Why Seniors Need to Know About Immediate Coverage Options

Life insurance for seniors no waiting period is a policy that provides an immediate death benefit from day one. This means there’s no two- or three-year delay before your family can receive the full payout.

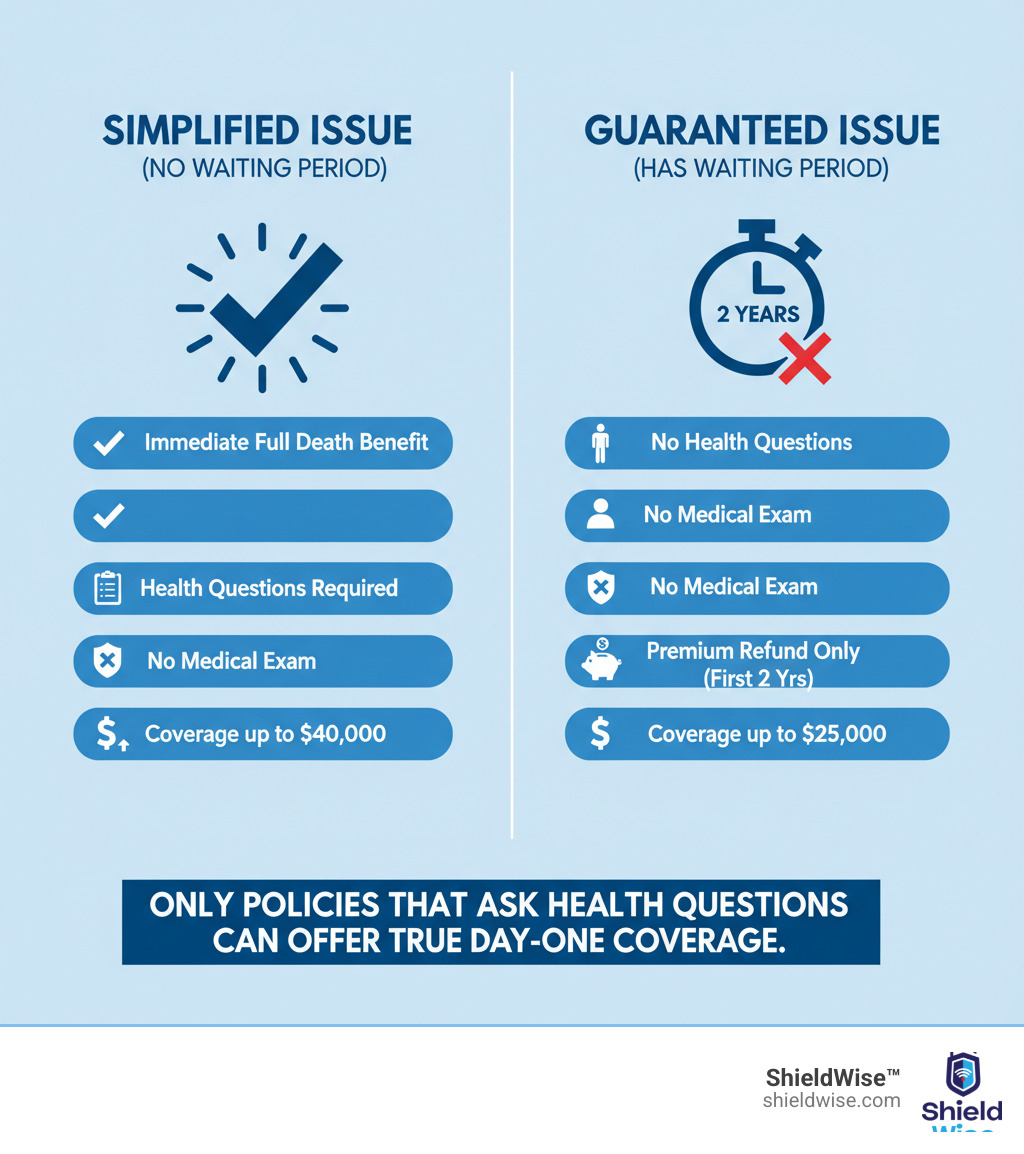

These policies, also called “simplified issue” or “day-one coverage,” allow you to secure between $5,000 and $40,000 in coverage. While they don’t require a medical exam, they do require you to answer health questions. This is a key distinction from “guaranteed issue” policies, which skip the health questions but always include a waiting period.

Many seniors worry about leaving loved ones with unexpected bills, especially with funeral costs averaging over $8,300. The good news is that getting immediate coverage is simpler than you might think, even with some health conditions.

The secret is understanding that any policy promising “no questions, no wait” is misleading. Insurers must assess risk. If they ask no health questions, they use a waiting period as a safeguard. True immediate coverage requires you to answer health questions, but you don’t need to be in perfect health. Conditions like controlled diabetes or high blood pressure often won’t prevent you from qualifying for a policy that pays out from day one.

