Why No Health Question Policies Exist—And What They Really Cost

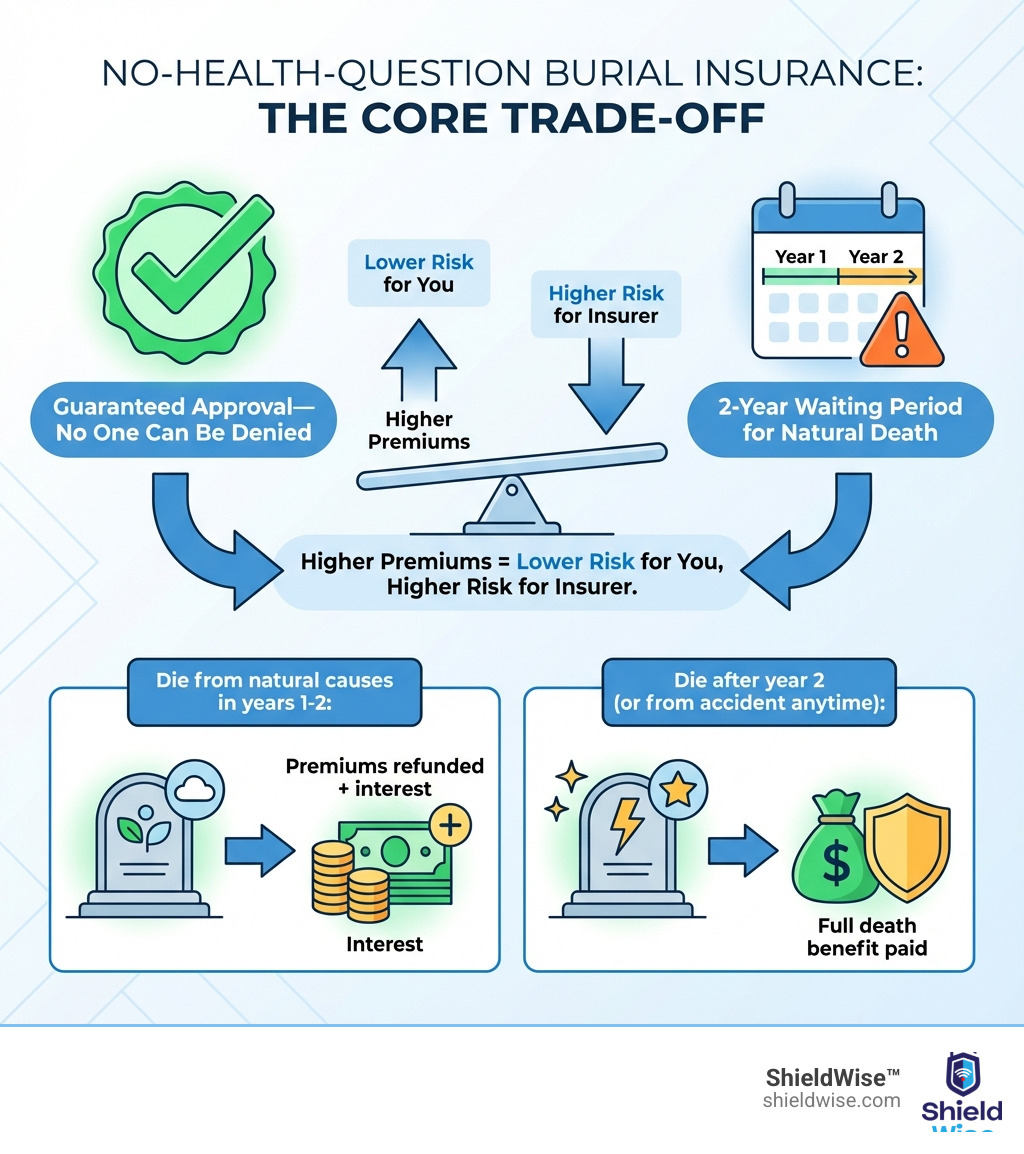

Burial insurance with no health questions is a type of guaranteed issue life insurance designed for people who cannot qualify for traditional coverage due to serious health conditions. Here’s what you need to know:

