Understanding Your Life Insurance Options: Why the Choice Matters

Universal life – term versus permanent insurance isn’t just industry jargon—it’s a fundamental decision affecting your family’s financial security and long-term wealth strategy. If you’re at this crossroads, you’re asking the right question.

Here’s the quick answer:

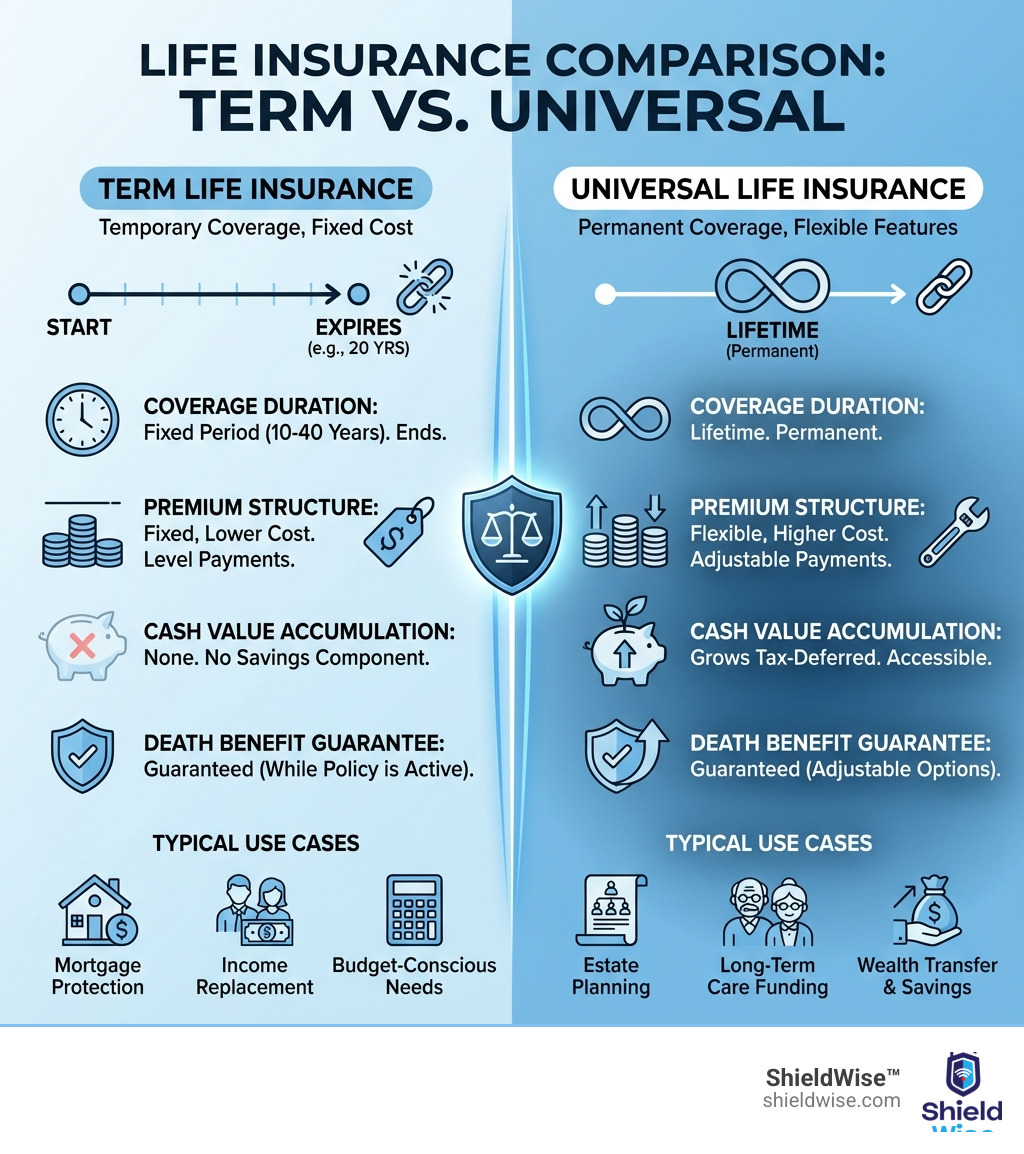

-

Term Life Insurance = Temporary coverage (10-40 years) with affordable, fixed premiums and no cash value. Best for covering specific debts or income replacement during working years.

