Understanding Final Expense Options When You Have Diabetes

Final expense for diabetics is not only available—it’s often more affordable than you think. Whether you have Type 1 or Type 2 diabetes, use insulin, or even combine your condition with tobacco use, there are insurance options designed specifically for your situation.

Quick Answer for Diabetics Seeking Final Expense Insurance:

- Yes, you can qualify even with diabetes, insulin use, or complications

- Level benefit plans (immediate coverage) are available for well-managed diabetes

- Modified or guaranteed issue plans are available for advanced complications

- Monthly premiums typically range from $30-$150 for $10,000-$15,000 coverage

- No medical exam is required for most final expense policies

- Tobacco use increases rates by 50-100%, but coverage is still obtainable

Thinking about end-of-life expenses is never easy, especially when managing a condition like diabetes. The good news is that final expense insurance exists specifically to help people with pre-existing conditions secure affordable coverage. These policies typically offer $5,000 to $25,000 in coverage—just enough to handle funeral costs, which can average $5,000-$15,000, and other final expenses without burdening your family.

The key is understanding how insurers evaluate your specific situation. They look at factors like your A1C levels, whether you have complications like neuropathy, your age at diagnosis, and whether you use tobacco. But even if you check multiple “high-risk” boxes, coverage options still exist.

This guide will walk you through exactly what’s available, what you’ll pay, and how to find the best policy for your situation. No jargon, no pressure—just clear information to help you make an informed decision.

Understanding Final Expense Insurance and Its Benefits for Diabetics

Final expense insurance, also known as burial or funeral insurance, is a type of whole life policy designed to cover end-of-life costs. Unlike large traditional life insurance policies, its purpose is more focused.

The death benefit is smaller, typically ranging from $5,000 to $25,000. This amount is designed to cover funeral costs (which can range from $5,000 to $15,000), plus other unexpected End of Life Expenses that can arise.

What makes final expense for diabetics particularly attractive is the simplified underwriting process. Most policies don’t require a medical exam. Instead, you answer a few health questions, and the insurer may review your prescription history. That’s it.

Once approved, your premiums are locked in—they never go up, and your coverage amount never decreases. As long as you pay your premiums, the policy cannot be canceled, even if your health worsens. These policies also build cash value over time.

Best of all, your beneficiaries have complete flexibility with the payout. While intended for funeral costs, the money can be used for anything, such as final medical bills, outstanding debts, or providing financial breathing room during a difficult time.

Why It’s a Critical Tool for Financial Planning

Living with diabetes means planning ahead is essential, and this should extend to your final expenses. Traditional life insurance can be a challenge for diabetics, often involving higher premiums, invasive exams, or even rejection. Final expense insurance is a critical alternative.

It protects your loved ones from debt by covering outstanding medical bills, legal fees, and credit card balances. Even with good health insurance, final medical bills from hospital stays or hospice care can linger. This insurance steps in to handle these costs without draining your family’s savings.

Beyond expenses, you’re also leaving a small legacy—an immediate financial cushion that gives your family time to make decisions without panic. For seniors with health conditions like diabetes, traditional life insurance can feel out of reach. Final expense policies offer accessible End of Life Insurance for Seniors who might otherwise have no options. You can learn more about What is Burial Insurance? to understand how these policies work.

Finally, pre-planning and funding these expenses ensures your final wishes are honored with dignity. This peace of mind is priceless, both for you and your family.

How Insurers Evaluate Diabetics & Tobacco Users for Coverage

When you apply for final expense for diabetics, insurance companies perform a risk assessment called underwriting. They’re not trying to catch you; they’re trying to understand your health to price your policy fairly. They’ll ask health questions and likely run a prescription history check to estimate mortality risk. The better your health profile, the better your rates. For a broader overview, check out our guide on What is Burial Insurance?.

Even with imperfect health, coverage is available. The key is finding a carrier that understands your situation.

Key Underwriting Factors for Diabetics

Insurers focus on specific details of your diabetes management. Better management leads to better rates.

- Age at diagnosis: Diagnosis later in life is often viewed more favorably than an early diagnosis, which implies a longer history of managing the condition.

