of annual yield. | Assumes an all-cash purchase (unlevered); does not factor in mortgage debt or interest. |

| Return on Investment (ROI) | The total profit or loss generated by an investment relative to its initial cost. | To evaluate the efficiency of an investment or to compare the efficiency of several different investments. It can be used for any type of investment (stocks, bonds, real estate, etc.) and typically covers a specific time horizon. | Can be levered (includes debt financing costs) or unlevered, depending on how it’s calculated. |

The table highlights the apples-to-oranges comparison between these metrics. Each serves a specific purpose and reveals different insights about risk profiles and potential returns.

What is a cap rate’s role compared to ROI?

It’s crucial to understand the difference between an IUL cap rate and Return on Investment (ROI).

ROI measures the total profit or loss on an investment over time relative to its cost. For example, if a $10,000 investment grows to $13,000, the ROI is 30%.

An IUL cap rate is not an ROI. It is a growth limiter—the maximum potential interest credited in a given year. It’s a ceiling, not a guaranteed return. Your actual return depends on the index performance (up to the cap), minus any policy charges and fees.

This is about differentiating potential from actual returns. A 12% cap rate is the best-case scenario for a single year’s interest credit, not the overall ROI of the policy. The trade-off for this cap is the 0% floor, which protects your principal from market losses. This feature makes IULs a unique tool for those seeking market-linked growth without full downside risk, offering a balance between volatile market investments and more stable insurance products.

Key Factors That Influence IUL Cap Rates

IUL cap rates are not static; they are non-guaranteed and can change based on several financial factors. Understanding these forces helps explain why your rate might adjust from year to year.

The primary driver is the cost of options. To provide index-linked returns, insurance carriers buy call options. When these options are expensive, carriers may lower cap rates to keep the policy sustainable. Key influences on option costs include:

- General Interest Rate Environment: Higher interest rates generally lower the carrier’s hedging costs, which can lead to higher cap rates for policyholders. Conversely, low rates often mean lower caps.

- Market Volatility: High market volatility (often measured by the VIX index) increases the cost of options, putting downward pressure on cap rates.

Other factors also play a role:

- Insurance Carrier’s Strategy: Each company has a different approach to risk management and product design. Some may offer more stable, conservative caps, while others might be more aggressive.

- Policy Design and Charges: The internal fees and structure of a specific IUL product can influence the cap rate the carrier can sustainably offer.

These elements interact, creating a dynamic environment for cap rates. This is why carriers reserve the right to adjust them annually, though policies include a minimum guaranteed cap for baseline protection. Your cap rate isn’t changing arbitrarily—it’s responding to real financial forces.

Frequently Asked Questions about IUL Cap Rates

We know that navigating the intricacies of IUL policies can raise many questions. Here are straightforward answers to the most common ones.

Is a higher cap rate always better in an IUL?

Not necessarily. A high cap rate is attractive, but it’s only one part of the policy. You must also consider the participation rate. A policy with a 10% cap and 100% participation may perform better than one with a 12% cap and a 60% participation rate.

Also, look for hidden trade-offs like spreads (asset fees) or high internal policy charges that can erode returns. The overall policy health and the carrier’s financial strength are often more important than the highest advertised cap rate. A well-designed policy from a stable carrier is a smarter long-term choice.

Can my IUL’s cap rate change over time?

Yes. Cap rates are non-guaranteed elements of an IUL policy, meaning the carrier has the right to adjust them. These changes, typically made during an annual review, are based on market conditions like the cost of options, interest rates, and volatility.

Carriers will notify you of changes. Importantly, your policy includes a minimum guaranteed cap (often 2% to 3%). This is a contractual safety net, ensuring your cap rate will never fall below a certain level, providing a baseline for growth potential.

How does the cap rate affect my IUL’s cash value and death benefit?

The cap rate directly impacts both the living and death benefits of your IUL.

For cash value accumulation, the cap rate sets the ceiling for annual interest credits. Consistent growth, fueled by a competitive cap rate, allows your cash value to grow through compounding interest. This accumulated value can then be accessed via tax-free policy loans for retirement, education, or other needs.

The cap rate also helps support the death benefit. A healthy, growing cash value is used to pay for the policy’s rising internal cost of insurance as you age. Sufficient growth is crucial for preventing policy lapses, ensuring the death benefit remains in force for your beneficiaries. A strong cap rate is a key lever for maximizing both your lifetime access to cash and your family’s long-term protection.

Conclusion: Using Cap Rates to Secure Your Financial Future

Phew! We’ve covered a lot of ground today, haven’t we? We started by exploring what is a cap rate in commercial real estate. There, it helps investors quickly size up a property’s potential annual return and risk.

Then, we shifted gears to understand its equally important, but distinct, role in your Indexed Universal Life (IUL) insurance policy. In an IUL, the cap rate acts as the highest interest rate your cash value can earn from positive market index performance. This is a special feature that works hand-in-hand with a 0% floor, giving you the best of both worlds: growth potential when the market is up, and protection from losses when it’s down.

This unique setup is what makes IULs such a powerful tool for balancing growth and security in your financial planning. It’s not just about earning interest; it’s about doing so without the worry of market downturns impacting your principal.

Truly understanding your IUL’s cap rate, along with its participation rate and floor, is a big step towards making smart choices for your financial future. It’s how you can work towards tax-advantaged growth for your cash value, all while making sure your loved ones are financially protected by a robust death benefit. It’s a key part of building a solid long-term financial strategy.

At ShieldWise™, we’re all about making complex financial topics simple and clear. We believe everyone deserves straightforward guidance to help them steer these important decisions. We’re here to help you see how an IUL policy, with its clever cap rate mechanism, can fit perfectly into your overall financial plan and help you reach your goals.

Ready to explore how an IUL can help you protect your family, manage your costs, and build a more secure financial future?