Why How to Prioritize Insurance Coverage on Limited Income Matters More Than Ever

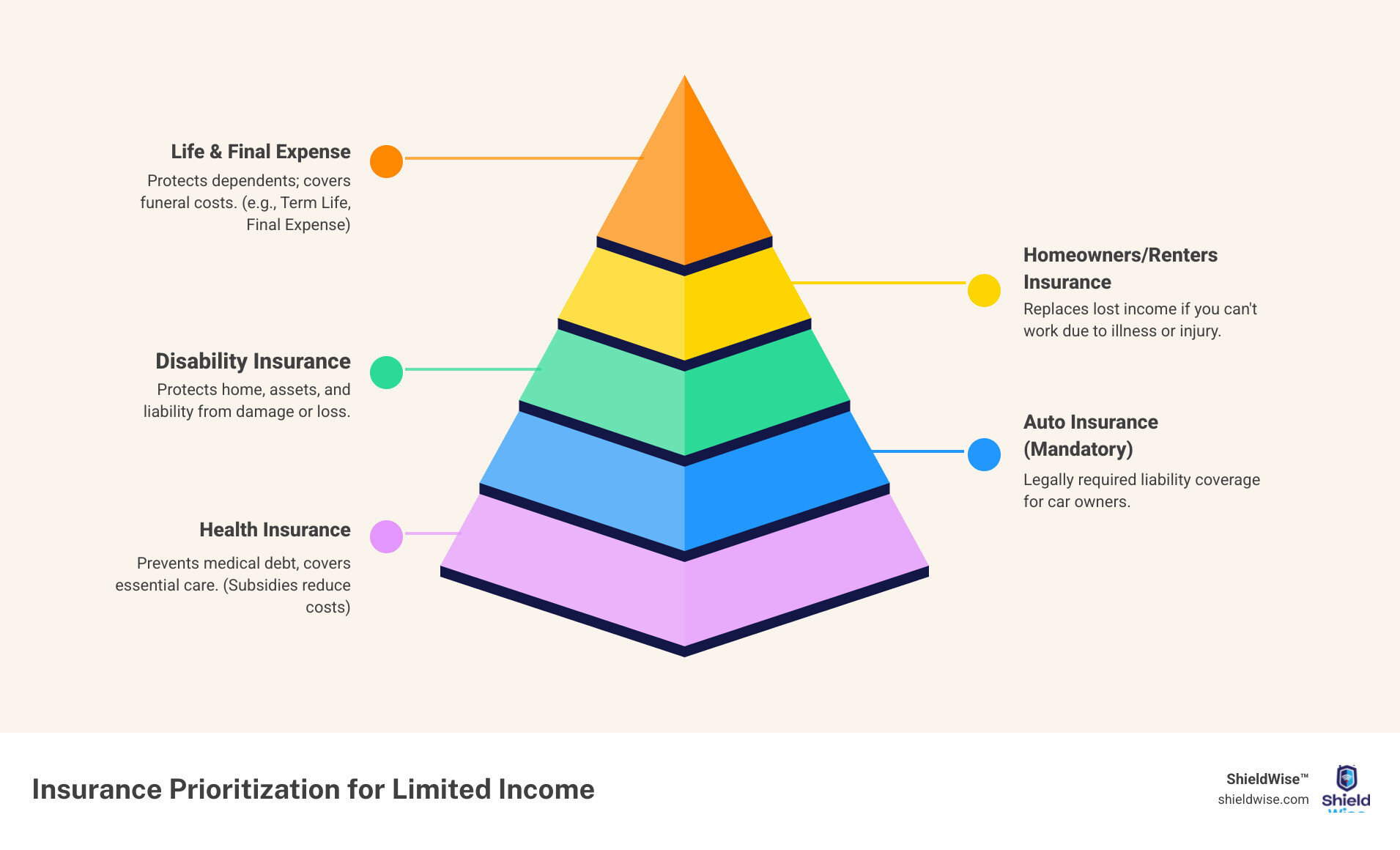

How to prioritize insurance coverage on limited income starts with protecting what you can’t afford to lose. Here’s the essential framework:

