Why Comparing Medicare Advantage Plans Is More Important Than Ever

Compare Medicare Advantage plans and you’ll join the minority—7 in 10 people on Medicare don’t take this critical step during open enrollment. That’s a costly mistake when you consider that more than half of all Medicare beneficiaries are now enrolled in Medicare Advantage plans, with 3,719 different options available nationwide in 2026.

Quick Answer: How to Compare Medicare Advantage Plans

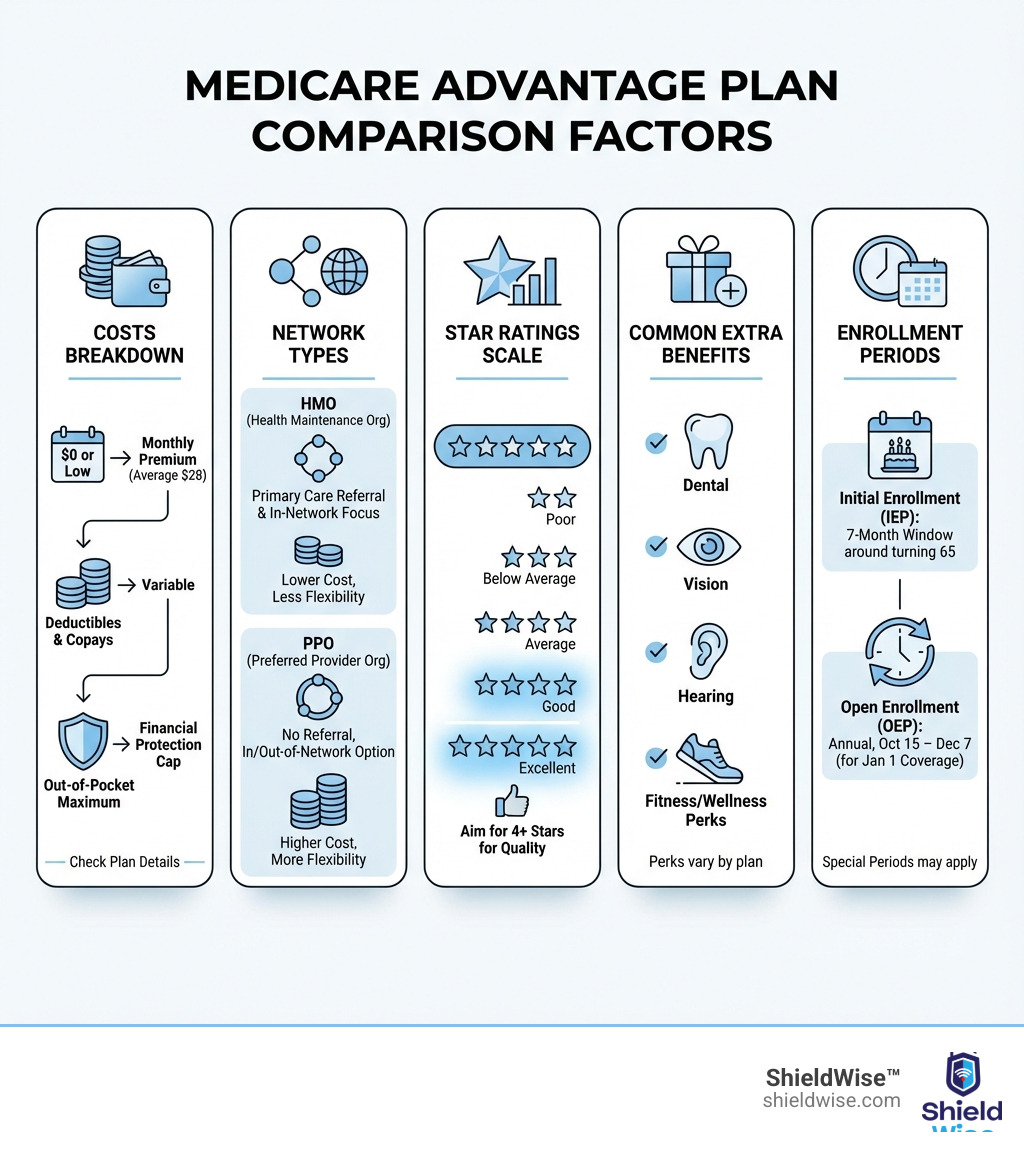

When comparing plans, focus on these key factors:

