Why Peace of Mind Shouldn’t Cost a Fortune

How to fit final expense insurance into a fixed budget is a pressing concern for many retirees. The good news is that you don’t have to choose between covering your final wishes and paying your monthly bills. With the right strategies, you can find affordable coverage.

The average final expense policy costs between $30–$70 per month, and premiums never increase once you’re approved. For seniors on fixed budgets, that predictability makes planning possible.

The costs your family may face are real and rising. The median funeral with burial now exceeds $8,300, not including other potential costs like medical bills or travel for relatives. Final expense insurance is designed to cover these needs with level premiums and lifetime coverage, so your loved ones aren’t left scrambling.

At ShieldWise, we help retirees steer insurance options without sales pressure or confusing jargon. Our platform shows you transparent comparisons and guides you through how to fit final expense insurance into a fixed budget with strategies that work.

Understanding the Costs: What Are You Really Paying For?

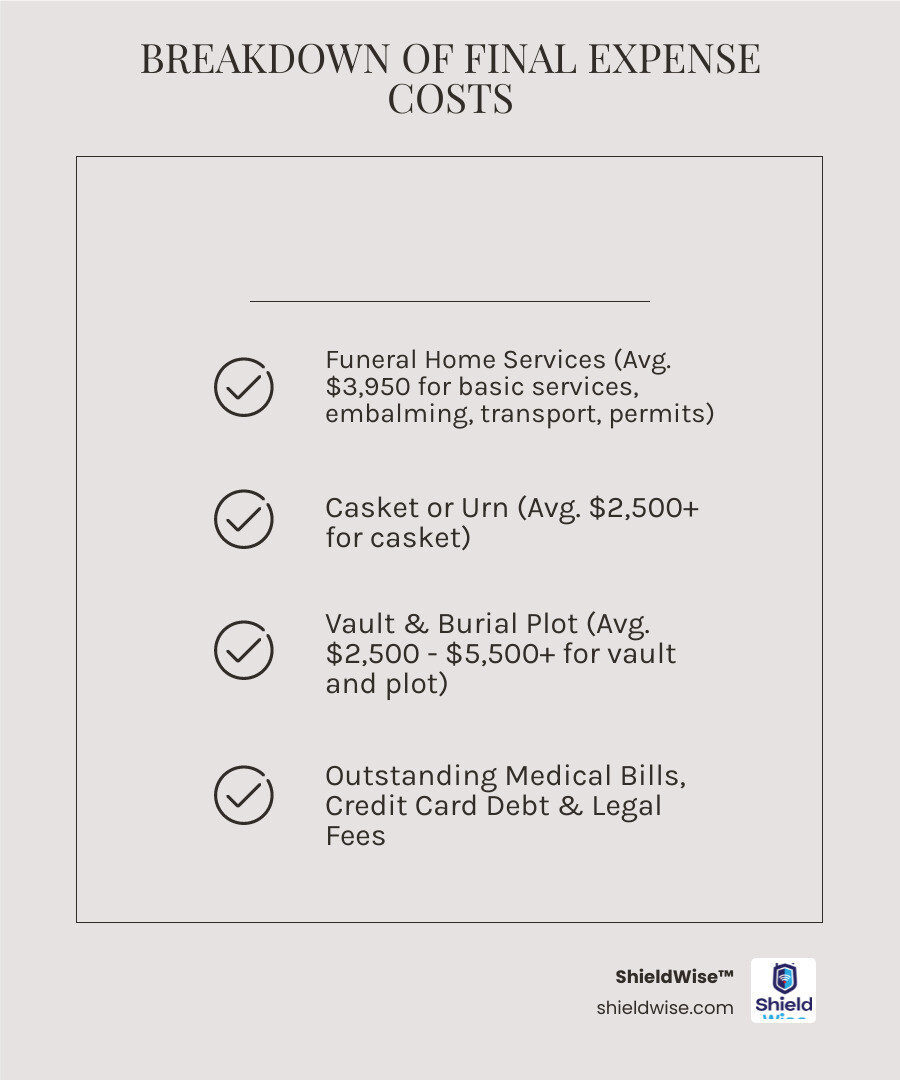

“Final expenses” include more than just funeral costs. They refer to all financial obligations left behind, such as medical bills, outstanding debt, and legal fees. These can create a heavy burden for grieving families.

