Understanding Your Life Insurance Options: Why Comparison Matters

IUL compared to other life insurance options reveals a landscape of trade-offs between guarantees, flexibility, and growth potential. For most families approaching life insurance decisions, the choice isn’t just about coverage—it’s about matching a policy’s features to your financial goals, risk tolerance, and long-term plans.

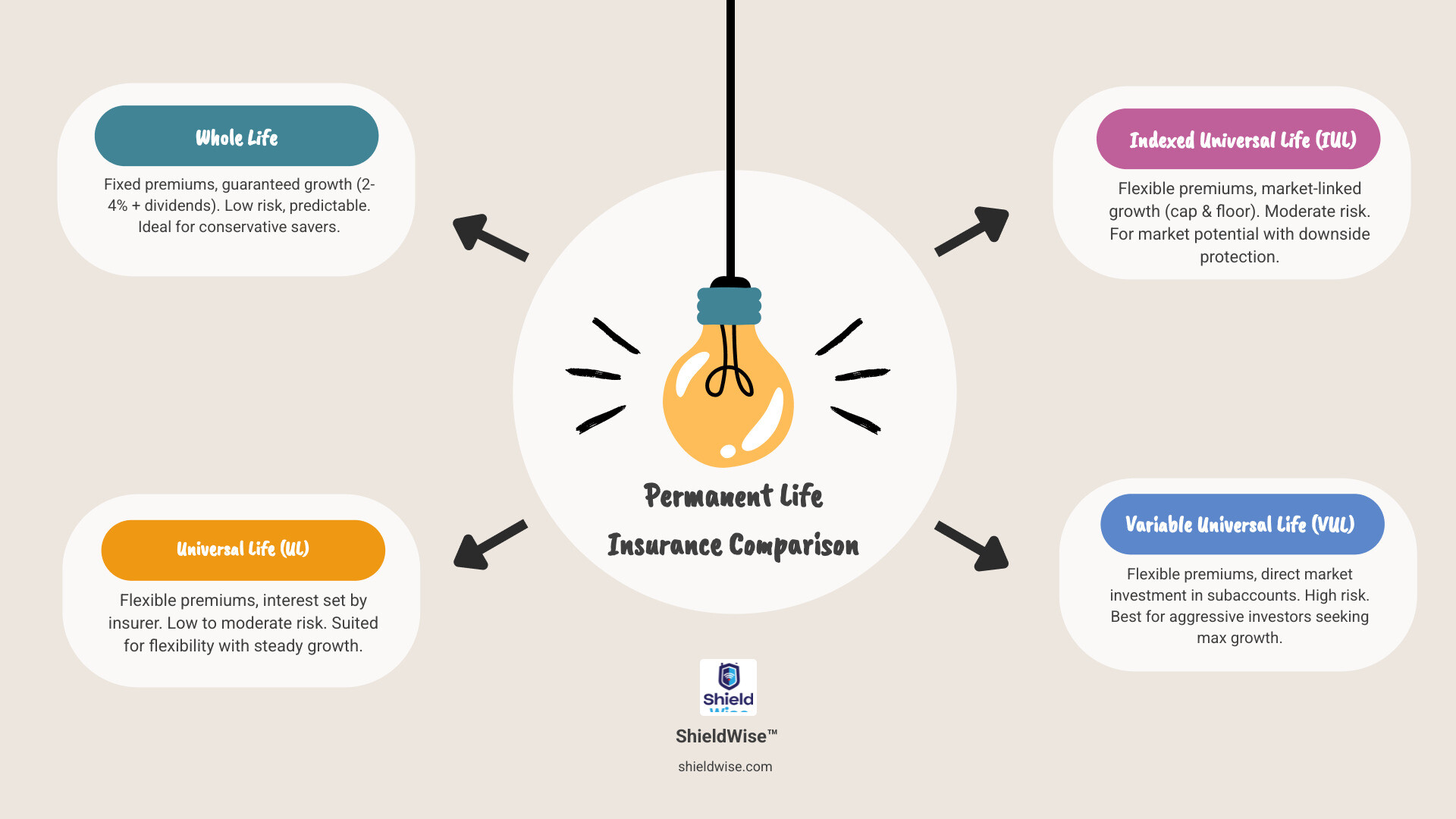

Here’s how the major permanent life insurance types stack up:

