Why Universal Life Insurance Matters for Your Long-Term Security

Universal life – cash value and flexibility brings together two powerful features that set it apart from traditional life insurance: the ability to adjust your premiums and coverage as life changes, and a savings component that grows tax-deferred over time.

Quick Answer: Universal Life – Cash Value and Flexibility

- Cash Value Component: A portion of your premium goes into a savings account that grows with interest and can be accessed during your lifetime

- Flexible Premiums: You can pay more when money is good, or pay less (or even skip payments) when budgets are tight—as long as your cash value covers the costs

- Adjustable Death Benefit: Many policies let you increase or decrease your coverage as your family’s needs change

- Tax Advantages: Cash value grows tax-deferred, and policy loans are generally tax-free

- Lifetime Protection: Coverage lasts your entire life, provided you maintain sufficient cash value or meet minimum premium requirements

Life insurance doesn’t have to be rigid or one-size-fits-all. For families navigating changing incomes, business owners with variable earnings, or anyone seeking both protection and a financial tool, universal life offers options that traditional policies simply can’t match.

The trade-off? You need to actively manage the policy. Unlike whole life insurance with its fixed premiums and guaranteed cash value growth, universal life requires you to keep an eye on your cash value balance and understand how your premium choices today affect your coverage tomorrow.

This isn’t the right fit for everyone—especially if you prefer “set it and forget it” simplicity. But if you value control, want your insurance to adapt as your circumstances change, and appreciate having access to accumulated cash value when opportunities or emergencies arise, universal life deserves a closer look.

What is Universal Life Insurance?

Universal life insurance (UL) is a type of permanent life insurance designed to offer lifelong coverage. Unlike term insurance, which covers a specific period, a UL policy is built to last your entire life, as long as premiums are paid or the cash value is sufficient. It combines a death benefit with a savings component known as cash value.

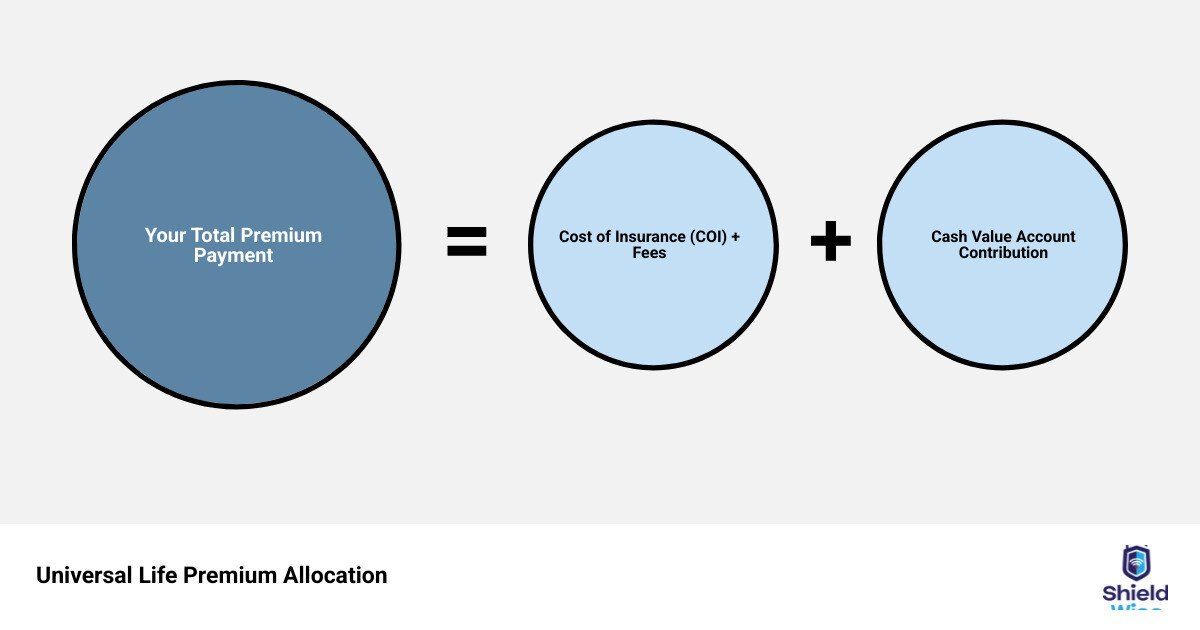

When you pay a premium, a portion covers the “cost of insurance” (COI) and administrative fees. The rest is allocated to your cash value account, where it grows over time, typically on a tax-deferred basis. The goal is to provide a death benefit for your loved ones while also offering a flexible financial asset you can access during your lifetime.

