Why Understanding Medicare Matters for Family Caregivers

Medicare for caregivers and adult children is often misunderstood, leading to confusion and missed opportunities. If you care for an aging parent, you’ve likely asked: “Will Medicare pay me for this work?” The short answer is no, but that’s not the whole story.

Here’s what every caregiver needs to know about Medicare:

- Medicare does NOT pay family members directly for caregiving services like bathing, meal prep, or daily companionship

- Medicare DOES cover certain home health services (skilled nursing, physical therapy, medical equipment) that can indirectly support your caregiving role

- Medicare Advantage plans may offer supplemental benefits like meal delivery, transportation, or respite care

- Other programs exist that CAN pay family caregivers—including state-based options and veterans’ benefits—but they’re NOT Medicare

- Caregiver training is now a covered Medicare service (though the payment goes to the provider, not you)

The confusion is understandable. An estimated 48 million Americans provide unpaid care for loved ones. Many are adult children juggling jobs and families while managing a parent’s healthcare, shouldering an average of $7,200 per year in out-of-pocket costs.

The key is knowing what Medicare covers for your loved one and where to find programs that support you. This guide explains Medicare’s role, identifies helpful services, and points you toward financial support options beyond Medicare.

Understanding Medicare’s Limits: What It Covers and What It Doesn’t

Understanding Medicare’s purpose and limitations is crucial, especially for long-term care and caregiver compensation. Medicare is a federal health insurance program for those 65+, younger people with certain disabilities, and people with End-Stage Renal Disease (ESRD). It covers medically necessary services, not long-term custodial care.

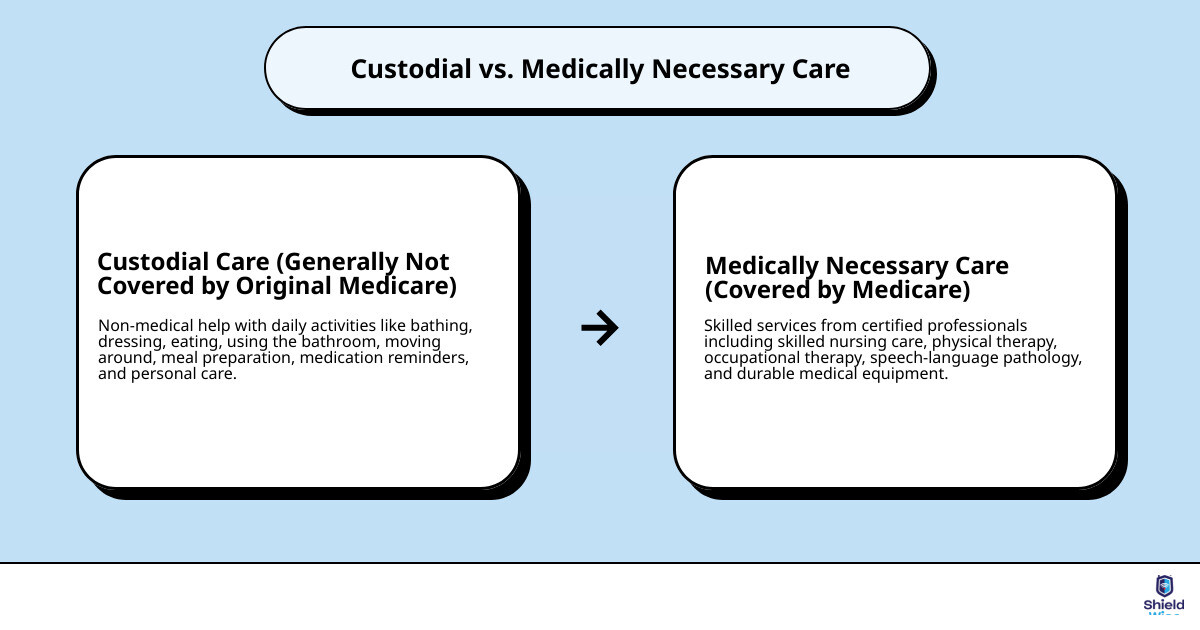

The distinction between custodial care (non-medical help with daily activities like bathing or dressing) and medically necessary care is vital. Medicare generally doesn’t cover custodial care if it’s the only care needed.

Medically necessary care, prescribed by a doctor to treat an illness or injury, is what Medicare covers. This includes skilled nursing or physical therapy. This distinction is a major limitation for long-term care, as Medicare is not designed for that purpose.

