Understanding Your Medicare Coverage Options

Medicare Advantage plans are an alternative way to get your Medicare coverage through private insurance companies approved by Medicare. Instead of having Original Medicare (Parts A and B) separately, you get all your coverage bundled into one plan—often including prescription drugs and extra benefits like dental or vision.

Quick Answer: What You Need to Know About Medicare Advantage

- What it is: Private insurance plans that provide all your Medicare Part A (hospital) and Part B (medical) coverage, usually with Part D (prescription drugs) included.

- Key benefit: Often has a $0 monthly premium and includes a yearly cap on your out-of-pocket costs.

- Main trade-off: You typically must use doctors and hospitals in the plan’s network and may need referrals to see specialists.

- Eligibility: You must have both Part A and Part B and live in the plan’s service area.

- When to enroll: The Annual Enrollment Period runs from October 15 to December 7 each year.

Medicare enrollment can be overwhelming, with a flood of information from various sources. It’s easy to get conflicting advice.

Here’s the truth: there’s no single “best” choice for everyone. Nearly half of all Medicare beneficiaries—about 33 million people—have chosen Medicare Advantage plans as of 2024, a significant increase from 24% in 2010. But that doesn’t mean it’s automatically right for you.

The decision comes down to understanding how each option works, what it costs, and how it fits your specific health needs and budget. If you’re on a fixed income, worried about surprise medical bills, or just want clear information, you’re in the right place.

In this guide, we’ll break down exactly how Original Medicare and Medicare Advantage plans compare, what the different plan types actually mean, and what questions you should ask before making your choice.