How UL Differs from Other Policies

To appreciate the “UL advantage,” it helps to see how it compares to other policies:

- Compared to Term Life Insurance: Term life is temporary coverage (e.g., 10-30 years) with no cash value. It’s cheaper initially, but coverage ends with the term. Universal life is permanent and builds cash value, offering both lifelong protection and a savings component.

- Compared to Whole Life Insurance: Whole life is also permanent with cash value, but it’s rigid, with fixed premiums and guaranteed growth. Universal life offers flexibility in premiums and death benefits, allowing adjustments as your needs change. This is why UL is often called “flexible premium adjustable life insurance.”

The key differentiators for universal life are its flexible premiums, adjustable coverage, and cash value growth, creating a dynamic tool that adapts to your life.

The Core Benefits of Universal Life: Cash Value and Flexibility

The cornerstone of universal life is its dual advantage of cash value accumulation and unparalleled flexibility, creating a robust financial tool.

Adjustable Premiums: A key benefit is the ability to adjust premium payments. Unlike the fixed payments of whole life, UL lets you pay more when finances are strong to build cash value faster. If you face financial challenges, you can pay less or even skip payments by using accumulated cash value to cover policy costs. This is ideal for those with fluctuating incomes.

Tax-Deferred Growth: The cash value grows on a tax-deferred basis, meaning you don’t pay taxes on the gains as they accumulate. This can significantly boost your long-term savings potential compared to taxable accounts.

Access to Funds: The accumulated cash value is a liquid asset you can access via loans or withdrawals for emergencies, major purchases, or supplemental retirement income.

Financial Planning Tool: A UL policy is a versatile tool that can be integrated into broader financial strategies, offering a blend of protection, savings, and wealth transfer.

Understanding Cash Value Growth in Universal Life – Cash Value and Flexibility

Understanding how your cash value grows is key to managing a universal life – cash value and flexibility policy. After your premium covers the cost of insurance (COI) and fees, the rest is credited to your cash value account, where it earns interest.

- Crediting Rate: This is the interest rate applied to your cash value, which is declared by the insurer and may change.

- Guaranteed Minimum Interest Rate: Most policies guarantee your cash value will grow by at least a certain percentage (e.g., 2-3%), providing a safety net.

- Cost of Insurance (COI): This covers the death benefit cost and increases as you age. If cash value growth doesn’t outpace the rising COI, your policy could be at risk, highlighting the need for active monitoring.

- Risks and Rewards: The reward is tax-deferred growth and a liquid asset. The risk is that low premium payments may not keep pace with the rising COI, potentially causing the policy to underperform or lapse.

- Accessing Cash Value: You can access funds through:

- Policy Loans: Borrow against your cash value, generally tax-free. Interest accrues, and an outstanding loan reduces the death benefit.

- Withdrawals: Take funds directly from your cash value. Withdrawals up to the amount you’ve paid in premiums are tax-free; gains are taxed as ordinary income. Withdrawals also reduce the death benefit.

Leveraging Flexible Premiums in Universal Life – Cash Value and Flexibility

The “flexible premiums” aspect is what truly sets universal life – cash value and flexibility apart.

- Adjust Payments to Your Needs: When finances are strong, you can pay more than the minimum premium to accelerate your cash value growth. During leaner times, you can pay less or even skip payments, as long as the cash value can cover the monthly policy costs. This adaptability is ideal for those with variable income, like small business owners in Illinois.

- Self-Funding the Policy: A common strategy is to overfund the policy in early years. Once the cash value is substantial, it can be used to pay future premiums, making the policy “self-funding,” which is especially useful in retirement.

- Manage the Lapse Risk: This flexibility requires responsibility. Consistently underfunding the policy will deplete the cash value, risking a policy lapse and loss of coverage. Regular monitoring is essential.

