Why Comparing Medicare Supplement Plans Matters

When you compare Medicare supplement plans, you’re taking a crucial step toward managing your healthcare costs. Original Medicare (Parts A and B) covers many expenses, but it leaves gaps like deductibles, coinsurance, and copayments that can quickly add up. Medicare Supplement Insurance, also known as Medigap, is designed to fill those gaps.

Quick answer: To compare Medicare Supplement plans, focus on these key factors:

- Coverage Level: Plans are standardized by letter. Plan G offers the most coverage for new enrollees, while Plan N is a lower-cost option with small copays.

- Monthly Premium: Costs vary by location, age, and insurer, even for identical plans.

- Out-of-Pocket Costs: Plans range from covering all gaps to requiring cost-sharing through copays.

- Eligibility: Plans C and F are only available if you were eligible for Medicare before January 1, 2020.

- Enrollment Timing: Your six-month Medigap Open Enrollment Period guarantees acceptance without medical screening.

Medigap plans are sold by private insurance companies but are standardized by the federal government. This means a Plan G from one company offers the exact same benefits as a Plan G from another—price is the only difference. This simplifies comparison once you know what each plan letter covers.

At ShieldWise, we’ve guided hundreds of families through Medicare decisions, helping them compare Medicare Supplement plans to find coverage that fits their health needs and budget. Our mission is to cut through the confusion and help you make informed choices without sales pressure.

Understanding the Medigap Alphabet: Plans A through N

Navigating Medicare Supplement plans is simpler than it looks. There are 10 standardized Medigap plans, identified by the letters A, B, C, D, F, G, K, L, M, and N. Standardization is a major benefit, as a Plan A from one insurer has the exact same benefits as a Plan A from another. The only difference is the premium. This applies in Illinois and most other states (Massachusetts, Minnesota, and Wisconsin have different systems).

To learn more, check out our guide on Medicare Supplement and Medigap.

Here’s a breakdown of what each plan covers to help you compare Medicare supplement plans:

-

Plan A: The most basic plan. It covers Part A coinsurance and extra hospital costs, Part B coinsurance/copayment, the first three pints of blood, and Part A hospice care coinsurance.

-

Plan B: Includes all Plan A benefits plus the Medicare Part A deductible ($1,676 in 2024).

-

Plan C: A comprehensive plan covering the Part A and B deductibles, coinsurance, and more. However, Plan C is no longer available to new enrollees (those eligible for Medicare after January 1, 2020).

-

Plan D: Covers the Part A deductible, Part A and B coinsurance, skilled nursing facility care, and foreign travel emergencies. It does not cover the Part B deductible or Part B excess charges.

-

Plan F: The most comprehensive plan, covering all gaps in Original Medicare, including both Part A and Part B deductibles. Like Plan C, it is no longer available to new enrollees.

-

Plan G: The most comprehensive plan for new Medicare enrollees. It covers everything Plan F does except for the annual Medicare Part B deductible ($257 in 2025). It covers Part B excess charges and foreign travel emergencies.

-

Plan K: A cost-sharing plan with a lower premium (average $83/month). It covers 100% of Part A coinsurance but only 50% of most other benefits until you reach the annual out-of-pocket limit ($7,220 in 2025). After the limit is met, it pays 100%.

-

Plan L: Similar to Plan K but covers 75% of most benefits. It has a lower out-of-pocket limit ($3,610 in 2025), after which it pays 100%.

-

Plan M: Covers most benefits but requires you to pay 50% of the Part A deductible. It does not cover the Part B deductible or Part B excess charges.

-

Plan N: Offers a balance of coverage and lower premiums (average $121/month). It covers most gaps but requires small copayments for some office visits (up to $20) and ER visits (up to $50). It does not cover Part B excess charges.

Phased-Out Plans: C & F

You might hear about the comprehensive coverage of Plan C and Plan F, but they are not available to everyone. The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) mandated that as of January 1, 2020, Medigap plans could no longer cover the Part B deductible for new beneficiaries.