- Total Costs – Monthly premiums (averaging $28), deductibles, copays, and out-of-pocket maximums

- Provider Networks – Confirm your doctors and hospitals are in-network

- Prescription Drug Coverage – Check if your medications are covered and at what tier

- Star Ratings – Look for plans rated 4-5 stars by CMS for quality

- Extra Benefits – Evaluate dental, vision, hearing, and fitness perks

- Plan Type – Choose between HMO (lower cost, less flexibility) or PPO (higher cost, more flexibility)

The stakes are high. Medicare Advantage plans bundle your hospital care (Part A), doctor visits (Part B), and usually prescription drugs (Part D) into one package—often with $0 monthly premiums. But network restrictions mean you could pay much more if you see the wrong doctor, or need prior authorization before seeing specialists.

Here’s the challenge: Plans change every year. Your current plan might drop your medications, remove your favorite doctor from the network, or increase costs significantly. What worked last year might not work this year.

The good news? Armed with the right information, you can find a plan that protects both your health and your budget. Whether you’re turning 65 and choosing your first Medicare plan, or you’re already enrolled and looking to switch during open enrollment, understanding how to compare your options puts you in control.

Original Medicare vs. Medicare Advantage: Understanding Your Core Options

Navigating Medicare can feel like choosing between a wide-open road trip and a structured city tour. On one hand, you have the traditional, government-run Original Medicare. On the other, you have Medicare Advantage, a private alternative that bundles benefits. Understanding the fundamental differences is the first step to finding your perfect match.

Original Medicare is the government-run health plan for those 65 and older, consisting of Part A (hospital insurance) and Part B (medical insurance). Its main advantage is freedom of choice—it’s accepted by most doctors and hospitals nationwide, with no referrals needed. However, it only covers about 80% of medical costs after deductibles and lacks prescription drug coverage (Part D), extra benefits like dental or vision, and an annual out-of-pocket maximum. This means your costs could be unlimited.

Medicare Advantage plans (Part C) are a private insurance alternative. They must cover everything Original Medicare does, but they often bundle in Part D and extra benefits like dental, vision, hearing, and fitness programs. The trade-off for these perks and lower premiums is that most plans use provider networks, meaning you must use their doctors and hospitals. You may also need referrals and prior authorizations. A key benefit is that all Medicare Advantage plans have an annual out-of-pocket maximum, capping your yearly medical spending.

Pros and Cons of Medicare Advantage

Choosing between Original Medicare and Medicare Advantage involves weighing various factors that impact your healthcare experience and budget.

Advantages of Medicare Advantage:

- All-in-one plans: These plans conveniently bundle Part A, Part B, and often Part D (prescription drugs) into a single plan, simplifying your healthcare management.

- Lower upfront costs: Many plans have $0 monthly premiums (though you still pay your Part B premium), making them attractive for budget-conscious individuals.

- Extra benefits: Plans often include dental, vision, hearing aids, and fitness programs (like SilverSneakers), which can lead to significant savings.

- Out-of-pocket spending cap: All plans have an annual out-of-pocket maximum, offering financial protection against catastrophic health costs.

Disadvantages of Medicare Advantage:

- Provider networks: Most plans limit your choice of doctors and hospitals. Going out-of-network can be costly or not covered at all.

- Referrals for specialists: Many plans, especially HMOs, require a referral from your primary care physician (PCP) to see a specialist.

- Prior authorizations: Plans may require pre-approval for certain services, procedures, or medications before they are covered.

- Less flexibility when traveling: Routine care may be challenging or more expensive to access outside your plan’s service area, though emergency care is covered nationwide.

