Planning for Peace of Mind: Understanding Burial Insurance

Understanding how burial insurance works? can bring real comfort. It’s a simple type of life insurance designed to cover your final expenses. When you pass away, it provides money to your loved ones so they don’t have to worry about costs during a difficult time.

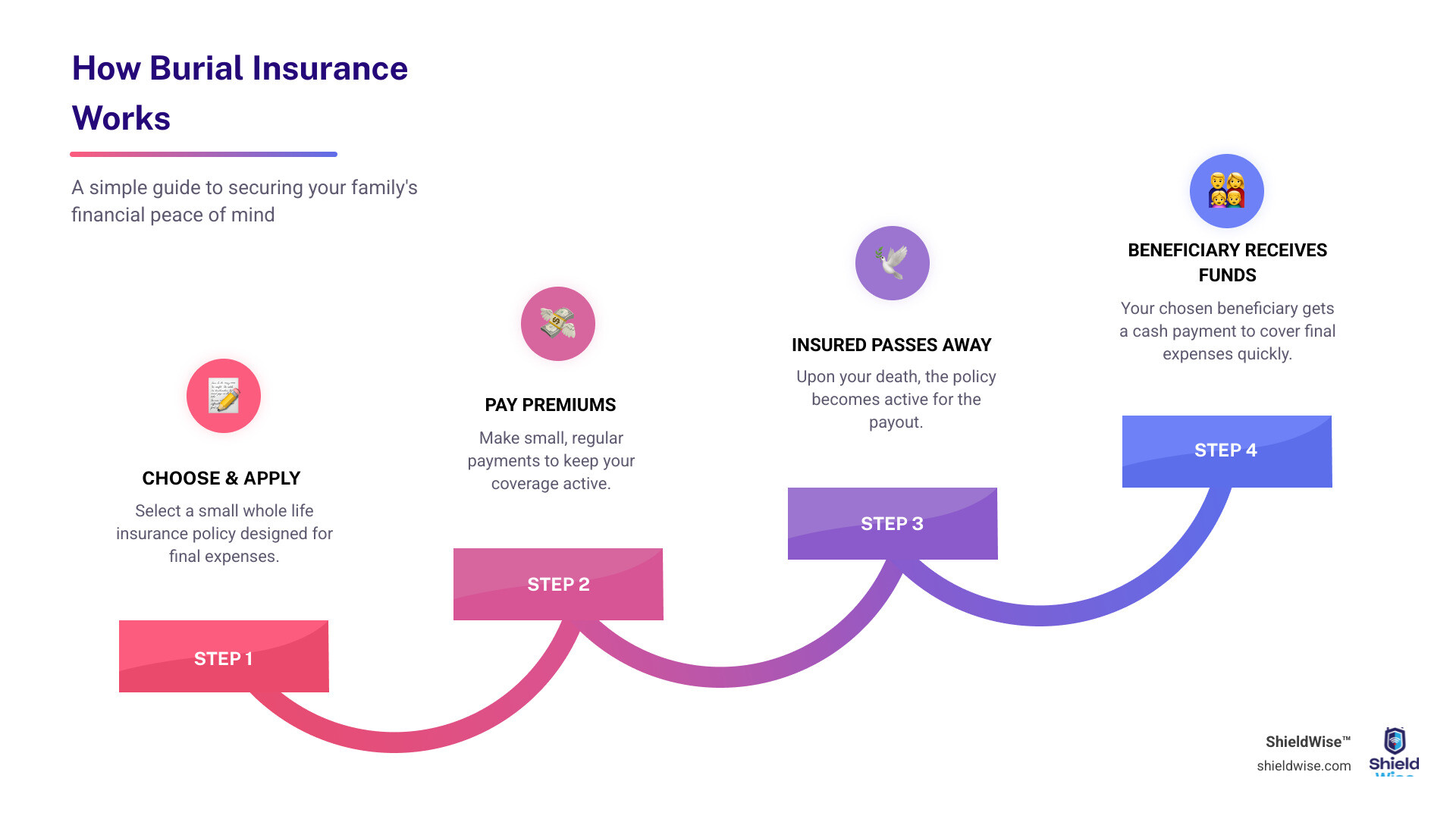

Here’s a quick overview:

- What it is: Burial insurance (also called final expense or funeral insurance) is a small whole life insurance policy meant to cover the costs that come after someone passes away.