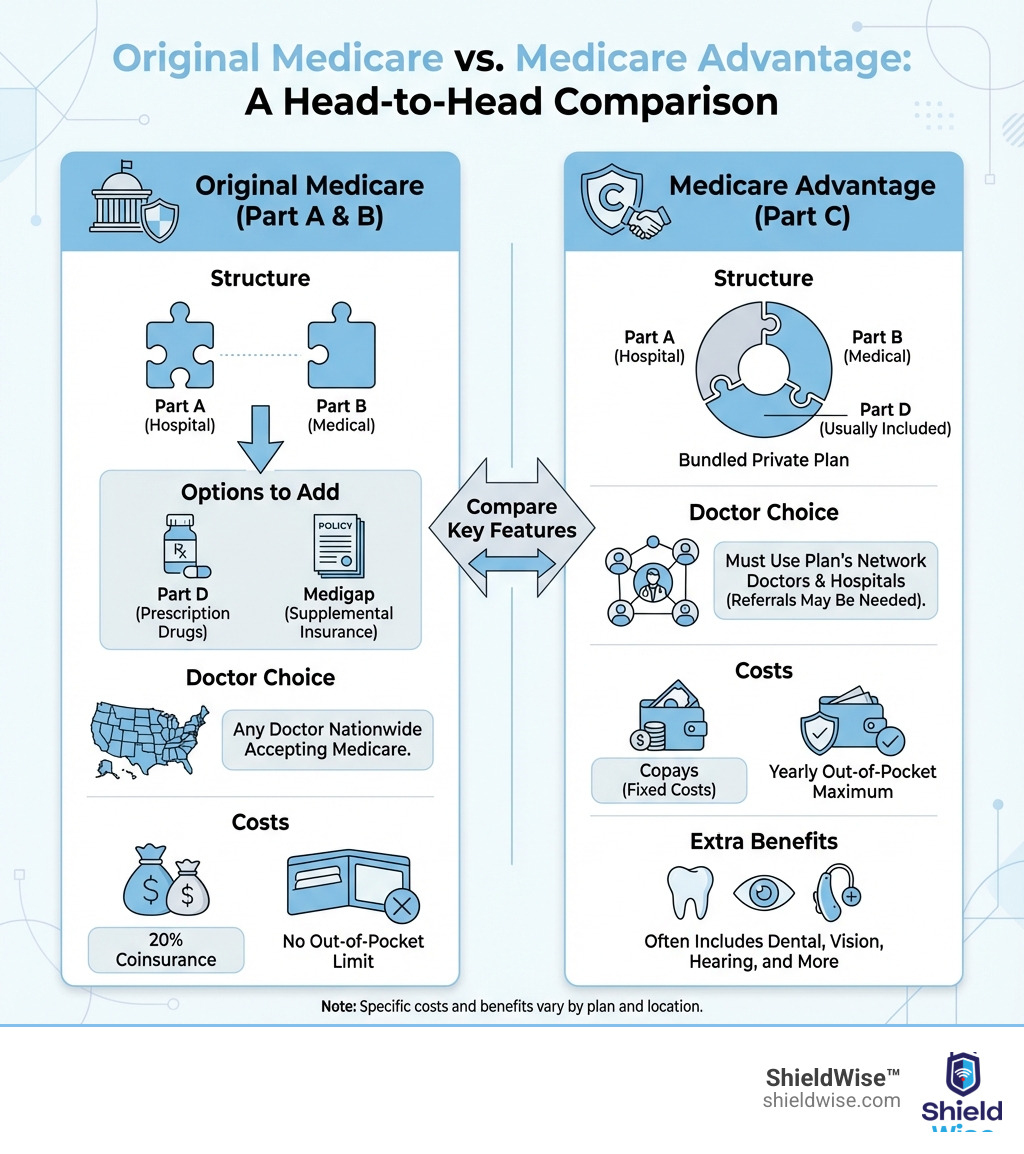

Original Medicare vs. Medicare Advantage: A Head-to-Head Comparison

Choosing between Original Medicare and a Medicare Advantage plan is a key healthcare decision. While both provide essential coverage, they work differently. Here’s a head-to-head comparison:

| Feature | Original Medicare | Medicare Advantage (Part C) – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

| Coverage | Part A (Hospital) + Part B (Medical) | All-in-one plan (Part A + B + often D) |

| Cost | Part B premium, deductibles, 20% coinsurance (no out-of-pocket limit for Parts A/B) | Part B premium (usually), plan premium (often $0), copays/coinsurance, annual out-of-pocket maximum |

| Provider Choice | Any doctor/hospital that accepts Medicare, nationwide | Typically limited to plan’s network, may need referrals for specialists |

| Extra Benefits | No (requires separate Medigap or Part D) | Often includes dental, vision, hearing, fitness programs, and Part D |

| Prescription Drugs | Separate Part D plan required | Usually included (MA-PD plans) |

| Out-of-Pocket Limit | No (unless you have Medigap) | Yes, yearly limit (typically $1,500 – $8,000 in 2023) |

| Regulation | Federal government (CMS) | Private companies regulated by CMS

To dive deeper into these distinctions, you can consult the official guide from Medicare.gov: Compare Original Medicare & Medicare Advantage.

Doctor and Hospital Choice

With Original Medicare, you can see any doctor or hospital in the U.S. that accepts Medicare, usually without needing a referral for specialists. This offers great flexibility, especially if you travel or have specific doctors you want to see.

Medicare Advantage plans are managed care plans, often HMOs or PPOs, which have provider networks.

- HMO Plans: You typically choose a primary care provider (PCP) and need referrals to see specialists. Out-of-network care is generally not covered, except for emergencies.

- PPO Plans: These offer more flexibility, allowing you to see out-of-network providers (usually at a higher cost) without a referral.

For Illinois residents, it’s crucial to check if your preferred doctors and hospitals are in a plan’s network to avoid unexpected costs.

Cost Breakdown: Premiums, Deductibles, and Limits

Understanding the costs is key.

- Part B Premium: You’ll pay your monthly Part B premium with either option, though some Medicare Advantage plans may help cover this cost.

- Deductibles & Coinsurance: Original Medicare has deductibles for Parts A and B, plus a 20% coinsurance for most Part B services with no annual limit. Medicare Advantage plans use copayments and coinsurance, but they include a yearly out-of-pocket maximum.