-

Universal Life Insurance = Permanent coverage (lifetime) with flexible premiums, a cash value component that grows tax-deferred, and higher costs. Best for estate planning, lifelong dependents, or building tax-advantaged wealth.

-

Key Difference: Term expires and pays nothing if you outlive it. Universal life stays active for life and builds savings you can access.

The confusion is understandable, as the differences between term and permanent policies can feel overwhelming. Making the wrong choice can be costly or leave your family unprotected.

The stakes are real. The wrong choice could mean overpaying, losing coverage when you still need it, or missing wealth-building opportunities. The right choice provides peace of mind and financial security.

This guide cuts through the noise. We’ll break down how term and universal life insurance work, compare them on cost, coverage, and flexibility, and help you determine which fits your financial goals.

The Core Concepts: What Are Term and Universal Life Insurance?

Life insurance falls into two main categories: temporary and permanent. Universal life is a unique type of permanent insurance. Understanding the difference is key to choosing the right coverage for your needs.

Term Life Insurance: Simple, Temporary Protection

Think of term life insurance as renting coverage. You get protection for a specific period—or “term”—such as 10, 20, or 30 years, designed to cover financial obligations during a critical time.

Term life’s beauty is its simplicity and affordability. It provides a pure, tax-free death benefit if you pass away during the term. If you outlive it, the policy expires with no cash value or premium refund. This straightforward approach is perfect for many families needing a financial safety net.

Universal Life Insurance: Flexible, Lifelong Coverage

If term life is renting, universal life is like owning. It’s permanent insurance designed to last your lifetime (as long as premiums are paid) and includes a key feature: a cash value component.

This cash value grows tax-deferred, a savings element term policies lack. Universal life is attractive for its flexibility; you can adjust premium payments and death benefits within limits. You can even skip payments if the cash value is sufficient, a game-changer for those with fluctuating incomes.

The cash value growth in a universal life – term versus permanent comparison can be tied to market conditions, often with a guaranteed minimum interest rate, providing potential for higher returns. This makes it a more hands-on policy for those who want permanent coverage with a dynamic cash value component. To dive deeper into how this flexible coverage works, you can explore our resources on Universal Life Insurance.

The Ultimate Showdown: Universal Life – Term Versus Permanent

Choosing between term and universal life insurance means comparing two very different products. Let’s pit them against each other to highlight their core distinctions.

| Feature | Term Life Insurance | Universal Life Insurance |

|---|---|---|

| Coverage Duration | Specific period (e.g., 10, 20, 30 years) | Lifelong (as long as premiums/cash value sustain it) |

| Premiums | Fixed, level for the term; lower initial cost | Flexible; can be adjusted; higher initial cost than term |

| Cash Value | None | Accumulates tax-deferred; accessible via loans/withdrawals |

| Death Benefit | Fixed for the term | Flexible; can be level or increasing; impacted by loans |

| Flexibility | Limited (conversion option usually available) | High (premiums, death benefit, cash value access) |

Coverage Duration: For a Season or a Lifetime?

The most fundamental difference in the universal life – term versus permanent debate is how long your coverage lasts.

Term life provides protection for a defined period, perfect for temporary needs like a mortgage or raising children. When the term ends, coverage expires. You can often renew at higher rates or convert to a permanent policy. If you outlive it, there’s no death benefit, and premiums aren’t returned.

Universal life insurance is designed for your entire lifetime. As long as premiums are paid or the cash value covers costs, the policy stays active. This is ideal for permanent needs like leaving an inheritance. However, there’s a risk of lapse if the policy isn’t managed well and the cash value is depleted.

Premium Payments: Predictability vs. Flexibility

Term life offers predictable premiums, while universal life delivers flexibility.

With term life, premiums are fixed and level for the entire term, making budgeting straightforward. If you renew after the term, expect higher premiums due to your increased age.

Universal life allows you to adjust premium payments within limits, even skipping them if the cash value is sufficient. This is great for fluctuating incomes but requires active management to ensure the cash value doesn’t drop too low, which could cause a lapse in coverage.

The Cash Value Component: A Key Distinction in Universal Life – Term Versus Permanent

Here’s where the comparison gets interesting.

Term life is pure protection with no savings component. Premiums fund the death benefit, and there’s no accumulated value if you outlive the policy.

Universal life, conversely, has a cash value component that grows tax-deferred. A portion of each premium funds this value, which can earn interest, sometimes tied to market conditions with a guaranteed minimum rate.