- Type 1 vs. Type 2: Type 1 is often seen as higher risk because it’s diagnosed earlier and always requires insulin. Well-managed Type 2 often receives more favorable rates.

- Insulin dependency: This doesn’t automatically mean higher rates. Many carriers are “insulin-friendly” and care more about your overall diabetes management than insulin use alone.

- A1C levels: This is a critical metric. An A1C under 7.0 is very favorable. Levels between 7.0 and 7.9 can still qualify for good coverage. Above 8.0, insurers see higher risk, leading to higher premiums or modified policies. Learn more about A1C levels explained.

- Medications: A simple medication routine is a good sign. Juggling multiple medications for diabetes, high blood pressure, and cholesterol signals more complex health issues and may result in higher costs.

The Impact of Common Diabetic Complications

Complications from uncontrolled diabetes significantly impact your insurance options.

- Diabetic neuropathy (nerve damage): This common issue, often felt as tingling or numbness in the feet, usually leads to a modified plan with a waiting period. However, some specialized carriers may still offer immediate coverage for mild cases. Learn more about diabetic neuropathy (nerve damage).

- Diabetic nephropathy (kidney damage): Impaired kidney function is a serious concern for insurers and almost always results in a modified plan with a two-year waiting period and higher premiums. Coverage is still possible. More info is available on diabetic nephropathy (kidney disease).

- Diabetic retinopathy (eye damage): Like neuropathy, this usually leads to a modified plan. However, if the condition is mild and stable, some carriers may still offer a level benefit plan with immediate coverage. Read more at diabetic retinopathy (eye damage).

- History of insulin shock: A recent episode of insulin shock (dangerously low blood sugar) will likely lead to a decline. If it’s been over two years with no recurrence, some carriers may offer a level benefit plan.

- Amputations: An amputation due to diabetes signifies advanced disease and will almost certainly limit you to graded or guaranteed issue policies with higher costs and waiting periods.

The Double-Edged Sword: Combining Diabetes with Tobacco Use

If you have diabetes and use tobacco, insurers see this as “compounded risk.” Diabetes and tobacco use both increase the risk of heart disease, stroke, and kidney failure. Together, they multiply these risks significantly. The Dangers of Smoking with Diabetes are well-documented.

As a result, you can expect:

- Significantly higher premiums: Often two to three times more than a non-smoking diabetic would pay.

- Limited eligibility for immediate coverage: You’ll likely be pushed toward graded benefit policies with waiting periods.

Despite this, coverage is still obtainable. It will cost more and may have a waiting period, but you can still protect your family. If you quit tobacco, many insurers will offer non-smoker rates after just 12 months, providing a powerful incentive for your health and wallet. Always be honest about tobacco use on your application.

