How Cash Value Works in Indexed Universal Life: The Basics You Need to Know

How cash value works in indexed universal life is simpler than it sounds: a portion of your premium goes into a cash value account that earns interest based on the performance of a stock market index (like the S&P 500), but with a guaranteed floor to protect against losses and a cap that limits your gains. You’re not investing directly in the stock market—your insurance company credits interest to your account based on how the index performs, subject to specific rules.

Here’s the quick version:

- Your premium is divided into three parts: cost of insurance, policy fees, and cash value

- The cash value earns interest tied to a stock market index performance

- A floor (often 0%) protects you from losing money when the market drops

- A cap (typically 8-12%) limits how much interest you can earn when the market rises

- A participation rate may further reduce your credited interest

- You can access the cash value through loans or withdrawals while you’re alive

If you’re approaching or already in retirement, you may be wondering if an indexed universal life (IUL) policy is right for you. Maybe you’ve seen ads promising “tax-free retirement income” or heard a friend mention it. IUL policies can be useful tools for some people, but they are also complex products that deserve a clear explanation.

This guide walks through how cash value works in these policies, what protections and limitations exist, and when this type of insurance may make sense. We’ll keep the jargon to a minimum and focus on the essentials.

What Is Indexed Universal Life (IUL) Insurance?

Let’s start with the basics. Indexed Universal Life (IUL) insurance is a type of permanent life insurance. What does “permanent” mean for you? It means the policy is designed to last for your entire life, providing coverage as long as premiums are paid and the policy remains in force. Unlike term life insurance, which covers you for a specific period, IUL offers lifelong protection.

An IUL policy isn’t just about a death benefit for your loved ones, though that’s a crucial component. It’s a dual-purpose financial tool that combines a death benefit with a cash value account. This cash value component is what makes IUL stand out and offers you unique financial flexibility during your lifetime.

The key features of an IUL policy include:

- Lifelong Coverage: As long as you keep up with your premiums, the policy is there for you and your beneficiaries, typically designed to last until age 121 or even longer.

- Flexible Premiums: You have the ability to adjust your premium payments within certain limits. If you have a good year financially, you might pay more to boost the cash value. If times are tight, you might pay less, or even skip a payment, using the accumulated cash value to cover the policy’s costs.

- Adjustable Death Benefit: Similar to premiums, the death benefit can often be adjusted over time, allowing you to increase or decrease coverage to match your changing life circumstances.

- Cash Value Growth Potential: This is where the “indexed” part comes in. The cash value has the potential to grow based on the performance of a stock market index.

It’s vital to understand that while its growth is tied to a stock market index like the S&P 500, an IUL policy is not a direct stock market investment. Your money isn’t actually put into stocks or mutual funds. Instead, the insurance company uses the index’s performance to calculate the interest credited to your cash value, often with built-in protections. We’ll dive deeper into that next.

For more information about what IUL is, you can check out our dedicated page: More info about what IUL is.

How Cash Value Works in Indexed Universal Life Policies

Now for the heart of the matter: how cash value works in indexed universal life policies. When you pay premiums, part of that money is used to provide insurance, part covers expenses, and the rest goes into the policy’s cash value.