According to the National Funeral Directors Association (NFDA), the median cost of a funeral with burial was about $8,300 in 2023, while cremation was around $6,280. These figures don’t include extras like a grave marker or memorial service.

Final expense insurance, also known as burial insurance, is a type of whole life insurance designed to cover these costs. Policies are for smaller amounts, typically $5,000 to $25,000, and are not meant for income replacement.

A key feature for those on a fixed budget is that premiums are fixed and level. Once your policy is approved, your payment will not increase, regardless of age or health changes. This predictability offers long-term peace of mind, and coverage lasts your entire life as long as premiums are paid. You can learn more in our guide to Final Expense Basics and Education.

What Final Expense Insurance Typically Covers

The payout from a final expense policy is a tax-free lump sum paid directly to your beneficiary. They have the flexibility to use the funds as needed.

Here’s what the death benefit can cover:

- Funeral and Burial/Cremation Costs: This includes the funeral home’s service fee, casket or urn, viewing, and ceremony.

- Unpaid Medical Bills: Many seniors have medical debt not fully covered by Medicare. This policy can help settle those balances.

- Legal or Administrative Fees: The payout can cover legal fees and probate costs associated with settling an estate.

- Credit Card Debt and Other Small Debts: It can help pay off smaller outstanding debts like credit cards or personal loans.

- Beneficiary Flexibility: Funds can also be used for family travel, living expenses, or other immediate needs. This flexibility provides a crucial financial cushion. We cover more on this topic in our article on End of Life Expenses.

How Premiums Are Calculated

Several factors determine your premium, but once it’s set, it’s locked in for life.

The main factors are:

- Age: The older you are when you apply, the higher your premium. Applying sooner saves money.

- Gender: Women typically pay less than men due to a longer life expectancy.

- Health Status: Better health generally leads to lower premiums. You’ll answer health questions for most policies, but a medical exam is not usually required.

- Coverage Amount: A higher death benefit means a higher premium.

- Policy Type: Simplified issue policies (with health questions) are usually cheaper than guaranteed issue policies (no health questions).

- No Rate Increases: A key benefit is that your premium is locked in for life. It will not increase as you age or if your health changes. This predictability is a cornerstone of how to fit final expense insurance into a fixed budget.

Understanding these factors helps you find an affordable policy. For personalized estimates, explore our Final Expense Cost and Quotes page.

How to Fit Final Expense Insurance into a Fixed Budget: 6 Smart Strategies

Living on a fixed income requires strategic planning, but final expense insurance can be affordable. There are several ways to make it fit your budget. Think of it as planting a seed of protection for your loved ones. For general advice, see this guide on How to Budget on a Fixed Income, and for specific solutions, visit Affordable Insurance Solutions for Retirees.

1. Accurately Calculate Your Coverage Needs

The first step is to determine what you need to avoid over-insuring.

Here’s how to calculate your needs:

- Itemize Your Funeral Wishes: Price out your preferences for burial or cremation. A funeral can cost over $9,000, while cremation averages around $6,280.

- Account for Existing Savings: Subtract any money you’ve already set aside for final expenses from your estimated costs.

- Consider the Social Security Death Benefit: Eligible survivors receive a one-time $255 payment, which can help offset costs.

- Factor in Other Debts: Add a small cushion for any outstanding medical bills, credit card debts, or utility bills.

- Avoid Income Replacement: Final expense insurance is for end-of-life costs, not to replace income for dependents.

This approach helps you choose a benefit amount that matches your actual needs, avoiding unnecessary premiums. For more resources, see How much life insurance do I need? and our guide on the Cost of Funeral Insurance.

2. Choose a Lower Coverage Amount

If the ideal coverage amount is out of reach, some coverage is far better than none.

- Focus on Essentials: If your budget is tight, aim to cover the minimum, such as the cost of a cremation. A $5,000 to $10,000 policy can prevent your family from going into debt.