- Tier 1 (Must-Have): Health insurance and legally required auto insurance

- Tier 2 (High Priority): Disability insurance, homeowners/renters insurance

- Tier 3 (Important): Life insurance for dependents, final expense coverage

- Strategy: Start with government subsidies, choose high-deductible plans, and focus on catastrophic protection first

When you’re living on a tight budget, every dollar counts. Yet 47% of American households say they’d feel financial hardship within six months of a primary wage earner’s death, according to the 2025 Insurance Barometer Study from LIMRA. That’s nearly half of all families—just one unexpected event away from serious trouble.

The stress is real. You know insurance is important, but when choosing between paying for coverage and buying groceries, insurance often loses. The problem? Going without the right coverage can turn a bad situation into a catastrophic one.

Medical debt is the leading cause of bankruptcy in America. A single car accident without insurance can destroy years of careful saving. A house fire without renters insurance can leave you with nothing.

The National Consumer Law Center’s number-one rule for managing bills on limited income is simple: pay the bills whose non-payment would cause immediate harm to you and your family. Insurance sits right at the heart of that principle. It’s not about buying everything—it’s about buying smart.

This guide will show you exactly how to do that. We’ll break down which types of insurance deserve your limited dollars first, how to find affordable options you didn’t know existed, and practical strategies to lower premiums without leaving your family exposed.

At ShieldWise, we’ve spent years helping individuals and families on fixed incomes steer these exact decisions, with special expertise in affordable final expense and life insurance options that fit tight budgets. Our mission is to make how to prioritize insurance coverage on limited income clear, actionable, and stress-free—because financial protection shouldn’t be a luxury.

Understanding the Stakes: Why Insurance is a Non-Negotiable Necessity

Imagine facing a sudden medical emergency, a car accident, or a fire, and realizing you have no safety net. For those on a limited income, these events aren’t just inconveniences; they can be financially devastating. Being underinsured can lead to catastrophic debt, wiping out savings and making it nearly impossible to regain financial stability.

Our research shows that around 47% of American households say they’d feel financial hardship within six months of a primary wage earner’s death. This statistic underscores the precarious position many families find themselves in. Without adequate insurance, unexpected events can lead to:

- Massive Medical Debt: A single hospital stay can cost tens of thousands of dollars. Without health insurance, you could face bankruptcy.

- Loss of Transportation: An uninsured car accident can leave you without a vehicle, impacting your ability to get to work and earn income. In Illinois, driving without proper auto insurance can lead to fines, license suspension, and even vehicle impoundment.

- Homelessness: A fire or natural disaster could destroy your home and belongings. Without homeowners or renters insurance, rebuilding your life would be incredibly difficult.

- Income Loss: An illness or injury that prevents you from working can cut off your sole source of income, leading to a cascade of unpaid bills.

- Burden on Loved Ones: In the event of your death, your family could be left with funeral costs, outstanding debts, and a sudden loss of income.

This is precisely why we align with the National Consumer Law Center’s (NCLC) guidance, which states that when managing bills, you should “Prioritize debts whose non-payment immediately harms your family.” Insurance, particularly essential types, falls squarely into this category. It’s not just about protecting your assets; it’s about protecting your ability to earn, your health, your home, and your peace of mind. Without it, you risk losing everything you’ve worked so hard for. You can find more impartial money advice on managing debt at The NCLC’s rule for prioritizing bills.

The Must-Haves vs. The Nice-to-Haves: A Triage Approach to Insurance

When every dollar is accounted for, deciding which insurance policies to keep or acquire can feel like an impossible puzzle. We advocate for a “triage” approach, categorizing insurance types based on their urgency and potential impact on your financial survival. This helps us determine how to prioritize insurance coverage on limited income.

Here’s an overview of common insurance types, categorized by their importance for someone on a limited income:

Tier 1: The Absolute Essentials

These are the non-negotiable policies that protect you from the most immediate and financially devastating risks. Without these, a single unexpected event could derail your entire financial future.