Navigating Your Policy Options: Finding the Right Final expense for diabetics

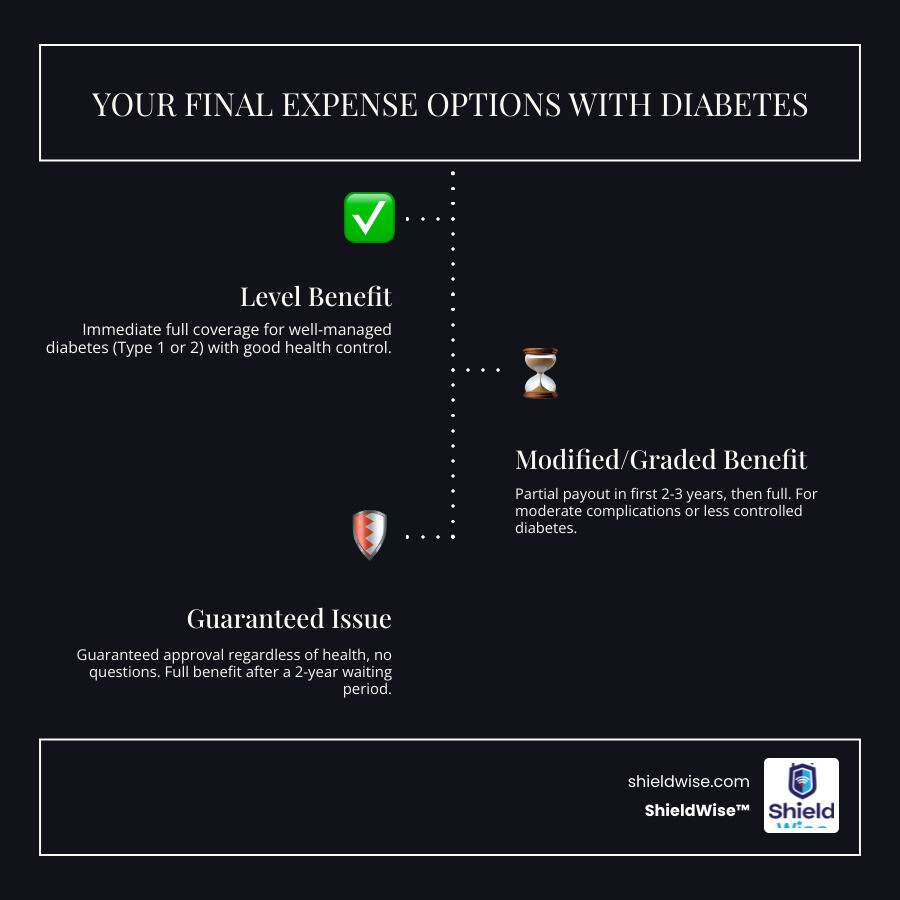

Finding the right final expense for diabetics means matching a policy type to your health situation. There are options for everyone, from those with well-managed diabetes to those with serious complications. Policies differ in cost, underwriting, and when the full death benefit is paid.

Level Benefit (Immediate Coverage)

This is the best-case scenario, offering the lowest rates and full coverage from day one. You’re a strong candidate if you’re a non-smoker with well-controlled diabetes (healthy A1C levels) and no major complications. Even insulin users can qualify if their condition is well-managed, as insurers care more about overall control than insulin use itself.

Graded & Modified Benefit (Waiting Periods)

If your diabetes is less controlled or you have complications, these policies are a great fit. They typically cost 10% to 25% more than level plans and include a two-to-three-year waiting period. If death occurs during this period, your beneficiary receives a return of premiums paid (often with ~10% interest) or a partial benefit (e.g., 30% in year one, 70% in year two). After the waiting period, the full death benefit is active.

Guaranteed Issue: The Ultimate Safety Net

For those who don’t qualify for the policies above, guaranteed issue ensures everyone can get coverage. There are no health questions and no medical exams. If you’re between ages 50 and 85, approval is guaranteed. For those over 85, see our guide on Life Insurance Over 85 No Medical Exam.

The trade-off is higher premiums (often 25-40% more than level plans) and a two-year waiting period. If death occurs during this time, your beneficiary receives a return of premiums plus interest. Afterward, the full benefit is available.

Comparing Sample Monthly Rates for a 65-Year-Old

Here are estimated monthly rates for a 65-year-old seeking $15,000 in coverage. Your actual rate will depend on your specific health, location, and carrier.

| Policy Type | Well-Managed Diabetic (Non-Smoker) | Well-Managed Diabetic (Smoker) | Diabetic with Complications (Smoker) |

|---|---|---|---|

| Level Benefit | $82-$92 | $164-$184 | Usually Not Available |

| Modified/Graded | $90-$102 | $180-$204 | $205-$230 |

| Guaranteed Issue | Usually Not Needed | Usually Not Needed | $250+ |

The rate difference between smokers and non-smokers is stark—tobacco use often doubles the premium. While combining diabetes, complications, and smoking leads to the highest premiums, coverage is still obtainable. To see your actual costs, explore our Burial Insurance Complete Guide.

Strategies to Secure the Best Rates and Approval

Getting final expense for diabetics doesn’t have to be overwhelming. With a few proactive steps, you can find affordable coverage that fits your needs. For a comprehensive overview, our Burial Insurance Complete Guide is a great starting point.

Improving Your Health Profile for Lower Premiums

Every positive step you take to manage your diabetes can lead to better insurance rates. Insurers reward good management.