Since Plans C and F both covered this deductible, they were discontinued for anyone who became eligible for Medicare on or after that date. If you were eligible for Medicare before 2020, you might still be able to buy or keep one of these plans. For everyone else, Plan G is the most comprehensive option.

A Closer Look: Comparing the 3 Most Popular Medigap Plans

When people compare Medicare supplement plans, they often focus on three popular choices: Plan F (if eligible), Plan G, and Plan N. Together, these plans account for about 75% of all Medigap enrollments.

Medigap Plan G: The Best Coverage for New Enrollees

For new Medicare enrollees, Plan G is the most comprehensive option available. It provides extensive protection by covering nearly all the gaps in Original Medicare.

Here’s what makes Plan G stand out:

- Comprehensive Benefits: Plan G covers your Part A deductible and coinsurance, Part B coinsurance, skilled nursing facility care, the first three pints of blood, and hospice care coinsurance.

- Part B Deductible Exception: The only gap Plan G doesn’t cover is the annual Medicare Part B deductible ($257 in 2025). You pay this amount once per year for doctor visits and other outpatient services.

- Part B Excess Charges: Plan G covers Part B excess charges. These are extra fees (up to 15%) that some doctors charge above the Medicare-approved amount. This coverage protects you from unexpected bills.

- Foreign Travel Emergency: Plan G includes coverage for foreign travel emergencies, paying 80% of approved costs after a deductible.

- High-Deductible Plan G Option: A high-deductible version is available in some states for a lower premium (average $49/month). You pay for Medicare-covered costs up to a deductible ($2,950 in 2026) before the plan pays anything. This is a good choice if you want lower monthly payments and can handle a higher initial deductible.

Since every company’s Plan G is identical, when you compare Medicare supplement plans, you are simply shopping for the best price.

Medigap Plan F: The Old Gold Standard

Before 2020, Plan F was known as the “gold standard” because it covered all gaps in Original Medicare. After paying your premium, you typically had no other out-of-pocket costs for Medicare-approved services.

Key features of Plan F:

- Most Comprehensive Coverage: Plan F covers everything, including the Part A and Part B deductibles, all coinsurance, Part B excess charges, and foreign travel emergencies.

- Eligibility Restrictions: Plan F is only available if you were eligible for Medicare before January 1, 2020. If you became eligible on or after this date, you cannot enroll in Plan F.

- Higher Premiums: Due to its complete coverage, Plan F premiums are generally higher than other plans, costing about $40 more per month than Plan G on average.

- High-Deductible Plan F Option: A high-deductible version was also available for those eligible, requiring you to meet a deductible ($2,950 in 2026) before the plan paid.

For new enrollees, Plan G is the closest and most comprehensive option available.

Medigap Plan N: The Lower-Premium Alternative

If you want to compare Medicare supplement plans with lower monthly premiums, Plan N is a popular choice. It offers strong coverage but requires some cost-sharing, making it a budget-friendly option for healthier individuals.

Here’s how Plan N works:

- Lower Monthly Cost: Plan N premiums are typically lower than Plan G, averaging around $121 per month.

- Copayments: In exchange for lower premiums, you pay a small copayment for some office visits (up to $20) and emergency room visits (up to $50, waived if admitted).

- No Part B Excess Charge Coverage: Unlike Plan G, Plan N does not cover Part B excess charges. If your doctor charges more than the Medicare-approved amount, you are responsible for the difference. However, most doctors accept Medicare’s rate.

- Core Coverage: Despite the cost-sharing, Plan N provides solid protection, covering the Part A deductible, Part A and B coinsurance, skilled nursing facility care, and foreign travel emergencies.

How to Compare Medicare Supplement Plans and Enroll

Finding the right Medigap plan requires matching your health needs and budget with the right plan and enrollment window. This decision can significantly affect your healthcare costs for years.

