Why Getting a Final Expense Quote Online Matters for Your Peace of Mind

A final expense quote online is the fastest way to compare affordable burial insurance plans from top-rated carriers. In 60 seconds or less, you can see instant pricing for coverage from $5,000 to $40,000 based on your age, health, and needs—all without a medical exam.

Quick Answer: How to Get a Final Expense Quote Online

- Enter basic information (age, gender, state, nicotine use, coverage amount)

- Review instant quotes from multiple carriers side-by-side

- Apply online with a simple health questionnaire—no medical exam required

- Get approved quickly, often within 24-48 hours

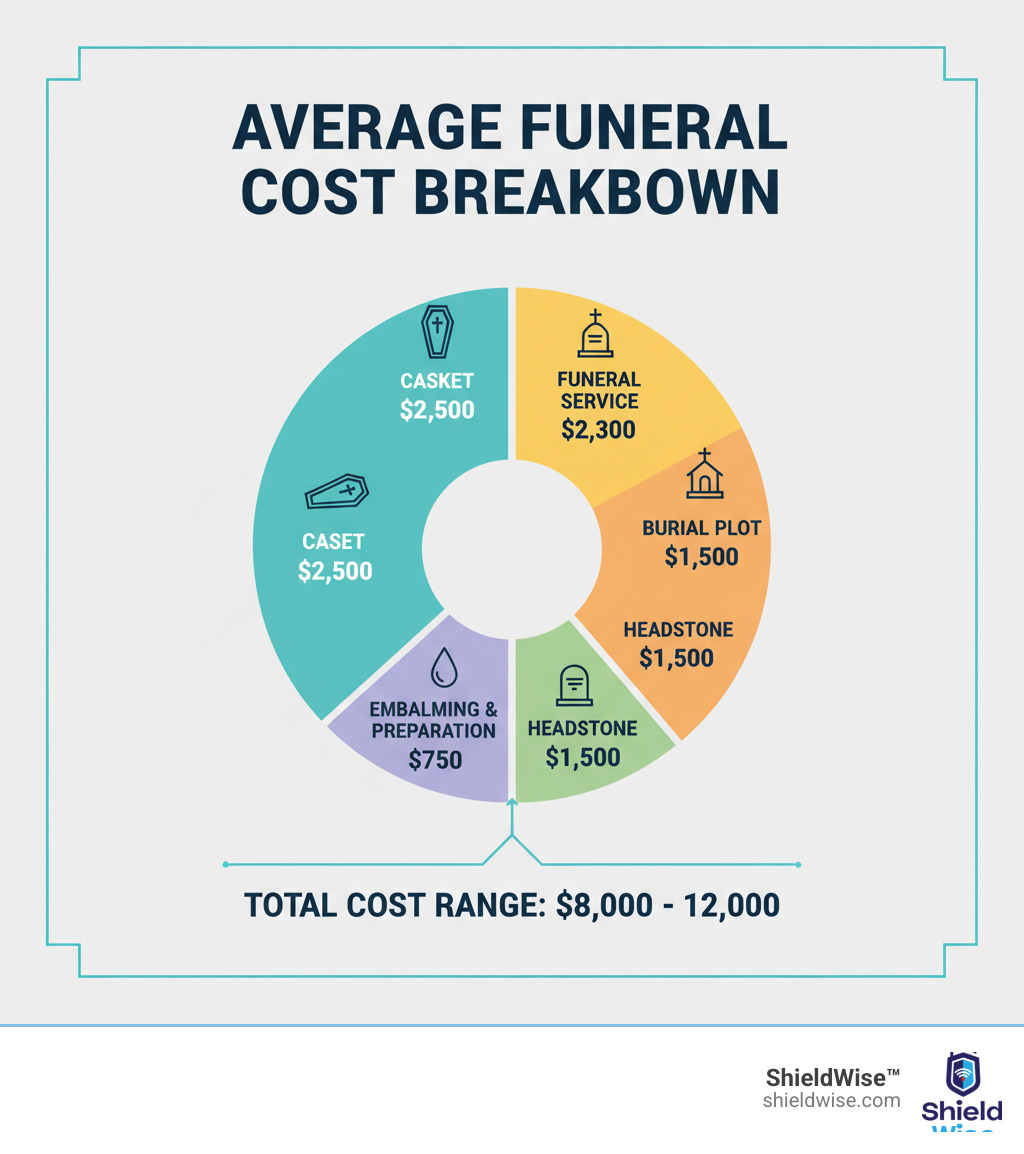

The thought of leaving loved ones with funeral bills is a common worry, especially with the average funeral costing between $7,000 and $12,000. This doesn’t even include burial plots, headstones, or outstanding medical bills.

Final expense insurance offers a simple solution, providing affordable, predictable coverage your family can rely on. Thanks to online quote tools, you can avoid high-pressure sales calls and confusing jargon.

Unlike traditional insurance that required medical exams and long waits, you can now compare final expense plans from your couch in minutes. This guide explains how to get a quote online, what to expect, and how to choose the right coverage to protect your loved ones without breaking the bank.

What is Final Expense Insurance?

Final expense insurance, also known as burial insurance, is a type of whole life insurance designed to cover the bills you leave behind. Unlike large traditional policies, final expense coverage is smaller, typically ranging from $5,000 to $40,000. This makes premiums more affordable for those on a fixed budget.

The key feature is simplified underwriting. When you request a final expense quote online, you won’t need a medical exam. Most policies only require you to answer a few health questions, and many applicants are approved the same day.

