Why Understanding Final Expenses Matters for You and Your Family

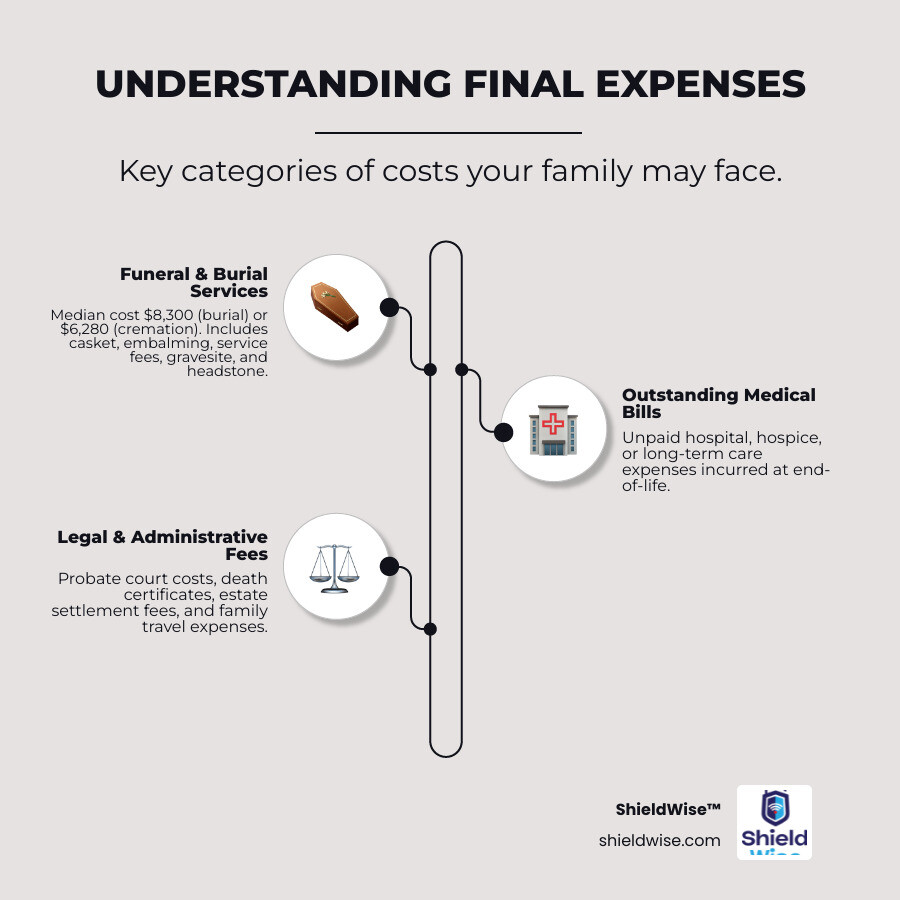

What are final expenses? They are the costs that arise after a person passes away, including funeral services, outstanding medical bills, and legal fees that loved ones must settle. Planning for them isn’t morbid—it’s a thoughtful act of care.

Quick Answer:

- Funeral & Burial Costs: The median cost was $8,300 in 2023.

- Cremation Costs: The median cost was $6,280 in 2023.

- Medical Bills: Unpaid hospital, hospice, or long-term care expenses.

- Legal & Administrative: Probate fees, death certificates, and estate settlement costs.

- Other Expenses: Family travel, obituary notices, and other unexpected costs.

Considering that 35% of adults would struggle with a $400 emergency, the thousands of dollars needed for final arrangements can be a significant burden. These figures don’t even include cemetery plots, headstones, or receptions, which can add thousands more.

Without a plan, your loved ones are left to make difficult financial decisions while grieving. This guide will walk you through what these expenses include and how you can prepare, so your family is protected from financial hardship.

Breaking Down the Bill: What are Final Expenses?

When we talk about what are final expenses, we’re referring to a broad category of costs that arise at the end of a person’s life. These include immediate costs like the funeral, burial, or cremation, as well as lingering expenses like unpaid medical bills and legal fees for settling an estate. Understanding these components is the first step to planning effectively and sparing loved ones from financial stress.

The Average Cost of a Funeral: Burial vs. Cremation

The choice between burial and cremation is personal, but cost is a significant factor. According to the National Funeral Directors Association (NFDA), the median cost of a funeral with burial was $8,300 in 2023, a figure that continues to rise. This price typically includes the funeral director’s services, embalming, a casket (which averaged $2,500 alone), viewing fees, and transportation. It often does not include the gravesite, headstone, or burial vault, which can add thousands more to the final bill.

