Why Final Expense Planning Matters for Families and Adult Children

Planning for final expense – family and adult children means having a loving but difficult conversation to ensure your parents’ end-of-life costs are covered, so your family isn’t left scrambling to pay for a funeral or medical bills.

Here’s what you need to know:

- Adult children can buy final expense insurance for parents – but only with the parent’s consent and signature

- Insurable interest is required – you must prove you’d face financial hardship if your parent passes away

- You can be the owner, payer, and beneficiary – this gives you control and protects your parent’s Medicaid eligibility

- Power of Attorney does NOT let you buy insurance without consent – your parent must actively participate in the application

- Final expense policies typically range from $5,000 to $25,000 – enough to cover funeral costs ($8,300 on average) plus related expenses

- Two main policy types exist: simplified issue (health questions, no waiting period) and guaranteed issue (no health questions, 2-year waiting period)

The harsh reality is that most seniors don’t have enough savings set aside for their own funeral. Without a plan, this financial burden typically falls on their children during an already emotional time.

Many adult children mistakenly assume their parents have a plan, only to find insufficient savings or expired policies later. This is why early conversations and understanding your options are crucial.

Final expense insurance is a type of whole life insurance for end-of-life costs. It’s often less expensive than traditional life insurance, usually requires no medical exam for seniors, and has fixed premiums that never increase. The death benefit is paid quickly to the beneficiary, bypassing probate, so funds are available when needed most.

