Open uping Your IUL: A Simple Guide to Policy Loans

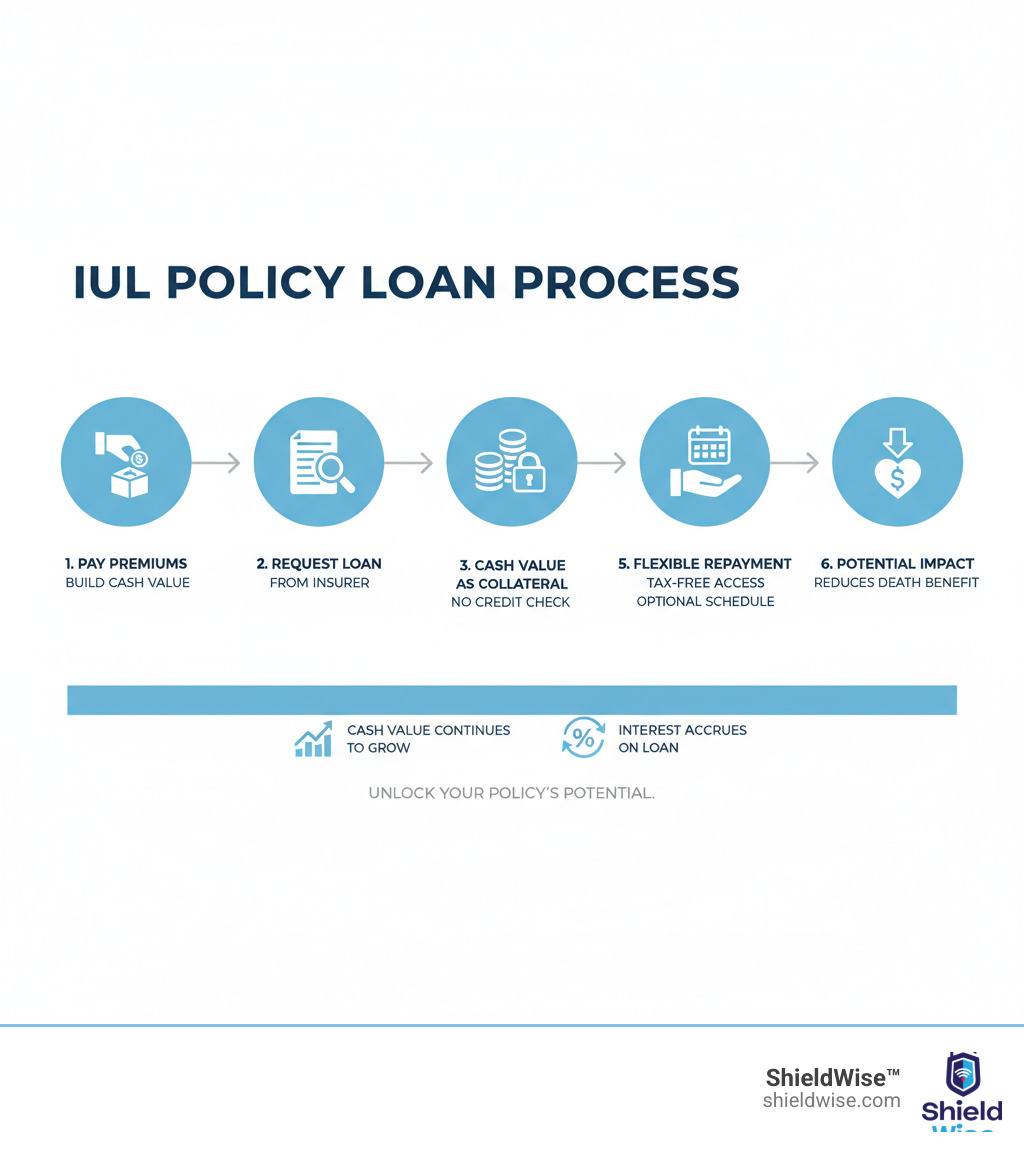

If you’re wondering How IUL loans work, here’s a quick overview:

- Build Cash Value: A portion of your premiums grows as cash value, often linked to market indexes.

- Request a Loan: Once enough cash value accumulates, you can request a loan from your insurance company.

- Cash Value as Collateral: Your policy’s cash value secures the loan, so no credit check is needed.

- Receive Funds: The insurance company provides you with the requested funds.

- Flexible Repayment: You can repay the loan on your schedule, or not at all, though interest will accrue.

- Impact on Policy: An outstanding loan reduces your death benefit and can affect cash value growth if not managed well.

