Understanding the Balance: What Makes IUL Insurance Unique

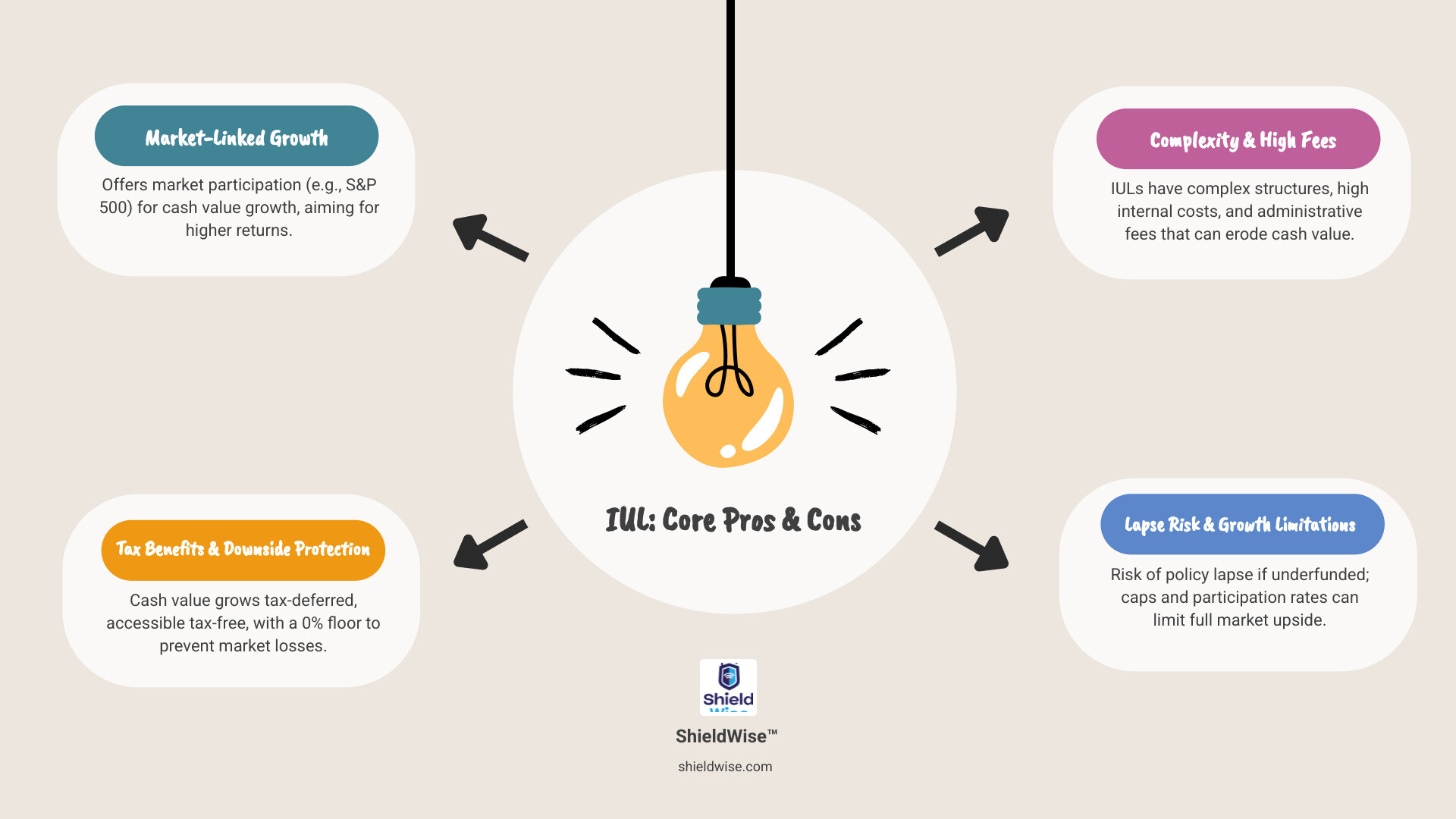

Evaluating the pros and cons IUL insurance offers is critical for anyone considering permanent life insurance. This policy combines a death benefit with a cash value component tied to a stock market index. While IUL provides market participation with downside protection and tax-advantaged growth, it also has complexities, fees, and risks that require careful consideration.