- Health Insurance: This is the cornerstone of your insurance strategy. Medical debt is a leading cause of bankruptcy. Even a minor injury or illness can result in significant bills, and a major health crisis can mean hundreds of thousands of dollars in costs.

- Why it’s essential: Health insurance prevents medical debt from accumulating. All health plans in the Marketplace, including those available in Illinois, offer “essential health benefits,” which are a set of 10 categories of services health insurance plans must cover by law. These benefits cover things like doctor’s visits, prescriptions, hospitalizations, pregnancy, and more. This means you’re covered for crucial care.

- Action: If you don’t have health insurance through an employer, explore options on HealthCare.gov or Get Covered Illinois. We’ll discuss subsidies later, but know that significant financial help is often available. Learn more about How to pick a health insurance plan.

- State-Mandated Auto Insurance: If you own and drive a car, this isn’t optional—it’s the law. In Illinois, you must carry minimum liability coverage to protect others in an accident.

- Why it’s essential: Beyond legal compliance (avoiding fines, license suspension, and vehicle impoundment), it protects you from financial ruin if you cause an accident. If you injure someone or damage their property, your auto insurance covers the costs, preventing lawsuits that could garnish your wages or seize assets.

Tier 2: Protecting Your Livelihood and Home

Once your health and legal driving requirements are met, the next priority is safeguarding your ability to earn an income and protecting your primary residence.

- Disability Insurance: This often-overlooked coverage replaces a portion of your income if you become too sick or injured to work.

- Why it’s essential: Your ability to earn is your most valuable asset. If you rely on your paycheck, disability insurance is critical. Our research shows that disability insurance generally costs 1% to 3% of your annual income, but it’s vital protection. Social Security Disability benefits also exist, but eligibility is strict and requires that you can’t engage in “Substantial Gainful Activity” (SGA), which involves earning more than a certain amount each month. Protecting your income with private disability insurance can be a smart move. You can learn more about What is Substantial Gainful Activity?.

- Homeowners Insurance: If you own your home, this protects your most significant asset from perils like fire, theft, and natural disasters. Your mortgage lender will typically require it.

- Why it’s essential: Without it, losing your home means losing everything you’ve invested. This is a debt that quickly becomes high priority if unpaid, similar to mortgage payments and property taxes, as outlined by the NCLC.

- Renters Insurance: If you rent, your landlord’s insurance doesn’t cover your personal belongings. Renters insurance protects your possessions from theft, fire, and other covered events, and also provides liability coverage.

- Why it’s essential: While not legally required, replacing your belongings after a fire or theft can be incredibly expensive, especially on a limited income. The cost is usually very affordable, making it a high-value protection.

Tier 3: Securing Your Family’s Future

After addressing immediate and significant risks, we can turn our attention to long-term financial security for your loved ones. These policies are crucial for protecting dependents and ensuring your legacy, even on a tight budget.

- Life Insurance: If anyone relies on your income or care, life insurance is vital.

- Why it’s essential: As we mentioned, nearly half of American households would face financial hardship if a primary wage earner died. Life insurance provides a financial safety net for your loved ones, covering immediate expenses like funeral costs, outstanding debts, and providing income replacement for a set period. Term life insurance is often the most affordable option for those on a limited income, as it provides coverage for a specific period (e.g., 10, 20, or 30 years) when your dependents need it most.

- Specifics: For those concerned about end-of-life costs, Final Expense Insurance is specifically designed to cover funeral and burial expenses, often with simpler underwriting and smaller coverage amounts, making it accessible on a fixed income. We at ShieldWise specialize in these types of policies, helping families in Illinois secure peace of mind. You can find More info about End of Life Coverage.

How to Prioritize Insurance Coverage on a Limited Income: A 3-Step Assessment

Figuring out how to prioritize insurance coverage on limited income requires a personal and practical approach. It’s not a one-size-fits-all solution. We’ve developed a simple, three-step framework to help you assess your unique needs and match them to your budget.