As a whole life policy, your premiums are locked in for life and will never increase. The policy also builds cash value over time, which you can borrow against if an emergency arises.

Common Covered Expenses

The death benefit is designed to cover a wide range of costs. The median funeral costs around $7,848, but the policy can also handle:

- Funeral and burial/cremation services

- Caskets, headstones, and burial plots

- Out-of-pocket medical bills

- Legal fees for settling an estate

- Credit card debt or other small loans

For a complete breakdown, see our guide on End of Life Expenses.

Beneficiary Payout Flexibility

Your beneficiary receives the death benefit as a tax-free lump sum with no strings attached. They are not required to use a specific funeral home or follow a rigid spending plan. If the funeral costs $8,000 and the policy pays $15,000, the remaining $7,000 can be used for medical bills, legal fees, or any other needs. This flexibility makes it vital to choose a beneficiary you trust to honor your wishes.

Types of Final Expense Plans

When you get a final expense quote online, you’ll see a few plan types based on your health:

- Level Death Benefit: This is the best option, offering full coverage from day one with no waiting period. You must answer some health questions to qualify.

- Graded/Modified Death Benefit: For those with more serious health issues, these plans have a two- to three-year waiting period. If death occurs during this time, beneficiaries receive a return of premiums paid, often with interest (e.g., 10%). After the waiting period, the full benefit is available.

- Guaranteed Acceptance: This plan has no health questions and guarantees approval. However, it comes with a waiting period and higher premiums.

- Accidental Death Coverage: Only pays if death is accidental. It’s affordable but offers limited protection and is not a comprehensive solution.

