- Your Life. Your Shield. Our Promise.

End of life insurance for seniors helps cover funeral costs, medical bills, and outstanding debts so your family doesn’t face financial hardship when you pass away. With the average funeral now costing over $8,300, this coverage is more important than ever.

Quick Comparison of Main Options:

| Policy Type | Best For | Medical Exam? | Typical Coverage | Average Monthly Cost (Age 75) |

|---|---|---|---|---|

| Simplified Issue | Seniors in fair health | No, health questions only | $10,000–$25,000 | $88–$113 |

| Guaranteed Issue | Seniors with health issues | No questions asked | $5,000–$15,000 | Higher premiums |

| Final Expense | Covering funeral/burial | Usually no exam | $10,000–$30,000 | $30–$70 |

Worrying about being a burden is common; over 60% of Americans buy life insurance for this reason. The good news is that coverage is accessible even with health issues, and premiums are locked in for life once approved.

Final expense insurance is a simplified whole life policy with a smaller death benefit and lower premiums than traditional life insurance. It offers straightforward coverage that pays beneficiaries quickly, without complicated investments or riders. Unlike employer-sponsored plans, these policies don’t expire upon retirement. They remain active as long as premiums are paid and often don’t require a medical exam.

Whether you’re 67 or 85, options exist. The key is understanding what type of policy fits your health, budget, and goals. This guide will help you figure that out.

At its core, end of life insurance for seniors is a small whole life insurance policy designed to handle the costs that come with your passing. It’s a financial safety net to ensure your family doesn’t have to empty their bank accounts or go into debt when you’re gone.

Here’s how it works: You choose a coverage amount, typically between $5,000 and $25,000, and pay a monthly premium that never changes. When you pass away, the insurance company sends a tax-free check to your beneficiary, often without waiting for probate. Because it’s a whole life policy, your coverage doesn’t expire as long as you pay your premiums. These policies also build a small cash value over time that you might be able to access.

Want to dive deeper into how these policies work? Check out our complete guide on final expense insurance.

You’ve probably seen these terms thrown around and wondered if there’s a difference. The good news is they are all interchangeable terms for the same product: a small whole life policy designed to cover your end-of-life expenses. Insurance companies use different names for marketing, but the core product is identical.

Final expense insurance was designed with seniors in mind, offering significant advantages:

Once your beneficiary receives the death benefit, they can use it for anything. While most people use it for immediate needs, your family has complete discretion. Common uses include:

If there’s money left over after covering these expenses, your beneficiaries can use it however they wish, whether for their own bills or as a small inheritance.

End of life insurance for seniors is designed to be affordable, with monthly premiums that are manageable for most seniors on a fixed income. On average, you can expect to pay between $30 and $70 per month for a final expense policy, but your actual cost will depend on several factors.

For example, a 75-year-old woman might pay around $88 per month for a $10,000 policy, while a 75-year-old man could expect to pay about $113 for the same coverage. Younger applicants in their 60s may pay as little as $18 per month.

Here’s a breakdown of sample monthly costs for a $10,000 policy:

| Age | Gender | Monthly Cost (Non-Smoking) |

|---|---|---|

| 65 | Female | ~$41 – $51 |

| 65 | Male | ~$56 – $70 |

| 75 | Female | ~$88 |

| 75 | Male | ~$113 |

| 85 | Female | ~$136 – $211 |

| 85 | Male | ~$183 – $286 |

Note: These are average estimates and actual rates will vary based on specific health conditions, provider, and state.

Insurance companies look at several key factors to determine your monthly premium:

Final expense policies are meant to cover end-of-life costs, not replace income. For this reason, death benefits are more modest than traditional life insurance.

Most policies offer coverage from $1,000 to $50,000, with most people choosing between $10,000 and $30,000. This range aligns well with the costs most families face. When choosing an amount, consider funeral costs, outstanding debts, and a small cushion for your beneficiaries. The goal is to provide enough coverage without paying for more than you need.

Not sure where to start? We can help you find out how much coverage you need based on your unique circumstances.

The application process for end of life insurance for seniors is much simpler than for traditional life insurance. You won’t need to schedule medical exams or have a nurse visit your home. Instead, most final expense policies use a streamlined underwriting process designed for seniors, recognizing that many have health histories that might complicate traditional applications.

