Why Affordable Insurance Matters When You’re on a Fixed Income

Affordable insurance solutions for retirees can feel out of reach when you’re living on Social Security and a small pension. But here’s the truth: you have more options than the commercials and mailers make it seem.

Quick Answer: Your Most Affordable Insurance Options as a Retiree

- Final Expense Insurance – Covers funeral and burial costs; no medical exam, low premiums (often $30–$100/month)

- Medicare Supplement (Medigap) – Fills gaps in Original Medicare; plans like High-Deductible Plan G or Plan N offer lower monthly costs

- Medicare Advantage – Alternative to Original Medicare; often includes dental, vision, and drug coverage with $0 premiums

- Guaranteed Issue Life Insurance – Accepts anyone up to age 85, regardless of health; small coverage amounts for final expenses

- State Assistance Programs – Medicaid, Medicare Savings Programs (MSPs), and Extra Help can reduce or eliminate premiums if you qualify

Retirement should bring peace, not financial panic. But according to recent data, Canadians aged 65 and older use around 45% of public healthcare funds while making up only 18% of the population. In the U.S., 5.6 million adults ages 50 to 64 remained uninsured as of 2021.

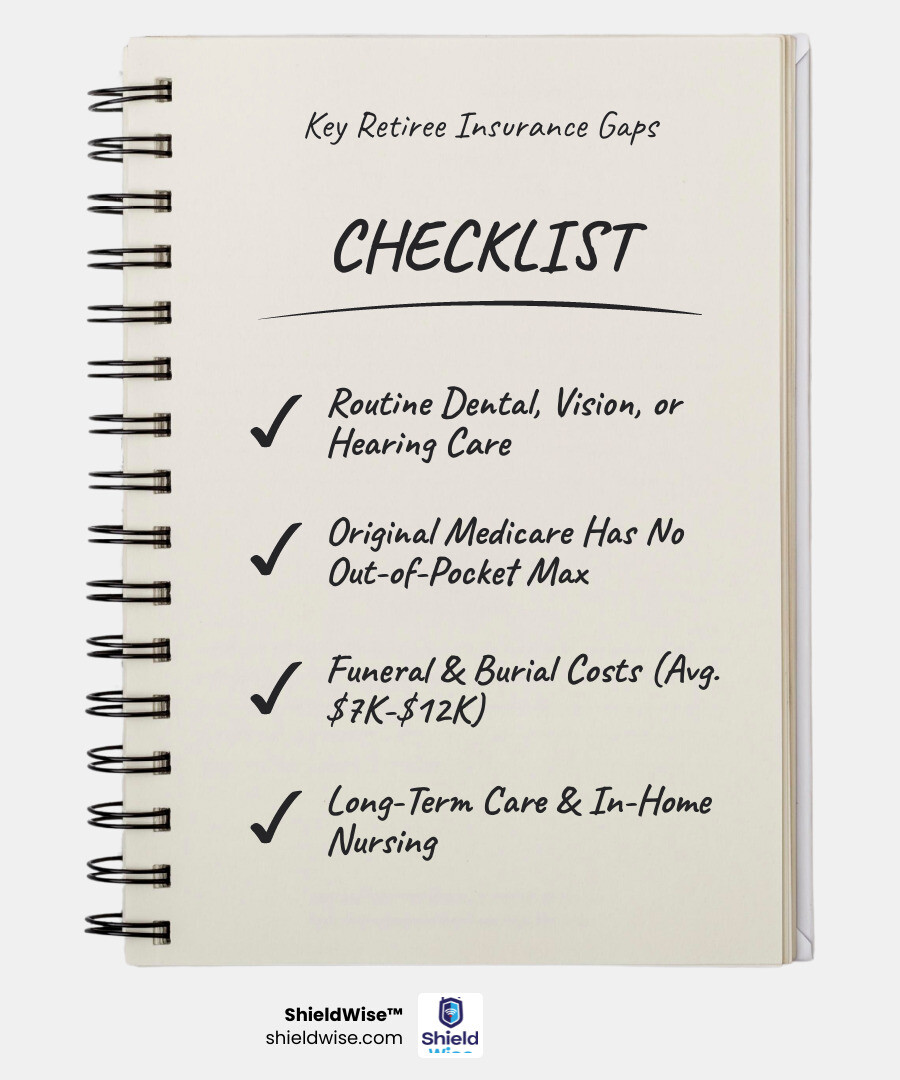

The problem? Government health plans don’t cover everything. Medicare doesn’t pay for most dental work, vision care, or hearing aids. And if you pass away unexpectedly, your family could face funeral bills of $7,000 to $12,000—or more.

That’s where the right insurance comes in. You don’t need expensive, complicated policies. You need coverage that fits your budget and protects the people you love from surprise bills.

In this guide, we’ll walk you through the types of insurance that matter most in retirement, how to find plans you can actually afford, and what to do if you’ve been told you’re “too old” or “too sick” to qualify. No jargon, no pressure—just clear answers.