Choosing and enrolling in Medigap can be complex, but we’re here to help. For a deeper look at the first steps, see our Medicare Basics Turning 65 guide.

Eligibility and Your Medigap Open Enrollment Period

Knowing when to enroll is critical for securing the best rates and avoiding denial based on your health.

- When You’re Eligible: You can buy a Medigap policy if you are 65 or older and enrolled in Medicare Part B.

- The Six-Month Window: The best time to enroll is during your Medigap Open Enrollment Period (OEP). This six-month window starts the first month you are 65 or older and have Part B.

- Guaranteed Issue Rights: During your OEP, you have “guaranteed issue rights.” This means insurers must sell you any Medigap policy they offer, regardless of your health. They cannot deny you coverage or charge you more because of pre-existing conditions. This protection from medical underwriting is a major advantage.

- Under-65 Rules: Some states, including Illinois, offer Medigap to people under 65 on Medicare due to disability. Protections can vary, so check with your State Insurance Department to confirm your rights.

Enrolling during your OEP is the best way to get the coverage you want at the best rate.

Key Factors to Compare Medicare Supplement Plans by Cost

While Medigap benefits are standardized, premiums vary widely. Here are the factors that influence cost:

- Premium Pricing Models:

- Attained-age rated: Premiums start lower but increase as you age. This is the most common model.

- Issue-age rated: Premiums are based on your age at purchase and won’t increase because you get older, but may rise with inflation.

- Community-rated: Everyone pays the same premium, regardless of age. Rates are stable but may start higher.

- Location: Premiums differ significantly by state and zip code.

- Gender: Some states allow for different premiums for men and women.

- Tobacco Use: Expect to pay more if you use tobacco.

- Household Discounts: Many companies offer a discount if you and your spouse both enroll.

- Insurance Company: Different insurers charge different rates for the exact same plan, so shop around.

When you compare Medicare supplement plans, get quotes from multiple carriers to find the best value.

Switching Plans and Guaranteed Issue Rights

You can switch Medigap plans later, but there are important rules to know.

- Medical Underwriting After OEP: Outside of your OEP, insurers in most states can use medical underwriting. They can review your health history and may deny you a policy or charge higher premiums. This is why the OEP is so important.

- Guaranteed Issue Rights: In certain situations, you have “guaranteed issue rights” to switch plans without medical underwriting. This means an insurer must sell you a policy. Common scenarios include:

- You move out of your plan’s service area.

- Your current Medigap company goes bankrupt.

- You lose other health coverage, such as from an employer.

- You joined a Medicare Advantage Plan for the first time and want to switch back to Original Medicare within 12 months.

Understanding these rights is crucial. Without them, switching plans could be difficult or expensive if your health has changed.

Medigap vs. Medicare Advantage: Choosing Your Path

One of the biggest Medicare decisions is choosing between Original Medicare with a Medigap plan or a Medicare Advantage (Part C) plan. These two paths offer different approaches to healthcare coverage.

Medigap: Freedom and Predictability

Pairing Original Medicare (Parts A and B) with a Medigap plan offers a straightforward and predictable way to manage healthcare costs.