- Annual Out-of-Pocket Maximum: This is a major advantage of MA plans. Once you reach this limit (which typically ranges from $1,500 to $8,000 in 2023), the plan covers 100% of your approved medical costs for the rest of the year. Original Medicare doesn’t have this cap, which is why many people buy a separate Medigap policy.

- $0 Premium Plans: Many Medicare Advantage plans have a $0 monthly premium (you still pay your Part B premium). Over 98% of enrollees are in a zero-premium plan with prescription drug coverage (MA-PD). Always check the full cost structure, including copays and deductibles.

Coverage for Your Health Needs

Both options cover all medically necessary services like doctor visits and hospital stays.

- Extra Benefits: Medicare Advantage plans often include benefits not covered by Original Medicare, such as routine dental, vision, and hearing care, as well as fitness programs like SilverSneakers.

- Prescription Drug Coverage (Part D): Most Medicare Advantage plans (MA-PDs) bundle prescription drug coverage. With Original Medicare, you need to buy a separate Part D plan.

Decoding Medicare – Advantage Plans: What Are Your Options?

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. They bundle your Part A and Part B benefits into a single plan and are regulated by the Centers for Medicare and Medicaid Services (CMS).

Types of Medicare Advantage Plans

There are several types of Medicare Advantage plans, each with different rules and networks:

- HMO (Health Maintenance Organization): Usually requires you to use doctors, hospitals, and specialists within the plan’s network and get a referral from your primary care physician (PCP).

- PPO (Preferred Provider Organization): Offers more flexibility to see providers both in and out-of-network, typically without a referral, but your costs will be lower if you stay in-network.

- PFFS (Private Fee-for-Service): Allows you to see any Medicare-approved provider who accepts the plan’s payment terms on a case-by-case basis.

- SNPs (Special Needs Plans): Custom for individuals with specific diseases, certain health care needs, or who are dual-eligible for both Medicare and Medicaid (D-SNPs).

The Benefits of Choosing an Advantage Plan

Why are Medicare Advantage plans so popular?

- All-in-one Coverage: Combines hospital (Part A), medical (Part B), and often prescription drug (Part D) coverage into a single plan.

- Cost Savings: Many plans have $0 monthly premiums (you still pay your Part B premium) and an annual out-of-pocket maximum, which protects you from catastrophic costs.

- Extra Perks: Often include benefits not covered by Original Medicare, such as dental, vision, hearing, and gym memberships.

What are the potential drawbacks of medicare – advantage plans?

It’s also important to consider the potential downsides:

- Network Restrictions: You may be limited to a specific network of doctors and hospitals, which can be a problem if you travel or have preferred providers outside the network.

- Prior Authorization: Many services and medications require pre-approval from the insurance company, which can sometimes delay care.

- Referral Requirements: HMO plans often require a referral from your primary doctor to see a specialist.

- Annual Changes: Benefits, provider networks, and costs can change each year, so you need to review your plan annually.

- Cost and Oversight Concerns: Critics point to issues like higher costs to the Medicare program and inappropriate denial of services. A 2022 report from the Office of Inspector General (OIG) found that some Medicare Advantage organizations have denied prior authorization requests that would have been covered under Original Medicare.

Eligibility and Enrollment: Your Guide to Getting Covered

Ready to enroll in a Medicare Advantage plan? Here’s what you need to know about eligibility and when you can sign up.

Who is Eligible for a Medicare Advantage Plan?

To join a Medicare Advantage plan, you must meet these requirements:

- Be enrolled in both Medicare Part A and Part B.

- Live in the plan’s service area. For our ShieldWise™ clients, this means finding a plan available in your Illinois county.

- Be a U.S. citizen or a legal resident for at least five consecutive years.

- People with End-Stage Renal Disease (ESRD) are now eligible to join most Medicare Advantage plans.

- You cannot be denied coverage due to pre-existing conditions.