Original Medicare (Parts A & B) covers hospital stays, doctor visits, and some home health care. Medicare Advantage (Part C) plans bundle Parts A, B, and often D (prescription drugs), with potential extra benefits. Part D helps cover prescription costs. Our goal at ShieldWise™ is to help you steer these options. For more information, explore our Medicare resources.

Home Health Services That Indirectly Support Caregivers

While Medicare doesn’t pay you directly, it does cover certain home health services that can ease your burden. These services, provided by Medicare-certified agencies, must be medically necessary and prescribed by a doctor. They help your loved one recover at home.

The specific home health services covered typically include:

- Part-time skilled nursing care: This could involve wound care, injections, monitoring vital signs, or medication management.

- Physical therapy: To help with movement, strength, and balance.

- Occupational therapy: To help with daily activities like dressing, bathing, and eating.

- Speech-language pathology services: To help with communication or swallowing difficulties.

- Part-time home health aide services: If your loved one also needs skilled nursing or therapy, Medicare may cover a home health aide to assist with personal care (like bathing, dressing, and using the toilet) for a limited time. This is only covered as part of a broader plan of care that includes skilled services.

- Durable Medical Equipment (DME): Medicare Part B covers 80% of the approved cost for certain DME like wheelchairs, walkers, hospital beds, and oxygen equipment, which can be essential for home safety and mobility.

These services reduce your hands-on duties and ensure professional medical attention for your loved one. You can find more details on Medicare’s official home health services page.

Medicare Advantage (Part C) Supplemental Benefits

Medicare Advantage (Part C) plans, offered by private companies, must cover everything Original Medicare does but often include extra benefits helpful to caregivers. These supplemental benefits support your loved one’s health, indirectly relieving some of your tasks.

Common supplemental benefits that can be helpful include:

- Transportation to doctor visits: Many plans offer rides to and from medical appointments, freeing up your time.

- Meal delivery: After a hospital stay or for those with chronic conditions, meal delivery services can ensure your loved one receives nutritious food without you having to cook every meal.

- In-home support services: Some plans may cover non-medical in-home support, such as help with light housekeeping, grocery shopping, or personal care, beyond what Original Medicare covers.

- Adult day care services: These programs provide supervised care, social activities, and sometimes meals during the day, offering you a much-needed break.

Benefit availability varies by plan and location. If your loved one has a Medicare Advantage plan, review the Evidence of Coverage document or use tools like BenefitsCheckUp to see what’s included. Ensure the plan aligns with your loved one’s needs and supports your caregiving role.

Caregiver Training and Respite Care Under Medicare

A new Medicare rule, effective in 2024, is good news for caregivers. It pays eligible health providers to offer you training and education. While the payment goes to the provider, you get free professional guidance on managing medications, personal care, and understanding your loved one’s condition. This training can empower you with skills and confidence.

Respite care offers temporary relief for primary caregivers. Here’s when it may be covered by Medicare:

- Hospice benefit respite care: If your loved one is receiving hospice care, Medicare covers short-term inpatient respite care. This allows your loved one to be cared for in a Medicare-approved facility (like a hospice inpatient facility, hospital, or nursing home) for up to 5 days at a time, providing you with a much-needed break.

- Medicare Advantage respite benefits: Some Medicare Advantage plans may offer limited respite care benefits as part of their supplemental services. Check your plan’s details, as these vary.

- GUIDE Model for dementia care: Launched in 2024, Medicare’s GUIDE Model (Guiding an Improved Dementia Experience) is a newer initiative designed to support both dementia patients and their unpaid caregivers. It allows Medicare providers to deliver care coordination, caregiver training, and access to respite care, covering up to 80 hours of Medicare-funded respite care per year. This is a promising development for families managing dementia.

Exploring Financial Support Options for Caregivers

Since Medicare doesn’t pay family caregivers directly, the next step is to explore programs that do. Many caregivers reduce work hours or leave jobs, impacting their finances. Fortunately, other public and private programs offer this crucial support.

Here’s a quick comparison of Medicare and other public programs for caregiver support:

| Program Type | Primary Focus | Direct Caregiver Payment? | Long-Term Care Coverage? | Eligibility |

|---|---|---|---|---|

| Medicare | Medical care for 65+/disabled | No (indirect support only) | Limited (medically necessary home health, hospice) | Age 65+, certain disabilities |

| Medicaid | Health coverage for low-income | Yes (via consumer-directed programs) | Extensive (home & community-based services) | Income & asset-based, varies by state |

| VA Programs | Veteran-specific benefits | Yes (stipends, assistance) | Yes (home & community-based services) | Veteran status, service-connected conditions |

| State PFL | Paid time off for family care | Yes (portion of wages) | No (short-term leave) | State-specific employment criteria |

State and Community Programs That May Support Family Caregivers

State and community-based programs are often the primary source of direct financial support for family caregivers, recognizing the value of home-based care over more expensive institutions.