Quick Overview: IUL Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Tax-deferred growth with tax-free access via loans | Complex structure requiring ongoing management |

| Downside protection through 0-1% floor rates | Caps and participation rates limit upside potential |

| Flexible premiums and adjustable death benefits | High fees including COI, admin costs, and surrender charges |

| Market-linked growth tied to indexes like S&P 500 | Policy lapse risk if underfunded or fees exceed growth |

| No RMDs or age 59.5 penalties for access | Non-guaranteed elements can change annually |

| Permanent coverage for lifelong protection | Requires active monitoring and adjustment over time |

IUL occupies a unique middle ground: it offers more growth potential than whole life insurance but is more complex. It’s less risky than variable universal life but not as simple as term insurance. While it can be a powerful tool for wealth accumulation, it’s not right for everyone.

According to financial planners quoted in industry research, “IULs come with a lot of internal fees that only work in very specific types of scenarios.” The key is understanding exactly what you’re getting—and what you’re giving up—before committing to a lifelong financial product. This guide will walk you through both sides of the IUL equation, explaining the advantages, hidden costs, and how to determine if this policy aligns with your goals.

The Advantages (Pros) of Indexed Universal Life Insurance

When weighing the pros and cons IUL insurance presents, it’s important to start with what makes it attractive. IUL is designed to serve multiple financial goals, combining permanent protection with the potential for significant cash value growth. The appeal lies in its tax efficiency, protected market-linked growth, and flexibility.

Tax-Deferred Growth and Tax-Free Access

An IUL’s cash value grows tax-deferred, meaning it compounds without being reduced by annual taxes on gains. This allows more of your money to stay invested and work for you.

When you need to access the funds, you can take withdrawals up to your basis (total premiums paid) tax-free. Beyond that, you can take policy loans against your cash value, which are generally not considered taxable income as long as the policy remains in force. The IRS confirms the favorable tax treatment of life insurance proceeds, which extends to policy loans.

This makes IUL a valuable retirement income supplement. Unlike 401(k)s or IRAs, there are no required minimum distributions (RMDs) at age 73. Accessing cash value via loans also avoids the 10% early withdrawal penalty before age 59½ (assuming the policy is not a Modified Endowment Contract). For those who have maxed out traditional retirement accounts, IUL offers a compelling, tax-advantaged alternative.

Market Participation with Downside Protection

This feature sets IUL apart. Your cash value’s growth is linked to the performance of a stock market index, like the S&P 500, allowing you to benefit from market gains.

However, IUL policies include a floor rate, typically 0%. This means if the market has a negative year, your cash value doesn’t lose money from that index performance. Your principal is protected from market downturns. This downside protection acts as a volatility buffer, providing peace of mind during turbulent economic times.

The insurance company achieves this through hedging strategies, not by directly investing your money in the market. You earn interest based on the index’s performance, with the insurer absorbing the downside risk. It offers the potential for steady, protected growth over the long term. For more details, see our guide on Universal Life Insurance.

Best Flexibility

IUL policies adapt to life changes in ways other permanent insurance cannot.

- Adjustable Premiums: You can increase, decrease, or even skip premium payments (within limits), as long as the cash value covers policy charges. This is ideal for those with variable incomes.

- Modifiable Death Benefit: You can adjust your death benefit over time to match your changing needs, such as reducing it after children are independent or increasing it for new business obligations (subject to underwriting).

- High Contribution Limits: Unlike 401(k)s and IRAs, IULs allow for large contributions, making them an attractive vehicle for accumulating additional tax-advantaged wealth.

- Valuable Riders: Many policies offer riders to improve coverage, such as an Accelerated Death Benefit Rider for terminal illness, a Long-Term Care Rider, or a Waiver of Premium Rider if you become disabled.