The Financial Reality of Saying Goodbye

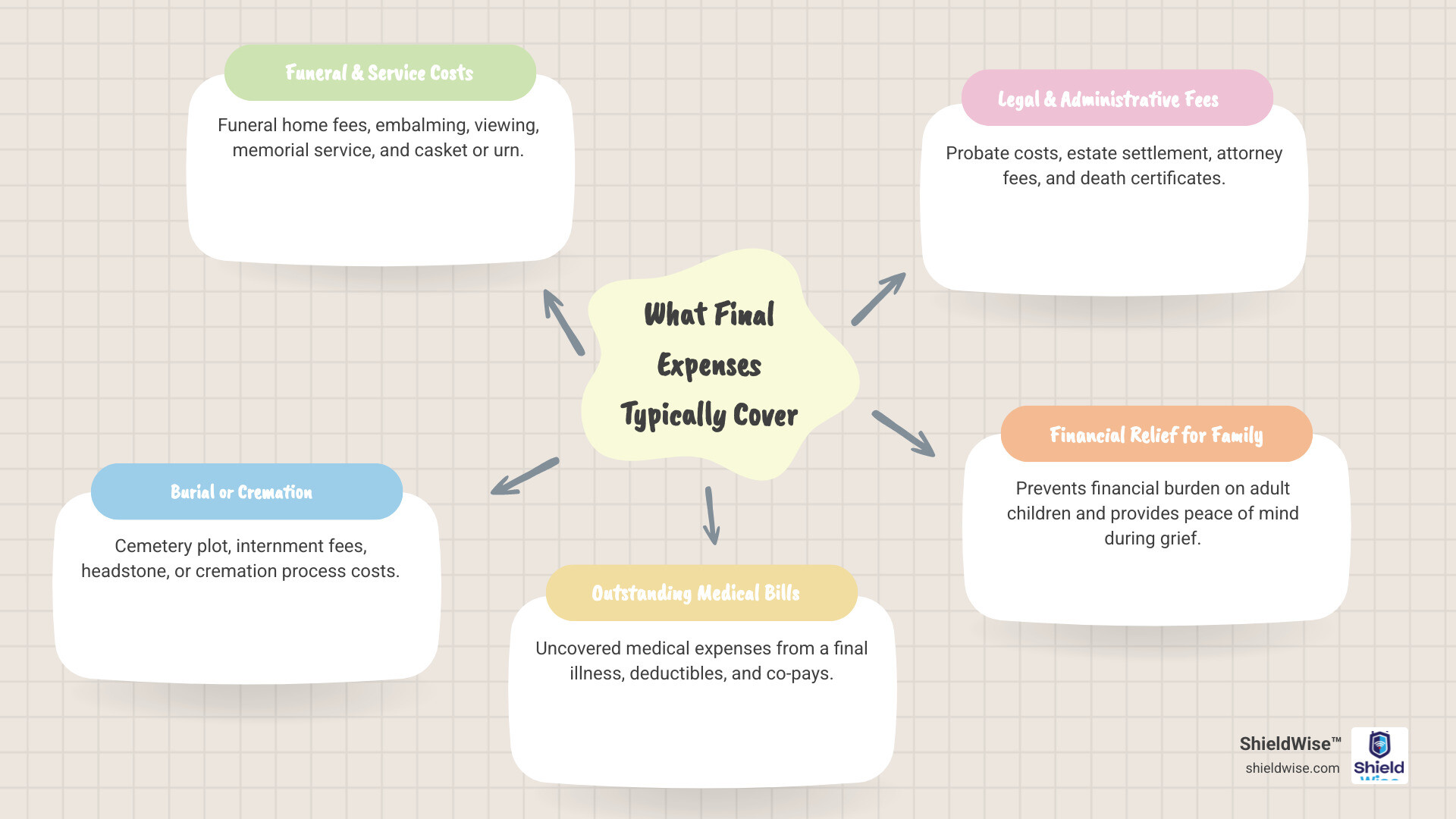

Saying goodbye is hard enough without the stress of unexpected costs. End-of-life arrangements can be surprisingly expensive, highlighting the value of planning for final expense – family and adult children.

Expenses go beyond the funeral, including medical bills, legal fees for estate settlement, and travel costs. Even with insurance, seniors can face large out-of-pocket bills. Without a plan, these costs can deplete savings or fall to adult children. Our guide on End of Life Expenses details these overlooked costs.

Understanding Today’s Funeral Costs

The cost of a funeral or cremation is a primary, rising concern for most families.

- The average cost of a funeral (including a viewing and burial with a vault) is approximately $9,995.

- The average cost of a funeral without a vault is around $8,300.

- For those considering cremation, the average cost is about $6,280 (this typically includes a viewing and memorial service).

- If a direct burial (without embalming or viewing) is chosen, the average cost drops to $5,128.

- A direct cremation (without a service) is the most economical option, averaging around $2,196.

These figures from the National Funeral Directors Association show how costs can escalate. See the NFDA cost study for details. The choice between burial and cremation greatly impacts the total, though both are substantial. Understanding these averages helps determine coverage needs. Learn more in What are Final Expenses?.

How Much Coverage Do Parents Really Need?

Determining the right coverage amount requires thoughtful estimation. Start with their preferences and add a buffer for unforeseen expenses.

Here’s a breakdown:

- For Cremation: If your parents prefer cremation, we generally recommend coverage between $7,000 and $10,000. This range accounts for direct cremation up to a cremation with a memorial service and other associated costs like an urn, death certificates, and flowers.

- For Burial: If a traditional burial is their wish, a coverage amount of $12,000 to $20,000 is often more appropriate. This covers the funeral home services, casket, cemetery plot, vault, opening/closing fees, and headstone.

- Adding a Cushion: Beyond the immediate funeral or cremation costs, it’s wise to consider an extra $2,000 to $5,000 as a cushion. This can cover unexpected medical bills, legal fees, or travel expenses for family.

- The Sweet Spot: For most families, a total coverage amount between $10,000 and $15,000 strikes a good balance between comprehensive protection and affordability. We aim for a practical amount that covers essential needs without over-insuring.

The goal is to balance adequate coverage with an affordable premium. To explore budget-friendly options, visit our Low Cost Final Expense guide.

Navigating Final Expense for Family and Adult Children: A Step-by-Step Guide

Securing final expense insurance for your parents is a thoughtful act, but it requires their involvement to ensure legality and ethical practice. We’re here to walk you through the process with transparency. For a comprehensive overview, check out our End of Life Insurance for Seniors guide.

Can an Adult Child Buy a Policy for a Parent?

Yes, an adult child can buy a final expense policy for a parent. It’s a common, responsible step to honor their wishes and prevent financial stress. However, there are two non-negotiable requirements:

- Parental Consent is Mandatory: Your parent must know about and agree to the policy, signing the application themselves. Buying a policy without their consent is insurance fraud and will invalidate it. Insurers are very strict on this point.

- Insurable Interest: This legal term means you would suffer a financial loss upon your parent’s death. For adult children, this is clear, as you would likely be responsible for funeral costs or medical bills. It’s about verifiable financial impact, not emotional loss.

In short, you cannot buy a policy in secret; it requires open communication with your parents.

Key Requirements for Final Expense – Family and Adult Children

When purchasing a policy for your parents, several key requirements ensure the process is smooth and legally sound:

- Parent’s Signature: The insured parent must sign the application, confirming their consent and understanding of the policy.

- Parent’s Health Questions: Your parent must answer health questions, even for simplified issue policies. The answers determine eligibility and premium rates.