- Guaranteed approval: No medical exam, no health questions, no denial—everyone between ages 50–85 is accepted

- Mandatory waiting period: If you die from natural causes in the first 2–3 years, beneficiaries receive only premiums paid back plus interest (usually 10%)

- Accidental death covered immediately: Full benefit paid from day one if death is from an accident

- Higher premiums: You’ll pay significantly more per dollar of coverage compared to policies that ask health questions

- Limited coverage: Typical death benefits range from $2,000 to $25,000

This trade-off exists because insurance companies take on much greater risk when they can’t evaluate your health. If you’re in poor health and have been denied coverage elsewhere, these policies offer a guaranteed path to leave something behind for funeral costs and final expenses.

At ShieldWise, we’ve spent years helping families understand final expense options, including burial insurance with no health questions, so you can make informed decisions without the pressure or confusion. Our goal is to explain exactly what you’re buying—and what you’re not.

What is Burial Insurance With No Health Questions?

When we talk about burial insurance with no health questions, we’re referring to a specific type of final expense insurance. This is a form of whole life insurance designed primarily to cover end-of-life costs, such as funeral expenses, burial or cremation, and any outstanding medical bills or debts. Unlike traditional life insurance, which often involves extensive medical exams and detailed health questionnaires, burial insurance with no health questions bypasses these requirements entirely.

The primary purpose of this coverage is to provide peace of mind, knowing that your loved ones won’t be burdened with significant financial costs during an already difficult time. According to the National Funeral Directors Association, the national median cost of a funeral with a viewing and burial in 2021 was approximately $7,848, while a funeral with cremation was around $6,971. These costs can be substantial, and our goal at ShieldWise is to help families prepare. You can learn more about this type of coverage in our guide, What is Burial Insurance?.

The Primary Type: Guaranteed Issue Life Insurance

The main type of burial insurance with no health questions is known as guaranteed issue life insurance (sometimes called guaranteed acceptance life insurance). The name says it all: acceptance is guaranteed. This means that if you fall within the eligible age range (typically 50-85 years old), you cannot be denied coverage due to your health history.

With guaranteed issue policies, there are absolutely no medical questions asked, and no medical exam is required. This makes it an invaluable option for individuals who have serious health conditions, such as a terminal illness, severe heart disease, or a history of cancer, which would otherwise disqualify them from most other life insurance options. It’s designed for those higher-risk applicants who need a safety net for their final expenses. For more foundational knowledge, explore our Final Expense Basics and Education.

How It Differs from Other Policies

To truly understand burial insurance with no health questions, it’s helpful to see how it stacks up against other life insurance policies. The key distinctions lie in the underwriting process, the presence of a waiting period, and the associated costs and coverage limits. We’ve put together a table to illustrate these differences clearly:

| Feature | Guaranteed Issue (No Health Questions) | Simplified Issue (Some Health Questions) | Fully Underwritten (Traditional) |

|---|---|---|---|

| Health Questions | None | A few brief questions | Extensive medical questionnaire |

| Medical Exam | No | No | Yes |

| Waiting Period | 2-3 years for natural death | Often none for natural death | None |

| Cost | Highest premiums | Moderate premiums | Lowest premiums (for healthy) |

| Coverage Limits | Lowest (e.g., $2,000 – $25,000) | Moderate (e.g., $5,000 – $50,000) | Highest (e.g., $100,000+) |

| Approval | Guaranteed | Quick, based on health answers | Can take weeks, based on exam/records |

As you can see, guaranteed issue policies offer the ultimate certainty of approval, but this comes with a trade-off in terms of cost and the mandatory waiting period. Simplified issue policies, on the other hand, require you to answer a few health questions, but still no medical exam. If your answers indicate a lower risk, you might qualify for immediate coverage without a waiting period, and at a lower premium than guaranteed issue. Fully underwritten policies are the most rigorous but offer the best rates for healthy individuals.