The Disadvantages (Cons) and Complexities of IUL

While the benefits of IUL are real, the pros and cons IUL discussion must include its drawbacks. These policies are not “set it and forget it” products. Their complexity comes with costs, limitations, and risks that can significantly impact performance if not properly managed.

Understanding the Fees, Costs, and Surrender Charges

IUL policies have a layered fee structure that can erode cash value growth, especially in the early years.

- Cost of Insurance (COI): This covers the death benefit and increases as you age. If the policy is not funded enough to handle rising costs, it can be a major drain on cash value later in life.

- Administrative and Premium Fees: Policies include charges for maintenance and upfront expenses, which can take a percentage of each premium payment.

- Rider Costs: Optional features like long-term care riders add to the monthly expenses.

- Surrender Charges: If you cancel the policy within the first 10-15 years, you will face substantial penalties that can wipe out most or all of your cash value. This makes IUL a long-term commitment.

These combined fees can significantly slow your cash value’s growth, making it critical to understand the full cost structure over the life of the policy.

Growth Limitations and the Real Pros and cons IUL

IUL’s market participation comes with limitations that can reduce your actual returns.

- Cap Rate: This is the maximum interest rate you can be credited in a year. If the S&P 500 gains 15% but your policy has a 10% cap, your credited interest is limited to 10%. You miss out on the market’s best years.

- Participation Rate: This is the percentage of the index’s gain credited to your account. An index gain of 10% with a 75% participation rate results in a 7.5% credit (before caps).

- Dividends Not Included: IUL crediting is based on index price movement only and does not include dividends, which can be a significant part of the S&P 500’s total return.

Crucially, insurance companies can change these rates annually. A 10% cap this year might be an 8% cap next year, making future returns unpredictable and requiring you to monitor your policy’s terms.

Major Risks: Policy Lapse and MEC Status

Two serious risks can turn an IUL into a financial liability: policy lapse and becoming a Modified Endowment Contract (MEC).

Policy lapse occurs when the cash value is no longer sufficient to cover the internal costs and fees. This can happen if the policy is underfunded or experiences several years of low returns. If a policy lapses, you lose the death benefit, all remaining cash value, and any accumulated gains may become immediately taxable as ordinary income.

A policy becomes a Modified Endowment Contract (MEC) if it is funded too quickly, failing the IRS’s “7-pay test”. Once classified as an MEC, the tax advantages are severely curtailed. Withdrawals and loans are taxed on a last-in, first-out basis (earnings first), and a 10% penalty applies if you are under age 59½. This undermines the key benefit of tax-free access to cash value.

How IUL Works: A Deeper Dive into the Mechanics

Understanding an IUL’s mechanics is key to setting realistic expectations. When you pay a premium, the insurer first deducts the cost of insurance (COI), administrative fees, and rider charges. The remaining amount goes into your policy’s cash value account.

From there, you can typically allocate your cash value between a fixed account, which earns a modest, guaranteed interest rate, and an index account. The index account links your growth potential to a market index like the S&P 500. Your money is not directly invested in the market; instead, the insurer uses options strategies to mirror the index’s performance within certain limits.

The Engine of Growth: Caps, Floors, and Participation Rates

Your cash value growth in the index account is governed by three key factors:

- The Cap Rate: The maximum interest rate your policy can be credited in a given period. For example, with a 10% cap, even if the index gains 18%, your credited interest is 10%.

- The Floor Rate: Your safety net, typically 0% or 1%. If the index loses value, your cash value is protected from that market loss and is credited with the floor rate.

- The Participation Rate: The percentage of the index’s gain you capture. If the index is up 10% and your participation rate is 80%, you are credited 8% (before the cap is applied).

These elements work together through various index crediting methods, such as point-to-point, which measures the change from the start to the end of a period. A common feature is the annual reset, which locks in any gains each year, so you don’t give them back in a subsequent market downturn.

Caps and participation rates are not guaranteed. Insurers adjust them based on market conditions, particularly interest rates and volatility.

