Why Finding Medicare Resources Near You Matters

Medicare – local and near me is one of the most important searches you’ll make when you turn 65 or retire. Here’s how to find help quickly:

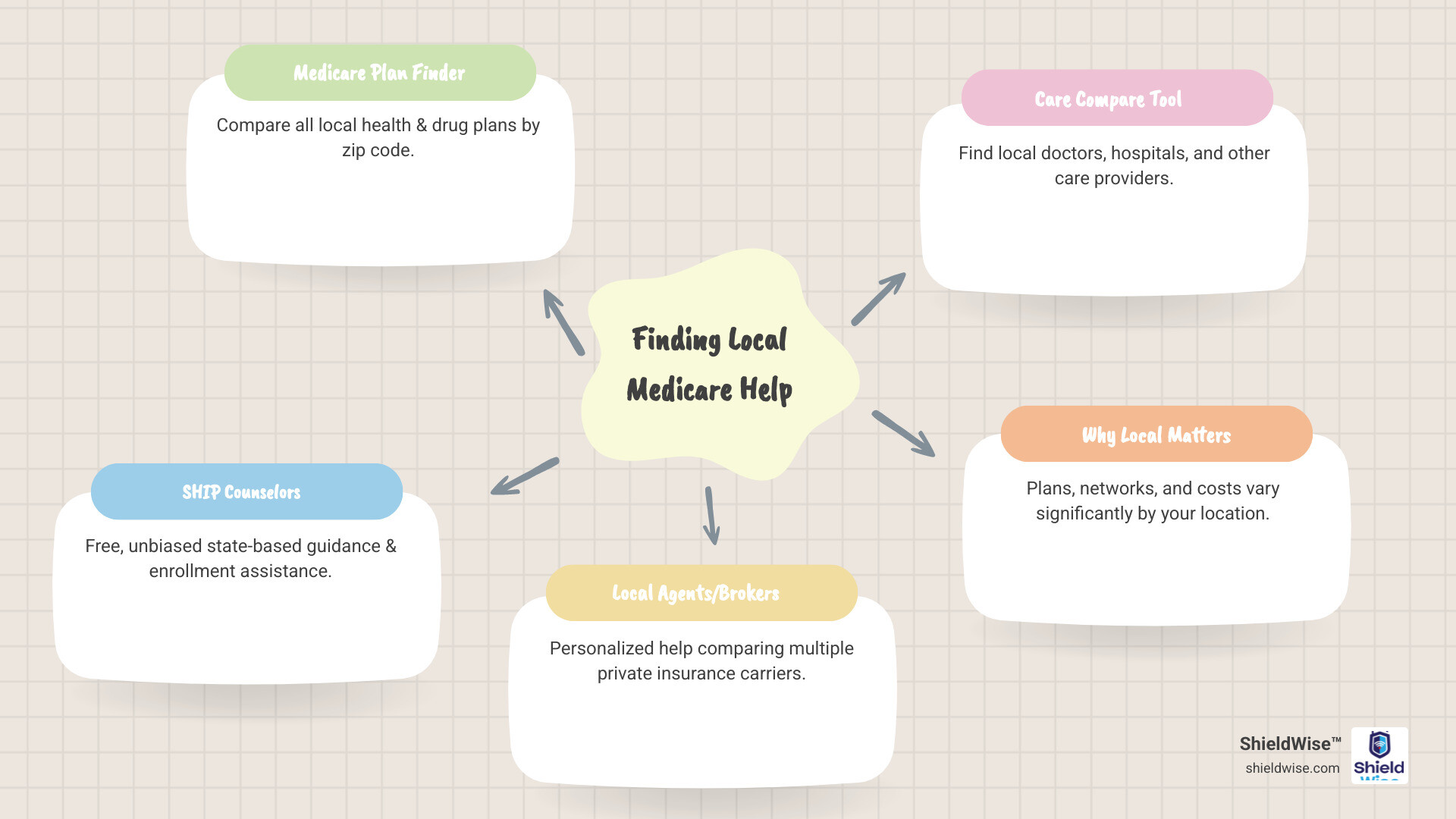

Quick Ways to Find Local Medicare Help:

- Medicare.gov Plan Finder – Compare all plans in your zip code

- SHIP (State Health Insurance Assistance Program) – Free, unbiased counseling in every state

- Medicare.gov Care Compare – Find doctors, hospitals, and providers near you

- Licensed Local Agents – Get personalized help comparing plans from multiple carriers

Medicare isn’t one-size-fits-all. The plans available to you, the doctors you can see, and the costs you’ll pay all depend on where you live. What works for your friend in another state might not even be available in your zip code.