When shopping for coverage, you’ll encounter two main policy types:

Simplified issue policies require you to answer a handful of health questions on your application. There’s no medical exam, but the insurer may verify your answers. If you’re in reasonably good health—perhaps with well-managed conditions like diabetes or high blood pressure—this is often the best option. If approved, your coverage typically starts immediately, providing the full death benefit from day one.

Guaranteed issue policies ask zero health questions. Acceptance is guaranteed regardless of your health history, even if you have serious conditions like cancer or COPD. The trade-offs are higher premiums and a graded death benefit, which means there’s a waiting period before the full benefit is paid for natural causes.

If you can qualify for a simplified issue policy, you’ll generally get better value. However, guaranteed issue provides a crucial safety net if you have serious health challenges.

Graded death benefits are a key feature of most guaranteed issue policies. They involve a waiting period, usually two or three years. If you die from natural causes during this period, your beneficiaries receive a return of the premiums you paid, often with interest (e.g., 110%). If death is accidental, the full benefit is typically paid immediately. Once the waiting period ends, the full death benefit is paid for any cause of death.

Nearly all life insurance policies also have a contestability period. This is a 12- to 24-month window where the insurer can investigate your application for fraud or misrepresentation, as outlined in the incontestability clause. If you were truthful on your application, this period is not a concern. The key takeaway is to always answer application questions honestly to ensure your beneficiaries receive the payout without issue.

Finding the right end of life insurance for seniors is about matching a policy to your specific needs and budget. You don’t need to be an expert, just follow a clear plan.