The Engine of Growth: Index-Linked Crediting

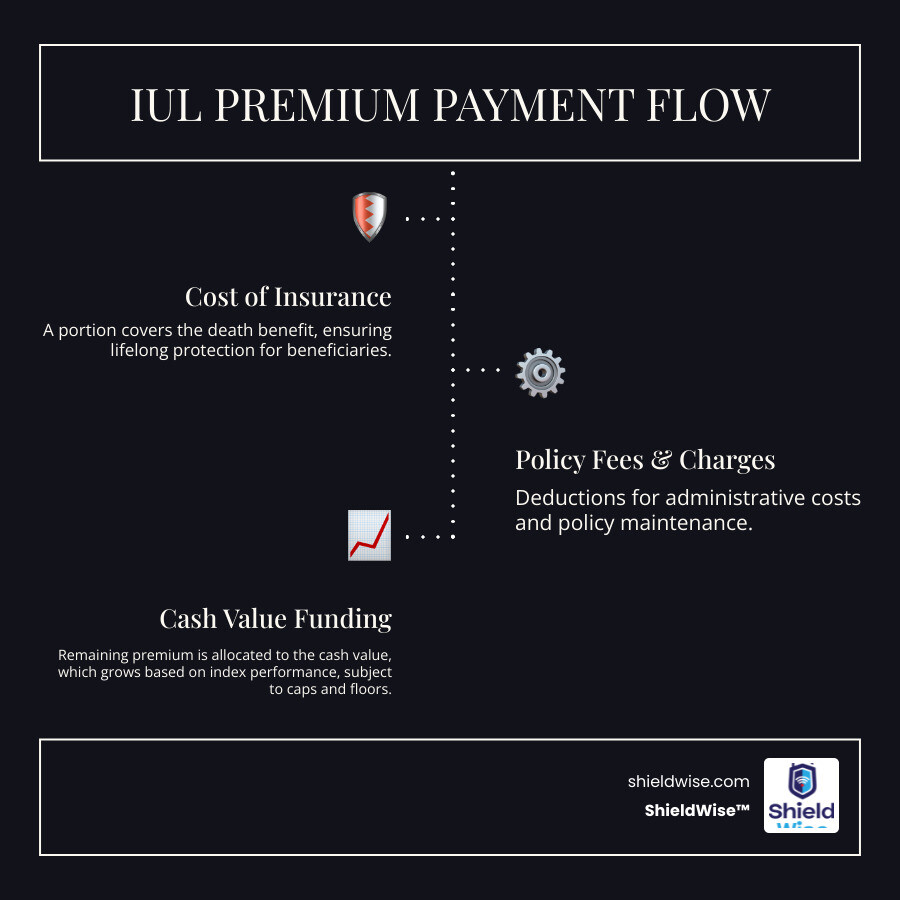

Each time you pay a premium, it is typically allocated into three main buckets:

- Cost of Insurance (COI): Covers the cost of providing the death benefit. This charge generally increases as you age.

- Administrative Fees: Charges for things like sales commissions, policy administration, and other overheads.

- Cash Value Funding: Whatever is left after COI and fees goes into your policy’s cash value account. This is the portion that can grow.

Once your money is in the cash value account, the insurer credits interest using one or more index strategies. The index might be the S&P 500 or the Nasdaq-100, among others. You are not directly investing in these indexes. Instead, your money sits in the insurer’s general account, and the company uses options and other tools to give you a portion of the index’s upside while protecting you from direct market losses. Because you are not a shareholder, you do not receive dividends from the index.

Many IUL policies also offer a fixed account option that credits a declared, guaranteed rate that is typically lower than the potential index rate. This can appeal to policyowners who want to blend more predictable returns with market-linked growth.

For a deeper dive into how IUL works, you can visit: A deeper dive into how IUL works.

Understanding the “Rules of the Road”: Caps, Floors, and Participation Rates

To understand how cash value works in indexed universal life, you need to know the three mechanisms that shape growth: floors, caps, and participation rates.

-

The Floor Rate: Your Downside Protection

The floor is the minimum interest rate your cash value account will earn for a crediting period, even if the linked index performs poorly. Most IUL policies offer a guaranteed floor of 0%. If the S&P 500 drops by 10% during that period, your cash value would be credited 0% interest from the index strategy, rather than a loss. You can still lose value if fees and COI charges exceed the interest credited. -

The Cap Rate: Your Growth Ceiling

The cap is the maximum interest rate your cash value can earn in a given period from that index strategy. If your policy has a 10% cap and the index gains 15%, your cash value for that period would be credited 10%. Typical cap rates often range from about 8% to 12%, but they are not guaranteed and can change at the insurer’s discretion within policy limits. -

The Participation Rate: Your Share of the Gains

The participation rate is the percentage of the index gain that will be used to calculate your credited interest (subject to the cap). For example:- If the index gains 10% and your participation rate is 80%, the rate before applying the cap would be 8%.

- If the index gains 12%, the cap is 10%, and the participation rate is 80%, your credited interest would be 9.6% (80% of 12%), because 9.6% is below the 10% cap.

A simple example:

- Cash value: $10,000

- Index gain: 6%

- Participation rate: 50%

- No cap issue

- Credited interest: 3% (6% x 50%), or $300 added to cash value.