- Mental Capacity: Your parent must have the mental capacity to understand the legal contract they are entering into and provide informed consent.

- Policy Ownership: This is a critical decision. If you, the adult child, own the policy, you have full control, and it will not count as a parental asset for Medicaid purposes. This is often the preferred setup.

- Naming a Beneficiary: Naming yourself as the beneficiary ensures the death benefit is paid directly to you, allowing you to manage final expenses.

- Who Pays the Premiums: The adult child can pay the premiums. It’s vital to choose an affordable premium to ensure the policy remains in force.

The Role of Power of Attorney (POA)

A common misconception is that having Power of Attorney (POA) for a parent lets you buy a life insurance policy on their behalf without their direct involvement. This is incorrect.

- POA Does Not Grant Authority for New Insurance: A POA allows you to act on your parent’s behalf in financial matters, but insurance companies almost universally require the insured’s direct consent and signature for a new policy.

- Consent is Still Needed: Even with a POA, your parent must participate in the application, answer health questions, and sign, provided they have the mental capacity. A POA is for managing existing affairs, not initiating new personal contracts without explicit consent.

- POA vs. Legal Guardianship: While a legal guardian might have broader authority for an incapacitated person, a standard POA does not supersede the need for the insured’s consent for a new life insurance policy.

Always remember that transparency and direct involvement from your parent are key to a valid and effective final expense policy.

Understanding the Nuts and Bolts of Final Expense Policies

Final expense insurance (or burial insurance) is a type of whole life insurance. It’s permanent, offering lifelong coverage as long as premiums are paid. Understanding its mechanics is key to an informed decision. For a deeper dive, see our Burial Insurance Complete Guide.

Here’s how these policies typically work:

- Whole Life Basis: It offers lifetime coverage and won’t expire as long as premiums are paid.

- Fixed Premiums: Your premiums are locked in and will never increase, providing budget predictability.

- Guaranteed Death Benefit: The death benefit amount is guaranteed and will not decrease.

- Cash Value Accumulation: Policies build a small amount of cash value over time, which can be a source for policy loans.

- Payout Procedures: The death benefit is paid quickly to the named beneficiary, usually bypassing the lengthy probate process.

Simplified Issue vs. Guaranteed Issue Policies

When considering final expense insurance, you’ll primarily encounter two main types:

| Feature | Simplified Issue | Guaranteed Issue |

|---|---|---|

| Health Questions | Yes (a few) | No |

| Medical Exam | No | No |

| Waiting Period | Generally no (full coverage from day 1) | Typically a 2-year waiting period |

| Cost | More affordable | More expensive |

| Ideal Candidate | Seniors with some health conditions | Seniors with serious health conditions |

- Simplified Issue Explained: This policy asks a few health questions but requires no medical exam. If approved, coverage usually begins immediately with no waiting period. It’s often the best option for most seniors, offering lower premiums and instant protection.

- Guaranteed Issue Explained: Acceptance is guaranteed regardless of health, with no health questions or medical exam. This is for those with significant health issues who can’t qualify for other insurance. The trade-offs are higher premiums and a mandatory waiting period.

- Graded Death Benefits: Some policies for higher-risk individuals have a “graded” death benefit. If death occurs in the first few years, the payout is limited to a percentage of the face value or a return of premiums plus interest, not the full amount.

Are There Waiting Periods?

Yes, waiting periods are a crucial aspect of guaranteed issue final expense policies.

- The 2-Year Waiting Period: Guaranteed issue policies have a standard two-year waiting period. If the insured dies from natural causes during this time, beneficiaries usually get a refund of all premiums paid, plus interest (e.g., 10%).

- Accidental Death Exception: If death is accidental during the waiting period, the full death benefit is usually paid out immediately.

- Why Waiting Periods Exist: Insurers use waiting periods to manage risk with guaranteed acceptance. It protects them from individuals buying a policy when they know their time is short.

- Why Policies with Health Questions are Often Better: If your parent can qualify for a simplified issue policy (with health questions), it’s usually preferable. These policies often offer full, immediate coverage with no waiting period and lower premiums.

Policy Riders and Special Considerations

- Child Insurance Riders: Some policies offer a rider to cover children or grandchildren, typically up to age 25. It’s often only cost-effective in specific situations.

- Accidental Death Benefit Riders: This rider increases the death benefit if the insured’s death is due to an accident.

- Medicaid Eligibility Impact: If the parent owns the policy, its cash value could affect their Medicaid eligibility. If the adult child is the owner, the cash value belongs to the child and generally doesn’t affect the parent’s eligibility.