Understanding the Most Important Insurance Types for Retirees

As we gracefully enter our golden years, our needs change, and so do our insurance priorities. The types of insurance most important for retirees to consider generally fall into two main categories: health and life. These aren’t just about covering costs; they’re about protecting our assets, maintaining financial stability, and providing peace of mind for ourselves and our loved ones.

Think of it this way: While Medicare provides a solid foundation for health coverage, it doesn’t cover everything. These gaps can lead to significant out-of-pocket expenses if we’re not prepared. Similarly, while we might think of life insurance as primarily for younger families, it takes on a new, crucial role in retirement, particularly for final expenses and estate planning.

The reality is that 29% of Americans paid $1000 out of pocket in the past 12 months for health or dental-related services, and 9% paid over $3000. These statistics highlight why relying solely on government programs can leave significant financial vulnerabilities. We need to be proactive in finding affordable insurance solutions for retirees to avoid these pitfalls.

For more insights on managing healthcare costs, you can refer to A guide to saving on health care costs.

Health and Dental Insurance: Covering Your Wellness

One of the biggest concerns for many retirees is healthcare. Our health needs often increase with age, and the costs associated with them can quickly add up. While Medicare is a lifesaver, it has its limitations. This is where private health and dental insurance step in, offering crucial advantages and benefits.

The main advantages of private health insurance for retirees include:

- Filling Medicare Gaps: Original Medicare (Parts A and B) doesn’t cover everything. Private plans, like Medigap or Medicare Advantage, can help cover deductibles, copayments, and coinsurance.

- Comprehensive Coverage: Many private plans include benefits for prescription drugs, dental care, vision care, and even paramedical services (like physical therapy or chiropractic care) that Original Medicare typically excludes.

- Predictable Costs: By paying a monthly premium for a private plan, we can budget for healthcare costs more effectively, protecting our savings from unexpected, large medical bills.

- Peace of Mind: Knowing we have comprehensive coverage for a wide range of services reduces stress and allows us to focus on enjoying retirement.

How can retirees ensure they have adequate coverage for prescription drugs, dental, and vision care?

This is a critical question. For prescription drugs, Medicare Part D plans or Medicare Advantage plans (which often bundle Part D) are essential. For dental and vision, many Medicare Advantage plans include these benefits, or we can purchase standalone dental and vision policies. These plans help cover routine check-ups, fillings, glasses, contacts, and even more extensive procedures that can otherwise be quite costly.

For those turning 65 and navigating Medicare for the first time, our guide on Medicare Basics: Turning 65 can provide a helpful starting point.

Life Insurance: Protecting Your Legacy and Loved Ones

Life insurance for seniors isn’t about replacing income for young children anymore; it’s about protecting our loved ones from financial burdens after we’re gone and ensuring our legacy. The key benefits of life insurance for seniors include:

- Covering Final Expenses: This is perhaps the most immediate and practical benefit. Funeral, burial, and cremation costs can be substantial, often ranging from $7,000 to $12,000. A final expense policy ensures our family isn’t left scrambling to cover these costs during a difficult time. You can learn more about these costs in our article on End of Life Expenses.

- Estate Planning: Life insurance plays a vital role in estate planning by providing a tax-free death benefit that can be used to pay estate taxes, equalize inheritances among beneficiaries, or leave a financial gift to children, grandchildren, or even a favorite charity.

- Income Replacement for a Spouse: If our retirement income includes a pension that doesn’t have survivor benefits, life insurance can provide a financial safety net for our surviving spouse, allowing them to maintain their standard of living.

- Debt Repayment: We might still have outstanding debts in retirement, such as a mortgage, credit card balances, or personal loans. Life insurance can ensure these debts are paid off, preventing them from becoming a burden on our heirs.

- Leaving an Inheritance: For many, life insurance is a simple and effective way to leave a financial legacy, even if our other assets are tied up or limited.

Understanding what burial insurance entails can also be very helpful in this context, so we recommend checking out What is Burial Insurance?.

Navigating Your Options for Affordable Insurance Solutions for Retirees

Finding the right affordable insurance solutions for retirees can feel like a treasure hunt, but with the right tools and guidance, it doesn’t have to be. We have more resources than ever to compare plans, understand policy details, and balance premiums with adequate coverage.

The advantages of using insurance calculators or consulting with advisors for retirement planning are immense. Calculators can give us a quick estimate of how much coverage we might need or what premiums could look like, helping us set a budget. Advisors, on the other hand, offer personalized guidance, helping us steer complex options and tailor solutions to our unique circumstances. They can explain the nuances of different policies and identify plans that truly fit our needs and budget.

