Securing Your Legacy: Why Final Expense Insurance Matters

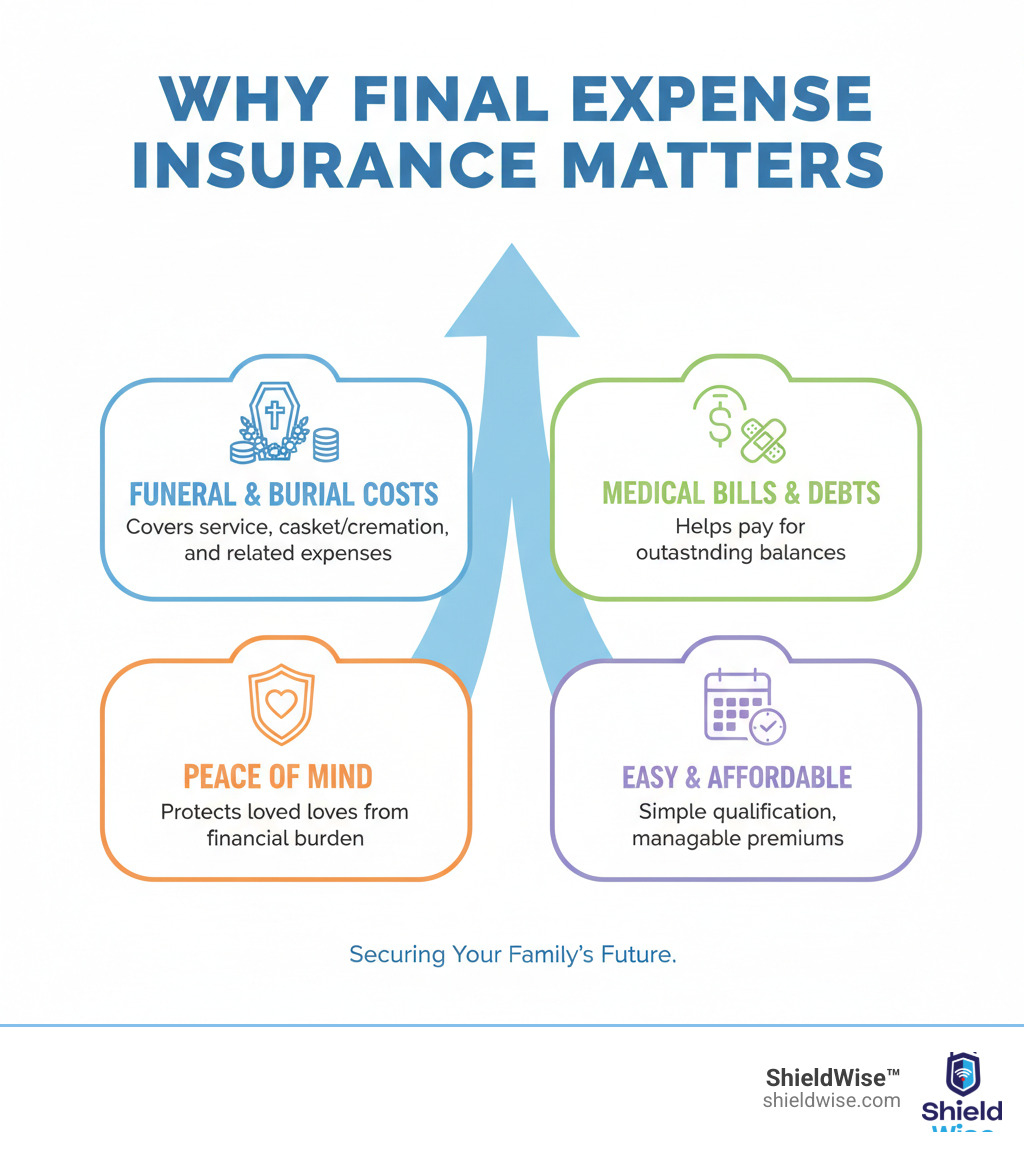

Many people wonder, Why final expense insurance? This small but important plan helps your loved ones cover costs when you pass away, removing a significant financial worry during a time of grief.