- Finding Companies with High AM Best Ratings: Choose insurers with strong financial stability, indicated by high AM Best ratings (A- or better). This signals an insurer’s ability to pay claims. You can check ratings on AM Best’s website.

Common Mistakes and Best Practices

Navigating final expense insurance for parents can feel complex, but awareness helps you avoid pitfalls. Our goal is to empower you to make the best family decisions.

Top 5 Mistakes to Avoid

- Waiting Too Long to Purchase Coverage: The older your parents get and the more their health declines, the more expensive premiums become and the fewer options they’ll have.

- Underestimating Final Expenses: Guessing at funeral costs can lead to underinsurance, leaving your family with a shortfall.

- Not Understanding Waiting Periods: Assuming full coverage from day one is a costly error. Guaranteed issue policies almost always have a two-year waiting period for natural deaths.

- Forgetting to Inform Family Members/Beneficiaries: A policy is only useful if the beneficiaries know it exists and how to claim it.

- Choosing the Wrong Policy Owner: If the parent owns the policy, its cash value might affect Medicaid eligibility. If the adult child owns it, this concern is mitigated.

Best Practices for a Smooth Process

Proactive planning and clear communication are key to a successful final expense strategy:

- Have an Open Conversation: Approach your parents with empathy. Frame the discussion around honoring their wishes and protecting the family from financial burden.

- Involve Siblings: If you have siblings, involve them early to prevent misunderstandings and share the responsibility.

- Shop Around and Compare Quotes: Don’t settle for the first quote. We simplify this process by allowing you to Compare Final Expense Quotes from trusted carriers.

- Read the Policy Carefully: Understand the terms, conditions, waiting periods, and exclusions before purchasing.

- Store Documents in a Safe, Accessible Place: Ensure beneficiaries know where the policy documents are and how to access them.

Frequently Asked Questions about Final Expense Insurance for Parents

Here are answers to common questions from families exploring final expense insurance for parents.

Can a child be the policy owner, payer, and beneficiary on a parent’s policy?

Yes, and this is often the ideal setup for final expense – family and adult children. Here’s why:

- Policy Owner: The adult child has full control over the policy.

- Payer: The adult child can pay the premiums directly.

- Beneficiary: The adult child can be the beneficiary, ensuring the death benefit is paid directly to them to cover final expenses.

- Medicaid Eligibility: When the adult child owns the policy, its cash value does not count as an asset for the parent, which is crucial for protecting the parent’s eligibility for Medicaid.

What happens if we stop paying the premiums on our parent’s policy?

If premiums aren’t paid, the policy will lapse, meaning all coverage is lost. Premiums that have already been paid are not refunded. This highlights the importance of choosing a policy with affordable, sustainable premiums from the start.

What are the pros and cons of final expense – family and adult children?

Final expense insurance has pros and cons for final expense – family and adult children:

Pros:

- Peace of Mind: Prevents financial stress during grief for both parents and children.

- Covers Costs: Addresses the rising costs of funerals and related end-of-life expenses.

- Quick Payout: Benefits are paid quickly, often bypassing probate, so funds are available when needed.

- Easy Qualification: Simplified and guaranteed issue options make it accessible for seniors, even with health conditions.

- Fixed Premiums: Premiums are locked in and never increase.

- Cash Value: As a whole life product, it builds a small amount of cash value over time.

Cons:

- Higher Cost Per Dollar of Coverage: More expensive per dollar of coverage than term life because it’s for older individuals and is permanent.

- Limited Coverage Amounts: Face values ($5,000-$50,000) are lower than traditional life insurance and are meant for final expenses, not income replacement.

- Potential Waiting Periods: Guaranteed issue policies have a 2-year waiting period for natural deaths.

- Slow Cash Value Growth: Cash value accumulates very slowly and is not an investment vehicle.

Secure Your Family’s Future and Honor Your Parents’ Legacy

The conversation about final expense – family and adult children can be challenging, but it’s a loving, responsible step. Planning ahead safeguards your family’s emotional and financial well-being, ensuring your parents’ final wishes are honored.

Navigating these decisions can feel overwhelming. ShieldWise™ makes the process simple and transparent. We provide clear, jargon-free guidance to help you compare plans from trusted carriers, find the right coverage, and control costs.

Taking action now gives your parents peace of mind and provides your family with the support they need when it matters most. It’s an act of love that resonates for generations.

Contact us for a free consultation today, and let us help you find the perfect final expense – family and adult children solution.