The Technical Side: A Look at the Pros and cons IUL

How do insurers offer both upside potential and downside protection? They use a portion of your funds for an options budget. The insurer buys call options on a market index, which provide the upside exposure. The majority of your cash value is held in conservative, fixed-income investments that generate the returns needed to fund the guaranteed floor and cover the cost of the options.

This hedging strategy’s cost fluctuates. When interest rates are low or market volatility is high, options become more expensive, leading insurers to lower the caps and participation rates they can offer. Conversely, higher interest rates can lead to more attractive caps. This is why the broader economic environment has a direct impact on your IUL’s performance. Understanding these mechanics is essential for evaluating whether the pros and cons IUL balance makes sense for you. For a deeper look, see our guide on How Does IUL Work?.

IUL Compared to Other Life Insurance Approaches

Understanding how IUL stacks up against other life insurance types is key to choosing the right policy. Each serves different needs and has unique trade-offs.

| Feature | Indexed Universal Life (IUL) | Whole Life Insurance | Variable Universal Life (VUL) | Term Life Insurance |

|---|---|---|---|---|

| Cost | Moderate to High | High | High | Low |

| Coverage Duration | Permanent (Lifelong) | Permanent (Lifelong) | Permanent (Lifelong) | Temporary (Specific Term) |

| Cash Value | Yes, market-linked growth | Yes, guaranteed growth | Yes, direct market investment | No |

| Growth Potential | Moderate to High (capped) | Low to Moderate (guaranteed) | High (uncapped) | None |

| Downside Risk | Low (0-1% floor) | Very Low (guaranteed) | High (can lose principal) | None (no cash value) |

| Flexibility | High (premiums, death benefit) | Low (fixed premiums, death benefit) | High (premiums, death benefit) | Low (fixed premiums, death benefit) |

| Complexity | High | Low | Very High | Low |

| Tax Advantages | Tax-deferred growth, tax-free loans | Tax-deferred growth, tax-free loans | Tax-deferred growth, tax-free loans | Tax-free death benefit only |

IUL vs. Other Permanent Life Insurance Options

When comparing pros and cons IUL against other permanent options, the differences are clear:

- Whole Life Insurance is the most predictable option. It offers guaranteed cash value growth and fixed premiums. It’s ideal for those who value certainty over high growth potential.

- Variable Universal Life (VUL) is the high-risk, high-reward option. Your cash value is directly invested in sub-accounts (like mutual funds), offering uncapped growth potential but also the risk of losing principal if the market declines.

- Term Life Insurance is the simplest and most affordable. It provides pure death benefit protection for a specific term (e.g., 20 years) with no cash value. It’s best for temporary needs like covering a mortgage.

IUL sits in the middle, offering higher growth potential than whole life with less risk than VUL, thanks to its floor. Its flexibility and cash value component distinguish it from term life.

IUL and Retirement Planning

IUL can be a powerful complement to a retirement strategy, but it shouldn’t be the primary vehicle. It’s best for those who have already maxed out their 401(k) and IRA contributions.

The main benefits for retirement are the ability to build a source of tax-free supplemental income through loans and the absence of required minimum distributions (RMDs). This provides flexibility and control over your taxable income in retirement, potentially keeping you in a lower tax bracket.

IUL offers tax diversification—having funds in tax-deferred (401k), taxable (brokerage), and tax-free (IUL loans) buckets. However, its effectiveness depends on proper, consistent funding over a long period (15+ years). For more insights, visit our retirement planning resources.

Who Is the Ideal Candidate for an IUL Policy?

IUL insurance is not a universal solution; it’s designed for a specific type of individual with particular financial goals. It’s best suited for those with a long-term perspective who can use its unique blend of protection, growth, and tax advantages.

Who Should Consider an IUL?

IUL can be an excellent fit for individuals who:

- Need permanent, lifelong life insurance coverage.

- Have a long investment horizon of 15 years or more.

- Are comfortable with complexity and active policy monitoring.

- Have maxed out other retirement accounts (401k, IRA) and seek another tax-advantaged vehicle.