That’s why finding local Medicare resources is so crucial. You need to know which plans cover your doctors, which pharmacies are in-network, and where to get help when you have questions.

The good news? You have multiple free resources right in your community. From online tools that compare every plan in your area to trained counselors who can walk you through your options—help is closer than you think.

This guide will show you exactly where to find local Medicare plans, providers, and trusted advisors who can answer your questions in plain English.

Understanding Medicare: The Basics of Parts, Plans, and Costs

Before searching for Medicare – local and near me resources, it’s helpful to understand the basics. Knowing how Medicare works helps you make informed decisions about your health coverage. This section breaks down the essential components so you can confidently find plans and providers that fit your needs.

The Parts of Medicare: A, B, C, & D

Medicare is a collection of “Parts,” each covering different health services.

-

Part A (Hospital Insurance): Covers inpatient care in a hospital, skilled nursing facility care (after a hospital stay), hospice, and some home health services. Most people who paid Medicare taxes while working get Part A without a monthly premium.

-

Part B (Medical Insurance): Covers outpatient services like doctor visits, preventive care (flu shots, screenings), durable medical equipment, and some home health services. Part B has a monthly premium.

-

Part D (Prescription Drug Coverage): Helps cover prescription drug costs. Offered by private insurance companies, these plans have their own premiums, deductibles, and list of covered drugs (formulary). It’s vital to compare plans to ensure your medications are covered affordably.

-

Part C (Medicare Advantage): An alternative to Original Medicare, these “MA Plans” are offered by private insurers. They provide all your Part A and Part B benefits, and usually Part D, in one plan. Many also include extra benefits like dental, vision, and hearing care.

For a deeper dive, explore our comprehensive guide: More info about Medicare.

Original Medicare vs. Medicare Advantage Plans

You can receive your Medicare benefits in two main ways: Original Medicare or a Medicare Advantage Plan. Your choice impacts costs, provider options, and extra benefits.

Original Medicare Explained:

This includes Part A and Part B. With Original Medicare, you can see any doctor or hospital in the U.S. that accepts Medicare, offering great flexibility. However, it doesn’t cover prescriptions (requiring a separate Part D plan), dental, vision, or hearing. It also has cost-sharing (deductibles, coinsurance) and no annual out-of-pocket limit, which can lead to high costs. Many people buy a Medicare Supplement (Medigap) policy to cover these gaps.

Medicare Advantage Explained:

Also called Part C, these plans are offered by private companies. They must cover everything Original Medicare does but often bundle in Part D drug coverage and extra benefits like dental, vision, and hearing.

-

Network Differences (PPO, HMO): Most MA plans have provider networks.

- HMOs (Health Maintenance Organizations) usually require you to use in-network providers and get referrals to see specialists.

- PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see out-of-network providers, though at a higher cost. You typically don’t need referrals for specialists.

Always check if your doctors are in-network for any MA plan you consider.

-

Cost Structures: You still pay your Part B premium with most MA plans, but many have low or $0 monthly plan premiums. They have their own cost-sharing, but all plans include an annual out-of-pocket maximum, which protects you from unlimited medical costs.

-

Extra Benefits (Dental, Vision): A major draw for MA plans is the inclusion of benefits not covered by Original Medicare, such as routine dental, vision, and hearing care. Some plans also offer fitness programs or transportation benefits.

Here’s a quick comparison:

| Feature | Original Medicare + Medigap + Part D | Medicare Advantage (Part C) |

|---|---|---|

| Parts Included | Part A, Part B, Part D, Medigap | Part A, Part B, usually Part D (all-in-one plan) |

| Provider Choice | Any Medicare-accepting provider | Typically network-based (HMO, PPO) |

| Referrals Needed | No | Often for HMOs |

| Monthly Premiums | Part B, Part D, Medigap | Part B (plus plan premium, often $0) |

| Out-of-Pocket Max | No (covered by Medigap) | Yes |

| Extra Benefits | No (unless purchased separately) | Often includes dental, vision, hearing, fitness |

| Administrative Body | Federal Government | Private Insurance Companies |

Medicare Coverage and Costs

Understanding what Medicare covers and what you’ll pay is crucial for budgeting. While a great benefit, Medicare is not free.

Common Covered Services:

Part A covers inpatient hospital stays and related care. Part B covers medically necessary services like doctor visits, preventive care, lab tests, and mental health care. Many preventive services, such as annual wellness visits, mammograms, and colonoscopies, are covered at 100%.

