Understanding Universal Life Insurance: A Flexible Approach to Lifetime Coverage

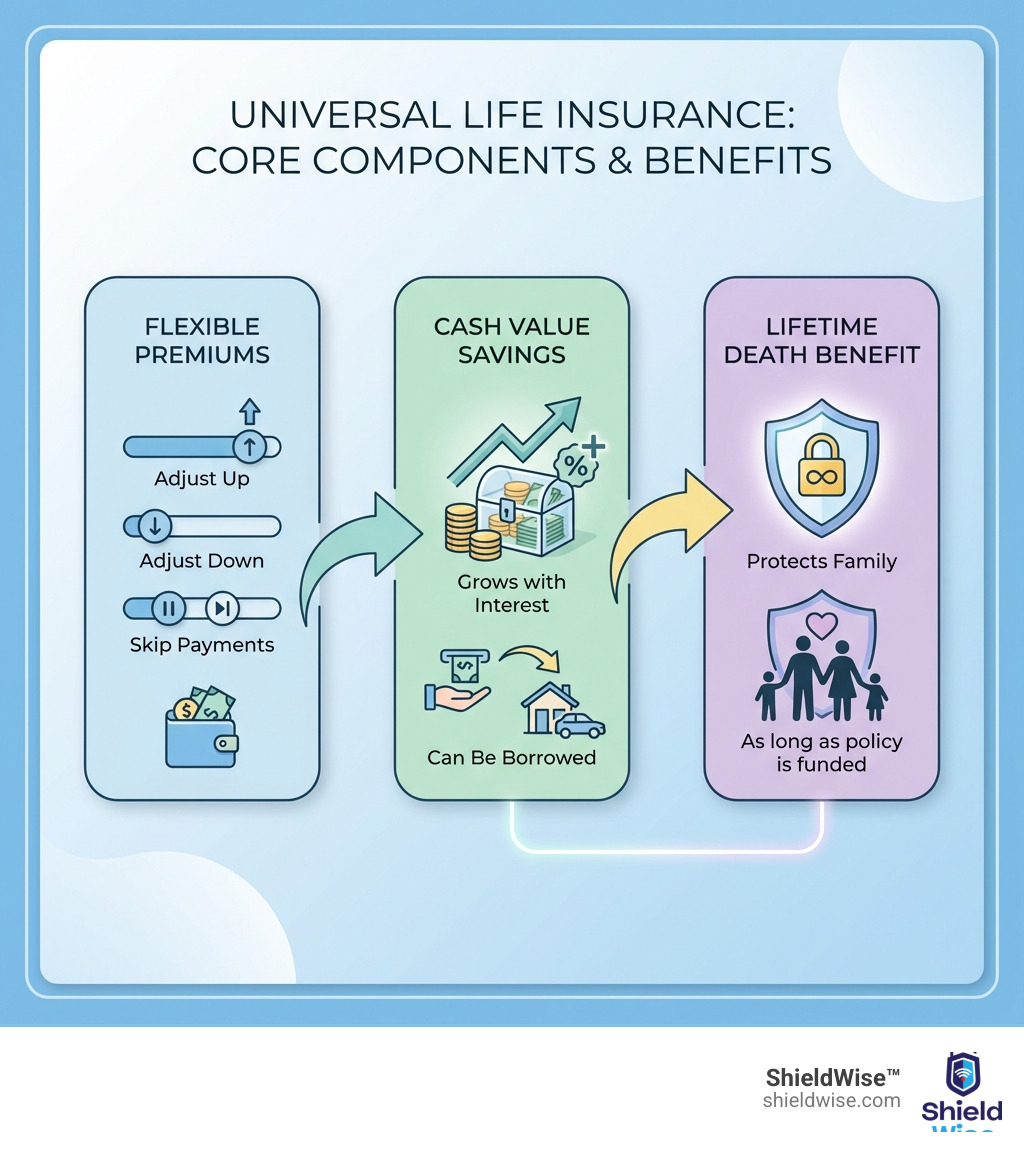

What is universal life insurance? Universal life insurance is a type of permanent life insurance offering lifetime coverage and a cash value component that grows over time. Unlike term life (which expires) or whole life (which has fixed premiums), universal life provides the flexibility to adjust your premium payments and death benefit as your needs change. It’s designed for those who want long-term protection with more control over their policy’s performance.