The most prominent are Medicaid programs with consumer-directed care models. If your loved one has Medicaid, your state may allow a family member to become a paid caregiver. Every state, including Illinois, has at least one consumer-directed Long-Term Services and Supports (LTSS) option.

Key aspects of these programs include:

- Home and Community-Based Services (HCBS) waivers: These Medicaid waivers allow states to provide long-term care services at home, often including payment for family caregivers. Eligibility requires meeting strict income/asset limits and needing a nursing home level of care.

- Consumer-directed models: These programs empower the care recipient to manage a budget and hire their own caregivers, which can include family members. This can improve quality of life and health outcomes.

- Eligibility requirements: These vary by state but typically include income and asset thresholds for the care recipient. In 2024, state Medicaid income limits for these services can range from $914/month to $2,742/month. The process involves a needs assessment and income screening.

To explore options in Illinois, contact the Illinois Department of Healthcare and Family Services (HFS) or your local Area Agency on Aging.

Support for Veterans and Their Caregivers

The Department of Veterans Affairs (VA) offers several programs for qualifying veterans that provide significant support, including financial compensation, for family caregivers.

Key VA caregiver support programs include:

- Aid and Attendance Benefits program: This provides monthly payments on top of a VA pension for qualified veterans and survivors. These benefits help cover caregiver costs, who may be a family member. Eligibility depends on the veteran’s need for assistance with daily living.

- Veteran-Directed Home and Community-Based Services (VDC) program: This program offers veterans a flexible budget to pay for care, including hiring a family member to assist with daily living activities.

- Program of Comprehensive Assistance for Family Caregivers (PCAFC): This program provides eligible family caregivers of veterans with a monthly stipend, health insurance, and access to training and counseling. It’s for veterans with a serious injury or illness from their time in service.

- Respite Care program: The VA’s Respite Care program can provide breaks for a veteran’s family caregiver, while still addressing the veteran’s care needs in their home, a VA facility, or a community setting.

Navigating the VA system can be complex, but organizations like the Elizabeth Dole Foundation and the American Legion offer assistance to military caregivers.

Other Financial Support Options

Beyond government programs, several other avenues can help family caregivers receive compensation:

- Personal Care Agreements: A formal, written contract between a care recipient and a family caregiver. It outlines services, pay rate, and payment frequency. This legitimizes payments, preventing issues with future Medicaid eligibility. We strongly recommend consulting an elder law attorney to draft one.

- Long-term care insurance policies: Some policies allow family members to be paid as caregivers. If your loved one has a policy, contact their insurance agent for written confirmation of benefits to see if this is an option.

- State-specific Paid Family Leave laws: A growing number of states offer Paid Family Leave (PFL), allowing eligible workers to take paid time off to care for a seriously ill family member. Unlike the unpaid federal FMLA, state PFL laws provide partial income replacement. As of now, Illinois does not have a PFL law, but this can change. Check with your state labor office for current information.

Essential Resources and Protections: A Guide to Medicare – for Caregivers and Adult Children

Being a caregiver is a demanding role. It’s essential to understand Medicare, tap into support networks, plan financially, know your legal rights, and protect yourself from scams.

Navigating Local and National Support Systems

You don’t have to steer caregiving alone. Many organizations support family caregivers:

- Area Agencies on Aging (AAAs): These local, federally supported agencies are a fantastic starting point. They offer guidance on state Medicaid programs, counseling, care referrals, respite care, and support groups. Learn more about AAAs and find local resources.

- National Family Caregiver Support Program (NFCSP): Administered through AAAs, this program funds state grants for caregiver support, including information, counseling, training, and respite care to help keep loved ones at home.

- Caregiver Action Network: This national organization provides education and resources for caregivers, including financial tips and self-care advice.

- Eldercare Locator: A public service connecting caregivers with local support for caregiving, financial management, and elder abuse prevention.

These networks can alleviate the toll of caregiving by connecting you to vital services.