Step 1: Identify Your Biggest Financial Risks

Start by taking an honest look at your current situation. What are the biggest financial threats you face?

- Your Health: Do you have a chronic condition? Do you visit the doctor frequently? Or are you generally healthy? Your health status heavily influences your need for comprehensive health insurance versus a high-deductible plan.

- Your Job Stability: Is your income secure? What would happen if you couldn’t work for an extended period due to illness or injury? If your job provides little in terms of benefits or paid time off, disability insurance becomes more critical.

- Number of Dependents: Do you have children, an elderly parent, or a spouse who relies on your income or care? If so, life insurance moves up the priority list. Consider the financial impact if your income were to disappear.

- Major Assets (Car, Home): Do you own a car that’s essential for work? Do you own or rent your home? These assets carry inherent risks that need protection. Losing your car could mean losing your job. Losing your home could mean homelessness.

- Current Debt Levels: High-interest debt can exacerbate any financial setback. While insurance isn’t debt, understanding your debt burden helps you prioritize cash flow for essential protections. The United Way offers excellent Tips for Prioritizing Monthly Expenses to help you identify what’s critical.

By listing these factors, you create a personalized risk profile. For example, a single, healthy individual with no dependents and no car might prioritize health insurance and renters insurance. A parent with a chronic illness and a car might prioritize health, auto, and disability insurance more heavily.

Step 2: How to prioritize insurance coverage on a limited income by analyzing your budget

Once you understand your risks, the next step is to see how much room you have in your budget for insurance premiums. This involves creating a simple, realistic budget.

- Track Your Income and Expenses: List all sources of income and every single expense for at least a month. Categorize them into fixed (rent, loan payments), variable (groceries, utilities), and irregular (car repairs).

- Separate Needs from Wants: Be ruthless here. “Needs” are essentials like housing, food, utilities, transportation to work, and medical care. “Wants” are discretionary spending like dining out, entertainment, and subscriptions. When money is tight, needs always come first.

- Find Funds for Premiums: Look for areas to cut back on wants to free up money for essential insurance. Even small changes, like making coffee at home instead of buying it daily, can add up. The NCLC also provides guidance on lower priority debts like credit card debt, which can often wait behind essential bills and insurance premiums.

- Balance Premiums with Out-of-Pocket Expenses: This is a crucial balancing act. A lower premium might seem appealing, but if it comes with a sky-high deductible you can’t afford, it might not provide real protection. We need to find the sweet spot where the premium is manageable, and the out-of-pocket costs in a worst-case scenario are also within reach. This is how to prioritize insurance coverage on limited income effectively.

Step 3: Match Your Needs to Affordable Policies

Now that you know your risks and your budget, we can explore specific insurance policies that offer better value for lower incomes.

- High-Deductible Health Plans (HDHPs): These plans typically have lower monthly premiums but higher deductibles. They can be a good option for generally healthy individuals who want protection against catastrophic medical events. If you qualify, an HDHP can often be paired with a Health Savings Account (HSA) to save for future medical expenses tax-free. You can learn more about High Deductible Health Plan (HDHP) options.

- State Minimum Auto Coverage: While it might not offer comprehensive protection for your own vehicle, opting for the state-mandated minimum liability coverage in Illinois is the most affordable way to stay legal and protect yourself from liability claims.

- Term Life Insurance: For life insurance, term policies are generally much more affordable than permanent options like whole life. They provide coverage for a specific period (e.g., 10, 20, or 30 years), which can be aligned with your period of greatest financial responsibility (e.g., until your children are grown or your mortgage is paid off).

- Medicare Supplement and Medigap Options for Seniors: For seniors on a fixed income, understanding Medicare Supplement and Medigap plans is vital. These plans help cover the gaps in Original Medicare, such as deductibles, copayments, and coinsurance, reducing your out-of-pocket costs.

The goal isn’t to buy the most expensive or comprehensive policy, but the one that provides the most critical protection within your financial constraints.