A Closer Look at the Types of Universal Life Insurance

While all universal life policies share the core principles of cash value and flexibility, there are several variations designed to meet different financial goals and risk tolerances. Understanding these distinctions is key to choosing the right policy.

| Feature / Policy Type | Standard Universal Life (UL) | Indexed Universal Life (IUL) | Variable Universal Life (VUL) | Guaranteed Universal Life (GUL) |

|---|---|---|---|---|

| Cash Value Growth | Interest-rate based, declared by insurer, with guaranteed minimum | Tied to stock market index performance (e.g., S&P 500), with caps/floors | Invested in sub-accounts chosen by policyholder (stocks, bonds, mutual funds) | Minimal or no cash value growth, focus on death benefit |

| Risk Level | Low-moderate (interest rate fluctuations) | Low-moderate (market-linked growth with downside protection) | High (market risk, potential for loss of principal) | Very Low (predictable, no investment risk) |

| Flexibility | High (premiums, death benefit) | High (premiums, death benefit, index allocation) | High (premiums, death benefit, investment choices) | Low (premiums, minimal cash value access) |

| Primary Focus | Lifelong coverage, moderate cash accumulation | Lifelong coverage, market-linked cash accumulation potential | Lifelong coverage, aggressive cash accumulation potential | Lifelong death benefit guarantee |

| Guarantees | Guaranteed minimum interest rate | Guaranteed minimum interest rate (floor), death benefit guarantee (if managed) | Death benefit guarantee (if managed) | Strong no-lapse death benefit guarantee |

Indexed Universal Life (IUL)

Indexed universal life (IUL) links cash value growth to a stock market index, like the S&P 500, without direct investment. Growth is determined by “caps” (maximum gain) and “floors” (minimum gain, often 0%), protecting your principal from market losses. For example, if the index gains 15% and your cap is 10%, you earn 10%. If the index loses 5%, your floor of 0% means you lose nothing. This offers a balance of growth potential and downside protection. To learn more about this specific type of universal life, you can explore our detailed guides on What is IUL and How Does IUL Work.

Variable Universal Life (VUL)

Variable universal life (VUL) allows you to invest your cash value directly into “sub-accounts,” which are similar to mutual funds containing stocks and bonds. This gives you control and the potential for higher growth than other UL types. However, it also comes with direct market risk; if your investments perform poorly, your cash value can decrease, and you could lose principal. VUL requires active management and a higher risk tolerance. Because of these investment risks, VUL policies are considered securities and are regulated by the Financial Industry Regulatory Authority (FINRA). For a neutral overview, see Variable universal life insurance.

Guaranteed Universal Life (GUL)

Guaranteed universal life (GUL) prioritizes a lifelong, guaranteed death benefit over cash value accumulation. These policies often have minimal or no cash value growth, resulting in lower premiums than other UL types. The key feature is a “no-lapse guarantee”: as long as you pay the specified premium, the policy remains in force, typically to an advanced age like 95 or 121. This makes GUL an affordable, predictable option for those focused solely on leaving a death benefit.

Key Considerations and Potential Downsides

While universal life – cash value and flexibility offers compelling advantages, it’s not without its complexities and potential drawbacks. Understanding these is crucial for making an informed decision and effectively managing your policy.

- Policy Management: Unlike “set it and forget it” whole life policies, universal life requires active management. You need to monitor your cash value balance, understand how your premium payments affect it, and be aware of the rising cost of insurance (COI). If you don’t manage it proactively, your policy could underperform or even lapse.

- Rising Cost of Insurance (COI): The cost of insurance component of your premium generally increases over time as you age. If your cash value isn’t growing fast enough to offset this rising COI, you might need to pay higher out-of-pocket premiums later in life to keep the policy in force.

- Surrender Charges: If you decide to cancel or “surrender” your universal life policy in its early years, you may incur surrender charges. These fees can significantly reduce the amount of cash value you receive back. Surrender charges typically phase out over a period, often 10-20 years.

Tax Implications of Loans and Withdrawals

Accessing your cash value has tax consequences. While policy loans are generally tax-free, withdrawals and surrenders can trigger taxes on any gains. It’s crucial to understand these rules before accessing your funds.