A key feature is accessing the cash value while you’re alive via tax-free loans or withdrawals. However, doing so reduces the death benefit. Withdrawals exceeding the premiums paid can also have tax consequences. It’s an emergency fund within your policy, but its use impacts the final payout.

Death Benefit Guarantees: What Your Beneficiaries Receive

Both policies provide a death benefit, but the structure can differ.

With term life, the death benefit is fixed and guaranteed for the term, provided premiums are paid.

Universal life offers more flexibility. You can typically choose between:

- Option A (Level Death Benefit): The death benefit remains level. As cash value grows, it becomes part of the death benefit, reducing the insurer’s risk.

- Option B (Increasing Death Benefit): The death benefit equals the policy’s face amount plus the accumulated cash value, providing a potentially larger payout.

Taking loans or withdrawals from your universal life policy’s cash value will reduce the net death benefit paid to your beneficiaries.

The Financial Breakdown: Costs, Risks, and Rewards

When evaluating universal life – term versus permanent policies, it’s about the financial implications. Let’s weigh the costs, potential rewards, and inherent risks.

Comparing the Costs: What to Expect on Your Bill

Term life insurance is the more budget-friendly option, especially short-term. Its premiums are significantly lower because it covers a specific risk for a set period with no cash value to fund.

Universal life has higher initial premiums because you’re funding the death benefit, cash value, and lifelong coverage. For example, a $500,000 policy for a healthy 30-year-old might be around $23/month for a 20-year term, but closer to $175/month for universal life. Despite the higher cost, the long-term value can be significant if the cash value grows and you use its flexibility.

The Risks and Rewards of Universal Life’s Cash Value

The cash value component offers both compelling rewards and potential risks.

Rewards:

- Tax-Deferred Growth: The cash value grows without being taxed annually, a powerful tool after maximizing other tax-advantaged accounts like 401(k)s and IRAs.

- Supplemental Income: Access the cash value via loans or withdrawals to supplement retirement income, pay for college, or cover emergencies.

- Market-Linked Returns: Some policies, like Indexed Universal Life (IUL), link cash value growth to market indexes (e.g., the S&P 500), offering higher potential returns with a floor to protect against losses. If you’re curious, check out our explanation of What is IUL?.

Risks:

- Policy Lapse: If cash value doesn’t grow as expected or is depleted by loans, the policy might lapse if it can no longer cover insurance costs.

- Market Downturns: While IULs often have floors, growth is also typically capped. A market downturn could slow cash value growth.

- Internal Fees and Charges: Universal life policies have fees (cost of insurance, administrative, surrender charges) that are deducted from your cash value and can impact its growth.

Universal life’s flexibility gives you control, but also the responsibility to manage the policy effectively.

Understanding the Tax Implications

For both policy types, the death benefit paid to beneficiaries is typically income tax-free.

However, the cash value in universal life has additional tax considerations:

- Tax-Deferred Accumulation: The cash value grows tax-deferred.

- Withdrawals vs. Loans: Policy loans are generally tax-free. Withdrawals are tax-free up to your cost basis (premiums paid); amounts exceeding that are taxed as income.

- Estate Planning Benefits: Permanent life insurance, when owned by an Irrevocable Life Insurance Trust (ILIT), can be a powerful estate planning tool. An ILIT can remove the death benefit from your taxable estate, potentially reducing taxes for your heirs. For more information, you can refer to FINRA’s BrokerCheck website or RSM US LLP’s explanation of Irrevocable Life Insurance Trusts.

Understanding these tax nuances is crucial for maximizing a universal life policy’s benefits.

Making the Right Choice: Which Policy Fits Your Life?

Deciding between universal life – term versus permanent isn’t about finding a universally “better” policy; it’s about finding the policy that’s best for your unique life stage, financial goals, and circumstances. Let’s explore some common scenarios.

When Term Life Insurance is the Smartest Move

Term life insurance is often the go-to choice for individuals and families in specific situations:

- Young Families on a Budget: If you have young children and significant financial responsibilities like a mortgage, term life offers the most affordable way to secure a large death benefit during those crucial years. You can often get significantly more coverage for your dollar with term life compared to permanent options.

- Covering Specific Debts: Are you paying down a 30-year mortgage? Do you have student loans or other substantial debts that would burden your family if you were no longer around? A term policy for the duration of that debt can provide crucial protection.

- Income Replacement for a Defined Period: If your primary concern is replacing your income for your family until your children are grown and financially independent, or until your spouse retires, a term policy can align perfectly with that timeframe.