Cremation is often a more affordable alternative. In 2023, the median cost of a funeral with cremation was $6,280. This option is growing in popularity, with projections estimating that over 80% of families will choose cremation by 2045. While the base cost is lower, it still represents a significant expense for most families. For more details, you can consult the NFDA’s 2023 General Price List Study.

What are final expenses beyond burial or cremation?

Beyond the funeral itself, several other expenses can add to the financial burden:

-

Unpaid Medical Bills: Even with insurance, end-of-life care, such as hospital stays or hospice, can leave behind significant unpaid bills. These costs can continue to arrive for weeks after a death, creating lingering financial stress.

-

Legal and Administrative Fees: Settling an estate often requires paying for probate court, attorney and executor fees, and multiple copies of death certificates.

-

Outstanding Debts: Death doesn’t always erase debt. Research shows 73% of Americans die in debt, with an average balance of around $61,554 (including mortgages). While some loans are discharged, others like credit card debt may need to be settled by the estate, reducing the inheritance for beneficiaries.

-

Travel Expenses for Family: Grieving family members may need to travel to attend the funeral, incurring costs for flights, lodging, and meals.

-

Miscellaneous Costs: Expenses for obituary notices, flowers, and memorial receptions can also add up quickly.

These additional costs highlight why comprehensive planning is so crucial. It’s not just about the funeral; it’s about the entire financial landscape a family must steer.

How Final Expense Insurance Provides a Solution

Understanding what are final expenses is the first step; figuring out how to pay for them is the next. Final expense insurance offers a practical solution, providing a financial safety net that allows your family to focus on grieving instead of bills. It’s a form of permanent life insurance designed to provide peace of mind.

What is Final Expense Insurance and How Does It Work?

Final expense insurance, also known as burial or funeral insurance, is a simplified whole life insurance policy designed to cover end-of-life costs. Unlike traditional policies, it usually features simplified underwriting, requiring only a few health questions instead of a full medical exam. This makes it highly accessible, especially for seniors.

Here’s how it works:

- Simple Application: Apply by answering a few health questions.

- Fixed Premiums: Once approved, your premiums are locked in for life and will not increase.

- Death Benefit Payout: Upon your passing, your beneficiary receives a tax-free cash payment, typically between $2,000 and $50,000. Most policies are for $10,000 to $20,000, enough to cover typical final expenses.

- Cash Value: As a permanent policy, it can build a tax-deferred cash value over time that you can borrow against if needed.

The main goal of final expense insurance is to remove the financial stress of end-of-life costs from your family.

Who Typically Needs This Coverage?

Final expense insurance is especially helpful for:

- Seniors: Its simplified application process makes it an accessible way for seniors to cover funeral costs without a medical exam, protecting their adult children from unexpected bills.

- Individuals with Health Conditions: Those who may not qualify for other types of life insurance can often still get coverage.

- Those with Limited Savings: For people on a fixed income, this insurance ensures funds are available without depleting savings or forcing loved ones into debt.

- People Without Other Life Insurance: It’s a smart way to get a dedicated policy specifically for end-of-life expenses if you don’t have other coverage.

- Anyone Wanting to Protect Loved Ones from Debt: As Forbes explains, burial insurance is crucial for easing the financial burden on families. The benefit can cover leftover medical bills or small debts.

Understanding Guaranteed Issue and Graded Benefits

When exploring options, you may encounter these terms:

Guaranteed Issue Final Expense Insurance offers acceptance to all applicants regardless of health, with no medical questions asked. This accessibility typically comes with higher premiums and a waiting period, usually 2-3 years. If death from natural causes occurs during this period, beneficiaries generally receive a refund of premiums paid, plus interest. After the waiting period, the full benefit is paid for any cause of death.

Graded Death Benefits are similar. With these policies, the death benefit payout increases over time. For example, a policy might pay 25% of the benefit in the first year and 50% in the second, with the full amount payable after two or three years. For both guaranteed issue and graded policies, the full benefit is typically paid immediately if the death is accidental.

These features allow insurers to offer coverage to higher-risk individuals. It’s important to read your policy to understand how these conditions may apply.

Final Expense vs. Traditional Life Insurance

Final expense insurance and traditional life insurance (like term or whole life) both provide a payout upon death, but they are designed for different purposes. Final expense insurance is built for a specific task: covering end-of-life costs. Traditional life insurance is designed to handle larger financial needs, like replacing income or paying off a mortgage.

The key differences lie in their purpose, coverage amounts, cost, and application process.