| Policy Type | Premium Structure | Cash Value Growth | Risk Level | Best For |

|---|---|---|---|---|

| Whole Life | Fixed, guaranteed | Guaranteed rate (2-4% annually) + dividends | Low | Conservative savers seeking predictability |

| Traditional Universal Life (UL) | Flexible | Interest set by insurer | Low to Moderate | Those wanting flexibility with steady growth |

| Indexed Universal Life (IUL) | Flexible | Tied to market index with cap and floor | Moderate | Those seeking market-linked growth with downside protection |

| Variable Universal Life (VUL) | Flexible | Direct market investment in subaccounts | High | Risk-tolerant investors wanting maximum growth potential |

The core differences: Whole life offers guaranteed, predictable growth with fixed premiums but limited upside. IUL links cash value to market index performance with a floor (typically 0%) protecting against losses and a cap (often 8-12%) limiting gains. Traditional UL provides flexibility with insurer-set interest rates. VUL allows direct market investment with unlimited upside—and downside risk.

All permanent policies build tax-deferred cash value that can be accessed via loans or withdrawals, and all provide a death benefit for beneficiaries. The right choice depends on whether you prioritize safety and simplicity, flexibility and moderate growth, or maximum market participation with higher complexity.

At ShieldWise, we’ve spent years breaking down complex insurance products into clear, actionable guidance to help families understand how IUL compared to other life insurance options truly fits their unique financial picture. Our goal is to cut through industry jargon and sales pressure, so you can make decisions based on facts, not fear or hype.

Decoding Indexed Universal Life (IUL): The Hybrid Approach

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that has gained significant attention for its blend of traditional life insurance benefits with market-linked growth potential. Think of it as a financial chameleon, adapting to offer both protection and a unique approach to wealth accumulation.

Unlike traditional investments where your funds are directly in the market, with an IUL, your cash value grows based on the movement of a market index, such as the S&P 500, but your funds are not directly invested in the market. This means you can participate in market gains without directly owning stocks or bonds. This structure provides market-linked growth with downside protection, a compelling combination for many.

IUL policies are relatively new compared to their older siblings like whole life, but they’ve quickly become a strategic asset for individuals focused on wealth preservation and legacy planning. They offer flexible premiums and the potential for higher returns than traditional permanent policies, making them attractive retirement income vehicles. However, they are also more complicated and require active effort to maintain.

The Engine of IUL: Cash Value Growth, Caps, Floors, and Participation Rates

The magic behind an IUL policy’s cash value growth lies in how it’s linked to an external stock market index. We explore this in detail in our article, What is IUL?. Instead of earning a fixed interest rate or directly investing in market subaccounts, the interest credited to your IUL’s cash value is determined by the performance of a chosen market index. But here’s where the “hybrid” part comes in, with three key features:

- Participation Rate: This determines what percentage of the index’s gains will be credited to your policy. For example, if the index goes up by 10% and your policy has a 60% participation rate, your cash value might be credited with 6% interest (before considering caps).

- Cap Rate: This is the maximum interest rate your policy’s cash value can earn, even if the underlying index performs exceptionally well. If the index soars by 12% but your policy has a 10% cap, you’ll only be credited with 10% interest for that period. This limits your upside potential.

- Floor Rate: This is your downside protection, typically set at 0% or 1%. It means that even if the market index experiences a significant downturn, your cash value will not lose money due to market performance. This shields policyholders from direct market exposure and ensures your principal is protected from market losses.

These elements – participation rates, caps, and floors – are crucial to understanding the potential credited interest and the balance between growth and protection that an IUL offers. The specific crediting methods (e.g., point-to-point, monthly averaging) can also vary by insurer and impact how these rates are applied.