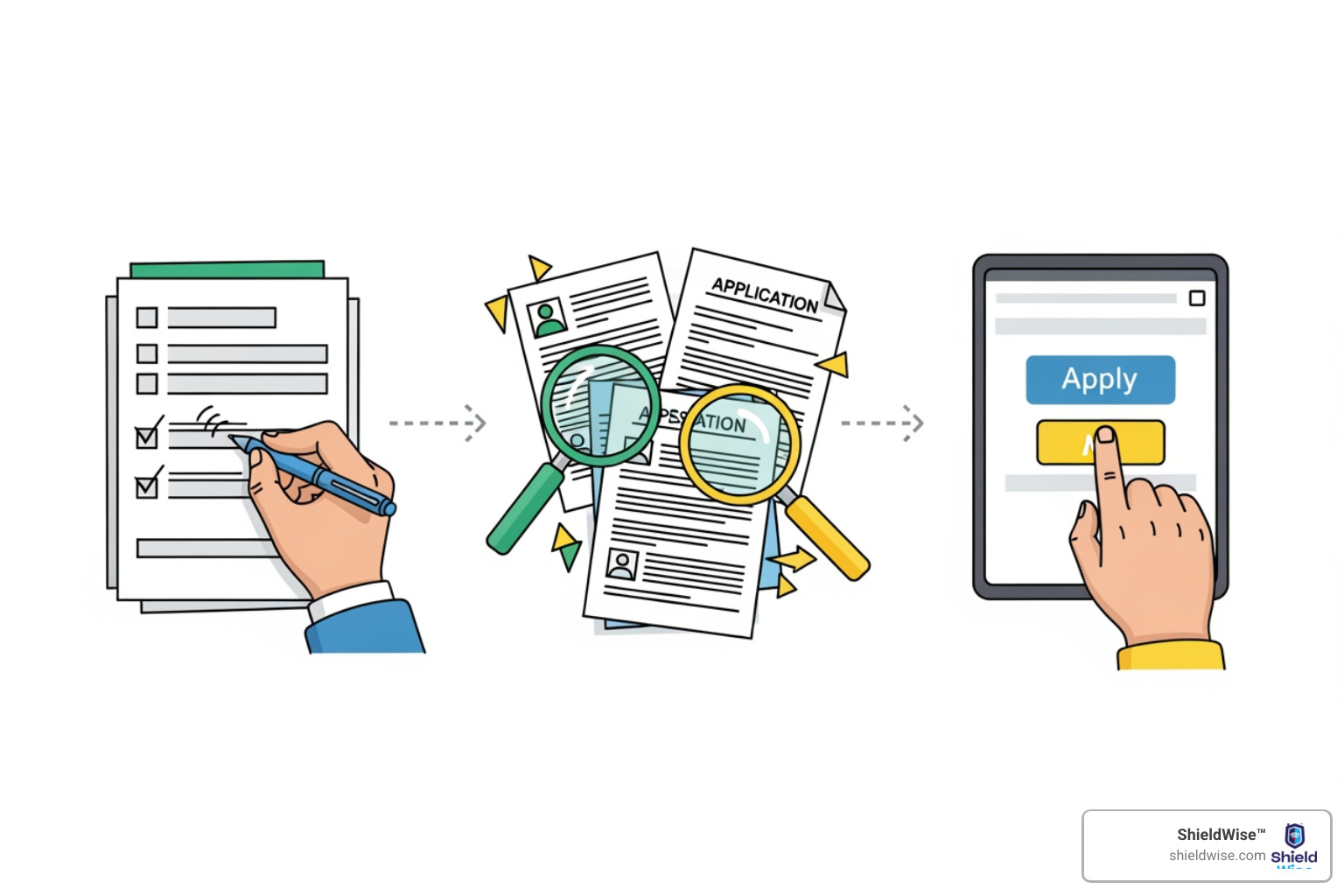

How to Get a Final Expense Quote Online in 3 Simple Steps

Getting a final expense quote online is a fast, convenient, and pressure-free process. You can compare multiple carriers from home and make an informed decision on your own timeline. For more resources, our Burial Insurance page offers helpful information.

Step 1: Gather Your Basic Information

To get an accurate quote, you’ll need a few key details. Don’t worry, it’s nothing complicated. Be ready with your:

- Date of birth (age is the biggest rate factor)

- Gender (women often pay slightly less)

- State of residence (rates vary by location, e.g., Illinois)

- Nicotine use (be honest about smoking, vaping, or chewing tobacco)

- General health status (for a few simple questions)

- Desired coverage amount ($5,000 to $40,000 is typical)

Step 2: Use an Online Quote Tool to Compare Options

After entering your information, you’ll see instant quotes from multiple top-rated carriers side-by-side. This is the power of getting a final expense quote online. The process offers:

- Convenience: Compare plans anytime, anywhere.