When to Consider Each Path

Deciding between Original Medicare and Medicare Advantage is a personal choice that depends on your health needs, financial situation, and lifestyle.

Choose Original Medicare if:

- You want maximum provider choice nationwide: You value the freedom to see any doctor who accepts Medicare without referrals.

- You travel frequently: Your coverage travels with you across the U.S. without network restrictions.

- You can afford a separate prescription drug and supplemental plan: You’ll need a standalone Part D plan for drugs and likely a Medigap plan to cover the 20% coinsurance and lack of an out-of-pocket maximum.

Choose Medicare Advantage if:

- You prefer predictable, lower monthly premiums: Many plans have $0 premiums, which can be a significant saving compared to paying for a Medigap plan.

- You want bundled benefits and an annual spending limit: You appreciate the convenience of an all-in-one plan with extra perks and a cap on your spending.

- Your preferred doctors are in-network: Your current doctors and hospitals are part of a plan’s network, and you’re comfortable with its rules.

Decoding the Alphabet Soup: Types of Medicare Advantage Plans

Just when you thought you understood the basics, Medicare Advantage introduces a whole new set of acronyms! These refer to different plan structures, each with its own rules about provider networks, referrals, and costs. Understanding these types is crucial when you compare Medicare Advantage plans to find the right fit.

The main types of Medicare Advantage plans you’ll encounter are Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-for-Service (PFFS), Special Needs Plans (SNP), and Medical Savings Account (MSA). Each is designed to cater to different healthcare preferences and needs.

HMO vs. PPO: The Most Common Choices

These two are the heavy hitters in the Medicare Advantage world, making up the majority of available plans.

-

Health Maintenance Organization (HMO):

- In-network care only: HMOs require you to use doctors and hospitals within the plan’s network, except for emergencies or urgent care.

- Primary Care Physician (PCP) required: You’ll typically need to choose a primary care doctor in the network.

- Specialist referrals needed: In most HMOs, your PCP must provide a referral to see a specialist.

- HMOs often have lower premiums and out-of-pocket costs, with an average monthly cost of around $16.

-

Preferred Provider Organization (PPO):

- In-network and out-of-network options: PPOs offer more flexibility, allowing you to see providers both in and out of the network.

- Higher costs for out-of-network care: You’ll pay less if you stay in-network; going out-of-network results in higher copayments or coinsurance.

- No referrals for specialists: You generally don’t need a referral to see a specialist.

- PPOs usually have higher premiums than HMOs (averaging around $28 for local plans) but offer greater flexibility.

Other Plan Types to Know

Beyond HMO and PPO, several other Medicare Advantage plan types address specific situations:

-

Private Fee-for-Service (PFFS):

- These plans let you see any Medicare-approved provider who accepts the plan’s payment terms. It’s crucial to confirm acceptance with your provider before receiving services.

- PFFS plans may or may not include prescription drug coverage.

-

Special Needs Plans (SNP):

- SNPs are designed for individuals with specific health needs or circumstances, such as those with chronic conditions (C-SNPs), those in nursing homes (I-SNPs), or those eligible for both Medicare and Medicaid (D-SNPs).

- All SNPs must offer prescription drug coverage (Part D) and often provide specialized care coordination.

-

Medical Savings Account (MSA):

- MSA plans combine a high-deductible health plan with a medical savings account funded by the plan. You use the account funds to pay for healthcare costs.

- These plans don’t charge a monthly premium (though you still pay your Part B premium) and generally don’t have provider networks.

- MSAs do not include Part D, so you may need to enroll in a separate Medicare drug plan.

How to Compare Medicare Advantage Plans: A Step-by-Step Guide

With thousands of Medicare Advantage plans available, finding the “best” one can feel daunting. The best plan for you is the one that aligns with your specific health needs, budget, and preferences. This guide will help you steer the options, often using online tools like the Medicare Plan Finder on medicare.gov.

