Your Guide to Final Expense Insurance in Atlanta

Are you looking for final expense insurance Atlanta? Heres what you need to know quickly:

- What it covers: Final expense insurance helps pay for funeral costs, burial or cremation, and other small end-of-life expenses.

- Cost in Atlanta: Funeral services in Atlanta can range from around $1,295 for direct cremation to $4,200 for a full burial. Total end-of-life costs across Georgia can be much higher, sometimes up to $19,300.

- Who can get it: Most plans are for people aged 50 to 85. Many don’t need a medical exam, making it easier to qualify even with health conditions.

- Key benefits: Premiums usually stay the same for life. Benefits are often paid quickly (within 24 to 72 hours) to your family.

ShieldWise is a digital marketplace with offices in Illinois, and we serve customers nationwide, including Atlanta and across Georgia. You can compare plans online and secure coverage where you live.

Losing a loved one is hard enough without adding money worries to the grief. After a lifetime of caring for your family, you want to ensure they aren’t burdened by unexpected bills when you pass away.

This insurance offers peace of mind by providing a simple way to cover final costs, allowing your family to focus on remembering you, not on funeral bills.

Understanding the Costs: Final Expenses in Atlanta and Georgia

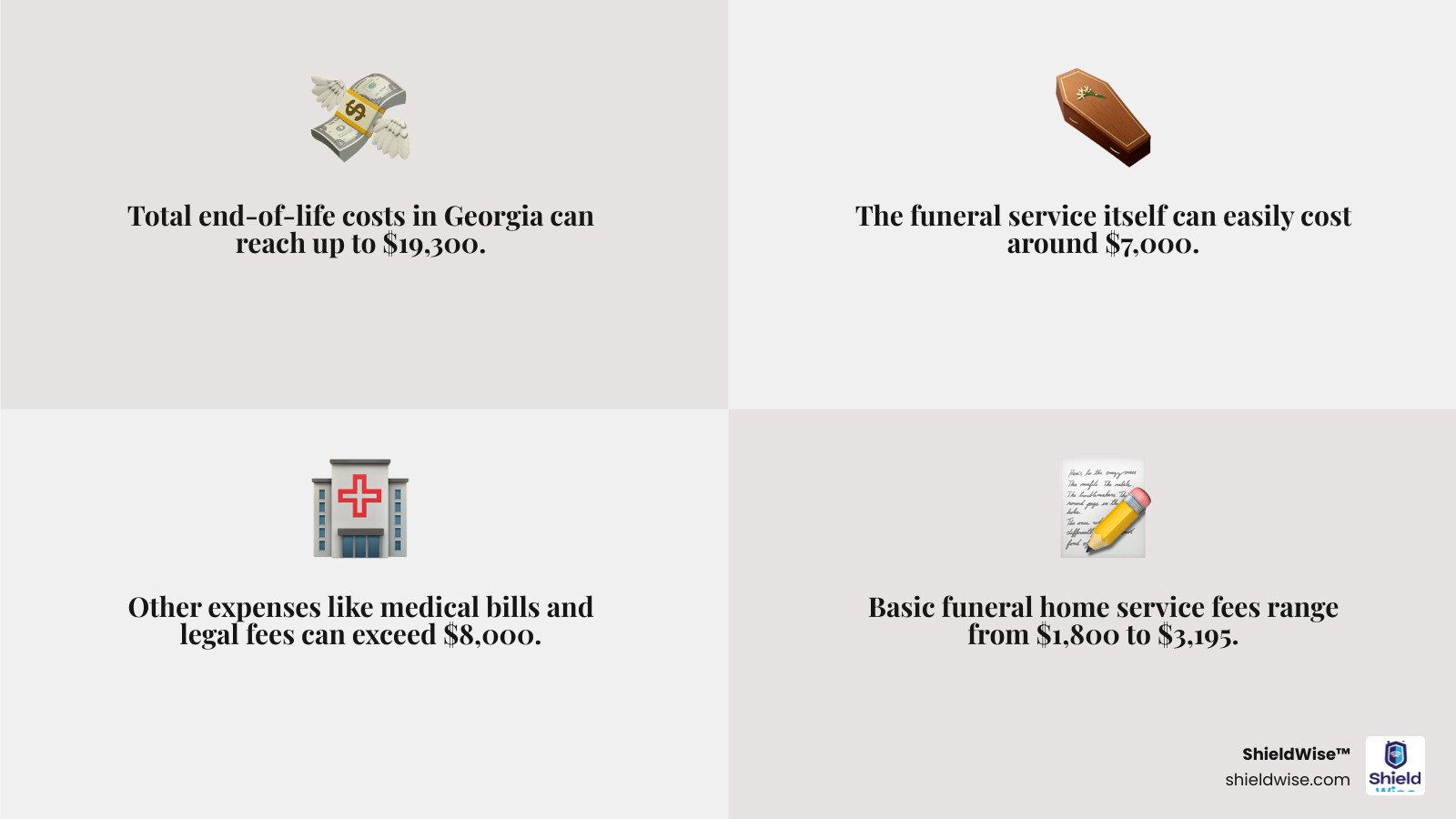

“Final expenses” is an umbrella term that covers everything from the funeral service to medical bills, burial or cremation, and legal fees. In Georgia, these end-of-life expenses can reach up to $19,300. The funeral alone typically runs about $7,000, while other death-related expenses often exceed $8,000.

According to the National Funeral Directors Association (NFDA), the average funeral cost keeps rising. A breakdown of typical funeral costs in Georgia includes the funeral director’s basic services fee ($1,800 to $3,195), embalming and preparation (~$875), use of the funeral home facility (~$447), and transportation (~$342). The casket is a major variable, with prices ranging from $2,000 to over $12,000. Other significant expenses include the burial plot or cremation niche and a headstone or marker.

Beyond the funeral, end-of-life medical costs and legal fees for settling an estate can add up quickly. To help, the Social Security Administration provides only a one-time payout of $255 to a qualifying survivor, an amount that barely makes a dent in the total costs.

Average Funeral Costs in Atlanta

Let’s zoom in on Atlanta specifically. The city’s costs reflect regional averages with some local variations.

Direct cremation in Atlanta runs approximately $1,295 (ranging from $800 to $2,000). A cremation memorial, which includes cremation followed by a memorial service, averages around $3,500 (ranging from $3,250 to $3,750). A full burial with a traditional funeral service, viewing, and burial costs about $4,200 (ranging from $4,150 to $4,250).