Accessing Your Cash Value: Policy Loans and Withdrawals

One of the most attractive features of permanent life insurance, including IUL, is the ability to access your accumulated cash value while you’re still alive. This can be a game-changer for financial flexibility, especially in retirement or during unexpected financial needs.

Policy loans from an IUL are generally tax-free, as long as the policy remains in force and is not over-funded to the point of becoming a Modified Endowment Contract (MEC). This means you can borrow against your cash value without immediate tax consequences. While interest is charged on these loans, repayment is often flexible, and in some cases, you might even have “wash loan” options where the interest charged is offset by interest credited. However, any unpaid loan balance will reduce the death benefit paid to your beneficiaries. We dive deeper into this topic in our guide, How IUL Loans Work.

Withdrawals, on the other hand, allow you to take money directly from your cash value. Withdrawals up to your “cost basis” (the amount of premiums you’ve paid) are typically tax-free. However, any withdrawals that exceed your cost basis will be considered taxable gains. Both loans and withdrawals reduce your policy’s cash value and death benefit.

For individuals focused on wealth preservation and legacy planning, the ability to access cash value can be invaluable. It can serve as a supplemental retirement income stream, providing tax-advantaged funds without liquidating other assets. This makes IUL policies more like retirement-income vehicles for many. We explore these strategies further in our article, Using Life Insurance in Retirement Planning.

Understanding the Risks and Complexities of IUL

While IUL policies offer exciting potential, they are not without their complexities and risks. It’s important to understand these before considering an IUL.

Can you lose money in an IUL policy? This is a common and critical question. Thanks to the floor rate, your cash value generally won’t lose money due to negative market performance. However, you can still lose money in an IUL policy. How? Through policy costs. These include mortality costs (the actual cost of providing the death benefit), administrative fees, and potentially surrender charges if you cancel the policy in its early years. If the interest credited to your cash value (even with market gains) isn’t enough to cover these ongoing fees and charges, your cash value can decline. This can lead to a situation where you might need to pay higher premiums later on to prevent the policy from lapsing.

The complexity of IUL policies stems from their dynamic nature. Unlike the fixed guarantees of whole life, IUL performance depends on market index movements, participation rates, caps, and the insurer’s crediting methods. Illustrated returns are projections, not guarantees, and actual performance can vary significantly. This performance variability means you need to monitor funding levels regularly and understand how premiums affect long-term performance to prevent policy lapse. Underfunding an IUL can cause the policy to lapse, especially if fees rise or returns fall short.

Choosing a reputable financial advisor and insurance company is key to navigating these complexities. We always recommend working with someone who can outline the benefits, risks, and terms of an indexed universal life policy with transparency. For a deeper dive into the nuances, you might find a critical review of IUL policies insightful. A Critical Review of Indexed Universal Life provides additional context.

IUL vs. Whole Life: Growth Potential vs. Guarantees

When we talk about permanent life insurance, the conversation often boils down to two heavyweights: Indexed Universal Life (IUL) and Whole Life insurance. Both offer lifelong coverage and build cash value, but they go about it in fundamentally different ways. It’s like comparing a steady, reliable old friend to an exciting, market-savvy newcomer.

Whole life insurance is considered the most basic form of permanent life insurance coverage. It’s known for its simplicity and predictability. IUL, on the other hand, adds a layer of market-linked growth potential, but with added complexity. The choice between them often reflects an individual’s risk tolerance and financial philosophy.

Premiums, Growth, and Guarantees

Let’s break down the core mechanics of each:

Whole Life Insurance Features:

- Fixed Premiums: With whole life, your premiums remain level and guaranteed for your entire life. This predictability makes budgeting straightforward.

- Guaranteed Cash Value Growth: The cash value in a whole life policy grows at a guaranteed, fixed interest rate, typically between 2% and 4% annually. This growth is slow and steady, offering a safe reserve of cash that you can borrow against.

- Dividends: Many whole life policies, especially from mutual insurance companies, are eligible to receive dividends. While not guaranteed, these can improve cash value, reduce premiums, or be taken as cash.