- No Sales Pressure: Review your options without obligation.

- Anonymity: Your information remains private until you decide to apply.

- Transparency: See real premiums, coverage amounts, and features clearly.

Online tools are highly efficient, but if you have a complex health situation or prefer one-on-one advice, you might feel overwhelmed. That’s why our team is here to help. If you need personalized guidance, visit our Contact Us page.

Step 3: Review and Apply for Your Policy

Once you’ve compared quotes, it’s time to choose a policy and apply. Before you do, carefully review the following:

- Premium: Ensure the monthly cost fits your budget. With whole life, this rate is locked in for life.

- Death Benefit: Confirm the amount is sufficient for your intended purpose.

- Waiting Periods: Understand if your policy has one. Level benefit plans offer coverage from day one, while graded or guaranteed plans have a two-year waiting period where the benefit is limited.

- Cash Value: If this feature is important, see how it accumulates and can be accessed.

The application itself is a simple online health questionnaire—no medical exam needed. Approval often happens within 24 to 48 hours, meaning you can secure peace of mind in just a couple of days.

Understanding Your Final Expense Insurance Costs

Final expense insurance is designed to be affordable, with premiums that can start for less than a cup of coffee per week. For example, a 50-year-old woman in Illinois could get a $2,000 policy for as little as $7.49 per month. A $10,000 policy for a 75-year-old woman might be around $88 per month, or $113 for a man of the same age.

These rates are locked in for life, so your premiums will never increase. This predictability makes budgeting simple. Getting a final expense quote online shows you exactly what you’ll pay with no surprises or hidden fees.

Factors That Influence Your Quote

Several key factors determine your monthly premium:

- Age: The younger you are when you apply, the lower your rate will be.

- Gender: Women typically live longer and therefore pay slightly less than men.

- Health Status: While there’s no medical exam, your answers to a few health questions determine which plan you qualify for. Better health generally means lower rates.

- Tobacco Use: Smokers and other tobacco users pay significantly more than non-smokers.

- Coverage Amount: A $20,000 policy will cost more than a $5,000 policy.

- Policy Type: Guaranteed acceptance plans cost more than level benefit plans due to higher risk for the insurer.

Our guide on End of Life Insurance for Seniors offers more insights for older applicants.

How to choose the right final expense quote online

Choosing the right coverage is about balancing your family’s needs with your budget. First, estimate your final expenses. According to the National Funeral Directors Association (NFDA), the median cost of a funeral with a viewing and burial in 2023 was $8,300. Remember to also account for potential medical bills, credit card debt, or legal fees.

Most experts recommend coverage between $10,000 and $15,000 to handle these costs comfortably. Next, look at your monthly budget and choose a premium that is sustainable long-term. Finally, consider your health to determine if you’ll qualify for an immediate benefit plan or if a guaranteed acceptance policy is a better fit. The goal is to find adequate coverage that gives you peace of mind without financial strain.

How Policies Build Cash Value

As a type of whole life insurance, your final expense policy builds cash value over time. A portion of each premium contributes to this account, which grows on a tax-deferred basis at a guaranteed rate. This cash value acts as a living benefit, providing a financial safety net. You can access it through policy loans or withdrawals if you face an emergency. Using the cash value will reduce the death benefit paid to your beneficiaries, but it adds valuable flexibility to your policy.

Choosing the Right Policy and Provider

You’ve compared quotes—now it’s time to choose a provider you can trust for the long term. This is a promise to your family, so you need a company with a proven track record.

Look for these key indicators of a quality provider:

- Financial Strength: Choose carriers with high ratings (A- or better) from agencies like A.M. Best. This shows they can pay claims.

- Customer Reviews: Check platforms like Trustpilot to see how real customers rate their experience, especially regarding the claims process.

- Simple Process: The application and approval should be fast and straightforward, typically within 24-48 hours.