When you compare these Atlanta figures to Georgia averages, they’re pretty consistent. Traditional burials across Georgia are estimated between $7,500 and $11,000, but that can include additional elements like higher-end caskets ($2,000 to $4,000), grave plots and headstones ($1,500 to $3,500), and more comprehensive funeral home services ($1,500 to $2,500).

Atlanta’s full burial costs tend to fall on the lower end of the state estimates, but remember—these are averages. Your individual choices can significantly impact the final bill. If you’re searching for final expense insurance Atlanta options, understanding these local costs helps you choose the right coverage amount.

Why Pre-Planning is Crucial in the Peach State

Pre-planning is crucial to protect your loved ones. With funeral costs rising due to inflation, planning now helps manage future expenses. More importantly, it removes the emotional and financial burden from your family during a time of grief.

Without a plan, families may need to drain savings or go into debt to cover costs that can reach up to $19,300 in Georgia, far more than the $255 Social Security death benefit.

Pre-planning with final expense insurance Atlanta residents trust is a final gift of financial security, allowing your family to focus on healing and honoring your memory when they need it most.

What is Final Expense Insurance and How Does It Work?

Final expense insurance, also known as “burial” or “funeral” insurance, is a type of whole life insurance designed to cover end-of-life costs. It’s a simple way to ensure your final wishes are honored without creating a financial burden for your family, making it a popular choice for seniors.

Its appeal lies in its simplified underwriting. Most policies don’t require a medical exam, only a few health questions on the application. This makes it easier to qualify for, even with existing health conditions.

The main purpose of a final expense policy is to provide a tax-free death benefit—a lump sum of money paid to your beneficiary after you pass away. Benefits typically range from $5,000 to $50,000, enough to cover funeral costs, medical bills, and other small debts.

As a whole life product, it includes key benefits: cash value accumulation that grows over time and can be borrowed against, fixed premiums that never increase, and lifetime coverage that remains active as long as premiums are paid.

Final Expense vs. Traditional Life Insurance

Final expense and traditional life insurance both provide a death benefit, but they serve different purposes. Final expense insurance is for immediate end-of-life costs, while traditional life insurance addresses larger, long-term financial needs like income replacement.