If the index drops by 5% and your floor is 0%, you would be credited 0% from the index strategy. Your cash value would not decline due to index performance, but ongoing COI and fees would still be deducted.

These elements—caps, floors, and participation rates—explain why IUL is often described as offering limited upside with built-in downside protection. Policy terminology in this section is adapted from guidance published by the Washington State Office of the Insurance Commissioner(WA OIC).

Accessing and Using Your IUL Cash Value

One appealing aspect of an IUL policy is the flexibility offered by its cash value. Unlike term insurance, which only pays a benefit at death, the cash value in an IUL can be accessed while you are alive. People use it to supplement retirement income, help pay for college, or serve as a backup source of funds.

Tapping Into Your Funds: Loans and Withdrawals

You generally have several ways to access the cash value in your IUL policy:

- Policy Loans: You can borrow against your policy’s cash value. The cash value is the collateral for the loan, and repayment schedules are usually flexible. Loans accrue interest, and any unpaid loan balance plus interest is deducted from the death benefit and remaining cash value. If the policy lapses with a loan outstanding, the loan amount can be treated as a distribution and may be taxable.

- Withdrawals: You can withdraw money directly from your cash value. Withdrawals permanently reduce both the cash value and the death benefit. Amounts up to your total premiums paid (your “cost basis”) are typically tax-free. Withdrawals above your basis are usually taxed as ordinary income.

- Paying Premiums: In leaner years, you may be able to use accumulated cash value to cover part or all of the policy’s required charges, which can help keep the coverage in force when cash flow is tight.

- Surrendering the Policy: If you no longer want the coverage, you can surrender the policy and receive the cash surrender value (cash value minus any surrender charges and outstanding loans). This terminates both the policy and the death benefit.

Any loans or withdrawals will reduce what your beneficiaries receive. Accessing cash value should therefore be coordinated with your broader financial and estate plans.

Navigating the Tax Implications

A key advantage of how cash value works in indexed universal life is its tax treatment. The cash value grows tax-deferred, which means you do not pay taxes on interest as it is credited.

When accessing funds, keep these tax points in mind:

- Tax-Deferred Growth: Interest credited to the cash value is not taxed as it accrues, allowing more money to potentially compound over time.

- First-In, First-Out (FIFO) Tax Basis: For non-MEC IUL policies, withdrawals are usually treated as coming from your premiums first (FIFO). This means you can typically withdraw up to your cost basis without income tax. Amounts over basis are taxed as ordinary income.

- Modified Endowment Contract (MEC): If a policy is funded too aggressively under IRS rules, it can become a Modified Endowment Contract. MECs are still life insurance, but loans and withdrawals are taxed on a gain-first (LIFO) basis and may have a 10% federal penalty if you are under age 59½. Proper funding and design are important if your goal is to access cash value on a tax-advantaged basis.

- Tax Treatment of Loans: As long as the policy is not a MEC and stays in force, policy loans are generally treated as tax-free. This is one reason some people use IUL cash value for supplemental retirement income.

- Policy Lapse with Loan: If your policy lapses or is surrendered with an outstanding loan, the loan may be treated as a taxable distribution to the extent of gain in the policy.

Understanding these rules can help you avoid unexpected taxes and make better use of an IUL policy within your overall plan.

IUL Cash Value in Your Financial Strategy

Integrating an IUL policy into a broader financial strategy requires looking at risk tolerance, growth expectations, and long-term goals. It is not a one-size-fits-all solution, but for some people it can provide a mix of protection and tax-advantaged accumulation.