- Fixed Premiums: Ensure the policy you choose is whole life insurance with premiums that are locked in for life.

ShieldWise vets our carriers to meet these standards, so you can compare top-rated options with confidence. Our Burial Insurance Complete Guide offers a deeper dive into what makes a great policy.

Guaranteed Acceptance vs. No-Exam Policies

Understanding the two main policy types will help you save money and get the right coverage.

Simplified Issue (No-Exam) Policies are the best choice for most people. You answer a few basic health questions on the application, but no medical exam is required. If you’re in reasonably good health, you can qualify for:

- Immediate Coverage: The full death benefit is active from day one.

- Lower Premiums: Rates are more affordable because the insurer has a clearer picture of its risk.

- Higher Coverage Amounts: You can often get up to $40,000 or more.

Guaranteed Acceptance Policies are a safety net for those with serious health conditions. As the name implies, approval is guaranteed with no health questions asked. The trade-offs are:

- A Waiting Period: These policies have a two- to three-year graded period. If you pass away from natural causes during this time, your beneficiary receives a refund of premiums paid, plus interest. The full benefit is available after the period ends.

- Higher Premiums: The cost is higher to compensate the insurer for taking on unknown risks.

- Lower Coverage Limits: Coverage is often capped at around $25,000.

For those over 85, our guide on Life Insurance Over 85 No Medical Exam provides specific options.

Optional Riders and Benefits

Riders are add-ons that improve your policy for a small additional cost.

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit while still living if you’re diagnosed with a terminal illness.

- Accidental Death Benefit Rider: Increases the payout if your death is the result of an accident.

- Children’s Term Rider: Provides a small amount of coverage for your children or grandchildren.

Some carriers also offer free services like help with creating wills and power of attorney documents, adding extra value to your plan.

Frequently Asked Questions about Final Expense Insurance

Can I get final expense insurance if I have health problems?

Yes, absolutely. This is a primary reason people choose final expense insurance. If you have manageable health conditions, you can likely qualify for a simplified issue policy by answering a few health questions—no exam needed. This often provides immediate coverage at affordable rates.

For those with more serious health issues, guaranteed acceptance policies are available. These plans ask no health questions and guarantee approval. The trade-off is a two-year waiting period before the full benefit is active and higher premiums. In either case, it’s crucial to answer all questions honestly to ensure your claim is paid.

How quickly is the death benefit paid out to beneficiaries?

Very quickly. Final expense claims are typically processed within a few days—often 24 to 48 hours—after the insurance company receives the death certificate and necessary forms. This rapid payout is designed to provide immediate funds for funeral costs and other urgent expenses, bypassing the lengthy probate process and easing your family’s financial burden.

Is the death benefit from final expense insurance taxable?

No, in nearly all cases, the death benefit your beneficiaries receive is 100% income tax-free. If you have a $15,000 policy, they get the full $15,000. This ensures the money is available for its intended purpose without your loved ones worrying about a tax bill. While estate taxes can apply to very large estates, this is extremely rare for typical final expense policy amounts. For specific advice, it’s always best to consult a tax professional.

Secure Your Family’s Future Today

You care about protecting the people you love, and getting a final expense quote online is the first step toward lasting peace of mind. In just a few minutes, you can lock in an affordable policy with fixed rates that will never increase.

This simple act ensures your family won’t face a financial crisis during an already difficult time. Final expense insurance is straightforward: no medical exams, no sales pressure, and no confusing fine print. It’s protection that does exactly what it promises.

ShieldWise was built to make this process easy. Our digital marketplace lets you compare plans from trusted carriers, see instant quotes, and get clear answers. We provide the transparency you need to secure the right coverage for your budget.

The average funeral costs over $8,000, but you don’t have to leave that burden behind. You can protect your family and preserve your legacy for just a few dollars a day. Take control today.

Get your free Final Expense Insurance quote now and see how affordable peace of mind can be. Your family’s security is just a few clicks away.