Smart Strategies to Lower Your Premiums Without Sacrificing Coverage

Finding affordable insurance on a limited income often feels like searching for a needle in a haystack. But with smart strategies and research, we can significantly reduce your premiums without leaving you exposed to major risks. This is a key part of how to prioritize insurance coverage on limited income.

Leveraging Subsidies and Government Programs

For many, government assistance programs are a lifeline, making essential insurance accessible.

- Health Insurance Marketplace (ACA): The Affordable Care Act (ACA) Marketplace (HealthCare.gov or Get Covered Illinois) is a treasure trove of affordable health plans. Most people qualify for savings, which come in two main forms:

- Premium Tax Credits: These reduce your monthly premium. The amount depends on your income and household size.

- Cost-Sharing Reductions (CSRs): These reduce your out-of-pocket costs like deductibles, copayments, and coinsurance. You must enroll in a Silver plan to receive CSRs. In Illinois, understanding the Ultimate Guide to Cost-Sharing Reductions in Illinois can be incredibly beneficial.

- Essential Health Benefits: All Marketplace plans cover a comprehensive set of “essential health benefits,” ensuring you get the care you need.

- Action: Visit HealthCare.gov/lower-costs to see what savings you qualify for. You might be surprised at how affordable coverage can be. You can also explore Financial help – Get Covered Illinois for state-specific resources.

- Medicaid and CHIP: For very low-income individuals and families, Medicaid provides free or low-cost health coverage. The Children’s Health Insurance Program (CHIP) offers similar benefits for children. Eligibility varies by state, but these programs are critical safety nets.

Adjusting Your Coverage Wisely

Sometimes, a slight adjustment to your policy can lead to significant premium savings.

- Increasing Deductibles: A deductible is the amount you pay out-of-pocket before your insurance kicks in. By choosing a higher deductible on policies like auto or homeowners insurance, you can often lower your monthly premium. Just make sure you have an emergency fund to cover that higher deductible if you need to make a claim. This is a primary way to balance the cost of insurance premiums with potential out-of-pocket expenses.

- Lowering Coverage Limits on Non-Essential Policies: For example, on auto insurance, you might opt for lower comprehensive and collision coverage limits if your car is older and its value is low.

- Removing Optional Riders: Many policies offer optional add-ons (riders) that improve coverage. Review your policies and eliminate any riders you don’t absolutely need.

- When to Consider Reducing or Dropping Coverage: This is a tricky decision and should only be done after careful consideration of the risks.

- For older, paid-off cars: You might consider dropping comprehensive and collision coverage if the cost of the premium outweighs the car’s value.

- For specific life insurance needs: If your children are grown and financially independent, and your mortgage is paid off, you might consider reducing your life insurance coverage, or switching to a final expense policy if your primary concern is covering funeral costs.

- Avoid dropping essential coverage: Never drop health or legally mandated auto insurance unless you have an immediate, comparable replacement. The consequences are too severe.

How to prioritize insurance coverage on a limited income with life insurance

Life insurance is a vital component of financial planning, especially when you have dependents. On a limited income, prioritizing means being strategic about the type and amount of coverage.

- Term Life Insurance as a Low-Cost Option: As mentioned, term life insurance is typically the most budget-friendly way to get substantial coverage. You choose a term (e.g., 20 years) and a death benefit, and the premiums are usually fixed for that period. This allows you to protect your family during the years they are most dependent on your income, like when you have young children or an outstanding mortgage.

- Final Expense Insurance for Seniors on a Fixed Income: For seniors, or anyone whose primary concern is covering funeral and burial costs without burdening their family, Final Expense Insurance for Seniors on a Fixed Income is an excellent solution. These policies are designed with smaller death benefits (typically $5,000 to $50,000), simpler underwriting, and affordable premiums, making them accessible even on Social Security. At ShieldWise, we specialize in helping individuals in Illinois find these low-cost options.

- Calculating Minimum Viable Coverage: Instead of aiming for the “10 times your income” rule, calculate the bare minimum your family would need.