- Guaranteed Death Benefit: The death benefit is fixed and guaranteed, providing absolute certainty for your beneficiaries.

- Simplicity and Predictability: Whole life is often seen as a “set it and forget it” policy, requiring minimal active management once purchased.

IUL Insurance Features:

- Flexible Premiums: IUL policies offer adjustable premiums, allowing you to pay more when you can and less during tighter financial periods, as long as there’s enough cash value to cover policy costs.

- Potential for Higher Returns: Cash value growth is linked to a market index, offering the potential for higher returns than whole life, especially in strong market years.

- Minimum Guaranteed Interest Rate (Floor): As discussed, this protects your cash value from market losses, typically guaranteeing 0% or 1% even in downturns.

- Upside Caps: These limit your maximum gains, meaning you won’t capture the full market upside if the index performs exceptionally well.

- More Complex: IUL requires more active monitoring and understanding of how index crediting, caps, and floors impact your policy.

Key differences when considering IUL compared to other life insurance options like Whole Life

The differences in how IUL compared to other life insurance options like whole life ultimately boil down to a trade-off between certainty and potential.

- Simplicity vs. Complexity: Whole life is straightforward; you pay a fixed premium, and the cash value grows predictably. IUL is more complex, requiring an understanding of index performance, caps, floors, and participation rates, and often demands more hands-on management.

- Safety vs. Risk: Whole life is considered the safest option, offering guaranteed growth and predictable outcomes, regardless of market conditions. IUL carries more risk because its returns are tied to market index performance, even with downside protection. While you won’t lose money due to market downturns, the growth isn’t guaranteed and can be limited by caps.

- Suitability for Conservative Individuals: If you prioritize guaranteed, stable returns, fixed premiums, and a predictable death benefit, whole life insurance is often the better fit. It’s ideal for conservative savers who want a safe, long-term financial vehicle.

- Suitability for Growth-Focused Individuals: If you’re comfortable with some market exposure (albeit with downside protection) and are seeking the potential for higher cash value growth, an IUL might be more appealing. It’s often considered by those who have maxed out other retirement accounts and are looking for another tax-advantaged way to grow wealth. High-net-worth individuals, in particular, consider IUL a strategic investment for wealth preservation and legacy planning.

IUL vs. Other Universal Life Options: Flexibility and Risk

Beyond whole life, there’s a family of Universal Life (UL) policies that offer even more flexibility. Universal life insurance, as a category, provides permanent coverage with adjustable premiums and death benefits. This flexibility is a significant draw for many, allowing policyholders to adapt their coverage as their life circumstances change. Our comprehensive Universal Life Insurance Guide digs into all the nuances of these policies.

IUL vs. Traditional Universal Life (UL)

The primary distinction between IUL and its traditional Universal Life (UL) counterpart lies in how the cash value earns interest:

- Traditional Universal Life (UL): In a traditional UL policy, the cash value credits interest at rates set by the insurance company. These rates are typically declared periodically by the insurer and are influenced by prevailing economic conditions and the insurer’s investment portfolio. While they offer flexibility in premiums and death benefits, the cash value growth is generally steady and predictable, but often lower than the potential offered by market-linked options.

- Indexed Universal Life (IUL): As we’ve discussed, IUL’s cash value growth is linked to the performance of a market index, offering higher potential returns balanced by caps and protected by floors. This makes IUL a more dynamic option, balancing market participation with risk mitigation.

Traditional UL provides steady accumulation with insurer-declared rates, offering predictability, while IUL links growth to a market index with downside protection, aiming for potentially higher returns. Both offer permanent coverage, flexible premium payments, and cash value growth, but the mechanism of that growth is the key differentiator.

Making the Right Choice: Which Policy Fits Your Financial Goals?

Choosing the right life insurance policy is a deeply personal decision, influenced by your financial goals, risk tolerance, and long-term vision. There’s no one-size-fits-all answer, especially when considering the nuances of IUL compared to other life insurance options.