When choosing between starting insurance online versus talking to an advisor, consider this: If our needs are straightforward and we’re comfortable with online research, starting online with quote comparisons can be efficient. However, if we have complex health conditions, multiple financial goals, or just prefer a human touch, an advisor can be invaluable. We often find that a combination of both works best – using online tools for initial research and then consulting with an expert for clarification and personalized recommendations.

Finding Affordable Health Coverage

For retirees in Illinois, navigating health insurance options means understanding Medicare and its supplements. Original Medicare covers much, but not all, of our healthcare costs. This leaves “gaps” that can become expensive. Fortunately, there are several affordable insurance solutions for retirees to fill these gaps:

- Medicare Supplement (Medigap) Plans: These plans, offered by private companies, work with Original Medicare to pay for some of the out-of-pocket costs like deductibles, copayments, and coinsurance. While they don’t offer extra benefits like dental or vision, they provide predictable cost-sharing. For low-income seniors, certain Medigap plans are particularly affordable. Depending on your location, age, and gender, you may find plans with monthly premiums starting as low as $40-$60. Some providers also offer household discounts, which can further reduce costs. For individuals first eligible for Medicare on or after January 1, 2020, High-Deductible Plan F is not available. High-Deductible Plan G is often the most affordable choice for those who are healthy and want lower monthly premiums, accepting higher out-of-pocket costs if care is needed. You can get more information on Get Medigap Basics.

- Medicare Advantage (Part C) Plans: These are alternative plans to Original Medicare offered by private companies approved by Medicare. They often include extra benefits like vision, hearing, dental, and prescription drug coverage (Part D) in one plan. Many Medicare Advantage plans have $0 monthly premiums, though we still pay our Part B premium. It’s crucial to check the network and coverage details as they can vary significantly.

- Affordable Care Act (ACA) Marketplace: For early retirees (under 65) who aren’t yet eligible for Medicare, the ACA Marketplace (Healthcare.gov) is a vital resource. If our income is below 400% of the poverty level, we may qualify for subsidies that significantly reduce our monthly premiums. Even if our income is higher, households with incomes above 400% of the poverty level won’t pay more than 8.5% of their income for a benchmark ACA policy through 2025. Losing job-based coverage (due to retirement) qualifies us for a Special Enrollment Period on the Marketplace.

- Medicaid: This joint federal and state program provides health coverage to low-income individuals, including older adults. Eligibility and coverage vary by state, so it’s important to check Illinois’ specific guidelines. If we qualify for both Medicare and Medicaid, Medicaid can help cover Medicare’s out-of-pocket costs.

- Medicare Savings Programs (MSPs): These state-level programs help low-income Medicare beneficiaries pay for Medicare Part A and/or Part B costs, including premiums, deductibles, coinsurance, and copayments. There are different types of MSPs with varying income and resource limits.

- Extra Help: This federal program assists with Medicare Part D (prescription drug) costs for low-income individuals. It can significantly reduce or eliminate prescription drug premiums, deductibles, and copayments.

Comparing Life Insurance Policies for Seniors

Choosing a life insurance policy in retirement means considering our age, health, and financial goals. What worked for us in our 30s might not be the best fit now. There are several types of life insurance, each with unique benefits for seniors.

Here’s a comparison of the main types:

| Policy Type | Best For | Pros | Cons -|

| Term Life Insurance | Affordable, temporary coverage for specific needs like mortgage protection or income replacement for a set term. | Lower premiums, simple to understand. | Coverage is for a limited time; no cash value. -|

| Whole Life Insurance | Lifelong coverage with a cash value component that grows over time. Good for estate planning and final expenses. | Permanent coverage, builds cash value, fixed premiums. | Higher premiums than term life. -|

| Guaranteed Issue Life | Seniors with significant health issues who may not qualify for other types of insurance. | No medical exam required, guaranteed acceptance. | Higher premiums for lower coverage amounts; typically has a graded death benefit (full payout only after 2-3 years). -|

For those looking for more flexibility, Universal Life Insurance offers a permanent policy with adjustable premiums and death benefits. A popular variation is Indexed Universal Life (IUL), which you can learn more about in our guide, What is IUL?. When choosing, consider your age, health, and financial goals to find the perfect fit.

How to find affordable insurance solutions for retirees online

Finding the right insurance doesn’t have to be complicated. Online tools have made it easier than ever to compare options from the comfort of your home.

- Use Insurance Calculators: Get a quick estimate of your coverage needs and potential costs.

- Explore Online Marketplaces: Websites like ShieldWise allow you to compare plans from multiple carriers side-by-side.

- Get Instant Quotes: Many providers offer instant, no-obligation quotes online, helping you understand your options quickly.

- Compare Carriers: Look at different insurance companies to see who offers the best rates and features for your situation.

- Advisor Consultation vs. Self-Service: Decide if you prefer the personalized guidance of an advisor or the convenience of managing your policy online. At ShieldWise, we offer both.

Ready to see your options? Compare Final Expense Quotes with our easy-to-use tool.