- How it works: You pay small, regular premiums. When you die, your chosen beneficiary gets a cash payment to help them manage expenses quickly.

- What it covers: The cash payout can be used for funeral services, burial costs, cremation, medical bills, and other small debts. Your beneficiary decides how to use the funds.

- Who it’s for: It’s useful for many seniors, people with health issues, or anyone on a fixed income, as it helps ensure your family isn’t burdened with unexpected costs.

Planning for end-of-life expenses isn’t always easy. But taking steps now can save your family from added stress and financial worry later. This guide will help you understand burial insurance, so you can make a clear, informed choice for your future and your loved ones.

What Is Burial Insurance and What Does It Cover?

Burial insurance is a financial safety net for your final goodbye. Also known as final expense insurance or funeral insurance, it’s a type of whole life insurance policy with a focused mission: to provide a cash payment to your loved ones when you pass away. The way how burial insurance works is straightforward. You pay regular premiums, and in return, your policy promises a death benefit—a lump sum of cash—that goes to your named beneficiary.

This cash payout is highly flexible. While designed for funeral costs, your beneficiary has complete freedom to use the money as needed. It can cover the funeral service, a burial plot, cremation, a casket or urn, and a headstone. Beyond that, the funds can also pay for leftover medical bills, legal fees for settling an estate, or outstanding debts like credit card balances. The point is to relieve financial pressure on your family in whatever form it takes.

According to recent industry data, typical funeral costs can range from about $6,300 for cremation to over $8,300 for a traditional burial, and that doesn’t always include everything. Most burial insurance policies offer coverage between $5,000 and $25,000, a range designed to cover these median costs and leave something for other immediate needs.

How It Differs from Traditional Life Insurance

You might wonder how this compares to traditional life insurance. They serve different purposes. Traditional term life or larger whole life insurance policies are built for income replacement. They offer large coverage amounts ($100,000+) to pay off a mortgage, fund education, or leave a substantial inheritance.

Burial insurance, however, is focused solely on final expenses. Its job is to prevent a financial crisis for your family upon your passing. This narrow focus means smaller coverage amounts—typically in the $5,000 to $25,000 range.

The biggest difference is often the underwriting process. Traditional life insurance usually requires a full medical exam and a detailed health review, which can be a barrier for older adults or those with health issues. In contrast, most burial insurance policies require no medical exam. You may answer a few health questions or qualify for guaranteed acceptance with no health questions at all. This makes it far more accessible, especially for seniors or those with pre-existing conditions.

How Burial Insurance Works: From Application to Payout

Understanding how burial insurance works? from application to payout reveals a process designed for simplicity, ensuring funds are available when most needed.

The Simple Application and Approval Process

A key feature of burial insurance is its simplified application. Many policies require no medical exam. Instead, you may answer a few health questions for a “simplified issue” policy. For those with more significant health issues or who prefer to skip health questions entirely, “guaranteed issue” policies offer guaranteed acceptance. You cannot be denied coverage for health reasons.

This accessibility is what “burial insurance” is designed for—to ensure almost anyone can secure coverage for their final expenses. During the application, you’ll designate a beneficiary and choose your coverage amount, typically between $5,000 and $25,000, based on your estimated needs.

Understanding Premiums, Coverage, and Cash Value

Once approved, your policy is activated by paying premiums. A key feature is fixed premiums, meaning your payments will not increase. As a type of whole life insurance, these policies provide lifetime coverage as long as premiums are paid.

Another feature is cash value accumulation. A portion of your premium contributes to a cash value component that grows on a tax-deferred basis. You can often borrow against this cash value or surrender the policy for its cash value if your financial needs change, adding a layer of flexibility during your lifetime.

The Payout Process and Waiting Periods Explained

When the time comes, your beneficiary files a claim with the insurance company, usually by providing a certified death certificate. Most providers aim for a quick payout, often within days, which is crucial for covering immediate funeral costs.

It’s important to understand waiting periods, especially with guaranteed issue policies. These policies often include a graded death benefit. This means if death from natural causes occurs within the first two or three years of the policy, the beneficiary typically receives a refund of premiums paid (often with interest) instead of the full death benefit. If death is accidental, the full benefit is usually paid. After the waiting period, the full death benefit is paid for any cause of death. This is a trade-off for guaranteed acceptance.

Types of Burial Insurance and Who It’s For

Just like there are different flavors of ice cream, there are different types of burial insurance, each suited for different needs and circumstances. Understanding these options is crucial for making an informed decision. It’s about finding the perfect fit for your unique situation!

