Securing Peace of Mind: Final Expense Health & Eligibility

Understanding Final Expense Health & Eligibility is key to securing peace of mind for your loved ones. This insurance, also known as burial or funeral insurance, covers end-of-life costs like funeral expenses, medical bills, and debts, ensuring your family isn’t left with a financial burden.

Many worry about qualifying for insurance due to age or health, but final expense insurance is designed for easier approval, often with no medical exam required.

Here’s a quick look at who can qualify and how your health plays a part:

Who is eligible for Final Expense Insurance?

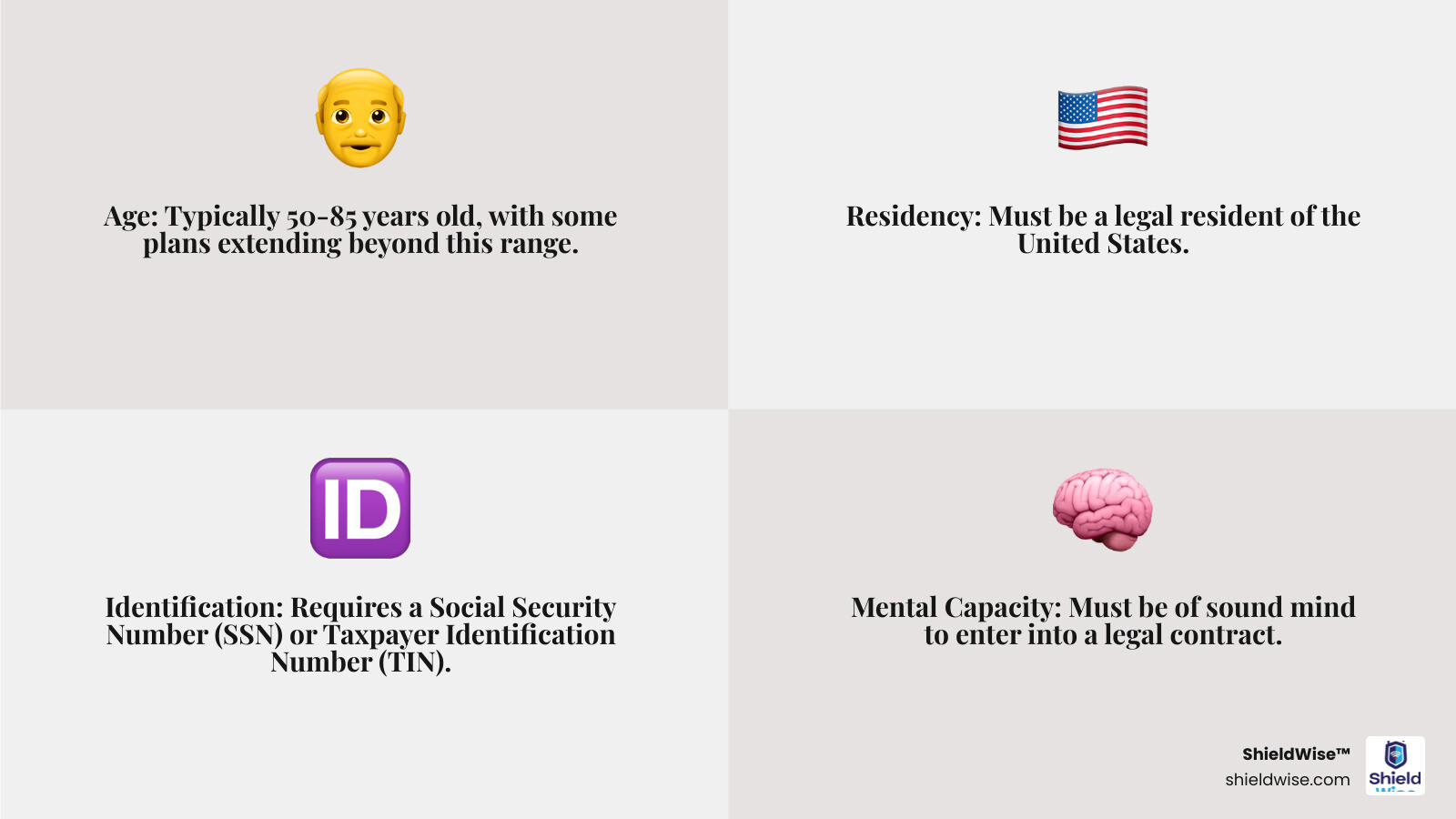

- Age: Generally, policies are for people aged 50 to 85. Some plans go even higher.

- Residency: You need to live in the United States.

- Identification: You’ll need a Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Mental Capacity: You must be of sound mind to sign a legal contract.

How does health affect eligibility?

- Many final expense plans do not require a medical exam.

- Simplified issue policies ask a few health questions, and most common health conditions don’t prevent coverage.

- Guaranteed issue policies ask no health questions, but often come with a 2-3 year waiting period.