Here’s why final expense insurance is so important:

- Covers Funeral & Burial Costs: The average funeral can cost $8,000 to $10,000 or more. This insurance helps pay for these expenses, like the service, casket, or cremation.

- Handles Outstanding Debts: It can cover leftover medical bills, credit card balances, or other small debts you might leave behind.

- Provides Peace of Mind: You get to rest easy knowing your family won’t face unexpected bills when they’re already grieving.

- Easy to Qualify: Many policies don’t need a medical exam. This makes them available even for seniors or those with health conditions.

- Affordable Premiums: These plans are often designed to fit a fixed income. They offer predictable monthly payments that won’t go up.

Losing someone is hard enough without the added stress of unexpected bills. Final expense insurance prevents that, ensuring your final wishes are honored without burdening the people you love most.

What is Final Expense Insurance and How Does It Work?

Final expense insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance designed to cover costs when someone passes away. Unlike large policies meant to replace income, final expense insurance provides a smaller payout, typically from $2,000 to $50,000, to handle specific end-of-life expenses. This makes it a practical way to protect your loved ones from financial strain.

The Mechanics: From Premiums to Payout

The mechanics are straightforward:

- Fixed Premiums: Your payments are set when you buy the policy and will never increase.

- Lifetime Coverage: As a whole life policy, your coverage lasts your entire life as long as premiums are paid.

- Cash Value: The policy builds a tax-deferred cash value over time, which you can borrow against or withdraw.

- Death Benefit: A pre-set, typically tax-free amount is paid to your beneficiary upon your passing.

- Streamlined Claims: The claims process is designed to be fast, often paying out in days rather than weeks, so your family gets funds when they’re needed most.

What End-of-Life Costs Can It Cover?

The death benefit is flexible and can be used by your beneficiary for various expenses. While not legally restricted, the funds are intended to relieve financial pressure during a difficult time. Common costs include:

- Funeral and Burial Costs: The median cost for a funeral can exceed $8,000. The policy can cover the service, casket, burial plot, and headstone.

- Cremation Expenses: This includes the cremation process, urn, and memorial services.

- Medical Bills: It can help pay for end-of-life care, hospice, or other medical expenses not covered by insurance.

- Legal and Administrative Fees: Costs associated with settling an estate, such as lawyer and probate fees.

- Outstanding Debts: The benefit can cover smaller balances like credit cards or personal loans.

The goal is to prevent your family from struggling with these costs while grieving. For more on funeral expenses, see statistics on the rising cost of funerals.

The Role of Your Beneficiary

A common question is whether the beneficiary must use the money for the funeral. Legally, the payout is flexible. Once paid, your beneficiary decides how to use the funds, which could include funeral costs, medical bills, or other debts. This flexibility is why final expense insurance makes choosing the right beneficiary so important.

- Choose Someone You Trust: Select a person who understands and will honor your wishes.

- Talk About Your Wishes: Have an open conversation with your beneficiary about your funeral preferences and any debts you’d like settled. Writing them down is also helpful.

- Name a Backup: Always name a contingent (backup) beneficiary in case your primary choice cannot receive the funds.

Following these steps provides peace of mind that your final plans will be respected.

Why Final Expense Insurance is a Crucial Part of Your Financial Plan

Planning for end-of-life expenses is a responsible and loving act that protects your family from financial and emotional stress. Without a plan, your loved ones could face thousands of dollars in funeral costs, medical bills, and other debts while grieving.

Many people assume savings or Social Security will be enough, but the reality is different. The average funeral can cost nearly $10,000, while Social Security provides a one-time death benefit of only $255. This significant gap can create real hardship. Final expense insurance is designed to bridge that gap, providing funds quickly when your family needs them most. That’s why final expense insurance is a crucial part of any financial plan.

Who Benefits Most from This Coverage?

While anyone can benefit, this coverage is especially valuable for:

- Seniors: Final expense policies are designed for older adults, with streamlined approvals that are often unavailable with traditional life insurance.

- Individuals with health conditions: Simplified and guaranteed issue options make it possible to get coverage even with pre-existing conditions that might lead to denial elsewhere.

- Those with limited savings: It provides a dedicated fund for final costs, protecting any existing savings for your heirs.