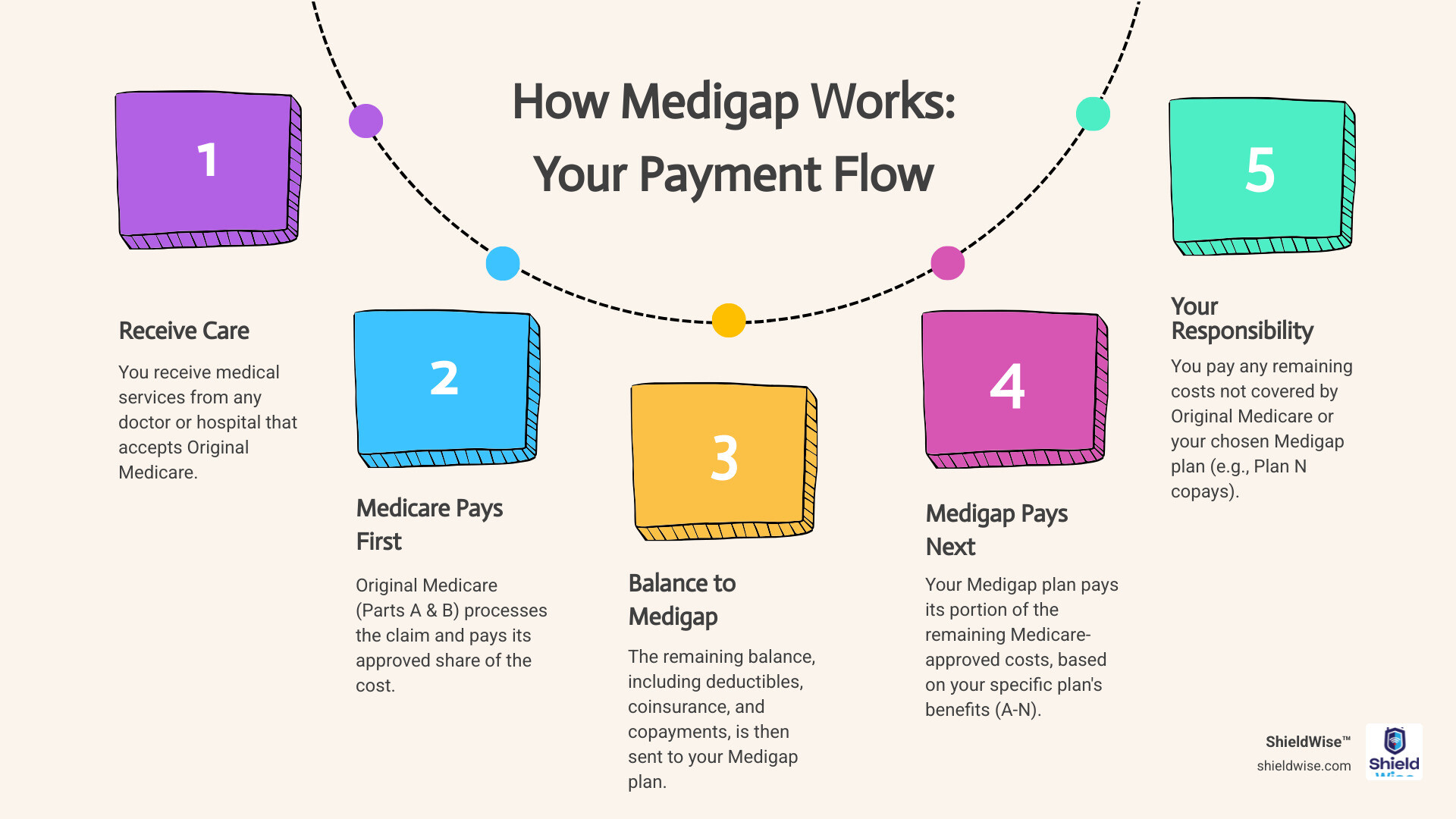

- Works with Original Medicare: Medigap pays after Original Medicare, covering costs like deductibles and coinsurance.

- See Any Doctor: With Original Medicare and Medigap, you can see any doctor or hospital in the U.S. that accepts Medicare. There are no provider networks or referral requirements, offering incredible flexibility. Around 93% of all U.S. primary care physicians accept Medicare.

- Predictable Out-of-Pocket Costs: Comprehensive plans like Plan G make your costs predictable. Your only major expenses are your monthly premium and the annual Part B deductible.

- Separate Part D Plan Needed: Medigap plans do not cover prescriptions. You must buy a separate Medicare Part D plan for drug coverage. Our guide on How Does Medicare Part D Work can help you understand your options.

