Why Medicare Enrollment Timing Matters More Than You Think

How to sign up for Medicare depends on your situation. Here’s the quick answer:

- If you’re receiving Social Security benefits: You’ll be automatically enrolled in Medicare Parts A and B when you turn 65. Your Medicare card will arrive about 3 months before your birthday.

- If you’re NOT receiving Social Security benefits: You must apply yourself. You can do this online at www.socialsecurity.gov/medicareonly/, by calling Social Security at 1-800-772-1213, or by visiting a local office.

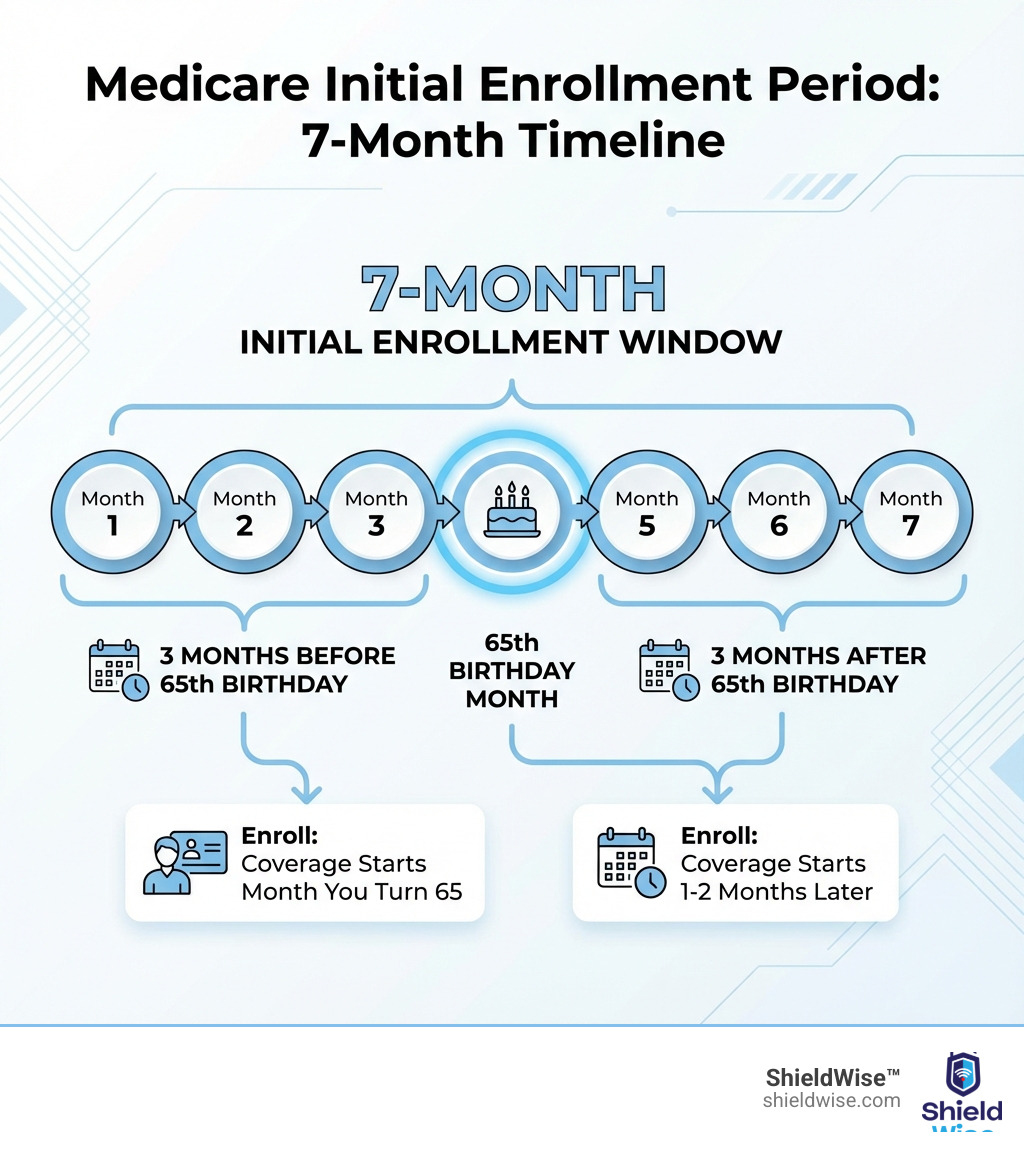

Your initial enrollment window is a 7-month period around your 65th birthday (3 months before, your birthday month, and 3 months after).