Step 1: Compare Medicare Advantage Plans by Total Cost

While a $0 premium is appealing, it’s just one piece of the puzzle. To effectively compare Medicare Advantage plans, you must look at the full financial picture.

- $0 premium plans: Many plans offer a $0 monthly premium, and about three-quarters of Medicare Advantage members are in such plans.

- Average monthly premiums: The average monthly premium for Medicare Advantage plans was $28 in 2025, but plans can range from $0 to over $300.

- Deductibles, Copayments & Coinsurance: These are your costs when you receive care. A plan with a higher premium might have lower copayments, and vice-versa. Estimate your potential costs based on your expected healthcare needs.

- Annual out-of-pocket maximum: This is a critical feature that caps the most you’ll pay for covered medical services in a year. Once you hit this limit, your plan covers 100% of additional costs. Comparing this figure is essential for financial protection.

- Part B premium giveback: Some plans offer a “Part B giveback” benefit, where the plan pays a portion of your Medicare Part B premium, further reducing your monthly expenses.

Step 2: Verify Provider Networks and Prescription Drug Coverage

Your doctors and medications are central to your health. Ensure your chosen plan supports both.

- Doctor and hospital networks: Medicare Advantage plans use provider networks. If you have preferred doctors or hospitals here in Illinois, you must verify they are in-network before enrolling. Using an out-of-network provider can result in no coverage or much higher costs.

- Prescription drug formularies (drug lists): Most plans include prescription drug coverage (Part D). Check the plan’s formulary to ensure all your current medications are covered.

- Drug tiers and costs: Formularies categorize drugs into tiers, with lower tiers having lower copayments. Compare how your medications are tiered and what your estimated annual costs would be. The maximum annual Part D deductible is $615 in 2026, and Medicare will cover all prescription costs after you’ve paid $2,100 out of pocket in 2026.

- Preferred pharmacies: Many plans have preferred pharmacies where you can get prescriptions at a lower cost. Use tools on medicare.gov to enter your medications and pharmacies to compare costs accurately.

Step 3: Evaluate Quality Ratings and Supplemental Benefits to compare medicare advantage plans

Beyond costs and networks, plan quality and extra benefits can greatly improve your healthcare experience.

- Star Ratings: The Centers for Medicare & Medicaid Services (CMS) rates plans from 1 to 5 stars. These ratings reflect customer service, member complaints, and chronic condition management. We recommend looking for plans with 4 or 5 stars, as these are considered top-tier.

- Customer satisfaction scores: Beyond CMS stars, independent surveys like the J.D. Power U.S. Medicare Advantage Study measure customer satisfaction. It’s worth checking these studies for insights into member experience.

- Extra benefits: Many plans offer valuable supplemental benefits not covered by Original Medicare, which can save you money. These can include:

- Dental: Routine cleanings, X-rays, and sometimes more extensive procedures.

- Vision: Eye exams, glasses, and contacts.

- Hearing: Hearing exams and hearing aids.

- Fitness programs: Like SilverSneakers, offering gym memberships or fitness classes.

- Other perks can include transportation, healthy meal delivery, and over-the-counter allowances.

Navigating Enrollment: When and How to Choose Your Plan

Once you understand the types of plans and how to compare Medicare Advantage plans, the next crucial step is knowing when and how to enroll or make changes. Missing deadlines can lead to penalties or delays in coverage.

Key Medicare Enrollment Periods

- Initial Enrollment Period (IEP): This is your first chance to sign up for Medicare. It’s a 7-month window around your 65th birthday (three months before, the month of, and three months after). Enroll during this time to avoid potential late enrollment penalties for Part B. You must sign up for both Medicare Part A and Part B on the Social Security website (ssa.gov) regardless of your final plan choice.

- Annual Open Enrollment Period (OEP): This runs from October 15 to December 7 each year. During this time, you can switch between Original Medicare and Medicare Advantage, switch from one Advantage plan to another, or join/switch/drop a Part D plan. Changes take effect on January 1.