- People on a fixed income: Predictable, fixed premiums make budgeting simple and stable.

- Anyone without other life insurance: It offers permanent protection specifically for end-of-life costs, filling a critical gap in financial planning.

Why final expense insurance is a smart choice for seniors

For seniors in Illinois, why final expense insurance is a smart choice becomes even clearer.

- Accessibility: Traditional life insurance often requires medical exams and can deny coverage based on age or health. Final expense policies are far more accessible, with many requiring no exam and some asking no health questions at all.

- Affordable Premiums: Because the death benefits are smaller and custom to final costs ($10,000 to $20,000, for example), premiums are kept manageable for those on a retirement budget. These premiums are also fixed for life.

- Protects Retirement Savings: You worked hard for your nest egg. This insurance prevents it from being drained by funeral costs, ensuring your savings can be used as intended.

- Supplements Inadequate Government Benefits: The Social Security death benefit is only $255, which is not nearly enough to cover funeral expenses. You can review the Social Security death benefit details to see how small it is.

This coverage provides true peace of mind, knowing you have protected your loved ones from a financial burden during their time of grief.

At ShieldWise™, we’ve seen how final expense insurance transforms difficult situations into manageable ones. It’s not about buying insurance. It’s about leaving a legacy of care and consideration, ensuring your final act is one of protection rather than burden.

Understanding the Pros, Cons, and Costs

Making an informed decision about any insurance product means weighing its advantages against its limitations and understanding the associated costs. When considering why final expense insurance might be right for you, we encourage you to look at the full picture.

The Clear Advantages of Final Expense Insurance

The benefits of final expense insurance make it an invaluable tool:

- Simplified Qualification: Most policies don’t require a medical exam, only a few health questions, making coverage accessible even with some pre-existing conditions.

- Fixed Premiums: Your premiums are locked in for life and will never increase.

- Quick Approval: The simplified process means coverage can often be approved in just a few days.

- Builds Cash Value: The policy accumulates a tax-deferred cash value that you can access during your lifetime.

- Tax-Free Death Benefit: The payout to your beneficiaries is generally not subject to federal income tax.

- Permanent Coverage: The policy lasts your entire life as long as premiums are paid.

The Drawbacks: Why final expense insurance isn’t for everyone

It’s also important to understand the limitations to know if it’s the right fit:

- Lower Coverage Amounts: With benefits typically under $50,000, these policies are not designed for large debts or income replacement.

- Higher Cost Per Dollar of Coverage: Compared to term life insurance, the cost per dollar of coverage is higher due to its permanent nature and simplified underwriting.

- Potential Waiting Periods: Guaranteed issue policies (with no health questions) usually have a two-year waiting period. If death occurs during this time, beneficiaries typically receive a refund of premiums plus interest.

- Not for Income Replacement: The policy is intended for final expenses, not to support dependents long-term.

Breaking Down the Cost

The cost of final expense insurance varies, with average policies often ranging from $30 to $70 a month. Several factors influence your specific premium:

- Age: The younger you are when you buy, the lower your premium.

- Gender: Women often receive slightly lower rates due to longer life expectancies.

- Health: Your answers to health questions affect your rate. Those with significant health issues or applying at older ages (over 70) may see premiums from $70-$120 a month.

- Coverage Amount: A larger death benefit means a higher premium.

- Smoker Status: Tobacco users will pay significantly higher rates.

We at ShieldWise™ understand that budgeting is key, especially for Illinois residents on fixed incomes. That’s why final expense insurance is designed with affordability in mind, offering a valuable solution without breaking the bank.

Navigating Your Options: From Application to Policy Features

Choosing the right final expense policy can feel a bit like navigating a maze, but it doesn’t have to be! Our goal at ShieldWise™ is to light the way, making sure you understand all your choices. We want you to confidently pick a policy that fits your financial plan perfectly and brings you the peace of mind you truly deserve.

Guaranteed Issue vs. Simplified Issue Policies

Final expense policies primarily come in two forms, based on their underwriting process:

- Simplified Issue: This is the most common type. It requires no medical exam but does ask a few health questions. It’s a great option for people in average health and is generally more affordable. Most policies offer immediate coverage with a level death benefit, meaning the full amount is available from day one.