To help you steer this decision, let’s look at a comparative overview of the major permanent policy types:

| Feature | Whole Life | Traditional Universal Life (UL) | Indexed Universal Life (IUL) |

|---|---|---|---|

| Coverage Duration | Lifetime | Lifetime | Lifetime |

| Premium Structure | Fixed and guaranteed | Flexible (within limits) | Flexible (within limits) |

| Cash Value Growth | Guaranteed fixed rate (e.g., 2-4%) + potential dividends | Insurer-declared rate (can vary) | Market index-linked (with cap/floor/participation rate) |

| Risk Level | Low (Guaranteed) | Low to Moderate (Insurer-dependent) | Moderate (Market-linked with downside protection) |

| Flexibility | Low (Fixed premiums/benefits) | High (Adjustable premiums/benefits) | High (Adjustable premiums/benefits, market-linked growth) |

| Best For | Conservative individuals, predictable planning, estate tax liquidity | Those needing flexibility with steady, moderate growth | Growth-focused individuals, retirement income, wealth preservation |

The most crucial step in this process is a thorough financial needs analysis. Ask yourself:

- What are my primary financial goals? Is it guaranteed protection, maximizing cash value growth, or a blend of both?

- What is my risk tolerance? Am I comfortable with market fluctuations, even with downside protection, or do I prefer absolute certainty?

- What is my time horizon? Do I need predictable growth for a specific future need, or am I planning for several decades down the line?

- Have I maxed out other tax-advantaged retirement accounts like 401(k)s and IRAs?

Consulting with a qualified financial advisor is paramount. They can provide personalized guidance, run policy illustrations based on your specific circumstances, and help you determine how any of these options fit into your broader financial strategy. We at ShieldWise are dedicated to offering clear, jargon-free guidance to empower you in this decision-making process.

Tax Advantages of Permanent Life Insurance

One of the most compelling aspects of permanent life insurance, including IUL, is its significant tax advantages, which are often comparable across whole life, traditional UL, and IUL policies:

- Tax-Deferred Cash Value Growth: The interest and gains accumulated within your policy’s cash value grow on a tax-deferred basis. This means you don’t pay taxes on the growth each year, allowing your money to compound more efficiently over time.

- Tax-Free Death Benefit: The death benefit paid to your beneficiaries is generally income tax-free. This provides a substantial financial safety net for your loved ones without them incurring a tax burden.

- Tax-Free Policy Loans: As mentioned earlier, you can typically access your cash value through policy loans on a tax-free basis, provided the policy remains in force and is properly structured. This can be a valuable source of funds for retirement income, emergencies, or other financial needs without triggering a taxable event.

- Estate Tax Liquidity: For high-net-worth individuals, the death benefit of an IUL policy can provide crucial liquidity for estate taxes, helping to preserve the value of your estate for your heirs. The U.S. tax code, specifically 26 U.S.C. 7702 – Life insurance contract defined, outlines the criteria for a policy to qualify for these favorable tax treatments.

These tax advantages make permanent life insurance a powerful tool for long-term wealth accumulation, preservation, and legacy planning, especially when integrated thoughtfully into a comprehensive financial strategy.

Frequently Asked Questions about IUL and Other Life Insurance

Can you lose money in an IUL policy?

This is one of the most common questions we hear, and it’s a critical one. While an IUL policy’s cash value is designed with a floor (often 0% or 1%) to protect against losses due to negative market performance, you can still lose money in an IUL policy. This loss isn’t from the market directly, but from the various costs and fees associated with the policy. These include:

- Mortality charges: The cost of the actual life insurance coverage.

- Administrative fees: Charges for managing the policy.

- Rider costs: If you’ve added extra benefits to your policy.

- Premium loads: A percentage of your premium that goes to the insurer for expenses.

- Surrender charges: If you cancel the policy in its early years, you’ll likely incur significant fees.