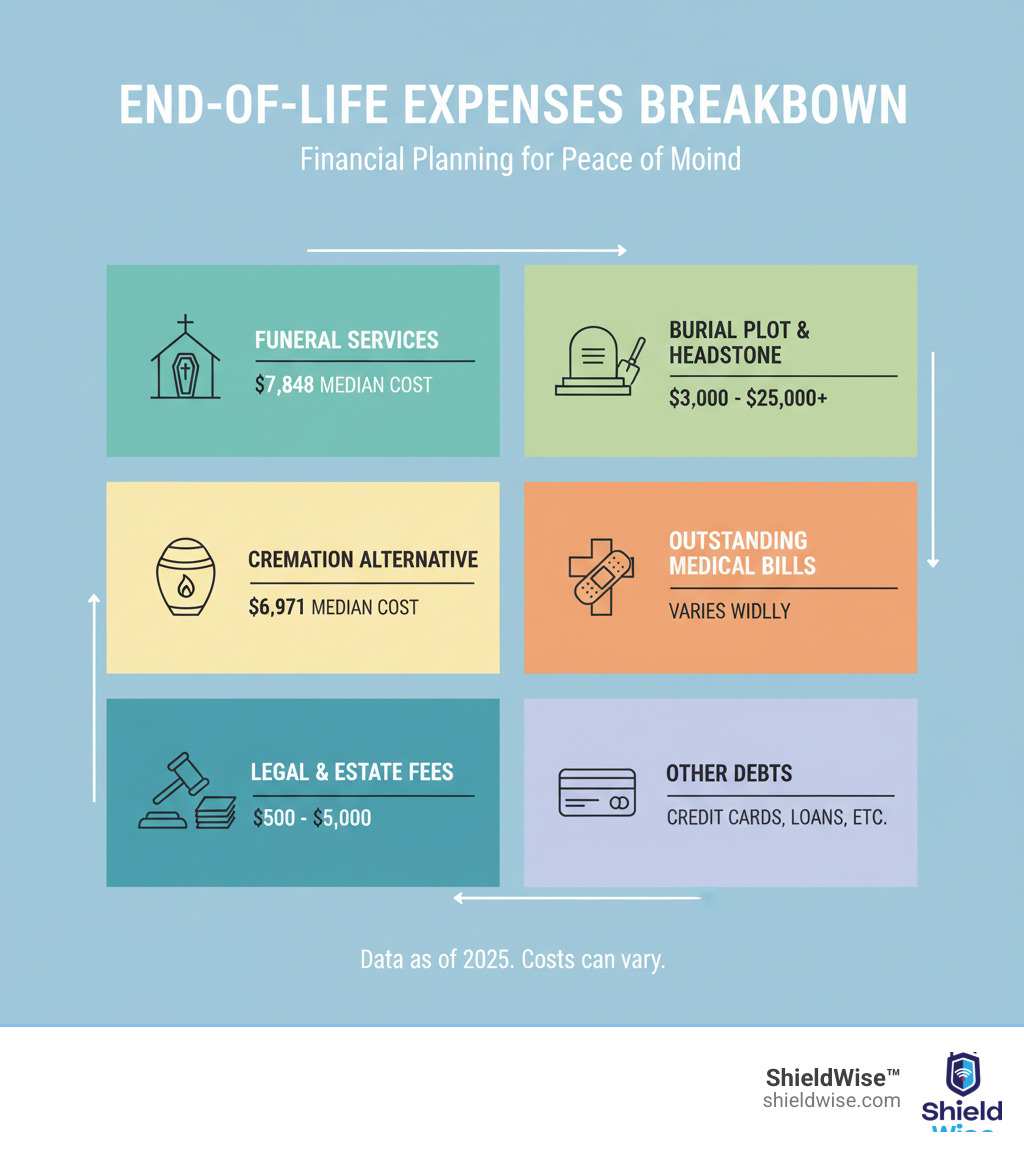

Start by calculating your potential final expenses. Tally up the estimated cost of the funeral or cremation you’d want, any outstanding medical bills, credit card balances, and other debts. Add a small cushion for unexpected costs to determine your target coverage amount. This helps you avoid paying for too much coverage or, worse, leaving your family underinsured.

Once you know how much coverage you need, follow these steps to find the right policy:

Yes, you can absolutely get end of life insurance for seniors after age 80, and some carriers offer coverage up to age 85 or even 90. However, your options become more limited and premiums will be significantly higher than for someone in their 60s or 70s.

Policies for older seniors are almost exclusively final expense whole life policies. You won’t need a medical exam, but guaranteed acceptance policies are generally unavailable after age 85. The math is simple: the earlier you apply, the more choices you have and the less you’ll pay. Waiting rarely works in your favor, as you may pass the maximum issue age for many policies.

Here are answers to some of the most common questions about end of life insurance for seniors.

Yes, you can purchase a policy for your parents, but there are two key requirements. First, you must have an “insurable interest,” meaning you would suffer a financial loss from their passing (which is a given for a child). Second, your parent must consent and participate in the application. They need to answer the health questions and sign the application. You cannot buy a policy on them without their knowledge and consent.

No. The death benefit from an end of life insurance for seniors policy is paid as a lump-sum cash payment. Your beneficiary has complete discretion on how to use the money. While it’s intended for funeral costs, it can also be used for medical bills, debts, or any other expenses. Any leftover money is theirs to keep. This flexibility is one of the policy’s most valuable features.

If you stop paying your premiums, your policy will eventually lapse, and your coverage will end. Before that happens, you may have options. Because these are whole life policies, they build a small cash surrender value over time, which you can receive if you surrender the policy.

Many policies also include an Automatic Premium Loan (APL) provision. If activated, this feature uses your policy’s cash value to pay missed premiums, keeping your coverage active. The loan accrues interest and reduces the final death benefit but can prevent a lapse.

Contact your insurance provider or agent immediately if you anticipate trouble with payments. They may be able to help you find a solution, such as reducing your coverage to lower your premium. You can also reach out to us to explore your options.

Planning for the end of life is difficult, but choosing end of life insurance for seniors is one of the most caring actions you can take for your loved ones. When you’re gone, your family will be grieving. The last thing they should worry about is finding thousands of dollars for a funeral or paying off final bills.

Final expense insurance removes that burden. It’s your way of providing peace of mind, a lasting gift that shows you cared enough to protect them. This is the real benefit: allowing your family to focus on healing, not finances.

We know comparing policies can feel overwhelming. ShieldWise™ exists to make this process simple. We provide honest guidance to help you find the right coverage for your budget, without confusing jargon or pressure.

Options are available whether you’re 67 or 87. The key is taking the first step now, while you have the most choices and can lock in the lowest premiums. Compare plans from trusted carriers and secure the right coverage today. It only takes a few minutes and can make all the difference for your family.

Your trusted source for navigating insurance with confidence and clarity. Expert insights, clear explanations, and smart guidance to help you choose the right insurance policies.