- Partial Coverage is Powerful: Even a small policy makes a big difference. A $5,000 policy means your family has $5,000 less to worry about.

- Minimum Benefit Amounts: Many policies start as low as $2,000 or $3,000, offering a crucial first step for those with limited income.

- Review and Adjust: You can always explore increasing coverage later if your financial situation improves. The immediate goal is to secure essential protection.

We can help you explore Low Cost Final Expense options that provide meaningful protection without straining your budget.

3. Select the Right Policy Type for Your Fixed Budget

The two main types of final expense insurance are simplified issue and guaranteed issue. Your choice will significantly impact your premium.

- Simplified Issue Policies: This is the most budget-friendly option for those in reasonably good health. There is no medical exam, but you will answer a few health questions. Qualifying often means lower premiums and immediate coverage for natural death.

- Guaranteed Issue Policies: If you have significant health issues, this policy is a great option. Acceptance is guaranteed with no health questions or medical exam. The trade-off is higher premiums and a graded death benefit. This means if you pass away from natural causes in the first two or three years, your beneficiary typically receives a refund of premiums plus interest. Accidental death is usually covered from day one.

If your health allows, a simplified issue policy is more affordable. If not, a guaranteed issue policy still provides valuable protection. We explore more options on our Best Insurance Options for Seniors on Medicare and Fixed Income page.

4. Compare Quotes from Multiple Carriers

This is one of the most impactful strategies. Premiums for identical coverage can vary significantly between companies.

- Shop Around: Don’t take the first quote. Monthly premiums for the same $10,000 policy can range from $30 to $70 depending on the carrier.

- Benefits of an Independent Marketplace: As an independent marketplace, ShieldWise compares plans from multiple trusted carriers. This allows you to see side-by-side comparisons and find the best value.

- Ensure Apples-to-Apples Comparisons: When comparing, look at policies with the same coverage amount, policy type, and waiting period rules. Confirm that premiums are level for life.

Our platform lets you quickly Compare Final Expense Quotes to find a policy that fits your budget.

5. Adjust Your Payment Frequency

How often you pay your premiums can affect your total cost.

- Annual Payment Discounts: Many insurers offer a 3% to 5% discount for paying your premium in one annual lump sum. This can save you a significant amount over the life of the policy.

- Other Payment Options: Some companies also offer semi-annual or quarterly payments, which may also include small discounts.

- Monthly Payments: If a lump-sum payment isn’t feasible, monthly payments are always an option. The key is to choose a frequency you can consistently afford to prevent your policy from lapsing.

We can help you understand the different payment frequencies and discounts to better fit final expense insurance into a fixed budget.

6. Apply Sooner Rather Than Later

The younger and healthier you are when you apply, the lower your premiums will be for life.

- Lock in Lower Rates: Premiums are based on your age at application. By securing a policy now, you lock in a lower rate for life. Delaying even a year can noticeably increase your cost.

- Age-Based Pricing: Policies are available up to age 85, but the cost at 65 is significantly less than at 75. For example, a $10,000 policy for a 75-year-old woman could have a monthly rate of $72-$108.

- Securing Insurability: Applying earlier increases your chances of qualifying for a more affordable simplified issue policy. As you age, health conditions may arise that limit you to more expensive guaranteed issue options.

Taking action now can save you money and help you secure the best possible terms.

Weighing Your Options: Policy Types and Considerations

Understanding the available policy types is key to aligning your choice with your health and budget. Here’s a quick comparison:

| Feature | Simplified Issue | Guaranteed Issue |

|---|---|---|

| Medical Exam | No | No |

| Health Questions | Yes (a few questions) | No (acceptance guaranteed) |

| Cost | Generally lower premiums | Generally higher premiums |

| Waiting Period | Often no waiting period | Usually a 2-3 year graded death benefit |

| Best For | Those in relatively good health | Those with significant health issues |

If your health allows, a simplified issue policy offers the most value on a fixed budget. If not, guaranteed issue provides a safety net, though at a higher cost and with a waiting period. For more insights, visit our Final Expense Seniors on Fixed Income page.

