Your Journey to Medicare Starts Here

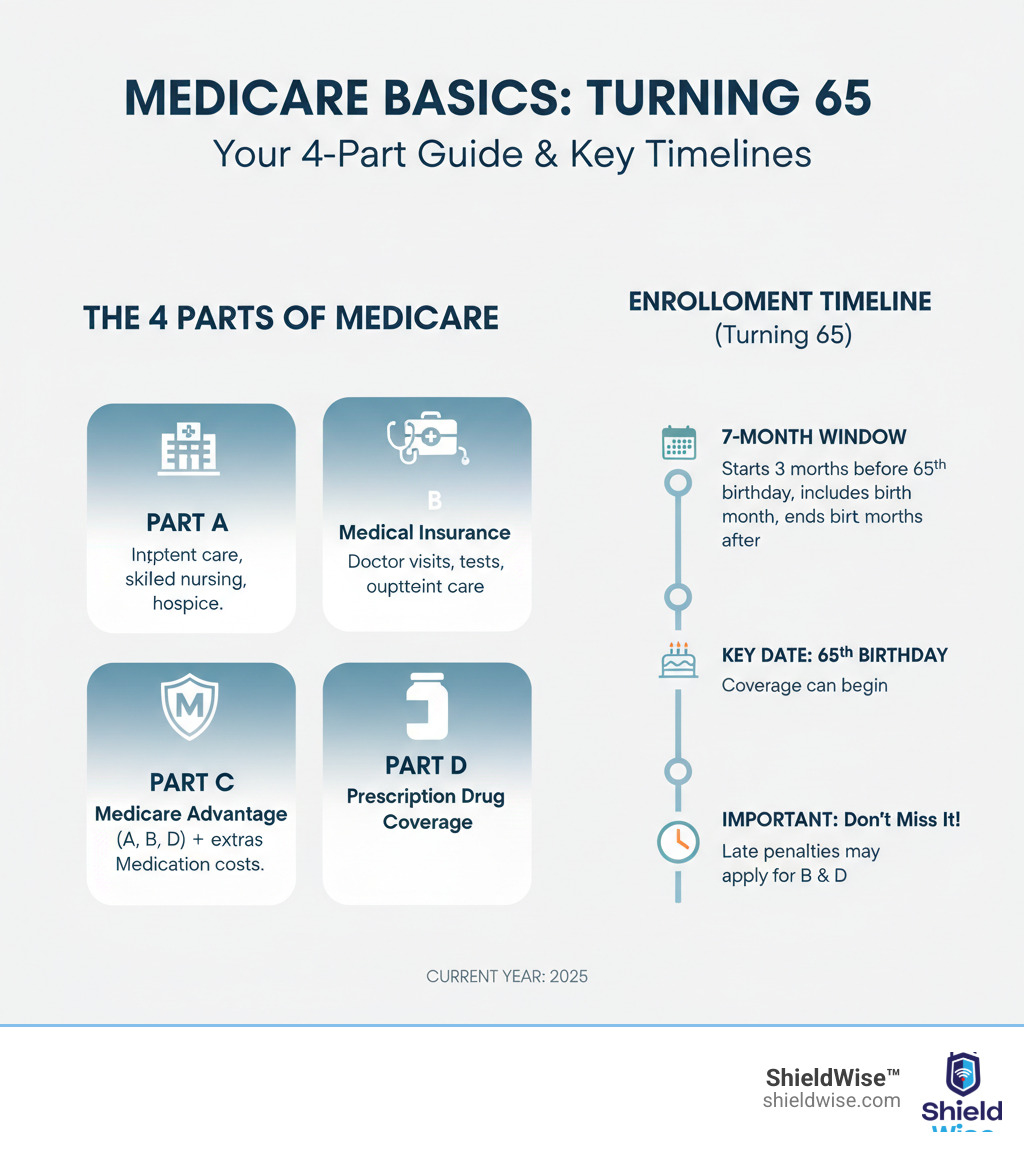

Turning 65 is a major milestone, and understanding Medicare Basics (Turning 65) is key to your future health coverage. Medicare can seem confusing with its various parts, rules, and deadlines, leading to a fear of costly mistakes. This guide simplifies the essentials.