- Medicare Advantage Open Enrollment Period: This period runs from January 1 to March 31 each year. If you’re already in a Medicare Advantage plan, you can make one switch to a different Advantage plan or back to Original Medicare (and join a Part D plan).

- Special Enrollment Periods (SEPs): You may qualify for an SEP due to certain life events, such as moving, losing other health coverage, or qualifying for Extra Help.

Where to Get Unbiased Help

We understand that comparing Medicare Advantage plans can be complex. Fortunately, there are several resources available to provide free, unbiased assistance:

- State Health Insurance Assistance Program (SHIP): Your state’s SHIP counselors provide free, unbiased advice. You can find your local program at shiphelp.org.

- Nonprofit advocacy groups: Organizations like the Medicare Rights Center offer counselors who can help you understand your options.

- Licensed independent brokers: You can locate a local, independent insurance broker at nabip.org. These brokers can help you find your best options and guide you through the sign-up process.

- Medicare.gov: The official Medicare website, medicare.gov, is an invaluable tool. Its Medicare Plan Finder helps you compare coverage options, premiums, and deductibles for plans in your area.

Frequently Asked Questions about Comparing Medicare Advantage Plans

We know you’ve got questions, and we’ve got answers! Here are some common inquiries we hear when people are looking to compare Medicare Advantage plans.

What is the main difference between a Medicare Advantage plan and a Medigap plan?

This is a common point of confusion.

- Medicare Advantage (Part C) is an alternative to Original Medicare. It’s an all-in-one plan from a private insurer that bundles your Part A, Part B, and often Part D benefits. You get your Medicare benefits through this private plan.

- Medigap (Medicare Supplement) works with Original Medicare. It’s extra insurance you buy to help pay for out-of-pocket costs like deductibles and coinsurance that Original Medicare doesn’t cover. It does not include drug coverage or extra benefits.

The key takeaway: You cannot have both a Medicare Advantage plan and a Medigap plan. You must choose one path or the other.

Can I keep my current doctor if I switch to a Medicare Advantage plan?

This is a critical question to ask when you compare Medicare Advantage plans, especially if you have established relationships with providers here in Illinois.

- It depends on the plan’s network. Most Medicare Advantage plans (especially HMOs) require you to use doctors and hospitals within their network for your care to be covered.

- You must verify before enrolling. Always check the plan’s provider directory or call your doctor’s office directly to confirm they accept the plan you are considering.

- PPO plans may offer some flexibility with out-of-network coverage, but it will come at a higher cost.

Do all Medicare Advantage plans offer the same benefits?

No, they vary significantly. While all plans must cover the same services as Original Medicare (Part A and Part B), that’s where the similarities end.

- Costs differ: Plans have different premiums, deductibles, copayments, and out-of-pocket maximums.

- Networks differ: The list of in-network doctors and hospitals varies from plan to plan.

- Drug coverage differs: Each plan has its own formulary (list of covered drugs) and cost structure.

- Extra benefits differ: The type and amount of extra benefits like dental, vision, and hearing coverage vary widely between plans.

It’s crucial to look beyond the basics and compare the specific details of each plan to find the best fit for your needs.

Find the Best Medicare Advantage Plan for Your Needs

We’ve explored the landscape of Medicare Advantage, from understanding its core differences with Original Medicare to decoding the various plan types and laying out a step-by-step guide for comparison. We’ve armed you with the knowledge to steer costs, verify provider networks, assess prescription drug coverage, and evaluate quality ratings and supplemental benefits. Remember the key enrollment periods and where to turn for unbiased help.

Choosing the right Medicare Advantage plan is a deeply personal decision. It’s about balancing your healthcare needs, your budget, and your preferences for flexibility and convenience. Don’t fall into the trap of not comparing your options; your health and financial well-being depend on it.

At ShieldWise™, we believe in providing clear, jargon-free guidance so you can protect your family, control costs, and secure the right coverage. We’re here to be your partner in navigating Medicare choices, making the complex simple.

Ready to explore your options and find your perfect match? Visit us today.

https://shieldwise.com/