- Business Owners: Term life can be used for specific business needs, such as funding a buy-sell agreement or providing key person protection for a defined period, ensuring business continuity.

Term life is often recommended as the “best option for most people” because it provides an affordable, straightforward financial safety net when it’s needed most.

When Universal Life Insurance Makes More Sense

Universal life insurance shines when your needs extend beyond a temporary timeframe or when you’re looking for additional financial tools:

- Lifelong Financial Dependents: If you have a child with special needs who will require lifelong care, a universal life policy can ensure continuous financial support, as it’s designed to last for your entire life.

- Estate Planning and Wealth Transfer: For individuals concerned about leaving a legacy, covering potential estate taxes, or transferring wealth to heirs in a tax-efficient manner, universal life can be an invaluable tool.

- Maximized Other Retirement Accounts: If you’ve already maxed out your 401(k)s, IRAs, and other tax-advantaged retirement vehicles, the cash value component of a universal life policy can serve as another avenue for tax-deferred savings and wealth accumulation. This is particularly appealing to high-net-worth individuals.

- Desire for Financial Flexibility: If your income fluctuates, or you anticipate needing the ability to adjust premiums or access cash value for future needs (like college tuition or retirement income), universal life’s flexibility can be a significant advantage.

- Building Long-Term Wealth: Certain types of universal life, like Indexed Universal Life (IUL), can offer market-linked growth opportunities for your cash value, providing a balance of growth potential and protection. To learn more about the mechanics of this, our guide on How Does IUL Work? can provide valuable insights.

Frequently Asked Questions about Universal Life – Term Versus Permanent

Here are answers to common questions about universal life – term versus permanent options.

Can I convert my term life insurance policy to a universal life policy?

Yes, many term policies include a “conversion option” or rider. This lets you convert your term policy to a permanent one, like universal life, without a new medical exam. This is a major benefit if your health has changed since you first bought the policy.

However, keep in mind:

- Conversion Window: The option to convert usually expires after a set number of years or before a specific age (e.g., 65).

- Premium Implications: Premiums for the new universal life policy will be higher, reflecting your current age and the permanent coverage with its cash value.

This feature offers flexibility, letting you start with affordable term coverage and switch to lifelong protection later if your needs change.

What happens if I outlive my term life insurance policy?

If you outlive your term policy, it simply expires. This means there is no death benefit payout and no premium refund.

At this point, your options are:

- Renew the Policy: Some policies allow renewal, often annually, but at significantly higher premiums.

- Convert to Permanent Coverage: If available, you can use a conversion option to switch to a permanent policy.

- Purchase a New Policy: You can apply for a new policy, with premiums based on your current age and health.

- Go Without Coverage: You may no longer need life insurance if your major financial obligations are met.

For more detailed insights on this, you can read about What Happens If You Outlive Your Term Life Insurance?.

Is the cash value in a universal life policy the same as the death benefit?

No, the cash value and death benefit are distinct components, though they are related.

- Death Benefit: The lump sum paid to your beneficiaries upon your death.

- Cash Value: The savings/investment component that accumulates tax-deferred within the policy.

How they interact depends on the death benefit option chosen:

- Option A (Level Death Benefit): The death benefit remains level. As cash value grows, it becomes part of the death benefit, reducing the insurer’s risk. Beneficiaries receive the stated death benefit.

- Option B (Increasing Death Benefit): The death benefit equals the policy’s face amount plus the accumulated cash value, so the total payout to beneficiaries increases as cash value grows.

Taking loans or withdrawals from your cash value will reduce the death benefit paid to your beneficiaries. The cash value offers living benefits but affects the final payout.

Conclusion: The Final Verdict in Your Insurance Journey

Choosing between universal life – term versus permanent policies can feel daunting. We’ve seen that term life offers simple, affordable, temporary protection, while universal life provides flexible, lifelong coverage with a tax-deferred cash value component.

The best policy depends on your personal circumstances, financial goals, and comfort with flexibility versus predictability.

- Choose Term Life if you’re on a budget, need coverage for a specific period (like for a mortgage), and prefer straightforward protection.

- Choose Universal Life if you require lifelong coverage, want flexible premiums, need to build tax-deferred cash value, or are focused on estate planning.

At ShieldWise™, we provide clear, jargon-free guidance. We’re here to help you compare plans from trusted carriers, get instant online quotes, and understand how these policies fit into your life. Don’t let complexity stop you from securing your family’s future.

Take the next step to gain peace of mind and protect what matters most. Explore your Universal Life Insurance options today.