What is Life Insurance With No Waiting Period?

Life insurance for seniors no waiting period is a policy that covers you completely from the first day—what insurers call “day-one coverage.” If you pass away after your policy starts, your family gets the full death benefit. The only exception is suicide within the first two years, a standard exclusion.

This is possible through simplified underwriting. Instead of a medical exam, you answer health questions on the application. The insurer verifies this information with databases like prescription records and the Medical Information Bureau (MIB). This allows for fast approval, giving you peace of mind that final expenses, like funeral costs (median of $8,300 in 2023), are covered without delay.

The Myth of “No Questions, No Wait”

You may have seen ads for policies with “no questions asked and no waiting period.” This is not a real product. If a policy asks zero health questions and guarantees acceptance, it will always have a waiting period. These are called guaranteed issue policies.

Insurers use health questions or a waiting period to assess risk. Without either, they would face unsustainable losses. So, when you shop for true day-one coverage, expect to answer health questions. It’s a sign that immediate benefits are actually on the table.

No Medical Exam vs. No Health Questions

Understanding this distinction is crucial.

No medical exam policies (or simplified issue) are the ones that can offer life insurance for seniors no waiting period. You skip the doctor’s visit and bloodwork, but you do answer health questions on the application. Based on your answers, you can be approved for immediate, full coverage. These policies work well for seniors in reasonably good health, even with managed conditions. For more information, see our guide on Final Expense Insurance.

No health questions policies (or guaranteed issue) guarantee acceptance to anyone in the eligible age range. The trade-off is a mandatory waiting period, usually two years. If you die from natural causes during this time, your beneficiary receives a refund of premiums paid (often with ~10% interest), not the full death benefit. This option is for those with serious health issues who may not qualify for other plans.

Types of Life Insurance for Seniors with No Waiting Period

When seeking life insurance for seniors no waiting period, you’re typically looking at whole life insurance policies. These last your entire life and build cash value. However, not all policies offer immediate coverage. The main types differ significantly.

| Feature | Simplified Issue (No Waiting Period) | Graded Death Benefit (Partial Waiting Period) | Guaranteed Issue (Full Waiting Period) |

|---|---|---|---|

| Waiting Period | None (Immediate Full Coverage) | Yes (Partial payout in first 2 years) | Yes (Full 2-year waiting period) |

| Health Questions | Yes (Few questions) | Yes (More detailed questions) | No (Guaranteed Acceptance) |

| Medical Exam | No | No | No |

| Coverage Amount | Higher (e.g., $10,000 – $40,000) | Moderate (e.g., $5,000 – $25,000) | Lower (e.g., $2,000 – $25,000) |

| Cost | Moderate | Moderate to High | Highest (per dollar of coverage) |

| Best For | Moderate health, quick coverage | Significant health issues, some immediate need | Very poor health, guaranteed acceptance |

If you want true day-one coverage, simplified issue is your goal. Let’s look at the top two options more closely.

Simplified Issue Life Insurance

This is the best option for most seniors wanting life insurance for seniors no waiting period. It provides immediate, full coverage once the policy is active. You skip the medical exam but must answer health questions. Because the insurer can assess your health, they can offer higher coverage amounts, typically from $10,000 to $40,000. This is often enough for a funeral and other final bills. These policies are ideal for seniors in reasonably good health or with well-managed conditions like high blood pressure or controlled diabetes. You can explore our guide to Final Expense Insurance for more details.

Graded Death Benefit Life Insurance

Graded benefit policies are a middle ground for those with more significant health issues who can’t qualify for simplified issue. They have a partial waiting period. If you pass away from natural causes in the first couple of years, your beneficiaries receive a percentage of the death benefit (e.g., 30-40% in year one, 70-80% in year two) or a premium refund plus interest. After the graded period (usually two years), the full benefit is paid. Importantly, accidental death is typically covered for the full amount from day one. This option provides some immediate protection while building toward full coverage.

Eligibility, Cost, and Key Considerations

When considering life insurance for seniors no waiting period, the main questions are “Will I qualify?” and “Can I afford it?”

The primary advantage is immediate financial protection for your family, without the stress of a medical exam. The trade-off is a higher premium compared to a fully underwritten policy, but it’s typically cheaper than a guaranteed issue plan. Before shopping, assess your needs. Consider debts and final expenses—the median funeral cost in 2023 was $8,300—to determine a suitable coverage amount.

Qualifying for Life Insurance for Seniors with No Waiting Period

Most seniors between 45 and 85 can qualify. You will answer health questions about your medical history, but no exam is required.

Many common, well-managed conditions won’t disqualify you from day-one coverage, such as controlled diabetes, high blood pressure, arthritis, or high cholesterol. However, more severe conditions like active cancer treatment, a terminal diagnosis, or being in hospice care will likely lead you to a graded or guaranteed issue policy with a waiting period.