Medicare is the federal health insurance program for people 65+, as well as younger people with certain disabilities, End-Stage Renal Disease (ESRD), or ALS. However, the process can be confusing, with 22% of enrollees reporting difficulty signing up.

Missing your enrollment window can lead to coverage gaps and a permanent 10% penalty on your Part B premiums for every 12-month period you delayed. The good news is that understanding the process helps you avoid these costly mistakes. Signing up online can take as little as 10 minutes.

Understanding Medicare Eligibility and Its Parts

Medicare is the country’s health insurance program for people 65 or older. Younger people can also qualify if they have received Social Security disability benefits for 24 months, have End-Stage Renal Disease (ESRD), or have Amyotrophic Lateral Sclerosis (ALS), which grants immediate eligibility.

Understanding your eligibility is the first step in learning how to sign up for Medicare. For more detailed information on this transition, see our guide at Medicare Basics: Turning 65.

The Four Parts of Medicare

Medicare is divided into distinct parts:

-

Part A (Hospital Insurance): Covers inpatient care like hospital stays and skilled nursing facility care. Most people get Part A premium-free if they or a spouse paid Medicare taxes for at least 10 years.

-

Part B (Medical Insurance): Covers outpatient services like doctor visits and preventive care. Part B has a monthly premium ($185 in 2025), often deducted from Social Security benefits.

-

Original Medicare Overview: This is the combination of Part A and Part B, the traditional federal program that allows you to see any provider that accepts Medicare.

-

Part D (Prescription Drug Coverage): Helps cover prescription drug costs. These plans are sold by private companies and have separate monthly premiums (averaging $38 in 2025).

-

Part C (Medicare Advantage): An alternative to Original Medicare, these private plans bundle Parts A, B, and usually D. They often include extra benefits like dental and vision. The initial enrollment process primarily focuses on Original Medicare (Parts A and B).

When to Sign Up: Your Medicare Enrollment Windows

Knowing when to enroll in Medicare is crucial to avoid coverage gaps and lifelong penalties. There are three main enrollment periods.