Indexed Universal Life (IUL) insurance is a powerful tool for growing money tax-efficiently and accessing it when needed. Beyond a death benefit, an IUL policy builds cash value that you can borrow against for life events or opportunities, offering unique financial control without going to a bank.

But how do these loans function? This guide will explain exactly how IUL loans work, covering the benefits and risks so you can make informed financial decisions.

The Mechanics of an IUL Policy Loan

An Indexed Universal Life (IUL) policy is permanent life insurance that also builds tax-deferred cash value. This value grows based on a stock market index, like the S&P 500, but with built-in protections. A floor (often 0%) prevents losses from market downturns, a cap limits the maximum gain, and a participation rate determines the percentage of the index’s gain you receive. This strategy offers growth potential while limiting risk.

When you take a loan from your IUL policy, your accumulated cash value serves as collateral. The insurance company lends you their money, secured by your policy’s value. This is why there’s no credit check, income verification, or lengthy approval process. You get quick, private access to funds by borrowing against an asset you’ve already built.

How IUL loans work: The step-by-step process

Let’s walk through exactly how IUL loans work from start to finish. The process is surprisingly simple.

First, verify your eligibility and loan limits. Check your available cash value and loan limits online or by calling your insurer. It’s critical to ensure enough cash remains after the loan to cover your policy’s ongoing fees to prevent a potential lapse.

Next, contact your insurance company. You can request a loan by logging into your online portal, using the insurer’s mobile app, or calling a representative.

Then, complete the loan application. You’ll fill out a simple form stating how much you want to borrow. Because your cash value serves as collateral, there is no credit check.

Finally, receive your funds. Once approved, the money typically arrives within a few days to a couple of weeks, depending on the insurance company and the loan amount.

This streamlined process is a major advantage. No one is checking your credit score or asking what you plan to do with the money. It’s your policy, your cash value, and your decision.

Withdrawals vs. Loans: What’s the Difference?

When tapping into your IUL’s cash value, you have two options: withdrawals and loans. They have very different impacts on your policy and taxes.

A withdrawal permanently removes money from your policy. The cash value and death benefit are reduced, and the funds cannot be repaid. Withdrawals are tax-free up to your “cost basis” (the total premiums you’ve paid). Any amount withdrawn beyond your cost basis is taxed as ordinary income.

A loan, however, is borrowed from the insurance company using your cash value as collateral. Crucially, policy loans are not considered taxable income as long as the policy stays in force. The IRS allows for tax-free access to cash value via loans, which is one of the most powerful features of an IUL. Unlike withdrawals, loans can be repaid, allowing you to restore your policy’s full value over time.

One important warning: watch out for Modified Endowment Contract (MEC) status. If you fund your IUL too quickly (beyond IRS limits), it can be reclassified as a MEC. Loans from a MEC are treated as taxable income and may face a 10% penalty if you’re under 59½. Working with a knowledgeable advisor is essential to structure your policy correctly and preserve the tax advantages that make how IUL loans work so attractive.

Understanding the Different Types of IUL Loans

When it’s time to take a loan from your IUL policy, it’s not a one-size-fits-all deal. The type you choose affects how interest is charged and how your cash value continues to grow. The key is the relationship between the loan interest (what you’re charged) and the credited interest (what your collateral earns).

The goal is to achieve positive arbitrage, where your cash value earns more than the loan costs. The difference between these two rates is known as the loan spread. A smaller spread means your loan costs you less overall. Choosing the right loan type depends on your financial goals and risk tolerance.

Fixed, Indexed, and Variable Loans Explained

IUL policies usually offer a few different types of loans. Each has its own features:

| Loan Type | Interest Rate Type | Collateral Treatment | Risk Level | Typical Use Case |

|---|---|---|---|---|

| Fixed Loan | Set interest rate | Collateral earns a guaranteed, fixed interest rate | Low | Predictability, stability |

| Indexed (Participating) Loan | Variable, tied to benchmark | Collateral continues to track underlying index performance (with caps/floors) | Moderate | Potential for positive arbitrage |

| Variable Loan | Variable, tied to benchmark | Collateral invested in a separate account (e.g., mutual funds) | High | Aggressive growth potential (not common in IUL) |

Let’s dive a little deeper:

- Fixed Loans: With a fixed loan, the interest rate is set and unchanging. The portion of your cash value used as collateral also earns a guaranteed, fixed rate, offering predictability. Some policies offer “wash” or “preferred” loans where the charged and credited rates match, resulting in a zero net borrowing cost.

- Indexed (Participating) Loans: With an indexed loan, your collateral continues to “participate” in the linked index’s performance (with caps and floors). While the loan rate may be higher, this creates the potential for positive arbitrage if the index performs well, making these loans very attractive.