- Debts: Funeral costs, credit card debt, car loans, and any other immediate liabilities.

- Income Replacement: How many years of your income would your family need to adjust? Even one or two years can make a huge difference.

- Value of a Stay-at-Home Parent’s Services: If you’re a stay-at-home parent, your contributions are invaluable and costly to replace. The average weekly cost of a nanny in the United States is $766, according to 2024 data calculated by Care.com. A house cleaner typically costs $19.39 an hour on average. These costs add up quickly. Factor in childcare, cooking, cleaning, and transportation when considering life insurance for a non-income-earning spouse. This is critical for protecting dependents on a limited income. For more details, you can look at The cost of a nanny.

Frequently Asked Questions about Prioritizing Insurance

We know you have questions, especially when navigating the complexities of insurance on a tight budget. Here are some of the most common ones we hear, and our straightforward answers to help you understand how to prioritize insurance coverage on limited income.

What is the single most important insurance to have on a low income?

Without a doubt, health insurance is the most critical type of coverage to prioritize when your income is limited. The cost of medical care in the U.S. is extraordinarily high, and unexpected illness or injury can lead to massive medical debt, even bankruptcy. With the Affordable Care Act (ACA) Marketplace, most people in Illinois qualify for subsidies (premium tax credits and cost-sharing reductions) that make health insurance much more accessible and affordable. This coverage ensures you can access necessary medical care without facing financial ruin.

Is it better to have a high-deductible plan with a lower premium?

It depends largely on your personal health and financial situation. For individuals who are generally healthy and rarely visit the doctor, a high-deductible health plan (HDHP) with a lower monthly premium can be a smart choice for how to prioritize insurance coverage on limited income. The lower premium helps keep monthly expenses down. However, it’s crucial that you have enough savings to cover the deductible if you do need medical care. If you have a chronic condition or anticipate frequent doctor visits, a plan with a higher premium but lower out-of-pocket costs (like a Gold or Platinum plan on the Marketplace, if affordable with subsidies) might be a better fit, as it balances the cost of insurance premiums with potential out-of-pocket expenses. If eligible, an HDHP can be paired with a Health Savings Account (HSA) to save and pay for qualified medical expenses tax-free.

How much life insurance is enough if I can’t afford much?

When facing limited income, the answer to “how much life insurance is enough” often shifts from ideal income replacement to covering essential needs. In this scenario, any coverage is better than none. Focus on securing a small, affordable policy that can at least cover immediate expenses your family would face upon your passing. This typically includes:

- Final expenses: Funeral, burial, and related administrative costs. Policies like Low Cost Final Expense are specifically designed for this purpose, offering benefits typically ranging from $5,000 to $50,000.

- Short-term income replacement: Enough to provide your family with one to two years of your income to help them adjust financially.

Even a modest policy can prevent your loved ones from incurring debt during a difficult time. Work with a trusted advisor at ShieldWise to explore options that fit your budget while providing crucial protection.

Conclusion: Taking Control of Your Financial Security

Navigating insurance on a limited income is challenging, but it’s far from impossible. By understanding how to prioritize insurance coverage on limited income, you empower yourself to build a robust financial safety net, even with tight constraints. We’ve seen that the key lies in a systematic approach:

- Assess Your Risks: Identify your most vulnerable areas—health, income, assets, and dependents.

- Prioritize Your Needs: Focus on essential coverage first, leveraging government programs and subsidies whenever possible.

- Shop Smart and Adjust Wisely: Compare options, adjust deductibles, and eliminate unnecessary riders to make premiums affordable.

Insurance isn’t just another bill; it’s a critical tool for financial stability, protecting you and your family from life’s inevitable curveballs. Even on a tight budget, you can find ways to protect what matters most.

At ShieldWise, we believe everyone deserves peace of mind. We’re here to help you compare affordable life and final expense options, guiding you through the process with clear, jargon-free advice. Take the first step towards securing your family’s future today. Explore end-of-life insurance for seniors to secure your legacy.