-

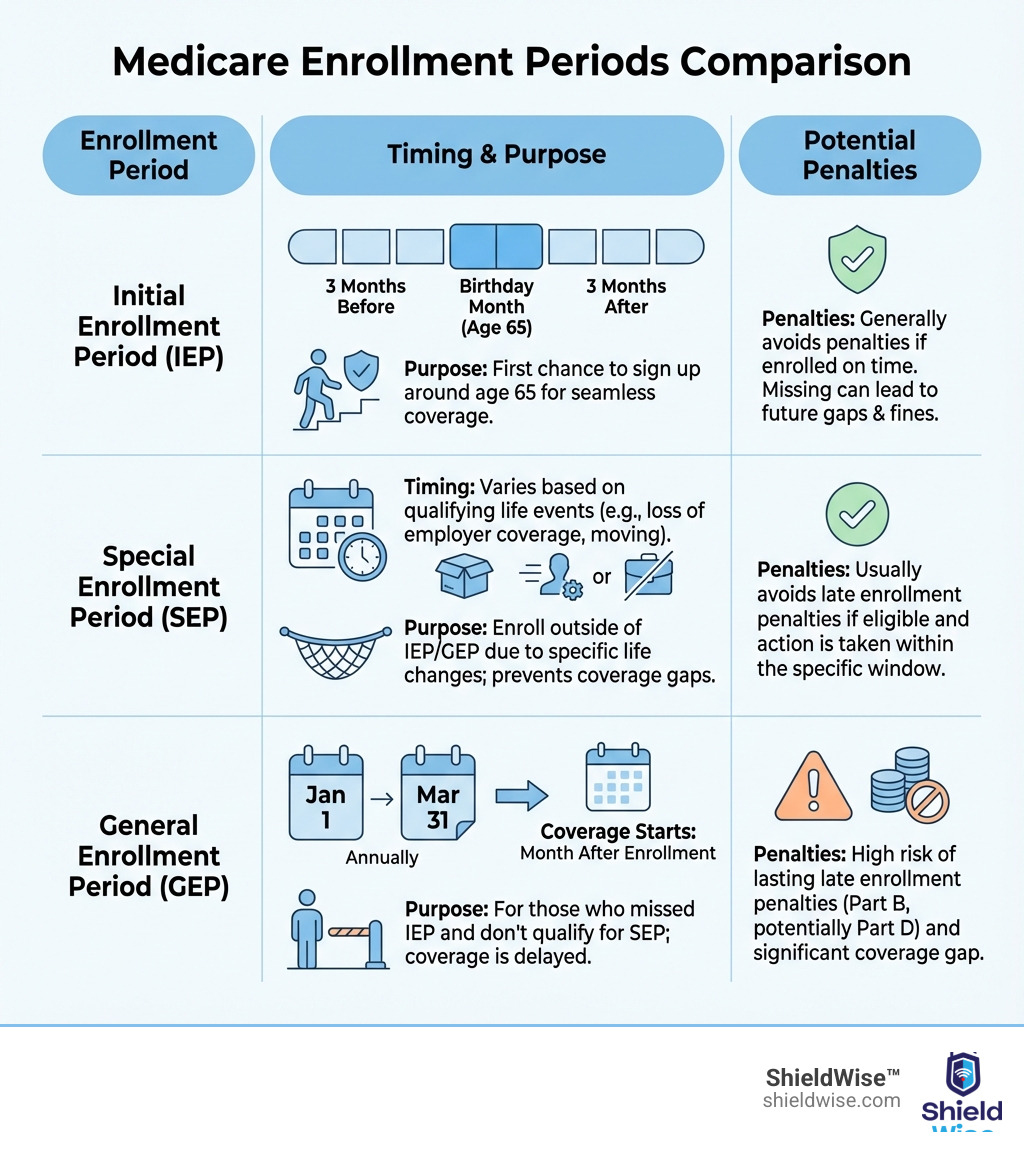

Initial Enrollment Period (IEP): Your first chance to sign up for Medicare. This 7-month window surrounds your 65th birthday (three months before, your birthday month, and three months after). Enrolling during the IEP is the best way to ensure seamless coverage and avoid penalties.

-

General Enrollment Period (GEP): If you miss your IEP, the GEP runs from January 1st to March 31st each year. However, coverage doesn’t start until July 1st, and you may face late enrollment penalties.

-

Special Enrollment Period (SEP): Certain life events, like losing employer health coverage, allow you to sign up for Medicare outside of the IEP and GEP without penalty. SEPs let you enroll based on specific qualifying circumstances.

To find your specific enrollment dates, use the official tool at Check your eligibility and enrollment period.

Working Past 65? Special Considerations for Enrollment

Working past 65 adds complexity to Medicare enrollment. The decision to enroll or stick with an employer plan requires careful thought.

-

Employer with 20+ Employees: If your employer has 20 or more employees, their group health plan is the primary payer. You can usually delay Part B enrollment without penalty until you stop working or lose that coverage. At that point, you’ll get an 8-month Special Enrollment Period to sign up for Part B. It’s still wise to enroll in premium-free Part A.

-

Employer with Fewer Than 20 Employees: If your employer is smaller, Medicare is the primary payer at 65. You generally must enroll in Parts A and B during your IEP to avoid coverage gaps and penalties.

-

Health Savings Account (HSA) Rules: You cannot contribute to an HSA once you are enrolled in any part of Medicare, including premium-free Part A. To continue HSA contributions while working past 65, you must delay both Part A and Part B. Stop HSA contributions at least six months before your Medicare enrollment to avoid tax penalties.

-

COBRA and Retiree Coverage: This coverage is not considered creditable for delaying Medicare. You must enroll in Medicare Parts A and B at 65 to avoid penalties.

Deciding whether to delay Medicare involves comparing the costs and benefits of your employer plan versus Medicare. Always check with your benefits administrator.

How to Sign Up for Medicare: A Step-by-Step Guide

Let’s walk through the practical steps of how to sign up for Medicare. The process differs depending on whether you’re receiving Social Security benefits.

For more resources, visit our dedicated section at Medicare.

If You’re Already Receiving Social Security Benefits

If you’re receiving Social Security or Railroad Retirement Board benefits for at least four months before you turn 65, you will be automatically enrolled in Medicare Parts A and B. No action is needed on your part. Your Medicare card will be mailed to you about three months before your 65th birthday, with coverage typically starting the first day of your birthday month. For more details, you can Learn more about automatic enrollment.

How to sign up for Medicare if you’re not receiving Social Security benefits

If you aren’t yet receiving Social Security benefits, you must actively sign up for Medicare. You have three options:

-

Online (Fastest): The online application at Apply for Medicare online takes as little as 10 minutes. You’ll need to create a

my Social Security accountfirst. -

By Phone: Call the Social Security Administration at 1-800-772-1213 (TTY 1-800-325-0778) for assistance over the phone.

-

In-Person: Visit a local Social Security office. It’s highly recommended to make an appointment first.

To apply, have your Social Security number, proof of birth, and information about any current health insurance ready.

How to sign up for Medicare for special situations

Enrollment isn’t always tied to age. You can also sign up for Medicare in these situations:

-

Under 65 with a Disability: You’re automatically enrolled in Medicare Parts A and B after receiving disability benefits for 24 months.