Here’s a quick look at how they stack up:

| Feature | Final Expense Insurance | Traditional Life Insurance |

|---|---|---|

| Coverage Amounts | Typically lower, ranging from $5,000 to $50,000. Designed for specific final costs. | Much higher, often $100,000 to millions. Designed for income replacement, large debts. |

| Policy Purpose | Primarily covers funeral, burial/cremation, medical bills, and small outstanding debts. | Replaces lost income, pays off mortgages, funds education, provides long-term financial security. |

| Underwriting | Simplified issue, usually no medical exam, just health questions. Easier to qualify, especially for seniors or those with health issues. | Full underwriting, often requires a medical exam, blood tests, and detailed health history. Stricter qualification. |

| Payout Speed | Often paid out quickly, typically within 24 to 72 hours of a valid claim. | Can take weeks or even months for the death benefit to be processed. |

| Target Demographic | Primarily individuals aged 50-85, especially those seeking simple, affordable coverage for end-of-life costs. | Broader age range, often younger individuals with significant financial responsibilities. |

| Cost Comparison | Generally more affordable monthly premiums for the benefit amount, especially given the simplified underwriting. | Can be more expensive for similar face amounts, but offers much higher coverage potential. |

As you can see, final expense insurance is a smart, cost-effective way to handle those end-of-life expenses. It takes the stress out of an already difficult time, letting your loved ones focus on what truly matters.

Qualifying for Coverage: Age and Health Requirements

Final expense insurance is highly accessible, with most plans available for individuals aged 50 to 85. Its lenient health requirements make it a great option for those who may not qualify for traditional life insurance. There are two main policy types based on health:

- Simplified Issue Policies: These require answering a few health questions but no medical exam. Many applicants with pre-existing conditions can still qualify for immediate full benefits.

- Guaranteed Issue Policies: Acceptance is guaranteed regardless of health history, with no health questions asked. These policies are a lifeline for those with significant health challenges, though they typically include a waiting period for the full benefit.

These options ensure that most people can find affordable final expense insurance Atlanta to protect their families.

Policy Types, Waiting Periods, and Exclusions in Georgia

It’s important to understand the different policy structures:

- Level Benefit Plans: Offer the full death benefit from day one.

- Graded Benefit Plans: Pay a partial death benefit if death occurs in the first few years, with the full amount available after that period.

- Modified Benefit Plans: Typically return all premiums paid plus interest if death from natural causes occurs within the first two years. The full benefit is paid after this period.

A two-year waiting period is common for guaranteed and some simplified issue policies. During this time, if death occurs from natural causes, the benefit is usually a return of premiums plus interest. However, accidental death is typically covered in full from day one.

Georgia law provides a 10-day “free look” period, allowing you to review your policy and cancel for a full refund if you’re not satisfied.

The Cost of Final Expense Insurance Atlanta

Many worry about the cost of final expense insurance Atlanta, but it’s often more affordable than expected. For a modest monthly premium, you can secure thousands of dollars in coverage, providing significant peace of mind.

Several factors determine your monthly premium. Age is the biggest factor—the younger you are when you buy, the lower your cost. Gender also matters, as women tend to live longer and often pay slightly less. Your health status plays a key role; good health generally leads to lower premiums. The coverage amount you choose and whether you use tobacco also affect the price. Finally, the policy type matters, as guaranteed issue policies typically cost more than simplified issue plans.

Estimated Monthly Premiums for Final Expense Insurance Atlanta

Let’s look at real numbers. The table below shows estimated monthly premiums for a $10,000 policy in Atlanta. Notice how age, gender, and health status affect what you’ll pay:

| Age | Gender | “Good Health” Premium (per month) | “No Health Questions Asked” Premium (per month) |

|---|---|---|---|

| 50 | Men | $30 | $40 |

| 65 | Men | $56 | $68 |

| 80 | Men | $126 | $162 |

| 50 | Women | $25 | $28 |

| 65 | Women | $41 | $55 |

| 80 | Women | $93 | $126 |

Note: These are estimated rates for a $10,000 death benefit. Actual premiums may vary based on specific insurer, underwriting, and individual circumstances.

An important feature is that your premium stays the same for life. If you lock in a rate at age 50, you’ll pay that same rate at age 80. This makes budgeting simple and removes the worry of rising costs.

How to Get an Affordable Policy

Finding an affordable final expense insurance Atlanta policy is straightforward with a few key strategies:

- Compare quotes: Prices vary significantly between insurers, so shop around.