With the average funeral costing over $9,000 and many Americans dying with debt, final expense insurance offers a straightforward way to protect your family from these stresses.

Core Eligibility: Who Can Get Final Expense Insurance?

Final expense insurance is designed for accessibility, especially for older adults wanting to protect their families from funeral costs and other end-of-life expenses. Unlike traditional life insurance, the application is simple, often without a full medical exam. When you apply, you’re entering a legal contract: you pay premiums, and the insurer provides a death benefit to your beneficiaries, offering peace of mind.

Age Requirements: Is There a Cutoff?

Age is a key factor for Final Expense Health & Eligibility. Most providers target people between 50 and 85 years old, the age when many begin end-of-life planning. While 85 is a common limit, some insurers offer coverage to older individuals, though options might differ. For those in this situation, our resource on Life Insurance Over 85 No Medical Exam can be helpful. A useful tip: applying earlier in the eligible age range typically secures lower premiums, leading to significant long-term savings.

Residency and Identification

Beyond age, you’ll need to meet two other basic requirements for Final Expense Health & Eligibility. First, you must be a U.S. resident when applying to comply with state insurance laws. Second, you’ll need a Social Security Number (SSN) or, in some cases, a Taxpayer Identification Number for identity verification. While most insurers require an SSN, some accept a TIN. We can help you steer these requirements.

Legal and Mental Capacity

Applying for final expense insurance means signing a legal contract, so you must be of sound mind to understand the terms. This legal safeguard protects individuals who may lack mental incapacity due to conditions like severe dementia. It’s also important to note that a Power of Attorney (POA) generally cannot sign an application on your behalf. You must personally complete and sign it, though someone can assist you through the process.

The Impact of Health on Final Expense Health & Eligibility

Many worry that their health history will disqualify them from life insurance. This is where final expense insurance stands out, as it’s designed to be more forgiving regarding your Final Expense Health & Eligibility.

How Your Health Status Plays a Role

The great news is the simplified underwriting process. Most final expense plans don’t require a full medical exam. Instead, insurers assess your Final Expense Health & Eligibility using a few key sources. You’ll answer straightforward health questions on your application about major conditions and hospitalizations. Insurers also often review your pharmacy report and the Medical Information Bureau (MIB) report. Honesty is crucial; discrepancies can lead to denied claims. This streamlined approach makes coverage accessible for seniors, even with some health concerns.

Navigating Final Expense Health & Eligibility with Pre-existing Conditions

Can you get final expense insurance with pre-existing conditions? For most people, yes. Common, manageable conditions like high blood pressure, diabetes, and arthritis typically don’t prevent you from qualifying for a “simplified issue” policy, which offers immediate coverage.

More severe issues like recent cancer, advanced heart disease, stroke, or HIV/AIDS might lead you to a “guaranteed issue” policy. These have no health questions but include a 2-3 year graded death benefit. Even with serious health concerns, final expense insurance provides a pathway to coverage. For more guidance, see our page on End of Life Insurance for Seniors.

Lifestyle Factors That Influence Your Policy

Beyond medical history, lifestyle choices also affect your Final Expense Health & Eligibility and premiums. Insurers assess risk, and certain factors are key.

- Smoking status is a major factor. Tobacco users, including vapers, pay higher premiums—often 30% more than non-users.

- High-risk professions (e.g., loggers, pilots) can be a factor, but it’s less common for final expense insurance and rarely a deal-breaker.

- High-risk hobbies like skydiving or scuba diving may be flagged, suggesting a higher risk of accidental death.

- Some insurers check your motor vehicle report (MVR). A history of DUIs or serious violations could affect your eligibility or premium.

Always be honest on your application. Misrepresentation could void your policy when your family needs it most. We’re here to help you find coverage for your real situation.

Finding the Right Policy Based on Your Health

Understanding your options is key to navigating Final Expense Health & Eligibility. The right policy depends on your health, budget, and needs. Whether you’re in excellent health or have medical conditions, there’s likely a final expense policy for you. Let’s break down the main types.

Simplified Issue vs. Guaranteed Issue: What’s the Difference?

Final expense insurance comes in two main types, catering to different health situations:

Simplified issue policies involve a short health questionnaire (no medical exam). If you’re in reasonably good health, you get immediate coverage from day one. These policies offer higher coverage amounts (up to $40,000 or even $50,000) and more affordable premiums. This is a great option for those with manageable conditions like high blood pressure or diabetes.

Guaranteed issue policies ask no health questions, guaranteeing approval if you meet age and residency requirements. The trade-off is a graded death benefit, a 2-3 year waiting period where beneficiaries receive returned premiums plus interest if you pass from natural causes. After that, the full benefit is active. Coverage is typically lower (up to $25,000) and premiums are higher. This is a lifeline for individuals with serious health issues.

Our Burial Insurance Complete Guide goes into even more depth if you’d like to explore these differences further.