How IUL Cash Value Differs from Other Universal Life Insurance Options

To appreciate how cash value works in indexed universal life, it helps to compare it with other forms of universal life insurance. All universal life policies offer flexible premiums and adjustable death benefits, but cash value growth works differently.

| Feature | Indexed Universal Life (IUL) | Standard Universal Life (Fixed UL) |

|---|---|---|

| Growth Mechanism | Cash value growth is linked to the performance of a stock market index (e.g., S&P 500), subject to caps, floors, and participation rates. | Cash value earns a declared interest rate set by the insurer, often tied to bond yields, with minimum guarantees. |

| Risk vs. Reward | Offers limited upside and downside protection. A 0% floor typically protects against index-based losses, while caps and participation rates limit growth in strong markets. | Offers more stable, bond-like growth with less variability, but usually lower long-term return potential than an IUL in strong markets. |

| Best For | People seeking potential for higher returns than a fixed UL, while still avoiding direct market losses. | People who prefer simpler, more predictable crediting and are comfortable with lower potential returns in exchange for stability. |

IUL vs. Traditional Savings Accounts

| Feature | Indexed Universal Life (IUL) | Savings Account |

|---|---|---|

| Primary Purpose | Life insurance with a cash value component for long-term, tax-advantaged accumulation and potential supplemental income. | Short-term savings, emergency funds, and easy access to cash. |

| Growth Potential | Potential for higher credited interest based on index performance, subject to caps and participation rates, with a floor that typically prevents index-based losses. | Low, fixed or variable interest rates that may lag inflation. |

| Tax Treatment | Tax-deferred growth; access via withdrawals up to basis and policy loans can be structured to be tax-advantaged. | Interest is generally taxed as ordinary income each year. |

| Liquidity | Accessible through loans and withdrawals, but subject to policy terms, possible surrender charges, and impact on death benefit. | Highly liquid; funds can usually be withdrawn at any time without penalties from the bank. |

| Protection | Includes a death benefit for beneficiaries and may provide certain guarantees within the policy. | No death benefit; balances are typically FDIC-insured up to applicable limits. |

Is an IUL Policy Right for You?

An IUL policy can be a useful tool for people who:

- Have a long-term time horizon and can keep the policy in force for many years.

- Value tax-deferred growth and the potential to access cash value in a tax-advantaged way.

- Want downside protection from market losses.

- Have a need for life insurance coverage in addition to savings goals.

IULs also have trade-offs: fees and insurance costs can be significant, caps can limit upside, and policy performance depends on how the product is structured and funded. Working with a knowledgeable professional and carefully reviewing illustrations can help you decide whether an IUL fits into your plan.

Frequently Asked Questions about IUL Cash Value

Can you lose money in an IUL policy?

While the 0% floor protects your principal from direct market losses, it’s important to understand that the cash value can still decrease. This is because the cost of insurance and other policy fees are deducted from your cash value. If the interest credited to your account is not enough to cover these costs, your cash value can decline. This is more likely to happen in the early years of the policy when fees are higher and the cash value is still small.

Do beneficiaries receive the cash value and the death benefit?

Typically, no. In most standard IUL policies, the insurance company keeps the cash value upon the insured’s death, and the beneficiaries receive the stated death benefit. However, some policies offer a rider (at an additional cost) that allows for the death benefit to be paid out in addition to the accumulated cash value. It’s crucial to understand the specific terms of your policy.

How long does it take to build significant cash value in an IUL?

Building substantial cash value in an IUL is a long-term strategy. In the initial years, a larger portion of your premiums goes towards covering the cost of insurance and various policy fees. As the policy matures and the cash value grows, the power of compounding takes over, and you’ll see more significant growth. Generally, it can take 10-15 years or more to build a substantial cash value that can be used for supplemental income or other financial goals. The exact timeline depends on factors like your premium payments, the performance of the chosen index, and the policy’s fee structure.

Conclusion

Indexed Universal Life insurance offers a blend of life insurance protection and cash value growth potential. By linking returns to a stock market index while providing a floor to limit index-based losses, IULs can play a role in long-term planning for people who value tax-deferred accumulation and flexible access to cash value.

To use these policies effectively, it is important to understand how cash value works, including the impact of caps, participation rates, fees, and the rising cost of insurance over time. IULs are complex, and outcomes can vary based on funding patterns, policy design, and insurer decisions about non-guaranteed elements.

If you are considering an IUL, take time to review illustrations, ask questions about assumptions, and make sure the policy matches your goals and risk tolerance. At ShieldWise, we focus on clear, unbiased information so you can compare options from trusted carriers and choose the coverage that fits your situation. Explore your universal life insurance options with us and take a step toward securing your financial future.