If the interest credited to your cash value (even with positive market performance) isn’t enough to cover these ongoing costs, your cash value will decline. This can lead to a situation where you need to pay higher premiums or risk the policy lapsing, meaning you lose your coverage and potentially the cash value you’ve accumulated. While the market floor protects you from index downturns, it doesn’t shield you from the policy’s internal expenses. Regular monitoring and proper funding are key to maintaining your IUL policy’s health.

Is IUL a good investment?

It’s essential to understand that IUL is primarily a life insurance policy with investment-like features, not a pure investment vehicle. While it offers tax-deferred cash value growth linked to market indices, it comes with insurance costs and potential caps on returns that pure investment vehicles don’t have.

For pure investment purposes, dedicated investment vehicles like IRAs, 401(k)s, or brokerage accounts typically offer better returns without the insurance costs. We generally advise our clients to maximize their contributions to traditional retirement accounts, especially if there’s an employer match, before considering IUL for wealth accumulation.

However, for the right individual, IUL can be a valuable and strategic financial asset. It can play a pivotal role in your comprehensive financial strategy, addressing both current protection needs and future financial goals. It can be particularly effective for:

- Individuals who have already maxed out other tax-advantaged retirement accounts.

- Those seeking a balance of market-linked growth with downside protection.

- Individuals focused on wealth preservation and legacy planning.

So, is it a “good investment”? It depends on your definition and your overall financial picture. It’s a powerful financial tool that combines death benefit protection with potential cash value growth, but it shouldn’t be viewed as a substitute for traditional retirement savings. For more detailed insights, check out our Complete Guide to IUL.

Who is IUL best suited for?

IUL isn’t a one-size-fits-all solution, but it can be an excellent fit for specific financial profiles and goals. We typically find IUL to be best suited for individuals who:

- Have a long-term wealth planning horizon: IUL policies are designed for long-term growth, with cash value accumulation becoming more significant over decades.

- Desire market-linked growth with downside protection: If you want the potential for higher returns than traditional fixed-interest policies but are uncomfortable with direct market risk and volatility, the cap and floor mechanism of IUL can be very appealing.

- Have maxed out traditional retirement accounts: For those who have already contributed the maximum to their 401(k)s, IRAs, and other tax-advantaged retirement vehicles, IUL can offer another avenue for tax-deferred growth and potential tax-free income in retirement.

- Are focused on wealth preservation and legacy planning: High-net-worth individuals often use IUL as a strategic tool for estate planning, wealth transfer, and providing liquidity for estate taxes.

- Are comfortable with complexity and active management: IUL policies are more intricate than whole life and require a more hands-on approach to monitoring and understanding their performance and costs.

If these characteristics sound like you, an IUL policy might be a valuable anchor within your broader wealth strategy, especially when guided by custom, professional advice for those navigating wealth transfer, retirement planning, or legacy goals simultaneously.

Conclusion: Securing the Right Coverage for Your Future

Navigating life insurance, especially when delving into the specifics of IUL compared to other life insurance options, can feel like a complex journey. We’ve explored the unique hybrid nature of Indexed Universal Life, its market-linked growth with protective floors and limiting caps, and how it stacks up against the guaranteed predictability of Whole Life and the flexibility of Traditional Universal Life.

The ultimate takeaway is that each policy type serves different needs and aligns with different financial philosophies. Whether you prioritize the unwavering guarantees and simplicity of whole life, the flexible yet steady growth of traditional universal life, or the dynamic, market-linked potential with downside protection of IUL, the right choice is the one that fits your unique circumstances.

Making informed decisions about your life insurance is crucial for securing your financial future and protecting your loved ones. It’s about understanding the mechanics, weighing the benefits against the complexities and costs, and aligning the policy with your personal goals, risk tolerance, and long-term financial strategy.

At ShieldWise, we believe that understanding your options shouldn’t be a chore. We’re here to cut through the jargon, provide clear guidance, and help you compare plans from trusted carriers. With instant online quotes and transparent information, we empower you to find the right coverage in just a few clicks. Don’t leave your financial future to chance; explore your options and secure the protection you deserve.

Ready to take the next step? Explore Universal Life Insurance options today and find the clarity you need to make the best choice for you and your family.