- Control your A1C: Keeping your A1C levels below 7.0 demonstrates control and carries enormous weight with underwriters.

- Diet and exercise: Regular physical activity helps manage blood sugar, weight, blood pressure, and cholesterol—all factors on an insurer’s radar.

- Adhere to medical advice: Taking medications as prescribed and attending regular doctor appointments shows stability and reduces your risk of complications.

- Quit tobacco: This is the single most powerful move you can make. Quitting can cut your premiums in half or more and dramatically reduces your health risks.

- Keep records: Document your health improvements, such as recent A1C results. This can help you qualify for a better policy.

The Advantage of Using an Independent Marketplace

Shopping for final expense for diabetics through a single company is like visiting only one car dealership. You might miss out on a better deal.

Every insurance carrier underwrites diabetes differently. One may penalize insulin use, while another is insulin-friendly. One might decline you for neuropathy, while another offers a competitive rate. Without comparing carriers, you could be leaving money on the table.

An independent marketplace like ShieldWise works with dozens of carriers. We compare quotes and underwriting guidelines across the market to find the companies most lenient with your specific health situation. Our licensed agents work for you, not an insurance company, to find the most suitable and affordable policy.

Preparing for the Application: Common Questions for Final expense for diabetics

Being prepared makes the application process smoother. Be ready to answer the following questions honestly and accurately:

- When were you diagnosed and with what type of diabetes (Type 1 or 2)?

- Do you use insulin, and what is your dosage?

- What are your current medications (for diabetes and related conditions)?

- What is your most recent A1C reading?

- Do you have complications like neuropathy (nerve damage), retinopathy (eye damage), or nephropathy (kidney disease)?

- Do you have a history of stroke, heart attack, or amputations?

- Have you ever experienced insulin shock or a diabetic coma? If so, when?

- Have you used tobacco (including vaping) in the last 12 months?

Honesty is crucial. Misrepresentation can lead to a denied claim or canceled policy. Once you’re approved, your policy is yours for life as long as you pay your premiums.

Frequently Asked Questions about Final Expense Insurance for Diabetics

Can I get immediate coverage if I use insulin for my diabetes?

Yes, absolutely. Many people with well-managed diabetes, even those on insulin, can qualify for level benefit plans with immediate, day-one coverage. Insurers are more concerned with how well your condition is controlled (e.g., stable A1C levels) and the absence of major complications than with insulin use alone. An “insulin-friendly” carrier will not penalize you for it.

How much more does it cost if I’m a diabetic who also smokes?

Expect to pay 2-3 times more than a non-smoking diabetic. The combination of diabetes and tobacco use creates a compounded health risk in the eyes of an insurer, placing you in a much higher risk category. While coverage is still obtainable, quitting tobacco is the best way to lower your rates. Many carriers offer non-smoker rates after just 12 months of being tobacco-free.

What happens if my diabetes gets worse after I buy the policy?

Nothing happens to your policy. This is a key benefit of final expense insurance. As long as you were truthful on your application and continue to pay your premiums, the insurance company cannot raise your rates, reduce your benefits, or cancel your coverage if your health declines. Your premium and death benefit are locked in for life, providing predictable and reliable peace of mind.

Secure Your Family’s Future Today

Shopping for insurance with diabetes and a history of tobacco use can feel daunting, but final expense for diabetics is real, accessible, and likely more affordable than you imagine.

Remember what’s most important: coverage exists for you, regardless of your specific situation. How well you manage your diabetes is the biggest factor in what you’ll pay. Quitting tobacco can dramatically improve your rates. Most importantly, working with an independent marketplace gives you the advantage.

ShieldWise™ isn’t tied to one company. We show you options from multiple carriers to find the one with the most favorable view of your health profile. We’ve seen clients get approved for immediate coverage at half the cost quoted elsewhere, simply by finding the right carrier.

Your family deserves the peace of mind that comes from knowing End of Life Expenses won’t become their burden. This is one final, powerful way to protect them.

Ready to see your options? Compare your final expense insurance options now with ShieldWise™. Get instant quotes and clear guidance to find the right coverage at the right price.