- Variable Loans: These are less common in IULs. While the interest rate on a variable loan might be lower, the collateral is often exposed to market risk without the downside protection of a floor, potentially leading to losses.

How the Loan Spread Affects Your Borrowing Costs

The loan spread is the difference between the interest rate the insurance company charges on your loan and the rate it credits to your collateral. It’s a critical factor in the true cost of an IUL loan.

If your collateral earns 6% and your loan interest rate is 5%, that 1% difference is a positive loan spread. This is positive arbitrage, and it allows your policy’s value to grow even while you have an outstanding loan.

Conversely, if the loan rate is 6% and your collateral only earns 4%, you have a 2% negative arbitrage, which will erode your cash value over time. Loan spreads typically fall between 1.25% and 3.50%. Some policies even offer wash loans, where the spread is zero, resulting in no net borrowing cost.

Understanding your policy’s specific loan spread is vital for managing borrowing costs and is a key part of knowing how IUL loans work for your benefit.

The Pros and Cons: Weighing the Benefits and Risks

IUL policy loans offer significant financial autonomy, but balance the benefits against the risks through careful policy management. Understanding both sides helps you use these loans as a smart part of your long-term financial strategy.

The Primary Benefits of an IUL Loan

IUL loans are appealing for several reasons:

- Tax Advantages: Loan proceeds are generally not considered income and are therefore tax-free, as long as the policy remains active. The IRS supports this tax-free access to cash value via policy loans.

- Flexible Repayment: Unlike bank loans, there are no mandatory repayment schedules. You can repay on your own timeline or not at all during your lifetime.

- Continued Cash Value Growth: With participating loans, the collateralized portion of your cash value continues to earn interest based on index performance, so your money keeps working for you.

- Easy Access & Privacy: Because your cash value is the collateral, there is no credit check, and the loan does not affect your credit score. This offers quick and private access to funds.

Potential Drawbacks and Risks to Consider

While the benefits are strong, it’s crucial to understand the potential pitfalls to make informed decisions.

- Reduced Death Benefit: The outstanding loan balance, plus any accrued interest, is deducted from the death benefit paid to your beneficiaries.

- Policy Lapse Risk: If the loan balance grows to exceed the policy’s cash value, the policy can lapse, terminating your coverage entirely.

- Taxable Event Upon Lapse: If a policy lapses with an outstanding loan, the amount of the loan that exceeds your cost basis (total premiums paid) can become taxable income, creating an unexpected tax bill.

- Compounding Interest: Unpaid interest is added to the loan balance, causing it to grow faster and increasing the risk of eroding your cash value.

- Impact of Fees: Policy fees and the cost of insurance continue to be deducted from cash value, which can accelerate lapse risk if the policy is underperforming or heavily loaned against.

How IUL Loans Work in Real-Life Scenarios

Seeing how IUL loans work in practice highlights their value as a liquid asset that can be accessed without disrupting other long-term investment strategies.

Common Applications for IUL Policy Loans

The versatility of IUL policy loans means they can be used for almost any purpose:

- Funding Business Opportunities: Access capital for expansion or cash flow without the strict requirements of traditional bank loans.

- College Tuition: Use as a tax-free funding source for higher education expenses.

- Home Down Payment or Renovation: Leverage cash value for real estate investments or home improvements.

- Emergency Fund: Serve as a built-in financial safety net for unexpected costs like medical bills or job loss.

- Supplemental Retirement Income: Provide a potential source of tax-free income in retirement when managed carefully.

- Debt Consolidation: Pay off higher-interest debt, such as credit card balances, with a potentially lower-rate loan.

IUL Loans vs. Other Borrowing Options

When you need funds, IUL loans have unique advantages compared to other common borrowing options:

- Interest Rate Comparison: IUL loans often have competitive interest rates, typically lower than unsecured personal loans or credit cards.

- Credit Impact: A major differentiator is that IUL loans require no credit check and do not appear on your credit report, leaving your credit score unaffected.

- Repayment Flexibility: IUL loans offer unparalleled flexibility with no mandatory repayment schedule, unlike the strict monthly obligations of other loans.

- Tax Treatment: IUL loans are generally tax-free as long as the policy remains in force. In contrast, interest on personal loans is not tax-deductible.

- Accessibility: Once sufficient cash value is available, IUL loans are easy and quick to access, often within days, avoiding the lengthy processes of traditional loans.

Smart Strategies for Managing Your IUL Loan

IUL policy loans are powerful tools that require active management, not a set-it-and-forget-it approach. Smart planning helps you access funds when needed while keeping your policy healthy for the long term. The goal is to use how IUL loans work to your advantage without risking a policy lapse.

Choosing the Right Policy and Monitoring Performance

Successful loan management begins with selecting the right policy and monitoring it closely.