How It Works: The Waiting Period, Costs, and Application

Understanding the mechanics of burial insurance with no health questions is crucial for making an informed decision. While the promise of guaranteed acceptance is appealing, grasp the details of how these policies function, particularly regarding the waiting period, typical costs, and the straightforward application process.

The Mandatory Two-Year Waiting Period

One of the most significant characteristics of burial insurance with no health questions is the mandatory waiting period. As the statistics show, these policies always have a two-year waiting period before beneficiaries are eligible for the full death benefit if death is due to natural causes. This is often referred to as a “graded death benefit.”

What does this mean in practice? If the policyholder passes away from natural causes within the first two years (or sometimes three, depending on the policy and state regulations), the insurance company will not pay out the full coverage amount. Instead, your beneficiaries will receive a refund of all the premiums you’ve paid into the policy, typically with an additional interest amount, often around 10%. This ensures that your family isn’t left completely empty-handed.

However, there’s a silver lining: if death occurs due to an accident, the full death benefit is usually paid out immediately, even if it’s within the waiting period. We understand that the idea of a waiting period can be a concern, and we cover this in more detail in our Life Insurance for Seniors No Waiting Period guide. It’s important to reiterate that “guaranteed acceptance life insurance with no waiting period does not exist.” If you encounter a claim that it does, it’s a red flag.

Typical Coverage and Costs

Because burial insurance with no health questions involves a higher risk for the insurer (they don’t know your health status), these policies generally come with higher premiums compared to policies that require health questions or medical exams. The costs are also influenced by your age and gender, with premiums increasing as you get older.

Coverage amounts for these policies are typically modest, designed to cover final expenses rather than provide substantial income replacement. We often see coverage ranging from $2,000 up to $25,000, though some providers may offer slightly more. These amounts are usually sufficient to cover the national median cost of a funeral, which, as we mentioned, can be around $8,000 or more.

For example, a 75-year-old woman might pay about $88 per month for a $10,000 final expense policy, while a 75-year-old man might pay around $113 per month for the same coverage. These figures illustrate that while the premiums are manageable, they are indeed higher per dollar of coverage due to the guaranteed acceptance nature. You can explore more about these costs in our Final Expense Cost and Quotes resource.

How to apply for burial insurance with no health questions

One of the biggest advantages of burial insurance with no health questions is the incredibly simple and quick application process. There are no lengthy forms, no nurses coming to your home for blood and urine samples, and no doctor’s reports to chase down.

The application typically involves providing basic personal information like your name, address, date of birth, and designating your beneficiaries. Approval is often instant or within a few days, making it a very accessible option for those who need coverage quickly or prefer to avoid medical procedures. We believe that securing your family’s future shouldn’t be a hassle, and this process reflects that. For a deeper dive into the application process, check out our How Burial Insurance Works Guide.

Is Guaranteed Acceptance Right for You?

Deciding if burial insurance with no health questions is the right choice for your situation involves weighing the convenience of guaranteed acceptance against the associated costs and limitations. It’s about finding the right balance between your financial situation, health status, and your ultimate end-of-life needs.

Who Benefits Most from These Policies?

While not for everyone, burial insurance with no health questions is a lifeline for specific individuals. We often recommend these policies to:

- Individuals with serious health conditions: If you’ve been diagnosed with a terminal illness, have a history of severe heart disease, active cancer, or other significant health issues that make you ineligible for other types of life insurance, guaranteed issue policies are a viable solution. As financial services executive Joe Bogardus noted, it’s a good option for an older person with health issues who might not pass a medical exam.

- Previously denied applicants: If you’ve tried to get life insurance before and were denied due to your health, a guaranteed issue policy offers a guaranteed path to coverage.

- Seniors on a fixed income needing a safety net: For many seniors, ensuring that their funeral costs won’t burden their loved ones is a top priority. These policies provide that essential safety net, even with health challenges.

- Those wanting to avoid medical exams and health questions: Some people simply prefer to bypass the medical underwriting process, regardless of their health. The simplicity and speed of application are a major draw.