Key Differences in Purpose and Payout

This table highlights the main distinctions:

| Feature | Final Expense Insurance | Traditional Life Insurance (Whole Life/Term Life) |

|---|---|---|

| Primary Purpose | Cover end-of-life costs (funeral, burial, medical bills) | Income replacement, debt payoff (mortgage), wealth transfer, college funding |

| Typical Coverage | $2,000 – $50,000 (most commonly $10,000 – $20,000) | $100,000 – $1,000,000+ |

| Average Premium | Generally lower monthly premiums due to smaller coverage | Higher monthly premiums, reflecting larger death benefits and broader coverage needs |

| Underwriting | Simplified underwriting (few health questions, no medical exam) | Full medical exam, detailed health questionnaire, blood/urine tests, medical records |

| Cash Value | Builds modest cash value over time, can be borrowed against | Builds significant cash value over time, can be borrowed against, or withdrawn |

| Duration | Permanent (whole life) | Permanent (whole life) or for a specific term (term life) |

| Accessibility | Easier to qualify for, especially for seniors/unhealthy | More stringent qualification, typically requires good health |

Final expense insurance is custom for a specific, smaller financial need and is much easier to qualify for, making it a practical choice for many.

What are final expenses that insurance is designed for?

When we ask what are final expenses in the context of this insurance, we’re focusing on the immediate costs that arise after death. A final expense policy acts as a dedicated fund to ensure these don’t become a burden for your family.

It is specifically designed to cover:

- Funeral and Burial/Cremation Costs: The services, casket or urn, and related fees.

- Medical Debt: Leftover bills from hospital or hospice care.

- Legal and Administrative Fees: Costs associated with settling your estate, like probate or attorney fees.

- Small Outstanding Debts: Such as credit card balances or personal loans.

By having a dedicated fund, you also help your family avoid emotional overspending and ensure your final wishes are met without causing them financial strain. It’s about providing peace of mind when it’s needed most.

Frequently Asked Questions about Final Expenses

Navigating what are final expenses and how to plan for them brings up many questions. Here are answers to some of the most common concerns.

Will my beneficiary have to use the money for my funeral?

No. The death benefit from a final expense policy is paid directly to your beneficiary, who has full discretion on how to use the funds. They are not legally required to use it for the funeral. This flexibility allows them to cover funeral costs, medical bills, or any other pressing financial needs. Because of this, choose a beneficiary you trust and to communicate your wishes to them, perhaps in a letter of instruction.

Are Social Security or Veterans benefits enough to cover final expenses?

Generally, no. These benefits are helpful but are rarely enough to cover the full cost of a funeral. The Social Security Administration provides a one-time death payment of only $255 to an eligible surviving spouse or child. The Department of Veterans Affairs (VA) offers more support, including free burial in a national cemetery and a monetary benefit that typically ranges from $300 to $2,000, depending on circumstances. However, this still leaves a significant financial gap that the family must cover. A final expense policy is designed to bridge this gap.

Is putting money in my will or savings account a better option?

While seemingly practical, these methods have significant drawbacks. Money designated in a will is often tied up in probate court for months or even years, but funeral homes require payment upfront. This forces families to pay out-of-pocket and wait for reimbursement.

A savings account is more accessible, but the funds are not protected. They could be depleted by emergencies before your passing. Upon death, a standard savings account may also be frozen until an executor is appointed. A Payable-on-Death (POD) account is a better savings option, as it bypasses probate.

However, a final expense insurance policy offers the most reliable solution. It provides a guaranteed, tax-free death benefit paid directly to your beneficiary, typically within days or weeks. The funds bypass probate, are protected from your spending habits, and ensure money is available immediately for its intended purpose.

Secure Your Legacy and Protect Your Loved Ones

We’ve walked through what are final expenses—from funeral services to unexpected medical and legal fees. With median costs running into thousands of dollars, these expenses can create a significant financial and emotional burden for the families left behind.

The solution is proactive planning. Final expense insurance is a straightforward tool designed specifically for this purpose. It’s a form of permanent life insurance with simplified qualification, fixed premiums, and a payout designed to cover end-of-life costs. Unlike relying on savings or a will, it provides a dedicated, tax-free sum of money directly to your beneficiary, bypassing probate delays and ensuring funds are available when needed most.

Planning for your final expenses is one of the most thoughtful and loving things you can do for your family. It’s your final act of care, removing the burden of difficult financial decisions during a time of grief and ensuring your wishes are honored without causing debt or stress.

If you’re ready to take this important step, we’re here to help. At ShieldWise™, we specialize in helping families find the right coverage with clear, jargon-free guidance.

Compare final expense insurance plans and get a free quote today. It only takes a few minutes to gain the peace of mind that comes from knowing your loved ones are protected.