Here is a summary of how accessing cash value is typically taxed:

- Policy Loan: Generally tax-free. Interest accrues, and an outstanding loan reduces the death benefit. If the policy lapses, the loan amount above your cost basis (premiums paid) may be taxed.

- Withdrawal: Tax-free up to your cost basis. Any amount withdrawn beyond that is considered a gain and is taxed as ordinary income. Withdrawals reduce the death benefit.

- Full Policy Surrender: You receive the cash value minus any surrender charges. If this amount exceeds your cost basis, the gain is taxed as ordinary income, and your coverage ends.

Always consult a qualified tax advisor for personalized guidance on your specific situation.

The ‘No-Lapse Guarantee’ Explained

A ‘no-lapse guarantee,’ common in GUL policies, addresses the risk of a policy lapsing if the cash value is depleted.

- How it Works: This feature guarantees your policy will remain in force as long as you pay a specified minimum premium. This premium is designed to maintain the death benefit, not build significant cash value.

- Peace of Mind: It acts as a secondary guarantee that overrides cash value performance. Even if the cash value drops to zero, the policy won’t lapse if the required premiums are paid. This provides certainty for those who prioritize a guaranteed death benefit over cash value accumulation.

- The Trade-off: Paying only the minimum no-lapse premium means you won’t build much, if any, accessible cash value.

Frequently Asked Questions about UL Insurance

We often get questions about the nuances of universal life insurance. Here are some common inquiries to further clarify how universal life – cash value and flexibility truly works.

Can you lose money in a universal life insurance policy?

Yes, if the cash value is depleted by high policy costs, poor investment performance (in VUL), or unpaid loans, the policy can lapse and you could lose the premiums paid. This is why active policy management is so important with universal life insurance. While standard UL and IUL policies have floors to protect against market losses on cash value, the rising cost of insurance can still erode value if not properly funded. VUL policies carry direct investment risk, meaning your cash value can decrease if the underlying investments perform poorly.

What happens to the cash value in a universal life policy when you die?

Typically, the insurance company keeps the cash value and your beneficiaries receive the stated death benefit. Some policies offer a rider to pay out both, but this costs more. It’s important to clarify this with your policy provider. Generally, the cash value is considered part of the insurer’s reserves to fund the death benefit, rather than an additional payout to beneficiaries. If you wish for your beneficiaries to receive both the death benefit and the cash value, you may need to select an “increasing death benefit” option or add a specific rider, which will usually result in higher premiums.

Is universal life a good choice for retirement savings?

It can be a tool for supplemental retirement income due to its tax-deferred growth and tax-advantaged access, but it should be considered alongside traditional retirement accounts. Universal life policies can offer a stable source of funds during retirement, especially during market downturns, allowing you to avoid selling investments at a loss. However, it’s generally not recommended as a primary retirement savings vehicle. Traditional retirement accounts like 401(k)s and IRAs often offer more direct investment options and higher growth potential. Universal life is best viewed as a complementary tool in a well-diversified financial plan.

Is a UL Policy the Right Shield for Your Future?

Universal life – cash value and flexibility offers a dynamic solution for those seeking lifelong financial protection coupled with adaptable savings. Its ability to adjust to your changing life circumstances, from fluctuating income to evolving family needs, makes it a powerful tool in a comprehensive financial plan.

We’ve explored how the cash value component grows tax-deferred, offering a reservoir of funds you can access for various needs, and how flexible premiums empower you to manage your policy payments in sync with your financial reality. Whether you’re drawn to the market-linked growth potential of Indexed Universal Life, the investment control of Variable Universal Life, or the pure death benefit guarantee of Guaranteed Universal Life, there’s a UL option designed to fit different goals and risk appetites.

However, the “UL advantage” comes with the responsibility of active policy management. Understanding the interplay between your premiums, cash value, and the cost of insurance is key to ensuring your policy performs as intended and provides the long-term security you expect.

For individuals in Illinois and beyond, who value control, adaptability, and a policy that can evolve with them, universal life insurance can be an indispensable part of their financial shield. We are here to help you understand these complex products and make the choice that best aligns with your long-term financial goals.

Ready to explore how universal life insurance can work for you? Explore your Universal Life Insurance options and connect with our experts today.