Here’s what you need to know:

- What is Medicare? Federal health insurance for people 65 or older.

- Who is eligible? Most people turning 65, or younger people with certain disabilities.

- When to enroll? During your Initial Enrollment Period, a 7-month window around your 65th birthday.

- What are the parts? Medicare includes Part A (Hospital), Part B (Medical), Part C (Medicare Advantage), and Part D (Prescription Drugs).

We’ll help you make informed choices for your health and finances.

Understanding Medicare Eligibility and Enrollment Windows

As you near 65, you’re likely wondering about Medicare eligibility and enrollment. The good news is most people 65 or older qualify. You may also be eligible earlier due to certain disabilities, End-Stage Renal Disease (ESRD), or ALS. If you’re a U.S. citizen or a legal resident for at least five years, and you or your spouse paid Medicare taxes for 10 years (40 quarters), you’ll likely get premium-free Part A.

If you’re already receiving Social Security or Railroad Retirement Board (RRB) benefits four months before turning 65, you’ll be automatically enrolled in Parts A and B. Otherwise, you’ll need to sign up yourself during your Initial Enrollment Period (IEP). This crucial 7-month window starts three months before your 65th birthday month, includes your birthday month, and ends three months after.

For more information, visit Get started with Medicare.

When is the Best Time to Enroll?

When it comes to Medicare Basics (Turning 65), timing is critical. The best time to enroll is during your Initial Enrollment Period (IEP) to avoid lifelong late enrollment penalties. Enrolling in the three months before your 65th birthday allows coverage to start on the first day of your birthday month. If you enroll during or after your birthday month, your coverage will be delayed.

If you miss your IEP, you might qualify for a Special Enrollment Period (SEP) due to life events like losing employer coverage. COBRA or retiree health plans don’t typically qualify you for an SEP to delay Part B. Without an SEP, you must wait for the General Enrollment Period (GEP) from January 1st to March 31st, with coverage starting the month after you enroll. Waiting for the GEP usually results in permanent late enrollment penalties. To learn more, see When does Medicare coverage start?.

What Happens if You Enroll Late?

Missing your Initial Enrollment Period (IEP) for Medicare Basics (Turning 65) can lead to significant, long-lasting financial penalties that increase your monthly premiums for life.

- Part B Late Enrollment Penalty: If you delay Part B without having other creditable coverage, your monthly premium may increase by 10% for each full 12-month period you were eligible but didn’t enroll. This penalty is typically permanent. For example, a two-year delay could mean a 20% higher premium for life.

- Part D Late Enrollment Penalty: If you go without creditable prescription drug coverage, you may face a penalty when you do enroll in a Part D plan. The penalty is 1% of the national base beneficiary premium multiplied by the number of months you were uncovered. This amount is added to your monthly Part D premium, usually for life.

These penalties encourage timely enrollment and help you avoid gaps in coverage that could leave you with large medical bills. Mastering your Medicare Basics (Turning 65) means understanding these deadlines. For details, visit Avoid late enrollment penalties.

The “Alphabet Soup” of Medicare: Breaking Down the Parts

Medicare’s different ‘Parts’ can feel like an ‘alphabet soup.’ Understanding your Medicare Basics (Turning 65) means knowing what each part covers. Medicare is a collection of parts, each for specific health services.

Here’s a quick breakdown:

- Part A (Hospital Insurance): Covers inpatient hospital stays.

- Part B (Medical Insurance): Covers doctor visits and outpatient care.

- Part C (Medicare Advantage): An all-in-one alternative from private companies.

- Part D (Prescription Drug Coverage): Helps pay for medications.