The application process is fast, with decisions often made in minutes or days. Honesty on your application is critical to ensure your family’s claim is paid.

Understanding Costs for Life Insurance for Seniors with No Waiting Period

Several factors determine your premium:

- Age: Younger applicants pay less.

- Gender: Women typically pay less than men due to longer life expectancy.

- Coverage Amount: A $25,000 policy costs more than a $10,000 one.

- Health Status: Better health, even with managed conditions, results in lower rates.

- Policy Type: Simplified issue costs more than traditional plans but less than guaranteed issue.

For example, a healthy 65-year-old might pay around $160/month for $25,000 in a no-exam policy. While a traditional plan might be slightly cheaper, you’re paying for the convenience and speed of a simplified issue policy. Given that funeral costs can easily exceed $8,000, a policy in the $10,000 to $25,000 range provides meaningful protection. At ShieldWise™, we help you compare plans from trusted carriers to find coverage that fits your needs and budget.

What Happens if Your Policy Has a Waiting Period?

It’s important to understand what happens if you get a policy that does have a waiting period, such as a guaranteed issue plan.

If you pass away from natural causes during the waiting period (typically two years), your family will not receive the full death benefit. Instead, the insurance company will return all the premiums you paid, usually with about 10% interest. While your loved ones get something back, it’s not the full amount you intended for them.

There is one crucial exception: accidental death. Most policies with a waiting period will still pay the full death benefit immediately if you pass away in an accident. This provides some level of protection from day one.

The Contestability Clause Explained

Even on a policy with no waiting period, you need to know about the contestability clause. This is a standard provision in nearly all life insurance policies. It gives the insurer the right to investigate your claim if you pass away within the first two years of the policy.

The insurer is looking for material misrepresentation on your application. If they find you were dishonest about a serious health condition, they can deny the claim and refund the premiums instead of paying the death benefit. This is why honesty on your application is non-negotiable. It protects your family from a potential claim denial.

After the contestability period ends (usually two years), the policy becomes incontestable. At this point, the insurer generally cannot dispute a claim, providing your beneficiaries with much greater certainty that the benefit will be paid.

Frequently Asked Questions about No Waiting Period Life Insurance

Here are answers to some of the most common questions we hear from seniors about immediate coverage.

Do I have to take a medical exam to get immediate coverage?

No. One of the biggest benefits of life insurance for seniors no waiting period is that you can get it without a medical exam. These simplified issue policies require you to answer health and lifestyle questions on your application. The insurer uses this information, along with data from sources like prescription databases, to approve your policy quickly—sometimes in minutes.

Can I get immediate coverage if I have health problems?

Yes, it’s often possible. The key is how well your conditions are managed. Common, stable conditions like controlled diabetes, high blood pressure, or arthritis typically do not prevent you from qualifying for a simplified issue policy with immediate coverage.

However, for more serious issues like current cancer treatment, a terminal diagnosis, or advanced Alzheimer’s, you will likely not qualify for immediate full coverage. In these cases, a graded death benefit or guaranteed issue policy (with a waiting period) would be your best options. An agent can help you find the right plan for your specific health situation. Always be honest on your application to avoid claim denial during the contestability period.

What is the Social Security death benefit?

The Social Security death benefit is a one-time payment of $255. It is paid to an eligible surviving spouse or child. Given that the median funeral cost in 2023 was $8,300, this benefit is not nearly enough to cover final expenses. It highlights the need for a dedicated life insurance policy to provide real financial protection for your loved ones.

Social Security also provides ongoing monthly survivor benefits to eligible family members, which are separate from the one-time death benefit. You can learn more at the official Social Security website at https://www.ssa.gov/survivor. These benefits help with living expenses but do not solve the immediate need to pay for a funeral.

Find the Right Coverage for Your Peace of Mind

We’ve covered a lot of ground, and hopefully, you feel more confident about your options. Understanding life insurance for seniors no waiting period is about knowing what’s available and what’s right for you.

Remember: immediate coverage is within reach for many seniors. By answering a few health questions honestly, you can secure a simplified issue policy with full protection from day one, no medical exam required. You don’t need perfect health.

If you have more serious health concerns, graded benefit and guaranteed issue policies still provide a path to coverage. The right choice depends on your unique situation.

Taking this step now means your loved ones won’t have to scramble for funds during an already emotional time. With funeral costs averaging over $8,000, a policy is one of the most thoughtful gifts you can give your family.

At ShieldWise™, we’re here to cut through the confusion. We provide straightforward information and access to trusted carriers so you can find the protection you need. Compare your options and get quotes in minutes.

You deserve peace of mind, and your family deserves financial security. Let’s make sure they have it.