Accessing and Using Your IUL Cash Value

One of the most appealing aspects of an IUL policy is the financial flexibility its cash value offers us. Unlike traditional term insurance, where the benefit is only paid upon death, the cash value in an IUL can be accessed and used during our lifetime. This can be incredibly valuable for various financial goals, from supplementing retirement income to paying for college or even serving as an emergency fund.

Tapping Into Your Funds: Loans and Withdrawals

We have several ways to access the cash value we’ve built up in our IUL policy:

- Policy Loans: This is a popular option. We can borrow money against our policy’s cash value. The cash value itself acts as collateral for the loan, and we typically aren’t required to pay it back on a strict schedule. While loans are generally tax-free, they do accrue interest. If the loan isn’t repaid, the outstanding balance, plus any accrued interest, will be deducted from the death benefit paid to our beneficiaries. If our policy lapses with a loan outstanding, that loan will be treated as a distribution and may become taxable.

- Withdrawals: We can also withdraw funds directly from our cash value. Unlike loans, withdrawals permanently reduce the policy’s cash value and the death benefit. These can be tax-free up to the amount we’ve paid in premiums (our “cost basis”). However, withdrawals that exceed our cost basis are generally subject to ordinary income tax.

- Paying Premiums: If we hit a rough patch financially, we can use the cash value to cover our premium payments, either partially or entirely. This can be a lifesaver, helping us keep our coverage in force without having to dip into other savings.

- Surrendering the Policy: As a last resort, we can surrender the policy and receive the cash surrender value (the cash value minus any surrender charges). This terminates the policy and its death benefit.

Any loans or withdrawals we take will reduce the death benefit our beneficiaries receive. So, while accessing our cash value offers flexibility, it’s a decision that should be carefully considered within our overall financial plan.

Navigating the Tax Implications

One of the significant advantages of how cash value works in indexed universal life policies is its favorable tax treatment. The cash value grows on a tax-deferred basis, meaning we don’t pay taxes on the interest earnings until we access the money. This allows our money to compound more efficiently over time.

When it comes to accessing the funds, the tax rules can get a little nuanced:

- Tax-Deferred Growth: This is a key benefit. Our cash value grows year after year, and we don’t owe taxes on those gains until we actually take money out. This allows for greater compounding over the long term.

- First-In, First-Out (FIFO) Tax Basis: Generally, withdrawals from an IUL policy are treated on a FIFO basis. This means the money we’ve paid in premiums (our “cost basis”) comes out first and is typically tax-free. Only when our withdrawals exceed our total premiums paid do they become subject to ordinary income tax.

- Modified Endowment Contract (MEC): This is a critical point. If our policy is “overfunded” according to IRS rules (meaning we’ve paid in too much premium too quickly), it can be reclassified as a Modified Endowment Contract (MEC). If a policy becomes a MEC, loans are treated differently. They are taxed as gain first (Last-In, First-Out, or LIFO), and any taxable withdrawals or loans may be subject to a 10% federal tax penalty if we’re under age 59½. This is why it’s crucial to properly fund an IUL policy and work with a qualified professional to avoid MEC status if we intend to use the cash value for tax-free income later.

- Tax Treatment of Loans: As long as our policy is not a MEC, loans from an IUL policy are generally tax-free. This is a powerful feature, allowing us to access our cash value for various needs without incurring immediate tax liabilities.

- Policy Lapse with Loan: If our policy lapses while we have an outstanding loan, the loan amount might be treated as a distribution and become taxable, potentially creating an unexpected tax bill.

Understanding these tax implications is vital for maximizing the benefits of our IUL policy and avoiding any unwelcome surprises down the road.

IUL Cash Value in Your Financial Strategy

Integrating an IUL policy into our broader financial strategy requires careful consideration of our risk tolerance, growth potential expectations, and long-term goals. It’s not a one-size-fits-all solution, but for some, it can be a valuable component of a diversified financial plan, offering both protection and a unique savings component.

How IUL Cash Value Differs from Other Universal Life Insurance Options

To truly appreciate how cash value works in indexed universal life, it helps to compare it with other types of universal life insurance. While all universal life policies offer flexible premiums and death benefits, their cash value growth mechanisms vary significantly.

| Feature | Indexed Universal Life (IUL)