- Medigap (Medicare Supplement Insurance): Helps cover costs Original Medicare doesn’t.

Understanding these pieces is key to choosing your coverage. Explore more at Parts of Medicare.

Part A (Hospital Insurance) and Part B (Medical Insurance)

Parts A and B form Original Medicare, the foundation of Medicare Basics (Turning 65).

Part A (Hospital Insurance)

Most people get Part A premium-free if they or their spouse paid Medicare taxes for at least 10 years. Part A helps cover:

- Inpatient hospital care (room, meals, nursing).

- Skilled nursing facility care (following a qualifying hospital stay).

- Hospice care.

- Some home health care.

If you don’t qualify for premium-free Part A, you can usually buy it.

Part B (Medical Insurance)

Part B has a monthly premium, which can be higher based on your income (the standard for 2025 is $185.00). Part B is vital for covering:

- Doctor and other provider services.

- Outpatient care, including ER visits.

- Durable medical equipment (wheelchairs, walkers).

- Many preventive services like screenings and vaccines.

After meeting the annual deductible ($257 in 2025), you typically pay 20% of the Medicare-approved amount for most services. Skipping Part B can lead to late enrollment penalties and large medical bills.

Part D (Prescription Drug Coverage) and Medigap (Supplemental Insurance)

As you finalize your Medicare Basics (Turning 65), consider Part D for drugs and Medigap for financial protection.

Part D (Prescription Drug Coverage)

Part D plans, offered by private insurers, help cover prescription drug costs. Plans vary in premiums, deductibles, and covered drugs (formularies), so compare them carefully. Like Part B, delaying Part D enrollment without other creditable drug coverage can result in a lifelong late enrollment penalty. Medicare is working to cap annual out-of-pocket drug costs at $2,100 in 2026.

Medigap (Medicare Supplement Insurance)

Medigap policies, sold by private companies, help pay for Original Medicare’s out-of-pocket costs like deductibles and coinsurance. Medigap works with Original Medicare, not in place of it. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period, which starts when you’re 65 or older and enrolled in Part B. During this period, you have guaranteed issue rights, meaning you can’t be denied coverage or charged more due to health issues. Medigap plans are standardized by letter (e.g., Plan G, Plan N), so benefits are the same across companies, but prices differ!

Your Two Main Paths: Original Medicare vs. Medicare Advantage

As you steer Medicare Basics (Turning 65), you’ll face a key choice: Original Medicare or a Medicare Advantage Plan. Both provide health coverage, but in different ways.

Original Medicare (Part A and Part B) is the government-run program. Its main advantage is flexibility—you can see any doctor or hospital in the U.S. that accepts Medicare, usually without referrals. However, it doesn’t cover prescription drugs (requiring a separate Part D plan), nor routine dental, vision, or hearing. Many people buy a Medigap policy to help cover out-of-pocket costs.

Medicare Advantage (Part C) plans are an all-in-one alternative from private, Medicare-approved insurance companies. They bundle Part A, Part B, and often Part D (prescription drugs). Many also offer extra benefits like dental, vision, and hearing care. The trade-off is that they typically use provider networks (like HMOs or PPOs) and may require referrals to see specialists.

Key Differences to Consider

To help you visualize these differences, here’s a quick comparison. Understanding these key distinctions is crucial as you steer your Medicare Basics (Turning 65).