Exploring the Different Policy Types

When we look at the landscape of burial insurance, we generally find three main types, each designed with different levels of health and acceptance in mind.

- Simplified Issue: This type is a good middle ground. There’s no medical exam, but you will answer a short health questionnaire. If you’re in generally decent health for your age, you’ll likely be approved. These policies often have lower premiums and shorter (or no) waiting periods compared to guaranteed issue.

- Guaranteed Issue: Acceptance is guaranteed regardless of your health—no medical exams and no health questions. This makes it a great option for individuals with serious health problems. The trade-off is typically higher premiums and a two- to three-year waiting period. If death from natural causes occurs during this period, beneficiaries usually receive a refund of premiums paid, plus interest.

- Pre-need Insurance: This type is different because it’s usually purchased directly through a funeral home to pre-pay for specific funeral services. While it ensures your exact wishes are met, it lacks the flexibility of other types, as the funds are tied to a specific provider and services. Here at ShieldWise™, our focus is on providing flexible final expense solutions that give your beneficiary direct control over the funds.

Who Is the Ideal Candidate for Burial Insurance?

This type of coverage is particularly beneficial for certain individuals:

- Seniors (ages 50-85) who want an accessible and straightforward solution.

- Individuals with pre-existing conditions who may not qualify for traditional life insurance.

- Those on a fixed income who need predictable, affordable premiums.

- Budget-conscious planners who want to cover final expenses without buying a large life insurance policy.

- Anyone without other life insurance or who wants to supplement an existing policy with a dedicated fund for final expenses, ensuring quick cash access without touching other long-term financial plans.

Comparing Burial Insurance: Costs, Pros, and Cons

When you’re thinking about how to prepare for end-of-life expenses, it’s worth stepping back to see the full picture. Burial insurance is a powerful tool, but it’s not the only option. Understanding how it compares to other financial strategies can help you make the right choice for your family.

How burial insurance works compared to other financial tools

One common approach is setting money aside in savings. While this gives you control, these funds can get tied up in probate—a legal process that can take months—delaying your family’s access to the cash. Payable on Death (POD) accounts or trusts can bypass probate, but self-funded plans require discipline to save enough.

Burial insurance provides a key advantage: immediate access to funds. After any waiting period, the policy guarantees a specific payout amount that goes directly to your beneficiary, often within days of filing a claim. This avoids probate and ensures money is available for time-sensitive decisions.

Compared to traditional life insurance, which is designed for large-scale goals like income replacement, burial insurance has a narrower focus on final expenses. While a healthy, younger person might get more coverage per dollar with a traditional policy, the strict underwriting can be a barrier for seniors or those with health issues. Burial insurance fills this gap by being more accessible.

How burial insurance works in terms of cost and value

Several factors influence your premium: age (younger is cheaper), gender (women often pay less), health (for simplified issue policies), and your chosen coverage amount.

So, what are the pros and cons of this investment?

Pros:

- Accessibility: Many policies have no medical exam, opening the door for seniors and those with pre-existing conditions.

- Fixed Premiums: Your payments are locked in and won’t increase, making budgeting simple.

- Peace of Mind: Knowing final expenses are covered relieves a major burden from your family.

- Flexibility: The cash benefit can be used for any expense, from the funeral to medical bills.

- Cash Value: The policy builds cash value over time that you may be able to borrow against.

Cons:

- Higher Cost-Per-Dollar: Compared to traditional, fully underwritten life insurance, it can be more expensive for the amount of coverage you get.

- Lower Coverage Amounts: It’s designed only for final expenses, not for leaving a large inheritance.

- Waiting Periods: Guaranteed issue policies have a 2-3 year waiting period for natural death, during which the benefit is typically a return of premiums.

We want to be honest with you: some consumer advocates have raised concerns that certain burial insurance products can be marketed too aggressively to vulnerable populations, with premiums that seem high relative to the benefit. That’s why transparency matters so much. At ShieldWise™, our goal is to help you understand exactly how burial insurance works? and compare it with all your options, so you can make the choice that truly serves your family’s needs. There’s no one-size-fits-all answer—just the right answer for your specific situation.

Frequently Asked Questions about How Burial Insurance Works

It’s natural to have questions when you’re planning for something as important as your family’s future. We hear many questions about burial insurance, and we’re here to provide clear, straightforward answers. Understanding the nuances of how burial insurance works? can make all the difference in your planning.