-

ALS (Lou Gehrig’s Disease): If you have ALS, Medicare benefits begin the first month you get disability benefits, with no waiting period.

-

End-Stage Renal Disease (ESRD): People with permanent kidney failure can apply for Medicare through Social Security. Coverage start dates vary depending on your treatment.

-

Living in Puerto Rico or Outside the U.S.: Special rules apply, especially for Part B. Residents of Puerto Rico get Part A automatically but must sign up for Part B. U.S. citizens living abroad can get help signing up by visiting the SSA’s foreign services page: Get help signing up for Part B if you live in a foreign country..

After You Enroll: What to Expect and How to Manage Coverage

After you sign up for Medicare, you’ll receive important documents and have opportunities to manage your coverage.

-

Welcome Packet and Medicare Card: After enrolling, you’ll get a welcome packet with your official Medicare card. This card has your unique 11-character Medicare Number, which you’ll use for all healthcare services. Keep it safe.

-

Coverage Start Date: Your coverage start date depends on when you enrolled. Enrolling early in your Initial Enrollment Period (IEP) ensures coverage begins the month you turn 65. Later enrollment during your IEP or enrolling during the General Enrollment Period will delay your start date.

-

Finding Providers: Most doctors and hospitals in the U.S. accept Medicare. You can use the official search tool on Medicare.gov to find providers in your area.

Changing or Dropping Your Coverage

Medicare offers flexibility to change your coverage annually or after certain life events.

-

Medicare Open Enrollment (October 15 – December 7): This is the main annual period to make changes. You can switch between Original Medicare and Medicare Advantage, change Advantage or Part D plans, or enroll in a Part D plan. Changes take effect January 1st.

-

Medicare Advantage Open Enrollment Period (January 1 – March 31): If you’re in a Medicare Advantage Plan, this period allows you to switch to another Advantage Plan or return to Original Medicare (and add a Part D plan).

-

Returning to Original Medicare: You can leave a Medicare Advantage plan during the two enrollment periods mentioned above. If you do, you’ll likely need to buy a separate Part D plan and may want to consider a Medigap policy to cover out-of-pocket costs.

-

Dropping Part A or B: You can only drop Part A if you pay a premium for it. You can drop Part B at any time, but be aware that you may face permanent late enrollment penalties if you decide to re-enroll later and could have a gap in medical coverage.

Managing Costs and Avoiding Late Penalties

Strategically how to sign up for Medicare involves avoiding late enrollment penalties, which can permanently increase your monthly premiums.

-

Part B Late Enrollment Penalty: If you delay Part B enrollment without having other creditable coverage, your monthly premium may permanently increase by 10% for each full 12-month period you could have enrolled but didn’t.

-

Part D Late Enrollment Penalty: Similarly, if you go 63 consecutive days or more without Part D or other creditable drug coverage after you’re first eligible, you’ll likely pay a permanent monthly penalty. The cost is based on how long you went without coverage.

What Happens If I Miss My Initial Enrollment Period?

Missing your Initial Enrollment Period (IEP) without qualifying for a Special Enrollment Period (SEP) has consequences. Your next chance to sign up for Medicare is the General Enrollment Period (January 1 – March 31), but your coverage won’t start until July 1st. This creates a coverage gap and will likely trigger the permanent late enrollment penalties for Part B and Part D.

We cannot stress enough the importance of acting within your 7-month IEP. For more strategies, visit Avoid late enrollment penalties.

Getting Help with Costs

If you have limited income and resources, Medicare Savings Programs (MSPs) can help pay for premiums, deductibles, and other costs. These state-run programs (like QMB, SLMB, QI, and QDWI) can significantly reduce your out-of-pocket expenses. We encourage you to research these options if you’re concerned about affording Medicare.

Conclusion

Navigating how to sign up for Medicare is manageable once you understand the key steps. A smooth transition is possible by knowing your eligibility, the parts of Medicare, and your enrollment windows.

Key takeaways:

- Know Your Eligibility: Understand if you qualify based on age, disability, ESRD, or ALS.

- Don’t Miss Enrollment Windows: Your Initial Enrollment Period (IEP) is critical to avoid penalties and coverage gaps.

- Tailor Your Strategy: Account for special situations like working past 65 or having an HSA.

- Be Proactive: Apply on time, even if you’re not automatically enrolled.

- Review Annually: Use the Open Enrollment period (Oct 15 – Dec 7) to adjust your coverage.

By being informed and timely, you can secure the health coverage you need without unnecessary costs. ShieldWise™ is committed to providing clear guidance for your insurance decisions.

Protecting your family brings peace of mind. Explore how we can help you Plan for your future with senior insurance options.