| Feature | Original Medicare (Parts A & B) | Medicare Advantage (Part C) |

|---|---|---|

| Provider Choice | Any doctor/hospital nationwide that accepts Medicare. No referrals needed. | Often requires using doctors/hospitals within a specific network (HMOs, PPOs). May require referrals. |

| Drug Coverage | No prescription drug coverage. Requires separate Part D plan. | Most plans include Part D coverage. |

| Extra Benefits | No coverage for routine dental, vision, hearing, or gym memberships. | Often includes extra benefits like dental, vision, hearing, gym memberships, and more. |

| Out-of-Pocket Costs | No annual out-of-pocket maximum (unless you have a Medigap policy). Pays 80% for Part B services after deductible. | Has an annual out-of-pocket maximum. Once reached, the plan pays 100% for covered services. Co-pays and deductibles vary by plan. |

| Supplemental Coverage | Can purchase a Medigap policy to cover deductibles, copayments, and coinsurance. | Cannot purchase a Medigap policy. |

| Administration | Administered by the federal government. | Administered by private insurance companies approved by Medicare. |

A Deeper Look at Medicare Basics (Turning 65)

How do you choose the right path? It depends on your personal health, budget, and lifestyle.

- Provider Freedom vs. All-in-One Plan: Do you value seeing any doctor (Original Medicare) or prefer a structured plan with extra benefits and a yearly out-of-pocket maximum (Medicare Advantage)?

- Budget: Original Medicare involves premiums for Part B, Part D, and Medigap. Medicare Advantage plans often have lower monthly premiums but include co-pays for services.

- Travel: Original Medicare offers nationwide coverage. Medicare Advantage plans are typically regional.

- Doctor Preference: With Original Medicare, you can see any doctor who accepts Medicare. With Medicare Advantage, you must check if your doctors are in the plan’s network.

Weighing these factors will help you confidently make your Medicare Basics (Turning 65) decision.

Medicare Basics (Turning 65) When You’re Still Working

Working past 65 adds another layer to your Medicare Basics (Turning 65) decisions. You’ll need to understand how your employer health insurance coordinates with Medicare to determine which pays first (primary) and which pays second (secondary).

The size of your employer is the key factor. If your employer has 20 or more employees, your group health plan is typically the primary payer. If the employer has fewer than 20 employees, Medicare usually becomes primary at 65.

Can I Delay Medicare Part A and Part B?

Whether you can delay Medicare depends on your situation.

Large Employers (20+ employees): You can usually delay Part B without penalty because your employer plan is considered creditable coverage. You’ll get an 8-month Special Enrollment Period (SEP) to sign up for Part B penalty-free when your employment or coverage ends. Most people enroll in premium-free Part A at 65.

HSA Exception: A major exception involves Health Savings Accounts (HSA). You cannot contribute to an HSA once any part of Medicare starts. To continue HSA contributions, you must delay enrolling in all parts of Medicare, including premium-free Part A. Be aware that Medicare Part A coverage can be retroactive up to six months from when you apply, so stop HSA contributions accordingly.

Small Employers (fewer than 20 employees): Medicare becomes your primary insurer at 65. You should enroll in Parts A and B during your Initial Enrollment Period to avoid coverage gaps and penalties.

COBRA and Retiree Coverage: These do not count as active employer coverage. If you have COBRA or retiree coverage, you should still enroll in Medicare at 65 to avoid penalties and coverage issues.

Making the Right Choice for Your Situation

To decide, you need to do some homework.

- Compare Costs: Analyze the premiums, deductibles, and copays of your employer plan versus the costs of Medicare (Part B/D premiums) plus a potential Medigap policy. Medicare might be more affordable.

- Consider Dependents: Check how switching to Medicare would affect family members on your employer plan.

- Talk to Your Benefits Administrator: This is the most important step. Your HR or benefits department can explain how your specific plan works with Medicare. They can confirm if your coverage is creditable and how your choices impact dependents.

Getting this personalized information is crucial for making the right Medicare Basics (Turning 65) decision.

How to Sign Up and Get Help with Costs

You’ve learned about the different parts of Medicare, understood your enrollment windows, and figured out which coverage path makes sense for you. Now comes the practical part: actually signing up. The good news? It’s usually more straightforward than you might think, and if costs are a concern, there are several programs designed to help.

Step-by-Step Enrollment Guide

Here’s how to enroll in your Medicare Basics (Turning 65) coverage.