Additional Planning Considerations

- Use Existing Savings to Supplement Coverage: If you can’t afford a policy for the full amount, use existing savings to bridge the gap. A $5,000 policy combined with $5,000 in savings can cover a $10,000 need. This is an effective way to fit final expense insurance into a fixed budget.

- Importance of Beneficiary Planning: Designate a beneficiary and ensure they know about the policy, where to find it, and your wishes for the funds. This prevents delays and ensures your intentions are honored.

- Ensuring Immediate Cash Availability: A key benefit is the quick payout, often within 24-48 hours of an approved claim. This is vital since funeral homes require prompt payment, and it avoids the long delays of settling an estate.

When to Prioritize Final Expense Insurance

Prioritizing this insurance is especially wise in certain situations:

- Limited Savings: If you lack savings for end-of-life costs, this insurance is a critical safety net to prevent your family from going into debt.

- Desire to Protect Family from Debt: A policy spares your family the stress of finding money for funeral costs and other debts while they are grieving.

- Health Conditions Limit Other Options: If health issues make you ineligible for traditional life insurance, final expense policies offer an accessible alternative with simplified or guaranteed issue options.

- Need for Immediate Cash: The quick payout guarantees funds are available for urgent costs, unlike an estate which can take months to settle.

In these cases, a policy provides foresight and care, allowing loved ones to focus on healing.

Frequently Asked Questions about Affordable Final Expense Insurance

We understand that navigating insurance options on a fixed budget can bring up many questions. Here are some of the most common ones we hear at ShieldWise, along with our expert answers.

What is the cheapest type of final expense insurance?

For those in relatively good health, simplified issue policies are typically more affordable than guaranteed issue policies. Answering a few health questions allows the insurer to assess risk more accurately, often resulting in lower premiums and no waiting period for the full death benefit. If you have significant health conditions, a guaranteed issue policy is a valuable, albeit more expensive, option.

Can my final expense insurance premium increase over time?

No. A key benefit of final expense whole life insurance is that the premiums are fixed. Once your policy is approved, your rate is locked in for life and will not increase, regardless of changes in your age or health. This predictability is ideal for anyone trying to fit final expense insurance into a fixed budget, providing immense peace of mind.

What happens if I can no longer afford my premiums?

If you can no longer afford your premiums, contact your insurance provider immediately to avoid having your policy lapse. Depending on your policy, several options may be available:

- Non-forfeiture Options: Many whole life policies allow you to retain value even if you stop payments. You might be able to convert your policy to a smaller, fully paid-up one (Reduced Paid-Up Insurance) or get term coverage for a limited time (Extended Term Insurance). You could also surrender the policy for its Cash Surrender Value.

- Reduce Coverage Amount: Your insurer may allow you to lower your death benefit, which would also lower your premium.

- Policy Loan: If your policy has cash value, you may be able to take a loan against it to pay premiums.

- Grace Period: All policies have a grace period (usually 30 days) to make a missed payment without losing coverage.

It’s best to discuss your situation with your insurer or an agent at ShieldWise to find the best course of action.

Secure Your Legacy Without Straining Your Budget

We understand that planning for the future, especially when managing a fixed budget, can feel daunting. But as we’ve explored, securing final expense insurance doesn’t have to break the bank. It’s a thoughtful, practical step that provides immense peace of mind, not just for you, but for the loved ones you leave behind.

By accurately assessing your needs, choosing the right policy type, comparing quotes, and making smart payment choices, you can effectively steer how to fit final expense insurance into a fixed budget. This small investment ensures that your family won’t face financial strain during a time of grief, allowing them to focus on healing and remembrance.

At ShieldWise, we’re dedicated to helping you protect your family and secure your financial future. Our platform offers a clear, jargon-free way to compare plans from trusted carriers, get instant online quotes, and receive guidance custom to your unique situation. We believe everyone deserves the peace of mind that comes with knowing their final wishes are taken care of.

Take the next step today. Let us help you find an affordable solution that fits your budget and provides lasting security for your loved ones.