Can the death benefit be used for anything besides the funeral?

Yes, absolutely! This is one of the most common questions we get, and it’s a really important one. While burial insurance is designed with funeral and final expenses in mind, the cash payout it provides is incredibly flexible.

The death benefit goes directly to your chosen beneficiary as a lump sum of cash. This means there are no restrictions on how they can use the money. Your loved ones have complete beneficiary freedom to decide what’s most needed during that difficult time. Perhaps there are still some medical bills that weren’t fully covered by health insurance. Or maybe there’s outstanding debt like credit card balances or personal loans. The U.S. Consumer Financial Protection Bureau offers guidance on what happens to a person’s debt when they die. This amazing flexibility ensures the funds truly serve to ease financial stress, no matter what form that stress takes.

Do I still need burial insurance if I have savings?

That’s a thoughtful question, and it’s smart to consider all your options! While having savings is certainly a wonderful idea, burial insurance offers some distinct advantages that even a healthy savings account might not.

- Immediate Access to Funds: Even if you’ve set aside money in a savings account, those funds can sometimes be tied up after your death. This can happen because of banking procedures or, more often, due to probate. Probate is the legal process of proving a will and settling an estate, and it can take months, or even longer, especially in states like Illinois. During this time, your bank accounts might even be frozen. Burial insurance, on the other hand, pays out quickly to your named beneficiary, typically bypassing probate altogether.

- Protecting Savings for Heirs: You might want your hard-earned savings to go directly to your loved ones as an inheritance, not to be used up by funeral costs. Burial insurance makes sure those specific costs are covered, letting your other assets be distributed exactly as you wished.

- Ensuring Funds are Available: Life is full of surprises, and if an unexpected expense comes up during your lifetime, you might need to dip into your savings. A burial insurance policy guarantees that a specific amount will be there for final expenses, no matter what other financial ups and downs you face.

Can I be denied coverage for burial insurance?

The good news is that for many people, getting burial insurance is quite accessible! Whether you can be denied coverage truly depends on the specific type of policy you apply for.

For simplified issue policies, you’ll answer a few health questions, but you won’t need a medical exam. While denials are less common than with traditional life insurance, it is possible to be turned down if your health questionnaire shows very serious conditions. However, if you have significant health concerns or simply want to avoid any health questions, guaranteed issue policies are a wonderful option. With these, you cannot be denied coverage. There are no medical exams and absolutely no health questions asked. As long as you meet the age requirements (usually between 50 and 85), you are guaranteed to be approved. The main trade-off for this “no-questions-asked” coverage is usually higher premiums and a waiting period, typically 2-3 years, before the full death benefit is paid for natural causes.

Conclusion: Securing Your Legacy and Protecting Your Loved Ones

We’ve walked through everything you need to know about how burial insurance works?—from what it is and what it covers, to how you apply, the different policy types available, and how it compares to other financial tools. Throughout this guide, we’ve aimed to make this important topic clear and approachable, because planning for the end of life shouldn’t feel overwhelming.

At its heart, burial insurance is a straightforward whole life policy designed to cover the costs that come after you’re gone. It’s different from traditional life insurance because it focuses on smaller, more manageable coverage amounts, often requires no medical exam, and comes with premiums that fit most budgets. We’ve seen that the death benefit isn’t locked into just funeral costs—your beneficiary can use it for medical bills, outstanding debts, or any other pressing need that arises.

The real beauty of burial insurance is how it lifts a weight off your family’s shoulders. When you plan ahead, your loved ones don’t have to worry about how they’ll pay for your funeral or cover unexpected expenses during an already painful time. They can focus on remembering you, celebrating your life, and supporting each other. That’s a gift that goes far beyond dollars and cents.

Deciding on the right end-of-life planning approach is deeply personal. We hope this guide has given you the confidence to make a choice that feels right for you and your family. Whether you’re in your 50s or 80s, dealing with health challenges, or simply want to make sure everything is taken care of, understanding how burial insurance works? is an important step toward peace of mind.

If you’re ready to explore your options and find coverage that fits your needs, we’re here to help.

Learn more about final expense insurance and compare plans from trusted carriers. At ShieldWise™, we believe in clear answers, no confusing jargon, and a simple path to protecting the people you love. You can get instant online quotes and secure the right coverage in just a few clicks—because planning for the future should be simple, not stressful.