- Anyone prioritizing guaranteed acceptance: If your absolute priority is to secure some coverage, no matter what, and you’re comfortable with the waiting period and higher premiums, this policy type fits the bill.

For a comprehensive understanding of eligibility, refer to our Final Expense Health Eligibility Complete Guide.

What are the drawbacks of burial insurance with no health questions?

While incredibly valuable for those who need it, it’s important to be aware of the limitations of burial insurance with no health questions:

- Higher premiums per dollar of coverage: This is the primary trade-off. Because the insurer takes on unknown health risks, they charge more for the guaranteed acceptance. You will generally pay more for the same amount of coverage compared to a simplified issue or fully underwritten policy.

- Limited coverage amounts: These policies are designed for final expenses, not for large estate planning or income replacement. The maximum coverage is usually capped at $25,000-$30,000, which might not be enough if you have significant outstanding debts or wish to leave a larger legacy.

- The two-year waiting period for natural death: We can’t stress this enough. If you pass away from natural causes within the first two years of the policy, your beneficiaries will only receive a refund of premiums paid plus interest, not the full death benefit. This can be a significant drawback if you need immediate full coverage for natural death.

- Potential to pay more in premiums than the death benefit over a long life: If you purchase a policy at a younger age within the eligible range and live many years, it’s possible that the total premiums you pay could exceed the death benefit your beneficiaries eventually receive. This is a consideration for long-term financial planning.

Frequently Asked Questions about No-Question Policies

We often get specific questions about burial insurance with no health questions, and we’re here to provide clear, straightforward answers.

Can I get life insurance that starts immediately with no health questions?

No, you cannot. This is a common misconception we encounter. Policies that genuinely ask no health questions whatsoever (guaranteed issue policies) always include a waiting period of two to three years before the full death benefit is paid out for natural causes. If you die during this waiting period, your beneficiaries will receive a refund of the premiums you paid, usually with interest.

If a policy advertises “immediate coverage” and “no health questions,” it’s likely a misrepresentation. For immediate full coverage for natural death, you would typically need to qualify for a simplified issue policy, which does involve answering a few health questions, even if it doesn’t require a medical exam.

Can my beneficiaries use the payout for things other than the funeral?

Absolutely! The death benefit from burial insurance with no health questions is paid out as a tax-free cash sum directly to your named beneficiaries. They have complete freedom and flexibility to use these funds for any purpose they deem necessary. This could include covering funeral and burial costs, paying off outstanding medical bills, settling credit card debt, managing legal fees associated with your estate, or simply using the money to help with living expenses during a difficult time of grief. The insurance company does not dictate how the money is spent.

What happens if I pass away during the waiting period?

If you pass away from natural causes during the mandatory two-year waiting period (or three years, depending on the policy), your beneficiaries will not receive the full death benefit of the policy. Instead, the insurance company will refund all the premiums you have paid into the policy. This refund typically includes a small amount of interest, often around 10%.

However, if your death is due to an accident, the full death benefit is usually paid out immediately, even if it occurs within the waiting period. This distinction between natural and accidental death during the waiting period is a standard feature of guaranteed issue policies.

Secure Your Peace of Mind

Navigating life insurance can feel complex, but our mission at ShieldWise is to simplify it for you. We hope this guide has shed light on the truth about burial insurance with no health questions, helping you understand its unique benefits and limitations.

The key takeaways are clear: these policies offer guaranteed acceptance regardless of your health, making them an invaluable option for those who might otherwise be uninsurable. However, this comes with the trade-off of a mandatory waiting period for natural death and generally higher premiums.

Making an informed decision about your final expense coverage is a profound way to protect your loved ones from financial strain during a challenging time. We believe everyone deserves the peace of mind that comes from knowing their final wishes are accounted for.

At ShieldWise, we’re dedicated to providing clear, jargon-free guidance so you can protect your family and secure the right coverage. Ready to explore your options? Get a quote for your final expense insurance needs today.