Premiums, Deductibles, Coinsurance, Co-payments:

These are your out-of-pocket costs:

- Premium: A fixed monthly payment for your plan (e.g., for Part B, Part D, or a Medicare Advantage plan).

- Deductible: The amount you pay for care before your plan begins to pay.

- Co-payment: A fixed amount you pay for a service (e.g., $20 for a doctor’s visit).

- Coinsurance: A percentage of the cost you pay for a service after meeting your deductible (e.g., the 20% you pay for most services under Part B).

These costs can add up, which is why many people choose Medigap policies or Medicare Advantage plans to manage their expenses.

How to Find Medicare – Local and Near Me Resources

Now, let’s find Medicare – local and near me resources. Whether you need a health plan, a doctor, or free advice, excellent tools and people are ready to help.

Finding Local Health & Drug Plans Near Me

The plans available can vary by zip code, so local research is key.

- Medicare Plan Finder Tool: The official tool on Medicare.gov is the best place to start. It’s a comprehensive, unbiased resource for comparing all health and drug plans in your area.

- Search by Zip Code: Enter your zip code to see all Medicare Advantage and Part D plans available to you.

- Compare Costs: Review monthly premiums, deductibles, and estimated annual costs for different plans.

- Review Drug Formularies: Enter your prescriptions to see how each plan covers your specific drugs and what your costs will be at local pharmacies.

- Check Star Ratings: Use Medicare’s 5-star rating system to evaluate plan quality and member satisfaction.

Finding Local Medicare Providers Near Me

Ensuring your doctors are covered is crucial. The official Medicare Care Compare tool can help.

- Official Medicare Care Compare Tool: Found on Medicare.gov, this tool lets you find and compare doctors, hospitals, nursing homes, and other providers.

- Search for Doctors and Hospitals: Look up providers by name or specialty to see if they accept Medicare and check their quality ratings.

- Compare Facilities: Evaluate nursing homes and dialysis facilities based on health inspections, staffing, and quality measures.

Use this tool to verify your providers are in-network for any Medicare Advantage plan you’re considering. Find and compare care near you directly through this official link: Find and Compare Care Near You.

Free, Unbiased Help from Your Local SHIP Office

The State Health Insurance Assistance Program (SHIP) is a fantastic free resource for Medicare – local and near me assistance.

- SHIP Explained: SHIPs are federally funded state programs providing free, unbiased counseling to Medicare beneficiaries. They are educators, not salespeople.

- What They Do: Trained counselors offer personalized, confidential help. They can explain your options, help you compare plans, assist with enrollment, and help you apply for financial aid programs.

- Finding Your SHIP: Every state has a SHIP. You can find your local office by visiting Medicare.gov or calling 1-800-MEDICARE. This is one of the best free local Medicare resources available.

The Benefits of a Local Medicare Agent or Broker

While SHIP offers unbiased education, a local Medicare agent or broker provides personalized service and can help you compare plans from multiple private insurance carriers.

- Personalized Recommendations: An agent assesses your health needs, budget, and preferred doctors to recommend suitable plans.

- Application Assistance: They guide you through the enrollment process, helping you complete applications accurately and on time.

- Comparing Multiple Carriers: An agent offers insights into plans from different companies, explaining nuances that may not be obvious online.

- Simplifying Choices: A good agent translates complex Medicare jargon into plain English.

- Year-Round Support: Their service continues after enrollment, providing help with plan questions or issues.

At ShieldWise, we connect you with knowledgeable professionals who offer this personalized guidance, making it easier to compare plans from trusted carriers and secure the right coverage.

Enrolling in Medicare and Getting Financial Help

Knowing key deadlines and financial aid options makes Medicare enrollment much smoother. Missing a deadline can lead to coverage delays and lifelong penalties, so it’s important to know the dates.

Key Medicare Enrollment Periods

-

Initial Enrollment Period (IEP): Your first chance to sign up. This 7-month window starts 3 months before your 65th birthday month and ends 3 months after. Enrolling during your IEP helps avoid late penalties. For more details, see our guide: Medicare Basics: Turning 65.

-

General Enrollment Period (GEP): If you miss your IEP, you can sign up for Part A and/or Part B from January 1 to March 31 each year. Coverage starts July 1, and you may face a permanent late enrollment penalty for Part B.

-

Fall Open Enrollment (AEP): From October 15 to December 7 each year, all beneficiaries can switch plans. You can move between Original Medicare and Medicare Advantage, or change your MA or Part D plan. Changes take effect January 1.