- No Extra Benefits: Medigap plans generally do not include routine dental, vision, or hearing benefits.

This path is ideal for those who value provider freedom and predictable costs.

Medicare Advantage (Part C): All-in-One Convenience

Medicare Advantage (MA) plans, or Part C, are an all-in-one alternative to Original Medicare. Offered by private insurers, they bundle Part A, Part B, and usually Part D (drug coverage) into a single plan.

- All-in-One Plans: MA plans combine your hospital (Part A), medical (Part B), and often prescription drug (Part D) coverage.

- HMO/PPO Networks: Most MA plans use provider networks (HMOs or PPOs). You may need to use doctors and hospitals in the network for care to be affordable. Out-of-network care can be limited or more expensive.

- Extra Benefits: Many MA plans offer benefits not covered by Original Medicare, such as dental, vision, hearing, and gym memberships.

- Annual Out-of-Pocket Maximum: All MA plans have an annual out-of-pocket maximum. Once you hit this limit, the plan pays 100% of your covered costs for the year. This protects you from catastrophic costs, but your spending can vary more than with a Medigap plan.

- Referrals: Some plans (like HMOs) may require a referral from your primary doctor to see a specialist.

Medicare Advantage is a convenient, often lower-premium option if you are comfortable with provider networks and want bundled benefits. To learn more, visit our guide to Compare Medicare Advantage Plans.

Frequently Asked Questions about Comparing Medigap Plans

We know you have questions. Here are clear answers to help you compare Medicare supplement plans with confidence.

Which Medigap plan is the most popular?

While Plan F was historically the most popular, its restricted availability has shifted the landscape.

- Overall, Plan F remains the most common plan (nearly 4 in 10 policies) because many people who enrolled before 2020 have kept it.

- For new enrollees, Plan G is now the most popular choice. It offers the most comprehensive coverage available to anyone who became eligible for Medicare in 2020 or later.

Do Medigap plans cover prescription drugs?

No. Medigap plans are designed to fill cost-sharing gaps in Original Medicare (Part A and Part B) and do not include prescription drug coverage.

To get coverage for your medications, you must purchase a separate Medicare Part D Prescription Drug Plan. Enrolling in a Part D plan when you first become eligible is important to avoid potential late enrollment penalties.

Can I be denied a Medigap policy?

Yes, you can be denied a policy or charged more for health reasons if you apply outside of specific enrollment periods.

- During your Medigap Open Enrollment Period: In this six-month window (starting when you turn 65 and have Part B), insurance companies cannot deny you a policy or charge you more due to your health. You have guaranteed issue rights.

- Outside your Open Enrollment Period: If you apply at any other time, insurers in most states can use medical underwriting. They can review your health history and may deny your application, charge a higher premium, or impose a waiting period for pre-existing conditions.

There are some special circumstances (like losing other health coverage) that grant you “guaranteed issue rights” to buy a policy outside your OEP without medical underwriting. Always check if one of these situations applies to you.

Find the Right Coverage for Your Future

Choosing a Medigap plan is a personal decision, balancing the security of comprehensive coverage against the cost of monthly premiums. The key is to compare Medicare supplement plans based on your health needs, budget, and lifestyle. Decide if you prefer higher premiums for minimal out-of-pocket costs or lower premiums with some cost-sharing.

Medigap plans are standardized, so a Plan G is a Plan G, no matter which company sells it. This allows you to confidently shop for the best price from trusted carriers.

At ShieldWise, we understand that navigating these choices can be overwhelming. That’s why we’re dedicated to providing clear, jargon-free guidance. We help you compare plans from trusted carriers, get instant online quotes, and secure the right coverage in just a few clicks, empowering you to protect your family and control costs.

Your journey to understanding your Medicare options doesn’t have to be confusing. For a comprehensive overview, explore our Guide to Understanding Medicare Coverage Options. We’re here to help you find the coverage that fits your future, perfectly.