Financial and Legal Protections for Caregivers

Caregiving can cause financial strain. Thankfully, tax benefits and legal protections can help:

- Tax benefits: You may qualify for tax credits or deductions. The Child and Dependent Care Credit can help if you pay for care for a qualifying adult while you work. You may also deduct medical expenses if your loved one qualifies as a dependent. Consult a tax professional to maximize these benefits.

- Appealing service denials: If a service is denied, don’t give up. You can appeal:

- Medicare: Medicare has a multi-level appeals process. If a service is denied, you can request a “redetermination” within 120 days. Keep detailed records.

- Medicaid: States have a formal appeal process for Medicaid waiver programs. If an HCBS waiver is denied, you typically have 30-90 days to request a hearing. Document your loved one’s needs thoroughly.

- VA: The VA has an appeals process for denied benefits, which may involve a Higher-Level Review or an appeal to the Board of Veterans’ Appeals. Organizations can help you steer this.

Understanding and using these protections can make a tangible difference in your caregiving journey.

Avoiding Scams: A Critical Alert for Caregivers

Caregivers are often targets for Medicare scams. Scammers prey on the desire for financial relief. Be vigilant and informed.

Common red flags for Medicare caregiver payment scams include:

- Unsolicited calls, emails, or door-to-door visits promising “secret” or “new” Medicare benefits for caregivers.

- Requests for your Medicare number, Social Security number, or bank account information over the phone or by unverified individuals.

- High-pressure sales tactics or demands for immediate decisions.

- Offers that sound too good to be true, like “free money” from Medicare for caregiving.

Legitimate programs will never:

- Call you out of the blue asking for your personal information.

- Charge you a fee to apply for Medicare benefits.

- Threaten you if you don’t comply with their demands.

If you suspect a scam:

- Hang up immediately or close the door.

- Do not give out any personal information.

- Report it to the Federal Trade Commission at ReportFraud.ftc.gov.

- You can also report suspected Medicare fraud to the Office of Inspector General or your state Attorney General’s office.

- Remember: Official Medicare benefits are publicized on Medicare.gov, not through cold calls. When in doubt, call Medicare at 1-800-MEDICARE (1-800-633-4227) to verify claims.

Frequently Asked Questions about Medicare for Caregivers

Does Original Medicare pay family members to be caregivers?

No, Original Medicare does not directly pay family members for caregiving. It covers specific, medically necessary skilled services (like skilled nursing or physical therapy) for a limited time, not custodial care (like bathing or meal prep). The new caregiver training benefit pays the health provider for training you, not you directly.

What is the main difference between Medicare and other public programs for caregiver support?

The main difference is their purpose. Medicare is federal health insurance for acute medical needs and short-term skilled care; it does not pay for long-term custodial care or directly pay family caregivers. In contrast, other public programs like state-run Medicaid and VA initiatives are designed to support long-term care and do have options to pay family caregivers through programs like HCBS waivers or caregiver stipends.

Where is the best place to start looking for financial help as a caregiver?

Your local Area Agency on Aging (AAA) is the best place to start. These federally supported hubs offer free, personalized guidance on aging and caregiving resources, including:

- Connecting you with state-specific Medicaid programs that might pay family caregivers.

- Referring you to caregiver training programs and support groups.

- Providing information on respite care options.

- Helping you understand other local, state, and federal programs that can offer financial assistance or support services.

AAAs can help you steer the complex support landscape. You can find your local AAA through an online search or the Eldercare Locator.

Conclusion: Taking the Next Step in Your Caregiving Journey

Caring for an aging parent is a profound act of love. While Medicare is a cornerstone of senior healthcare, understand it’s for medical needs, not a direct payment system for family caregivers. This distinction is crucial for every adult child to grasp.

Understanding Medicare’s limits doesn’t mean you’re without options. As we’ve explored, Medicare offers indirect support through home health services and caregiver training. More importantly, other programs—like state Medicaid waivers, VA benefits, and Personal Care Agreements—can provide direct financial compensation.

Empowerment through knowledge is key. By understanding what’s available, you can build a more comprehensive care plan that leverages a mix of programs and resources custom to your unique situation. Don’t hesitate to seek out the invaluable support offered by Area Agencies on Aging and other advocacy groups.

At ShieldWise™, we understand the complexities you face. We are committed to providing clear, jargon-free guidance to help you protect your family, control costs, and secure the right coverage for your loved ones. Whether it’s navigating Medicare options or planning for long-term care, we’re here to help you take the next step in your caregiving journey. Learn more about planning for senior care.