- Are disciplined savers who can consistently fund the policy to maximize growth and avoid lapsing.

- Are high-net-worth individuals or business owners looking for tools for estate planning or wealth transfer.

Who Should Avoid an IUL?

Conversely, an IUL is likely not the best choice for those who:

- Need the lowest-cost coverage (term life is better for this).

- Have short-term financial goals, due to high surrender charges.

- Prefer simplicity and predictability (whole life may be a better fit).

- Have limited or inconsistent income to fund the policy adequately.

- Are young families whose primary need is maximum death benefit for the lowest cost.

Key Questions to Ask Before Buying

Before committing to an IUL, ask your agent these critical questions:

- What are the current and guaranteed cap and participation rates? How have they changed historically?

- Can you show me an illustration based on a 0% or 1% annual return after fees?

- What are all the fees (COI, admin, premium loads, rider costs) and how do they increase as I age?

- What are the surrender charges and how long do they last?

- What is the insurer’s financial strength rating (e.g., from AM Best)?

- How is this policy structured to avoid becoming a Modified Endowment Contract (MEC)?

- What is the agent’s compensation for selling this policy?

Frequently Asked Questions about IUL Pros and Cons

Can you lose money in an IUL policy?

Yes, but not directly from market downturns. The 0% floor protects your cash value from negative index performance. However, your cash value can still decline if the policy’s internal costs—the cost of insurance, administrative fees, and rider charges—are greater than the interest credited. If the cash value is depleted, the policy can lapse, and you would lose your coverage and any remaining value. Any gains could also become taxable.

Is IUL a good fit for retirement planning?

It can be, but as a supplemental tool, not a primary one. IUL is best for individuals who have already maxed out their 401(k)s and IRAs and are looking for another way to accumulate wealth in a tax-advantaged manner. Its key retirement benefits are the potential for tax-free income via policy loans and the absence of required minimum distributions (RMDs), offering significant flexibility in retirement. It is a long-term strategy that requires consistent funding to be effective. For more strategies, see our retirement planning resources.

How are IUL policies illustrated and are the returns guaranteed?

IUL illustrations are projections, not guarantees. They show how a policy might perform based on a set of assumptions about future index performance, caps, and participation rates. The only guaranteed elements are the minimum death benefit and the floor rate (typically 0% or 1%).

Caps, participation rates, and even some fees can be changed annually by the insurer. Because of this, you should view illustrations with skepticism. Industry rules like Actuarial Guideline 49 (AG 49) were created to make projections more realistic, but you should always ask to see illustrations based on conservative or poor performance scenarios to understand the potential risks.

The Bottom Line: Is an IUL Right for Your Financial Strategy?

After weighing the pros and cons, it’s clear that Indexed Universal Life insurance is a powerful but complex financial tool. It offers a unique balance of market-linked growth potential and downside protection, but it is not a simple product you can buy and forget. IUL demands active monitoring of its performance and costs to ensure it stays on track with your goals.

Who thrives with an IUL? Individuals with a long-term horizon (15+ years) who have already maximized other retirement accounts like 401(k)s and IRAs. It’s well-suited for disciplined savers who need permanent coverage and want an additional vehicle for tax-advantaged wealth accumulation and estate planning.

Who should look elsewhere? If your primary goal is affordable, temporary coverage, term life is a better choice. If you prefer guarantees and simplicity, consider whole life. The pros and cons IUL analysis suggests avoiding it if you have a tight budget, a short-term goal, or a low tolerance for complexity.

The key is an honest assessment of your financial discipline, time horizon, and goals. Are you prepared for the active management an IUL requires?

At ShieldWise™, we cut through the confusion to give you straight answers. We know evaluating IUL can be overwhelming, which is why we provide clear, jargon-free guidance. We help you compare top-rated policies side by side, so you can make a confident, informed decision.

If you’re still curious about whether an IUL could work for you, or if you want to see how it stacks up against other options, we’re here to help you explore your choices without the pressure or the sales pitch.

Explore how an IUL policy could fit into your financial plan.