-

Medicare Advantage Open Enrollment Period (MA OEP): From January 1 to March 31, if you’re in an MA plan, you can make one change: switch to another MA plan or return to Original Medicare (and get a Part D plan).

-

Special Enrollment Periods (SEPs): Certain life events, like moving, losing other coverage, or qualifying for Extra Help, allow you to change your coverage outside of standard periods.

How to Get Help Paying for Medicare

If you have limited income and resources, several programs can help lower your healthcare costs.

-

Medicare Savings Programs (MSPs): These state programs can help pay your Part A and/or Part B premiums, deductibles, and co-payments. Contact your state Medicaid office or SHIP to see if you qualify.

-

Extra Help for Part D: This federal program helps pay for Part D prescription drug costs, including premiums and deductibles. You can apply through the Social Security Administration.

-

Medicaid: This joint federal and state program provides comprehensive health coverage for people with very limited income. If you qualify for both Medicare and Medicaid, most of your costs will be covered.

-

State Pharmaceutical Assistance Programs (SPAPs): Some states offer programs to help residents pay for prescription drugs. Check with your state’s Department of Insurance to see if any programs are available.

Exploring these assistance programs is a smart way to manage your local Medicare resources effectively.

Protecting Yourself and Accessing Official Resources

Staying informed and secure is vital when managing your health information. Here’s how to protect yourself from fraud and find reliable, official Medicare information.

How to Protect Yourself from Medicare Fraud

Protecting yourself from Medicare fraud is crucial.

- Guard Your Medicare Number: Treat your Medicare number like a credit card number. Only share it with your doctors, pharmacists, or trusted advisors (like those at ShieldWise). Never give it to unsolicited callers.

- Identify Phone Scams: Be wary of unexpected calls from anyone claiming to be from Medicare asking for personal information. Medicare will rarely call you unprompted. If you’re suspicious, hang up and call 1-800-MEDICARE.

- Recognize Fraudulent Claims: Review your Medicare Summary Notices (MSNs) or Explanation of Benefits (EOBs). Look for services or equipment you didn’t receive.

- Report Fraud: If you suspect fraud, report it immediately to 1-800-MEDICARE or your local Senior Medicare Patrol (SMP) program. Reporting helps protect you and the Medicare system.

- Prevent Medical Identity Theft: This happens when someone uses your Medicare number to get care or submit false claims. Shred sensitive documents and check your medical records regularly.

Official Medicare Publications and Forms

When in doubt, go to the official source. Medicare provides reliable information to help you manage your healthcare.

- The ‘Medicare & You’ Handbook: This official government handbook is mailed to all Medicare households each fall. It’s an excellent, comprehensive resource for your benefits and rights.

- Official Medicare Publications: The Medicare website offers a library of publications on various topics. Find them at: Official Medicare Publications.

- Downloading Forms: You can find necessary forms on the official website, such as the Authorization to Disclose Personal Health Information form.

- Spanish-Language Resources: Medicare provides many publications and website resources in Spanish to ensure information is accessible to everyone.

Relying on official sources is the best way to get accurate information about your Medicare – local and near me options.

Frequently Asked Questions about Finding Local Medicare Help

We hear a lot of questions about finding Medicare – local and near me resources. Here are some of the most common ones, answered to help clarify your search.

What is the best way to find Medicare plans in my area?

The official Medicare Plan Finder tool on Medicare.gov is the most comprehensive resource for comparing all available health and drug plans in your zip code. For personalized guidance, a local SHIP counselor or licensed agent can help you narrow down the best options for your specific needs.

Is help from a SHIP counselor really free?

Yes, SHIPs are federally funded, state-based programs that provide free, confidential, and unbiased one-on-one insurance counseling and assistance to Medicare beneficiaries. Their goal is to educate you, not to sell you a plan.

How do I know if a local doctor accepts Medicare?

You can use the “Find care providers” tool on Medicare.gov to search for doctors, hospitals, and other providers in your area. The tool will indicate whether they accept Medicare and may also show if they accept new patients. It’s always a good practice to also call the doctor’s office directly to confirm.

Conclusion

Navigating Medicare can feel overwhelming, but you don’t have to do it alone. By using online tools like the Medicare Plan Finder, connecting with free local resources like SHIP, and consulting with knowledgeable agents, you can confidently find the right coverage. ShieldWise is committed to providing clear, jargon-free guidance to help you compare plans and secure the right coverage. Explore your Medicare options today.