Understanding Coverage Amounts and Premiums

Next, let’s consider how much coverage you need and what it will cost. Final expense policies offer modest coverage, typically $5,000 to $40,000, to cover end-of-life costs. According to the National Funeral Directors Association statistics, the average funeral costs over $9,000. A policy in the $10,000 to $20,000 range often covers these immediate expenses, plus other debts. For more details, see our page on End of Life Expenses.

Premiums depend on your age, gender, health status, and chosen coverage amount. Most people pay between $30 and $100 per month. This monthly payment provides priceless peace of mind, ensuring your loved ones aren’t left with thousands in unexpected bills.

The Application Process and Your Options

Applying for final expense insurance doesn’t have to be daunting. At ShieldWise, our goal is to provide clear, jargon-free guidance so you can secure the right coverage easily.

How to Apply for Final Expense Insurance

Here’s a straightforward guide to applying:

- Calculate Your Needs: Estimate your end-of-life costs, including funeral expenses (often over $9,000), medical bills, and debts, to determine your ideal coverage amount.

- Get a Quote Online: Use ShieldWise to get instant quotes from trusted carriers and compare plans and premiums with no obligation.

- Answer Health Questions Honestly: For simplified issue policies, answer the health questionnaire accurately to ensure your policy is valid. For serious health issues, a guaranteed issue policy with no health questions is an option.

- Review Policy Options: Compare plans, premiums, and provider reputations. Consider optional riders for improved coverage.

- E-sign and Submit: Complete the application and e-sign. Approval can happen within minutes or days, providing fast peace of mind.

What to Do If You Don’t Qualify

It’s rare not to qualify for a simplified issue policy, but if it happens, you still have options:

- Explore Guaranteed Issue Plans: These policies guarantee approval for those who meet age/residency rules, regardless of health. They have a 2-3 year waiting period and slightly higher premiums but are a solid option for securing coverage.

- Re-evaluate Coverage Needs: Lowering your desired coverage amount can sometimes open up more policy options.

- Speak with an Independent Agent: Our team at ShieldWise works with multiple carriers. We can shop around to find a plan that fits your unique situation, including guaranteed issue options, and steer the nuances to find a solution.

Is Final Expense Insurance Worth It?

Is final expense insurance worth it? For many seniors, the answer is yes. It’s wise to weigh the pros and cons to see if it fits your goals. Consider that a significant 73% of American consumers die with debt, averaging roughly $61,554, and the average funeral costs over $9,000. Final expense insurance provides priceless peace of mind by ensuring your loved ones don’t face this stress. For more on this, Experian offers a helpful article: Is Final Expense Insurance Worth It?.

The Pros: Key Benefits for Seniors

Final expense insurance offers several key benefits for seniors:

- Fixed premiums: Your monthly payment is locked in and will never increase, making budgeting simple and predictable.

- Cash value growth: As a form of whole life insurance, the policy builds cash value over time that you can borrow against in an emergency.

- Tax-free death benefit: Your beneficiaries typically receive the full death benefit without it being subject to federal income taxes.

- Simple application and high approval rates: No medical exam and minimal health questions make it easy to qualify, even with pre-existing conditions.

- Flexible beneficiary payout: The death benefit is paid to your beneficiary, who can use the funds for any purpose—funeral costs, medical bills, or other debts.

The Cons: Potential Drawbacks and Limitations

However, it’s important to be aware of its limitations:

- Lower death benefit: Coverage amounts (typically $5,000 to $40,000) are for end-of-life costs, not income replacement, and are smaller than traditional life insurance.

- Higher cost per dollar of coverage: The ease of qualification means the cost per thousand dollars of coverage can be higher than for fully underwritten policies.

- Waiting periods: Guaranteed issue policies have a 2-3 year waiting period. If death from natural causes occurs during this time, beneficiaries typically receive a return of premiums paid plus interest.

- Not for income replacement: If you need to replace income or cover large debts like a mortgage, a traditional term or whole life policy is a better fit.

The decision depends on your needs. If your goal is to cover final expenses with a simple application process, it’s an excellent choice.

Conclusion: Take the Next Step to Protect Your Loved Ones

We’ve covered how Final Expense Health & Eligibility is designed to be accessible for most people. The key takeaway is that this insurance is easy to get. Most applicants face no medical exam, only simple health questions. Even with serious health issues, guaranteed issue plans provide a path to coverage. It’s about finding the right fit for you.

Planning for final expenses is a caring act that gives your family the gift of peace, allowing them to grieve without the stress of unexpected bills.

At ShieldWise™, we make securing this protection simple. As a digital insurance marketplace for life, indexed universal life (IUL), final expense, and Medicare, we offer clear guidance and instant online quotes. We help you compare plans from top carriers to find the right fit.

Don’t let worries about Final Expense Health & Eligibility hold you back. Taking this step today brings comfort for tomorrow. Let us help you protect your loved ones and secure peace of mind.