- Guaranteed Issue: This type has no medical exam and no health questions, guaranteeing approval for applicants within the eligible age range (often up to 85). It’s ideal for those with serious health conditions who can’t qualify for other insurance. The trade-off is a higher cost and a mandatory waiting period (usually two years). If death occurs during this period, the benefit is typically a refund of premiums plus interest. This is often called a graded death benefit.

The right choice depends on your health. We can help you determine which policy is the best fit.

The Simple Application Process

Applying for final expense insurance is designed to be easy and fast. The process typically involves:

- No Medical Exam: Unlike traditional life insurance, you won’t need to undergo a physical check-up.

- Simple Health Questions: For simplified issue policies, you’ll answer a short health questionnaire. Honesty is crucial for a smooth claims process later.

- Online or Phone Application: At ShieldWise™, you can apply online or over the phone with guidance from our team.

- Quick Decisions: Because the process is streamlined, decisions are often made in days, sometimes even the same day.

- Minimal Paperwork: The entire process is hassle-free, allowing you to secure peace of mind quickly.

We’re here to guide you through these choices, ensuring you find a policy that truly protects your loved ones and manages costs effectively.

Frequently Asked Questions about Final Expense Insurance

We understand that you might have more questions about why final expense insurance is a good choice. It’s smart to be curious! Here are some of the most common questions we receive, answered in a way that we hope makes everything clear.

What is the difference between final expense and traditional life insurance?

While both are forms of life insurance, they have different purposes.

- Purpose: Traditional life insurance (term or whole) is designed for large-scale needs like income replacement or paying off a mortgage. Final expense insurance is specifically for smaller, end-of-life costs like funerals and medical bills.

- Coverage Amount: Traditional policies offer large death benefits (often $100,000+), while final expense policies have smaller benefits, typically from $2,000 to $50,000.

- Underwriting: Traditional insurance usually requires a full medical exam. Final expense insurance has simplified underwriting, often with no exam and just a few health questions, making it more accessible for seniors and those with health issues.

How much coverage do I actually need?

This is a personal decision based on your wishes and financial situation. To determine the right amount, consider:

- Average Funeral Costs: Research current funeral and burial/cremation costs in your area, as they can easily exceed $8,000.

- Personal Debts: Add any outstanding credit card balances, medical bills, or small loans you don’t want to leave behind.

- Desired Legacy: Many people choose a coverage amount between $10,000 and $20,000 to leave a small gift or financial cushion for their loved ones.

- Your Budget: The goal is to find a coverage amount with a premium that you can comfortably afford.

Our team at ShieldWise™ can help you find the right balance.

What happens if I stop paying my premiums?

If you stop paying premiums, your policy will eventually lapse, meaning your coverage ends and no death benefit will be paid. Before this happens, you have a few options. All policies have a grace period (usually 30-31 days) to make a late payment without losing coverage. If the policy has accumulated enough cash value, you may be able to use a non-forfeiture option, such as:

- Cash Surrender: You can take the accumulated cash value, which will terminate the policy.

- Reduced Paid-Up: Use the cash value to convert your policy into a smaller, permanent policy with no more premium payments.

- Extended Term: Use the cash value to keep your original death benefit amount for a fixed period of time as term insurance.

Consistent premium payments are essential to ensure your family receives the protection you planned for them. That’s why final expense insurance is a commitment to lifelong security.

Securing Peace of Mind for Your Loved Ones

As we’ve explored why final expense insurance is so valuable, it’s clear this is more than a policy—it’s a practical act of love. It shields your family from financial burdens, allowing them to focus on healing instead of bills. This affordable, streamlined plan covers funeral costs, medical bills, and other debts.

For seniors and those with health conditions, it’s a path to peace of mind. With fixed premiums, no-exam options, and a tax-free death benefit, you can ensure your final wishes are honored without creating stress for your family.

At ShieldWise™, we provide clear, simple guidance. We help you compare plans from trusted carriers to find the right coverage for your needs and budget in Illinois. Taking this step now ensures your legacy is one of care and protection. Don’t leave your loved ones to face unexpected costs alone.