- Check for Automatic Enrollment: If you’re already getting Social Security or RRB benefits for at least four months before turning 65, you’ll be automatically enrolled in Parts A and B. Your card will arrive about three months before your birthday.

- Sign Up Manually: If not automatically enrolled, you must sign up yourself. The easiest way is online at the Social Security Administration website. You can also call Social Security at 1-800-772-1213 or visit a local office.

- Choose Your Coverage Path: After enrolling in Original Medicare (Parts A and B), decide if you want to add a Part D drug plan and a Medigap policy, or switch to a Medicare Advantage plan.

- Receive Your Medicare Card: Your card will arrive in the mail, showing your Medicare number and coverage start dates. Keep it in a safe place.

Financial Assistance Programs

If you have limited income and resources, several programs can help with Medicare Basics (Turning 65) costs.

- Medicaid: A joint federal and state program that can help pay Medicare premiums, deductibles, and copayments for eligible individuals.

- Medicare Savings Programs (MSPs): State-run programs that help pay Part A and/or Part B premiums, deductibles, and coinsurance.

- Extra Help: A Social Security program that helps with Part D prescription drug costs, including premiums and deductibles.

- State Health Insurance Assistance Program (SHIP): SHIPs offer free, unbiased, one-on-one counseling on all things Medicare. They can help you compare plans, understand costs, and apply for assistance. Find your local SHIP for personalized guidance.

Don’t hesitate to see if you qualify for these programs; they can provide significant financial relief.

Frequently Asked Questions about Turning 65 and Medicare

We’ve covered a lot of ground on Medicare Basics (Turning 65), and we know you might still have some lingering questions. To help solidify your understanding, let’s address some of the most common questions.

What are the potential penalties for enrolling late in Medicare?

Late enrollment can lead to permanent penalties added to your monthly premiums.

- Part B Penalty: Your monthly premium may increase by 10% for each full 12-month period you were eligible for Part B but didn’t enroll. This penalty lasts for as long as you have Part B.

- Part D Penalty: If you go 63 consecutive days or more without creditable prescription drug coverage after your Initial Enrollment Period ends, you may owe a late enrollment penalty. This is added to your monthly Part D premium for as long as you have coverage.

Understanding these deadlines is a key part of Medicare Basics (Turning 65).

Am I automatically enrolled in Medicare when I turn 65?

Only if you’re already receiving Social Security or Railroad Retirement Board (RRB) benefits for at least four months before your 65th birthday. In that case, you’ll be automatically enrolled in Part A and Part B. Otherwise, you must sign up yourself during your 7-month Initial Enrollment Period.

What are the key decisions I need to make about my Medicare coverage?

Your Medicare Basics (Turning 65) journey involves three key decisions:

- When to enroll in Part B? If you’re still working with creditable health coverage, you might be able to delay Part B without penalty. Otherwise, enroll when you’re first eligible.

- Which coverage path to choose? Decide between Original Medicare (with a separate Part D plan and optional Medigap policy) and an all-in-one Medicare Advantage plan.

- Do you need supplemental coverage? If you choose Original Medicare, consider a Part D plan for prescriptions and a Medigap policy to help cover out-of-pocket costs.

These choices depend on your health, budget, and lifestyle.

Secure Your Health and Financial Future

You’ve now covered the essentials of Medicare Basics (Turning 65). From enrollment windows and penalties to the choice between Original Medicare and Medicare Advantage, you’re in a better position to make informed decisions. The most important takeaway is that timing is crucial. Enrolling on time prevents lifelong penalties, and choosing the right path depends on your personal needs, budget, and lifestyle.

Remember to consider your work status and explore financial assistance programs if needed. You don’t have to steer this alone. At ShieldWise™, we provide clear, jargon-free guidance to help you compare plans and find coverage that fits your life.

Ready to take the next step? Contact a licensed agent for personalized guidance and let us help you secure your health and financial future.