- Understand Loan Provisions: Before buying, review the policy’s available loan types, interest rates, and how the loan spread works. These details are critical for your financial strategy.

- Request In-Force IUL Illustrations: These reports are vital snapshots of your policy’s health. Use them to model the impact of a potential loan and monitor for any lapse risk.

- Conduct Annual Policy Reviews: Meet with your financial advisor yearly to ensure your policy is performing as expected and still aligns with your evolving financial goals.

- Monitor Policy Costs: Be aware of the cost of insurance (COI) and administrative fees. These internal costs reduce your cash value and can accelerate lapse risk when a loan is outstanding.

Best Practices for Borrowing and Repayment

When taking a loan, following best practices can prevent potential problems.

- Borrow Strategically: Take loans for specific, planned purposes—like a business opportunity or home down payment—rather than borrowing impulsively.

- Avoid Paying Premiums with a Loan: This practice can create a downward spiral, depleting cash value to keep the policy alive and accelerating the risk of a lapse.

- Manage Interest Accrual: You can let interest accrue, but consider making periodic interest payments to keep the loan balance from growing too quickly and compounding against you.

- Make Partial Repayments: Even small repayments or covering the accrued interest helps keep the loan manageable, reduces the risk to your death benefit, and protects your cash value.

- Protect Your Policy from Lapsing: This is the top priority. Ensure your cash value always exceeds your outstanding loan balance. Regular monitoring, strategic repayments, and even increased premium payments are all tools to keep your policy safely in force.

Frequently Asked Questions about IUL Policy Loans

We know that learning how IUL loans work naturally brings up questions. Here are clear answers to the most common concerns.

How much can I borrow from my IUL policy?

You can typically borrow up to 90% or even 100% of your accumulated cash value. The exact percentage varies by insurer and your specific policy’s terms. It is crucial to leave enough cash value in the policy to cover ongoing charges like the cost of insurance and administrative fees. If your cash value drops too low, your policy could lapse. Contact your insurer or financial advisor to find out your specific loan limits.

Do I have to repay an IUL policy loan?

Technically, no, you are not required to repay an IUL policy loan during your lifetime. This flexibility is a key benefit. However, not repaying has significant consequences:

- Unpaid interest accrues and is added to the loan balance, causing it to compound over time.

- The entire outstanding loan balance is deducted from the death benefit your beneficiaries receive.

- The most serious risk is policy lapse. If the loan balance grows larger than your policy’s cash value, the policy can terminate.

While there’s no mandatory repayment schedule, managing the loan responsibly by making partial payments or paying the interest is essential to protect your policy’s value.

What happens if my policy lapses with an outstanding loan?

This is the worst-case scenario and creates a significant financial problem. If your IUL policy lapses with an outstanding loan, the portion of the loan that exceeds your “cost basis” (the total premiums you’ve paid) can become immediately taxable as ordinary income.

For example, if you paid $50,000 in premiums and your policy lapses with a $70,000 loan balance, the $20,000 difference is treated as taxable income. This can result in a large, unexpected tax bill.

In addition to the tax bill, you have also lost your life insurance coverage entirely. Your family no longer has the death benefit protection you worked to build. This scenario is why careful policy management is crucial and is entirely preventable with proper planning and regular reviews with a knowledgeable advisor.

With proper attention, this worst-case scenario is preventable. That’s what we’re here to help with at ShieldWise™—guiding you through these decisions with clear, straightforward advice.

Conclusion

We’ve explored how IUL loans work, from cash value growth and loan types to the critical loan spread that can work in your favor. The beauty of an IUL policy loan lies in its flexibility: you can access your cash value tax-free, without credit checks, and without rigid repayment schedules. It’s a powerful tool for funding a business venture, helping with college tuition, or creating a financial cushion for retirement.

However, this flexibility requires responsibility. The risks of a reduced death benefit, compounding interest, and a potential policy lapse are real but manageable. With regular policy reviews, strategic borrowing, and thoughtful repayment practices, you can harness the power of IUL loans while protecting what matters most.

An IUL policy is a long-term financial tool that can serve multiple purposes throughout your life, but it works best when you understand it fully and manage it actively.

At ShieldWise™, we’re passionate about cutting through the insurance jargon and giving you the clear, straightforward information you need to make empowered financial decisions. We believe everyone deserves access to financial tools that can truly make a difference.

Ready to take the next step? Whether you’re just starting to explore your options or you’re ready to find a policy that fits your specific goals, we’re here to help. Secure your financial future with the right IUL policy and find how ShieldWise™ can connect you with trusted carriers, instant quotes, and personalized guidance—all in just a few clicks. Your future self will thank you for starting today.