- Choose the right coverage amount: Select enough to cover expenses without overpaying for unneeded coverage.

- Apply when you’re younger: Locking in a rate at a younger age saves a substantial amount over the life of the policy.

- Maintain good health: Good health, including being a non-smoker, helps you qualify for lower premiums on simplified issue policies.

- Work with a digital marketplace: A platform like ShieldWise lets you easily compare plans from multiple carriers, get instant quotes, and receive clear guidance to find the best rate. You can compare final expense plans in Atlanta now and see actual rates in minutes.

Finding the Right Policy: Your Options in Atlanta

Finding the right final expense insurance Atlanta policy means focusing on key features that provide peace of mind. A major benefit is the fast payout. In Georgia, valid claims are typically paid within 24 to 72 hours, giving your family immediate access to funds for funeral arrangements without financial stress.

Another key feature is beneficiary flexibility. You can designate any person you trust—a spouse, child, or friend—to receive the funds and manage your final affairs.

Why Final Expense Insurance is a Flexible Solution

The death benefit from a final expense policy is a flexible, unrestricted cash payment to your beneficiary. While intended for funeral costs, the funds can be used for any pressing need, such as outstanding medical bills, credit card debt, legal fees, or even daily living expenses. This flexibility provides crucial support during a difficult time.

Furthermore, the policy is fully portable. Unlike pre-need funeral plans tied to a specific provider, your insurance coverage moves with you if you relocate. Your beneficiary can use any funeral home, and your policy is secure with the insurance company, unaffected by changes in the funeral industry.

The Advantage of Using an Independent Agent or Digital Marketplace for Final Expense Insurance Atlanta

Using an independent agent or a digital marketplace like ShieldWise offers significant advantages when buying final expense insurance Atlanta. Instead of being limited to one company’s options, you can compare plans from multiple carriers to find the best policy for your needs and budget.

At ShieldWise, we provide unbiased, personalized recommendations based on your unique situation. Our digital platform simplifies the entire process, allowing you to compare rates, get instant online quotes, and apply for coverage with clear, jargon-free guidance. We help you find the most affordable premiums and make a confident decision to protect your family.

Frequently Asked Questions about Final Expense Insurance in Georgia

It’s natural to have questions when making important financial decisions. Here are answers to some of the most common questions about final expense insurance Atlanta.

Can I buy a final expense policy for my parents in Atlanta?

Yes, you can purchase a final expense policy for your parents. It’s a compassionate way to ensure their final wishes are honored without creating a financial burden. You will need their consent and must have an “insurable interest,” which is standard for immediate family. As the policy owner, you can manage the premiums while your parent is the insured individual.

Is the death benefit from final expense insurance taxable in Georgia?

Generally, the death benefit from a final expense policy is not taxable in Georgia. Your beneficiary typically receives the full amount free from federal income tax, ensuring the funds are available as intended. However, since tax laws can be complex, it’s always wise to consult a qualified tax professional for advice specific to your situation.

What happens if I stop paying my premiums?

If you stop paying premiums on your whole life final expense policy, it will enter a grace period (usually 30-31 days). If payment isn’t made, the policy will lapse, and coverage will end. However, policies that have accumulated cash value may offer “non-forfeiture options” as a safety net:

- Cash Surrender Value: You can terminate the policy and receive the accumulated cash value.

- Reduced Paid-Up Insurance: The cash value is used to buy a smaller, permanent policy with no further premiums.

- Extended Term Insurance: The cash value is used to keep the original death benefit active for a set period.

To maintain protection for your loved ones, it’s crucial to keep payments current. Always check your policy documents for specific terms.

Secure Your Family’s Future Today

Securing final expense insurance Atlanta is a responsible and caring step for your loved ones. It prevents your passing from becoming a financial burden, allowing you to take control of your legacy and provide your family with invaluable peace of mind. This insurance alleviates financial stress, protects savings, and gives your family space to grieve. It is a thoughtful final gift that demonstrates your foresight.

The ShieldWise digital marketplace simplifies the process. Our platform allows you to easily compare plans from trusted carriers, get instant online quotes, and receive clear, jargon-free guidance. We serve Atlanta and communities across Georgia through our nationwide online platform, with offices in Illinois, so you can compare quotes and enroll from anywhere.

Don’t leave your family vulnerable. Take a proactive step today to ensure their financial security.