Key Enrollment Periods You Need to Know

Timing is crucial for Medicare enrollment. Here are the key periods:

- Initial Enrollment Period (IEP): This is your first opportunity to sign up for Medicare. It’s a 7-month window surrounding your 65th birthday. If you’re new to Medicare, our guide on Medicare Basics: Turning 65 can help.

- Annual Enrollment Period (AEP): From October 15 to December 7 each year, you can join, switch, or drop a Medicare Advantage plan or Part D prescription drug plan. Your new coverage begins on January 1.

- Medicare Advantage Open Enrollment Period (MA OEP): From January 1 to March 31 annually, if you’re already in a Medicare Advantage plan, you can make a one-time switch to another MA plan or return to Original Medicare.

- Special Enrollment Period (SEP): Certain life events, like moving out of your plan’s service area or losing other health coverage, may qualify you for an SEP, allowing you to change your plan outside of the standard enrollment periods.

Frequently Asked Questions about Medicare Advantage

We know you’ve got questions, and we’re here to provide clear, straightforward answers.

Can I switch back to Original Medicare if I don’t like my Advantage Plan?

Yes, you have options to switch back.

- Medicare Advantage Open Enrollment Period (MA OEP): From January 1 to March 31 each year, you can switch from your Medicare Advantage plan back to Original Medicare and add a Part D plan.

- Trial Right: If you’re new to Medicare, you have a 12-month “trial right” to switch back to Original Medicare and buy a Medigap policy with guaranteed issue rights if you’re not satisfied with your first Medicare Advantage plan.

- Annual Enrollment Period (AEP): From October 15 to December 7, you can switch between Original Medicare and a Medicare Advantage plan.

Do all medicare – advantage plans include prescription drug coverage?

Most, but not all, Medicare Advantage plans include prescription drug coverage (Part D). These are called MA-PD plans. In fact, over 98% of enrollees are in a zero-premium MA-PD plan. Some plans, like certain PFFS or MSA plans, may not offer drug coverage. If you choose one of these, you generally can’t buy a separate Part D plan. Always check a plan’s formulary (list of covered drugs) to ensure your medications are included.

What happens to my Medicare Advantage plan if I move?

Medicare Advantage plans are geographically based. If you move out of your plan’s service area, you will need to choose a new plan. This move qualifies you for a Special Enrollment Period (SEP), giving you a window of time (usually 2 months) to enroll in a new Medicare Advantage plan or switch to Original Medicare in your new location. Plan availability and benefits can vary significantly by county, even within Illinois, so it’s important to research your new options.

Conclusion: Making the Right Choice for Your Health and Wallet

Navigating Medicare can feel like a maze, but we hope this showdown between Original Medicare and Medicare Advantage plans has brought some clarity. There’s no universal “best” option; the ideal choice depends entirely on your individual circumstances.

When making your decision, consider these key factors:

- Your Health Needs: Do you have chronic conditions that benefit from coordinated care? Do you need extensive dental, vision, or hearing services?

- Your Budget: Are low monthly premiums and an annual out-of-pocket maximum a top priority? Or are you comfortable with potentially higher out-of-pocket costs in exchange for more flexibility?

- Your Provider Preferences: Do you have a strong desire to keep specific doctors or access care nationwide? Or are you comfortable working within a plan’s network?

- Your Long-Term Planning: How might your health needs change in the future? Do you value the stability of Medigap with Original Medicare, or the bundled benefits of an Advantage plan?

The growth of Medicare Advantage plans to nearly half of all Medicare beneficiaries by 2024 shows their increasing popularity, often driven by the appeal of $0 premiums, bundled benefits, and an out-of-pocket spending limit. However, the flexibility of Original Medicare, coupled with supplemental plans, remains a strong choice for many.

This decision should be a thoughtful one, custom to your unique situation. We at ShieldWise™ are here to help you cut through the complexity. We focus on providing clear, jargon-free guidance so you can compare plans from trusted carriers, understand your options, and secure the right coverage for your health and financial future in just a few clicks.

Ready to explore your options with expert guidance? Get clear, jargon-free guidance on your Medicare options.