Quick Answer:

- Permanent coverage that can last your entire life (often to age 95–120)

- Flexible premiums you can raise, lower, or sometimes skip—as long as cash value covers costs

- Cash value component that grows based on interest rates and can be borrowed or withdrawn

- Adjustable death benefit you may increase or decrease over time

- Requires active monitoring to avoid underfunding or policy lapse

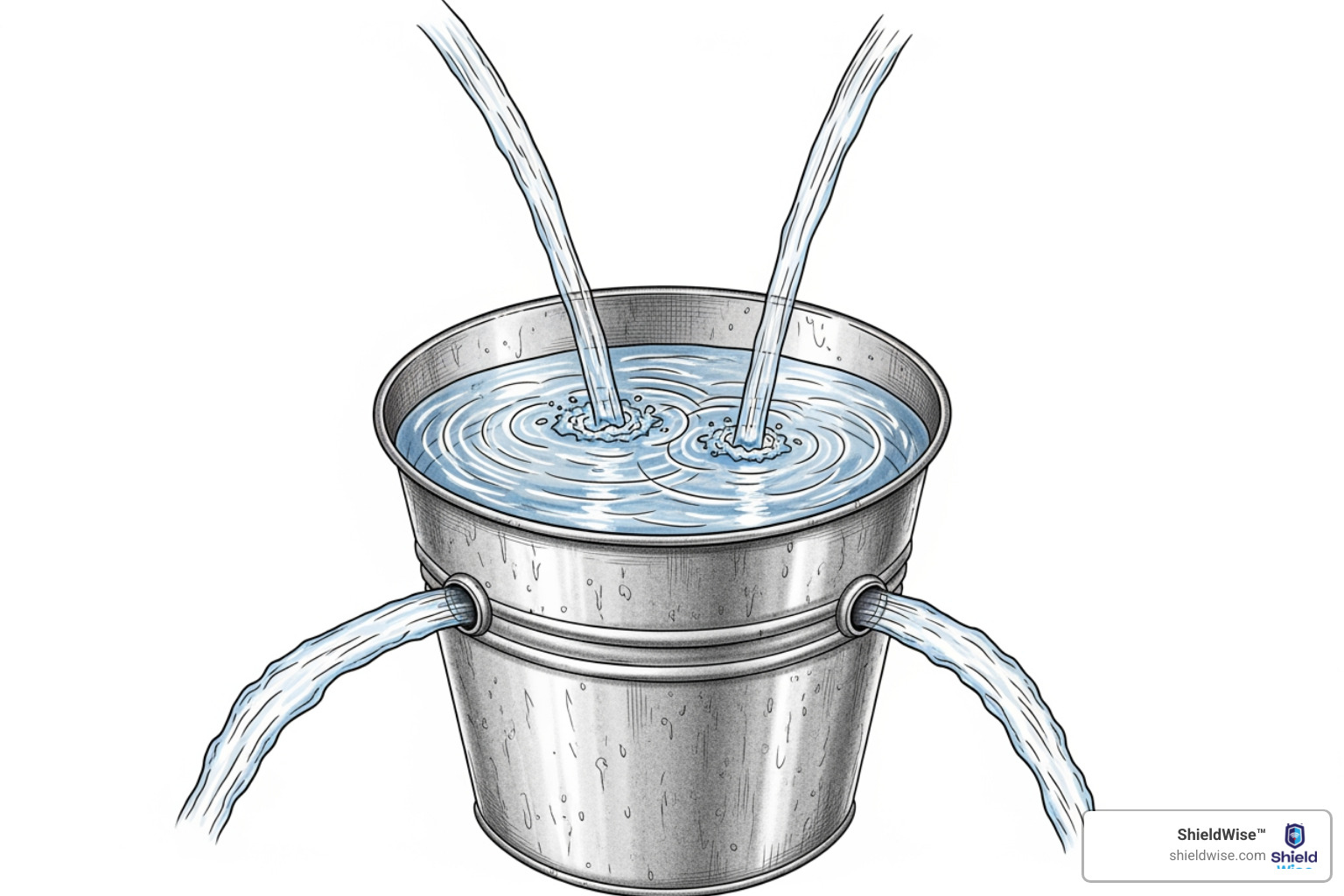

Many policyholders are surprised when their universal life policy is at risk of lapsing. They thought their premium was fixed, but UL policies work differently. Your premium goes into a cash value “bucket,” and each month, the insurer deducts the cost of insurance and fees. This cost increases as you age. If you don’t contribute enough to keep the bucket full, your coverage can end.

This guide will walk you through how universal life works, its pros and cons, and how it compares to other insurance types. You’ll get a clear picture of what universal life offers—and what it demands.

How Universal Life Insurance Works: A Look Under the Hood

Think of your universal life policy as a financial account with three main parts: premiums you pay, costs the insurer deducts, and the remaining cash value that earns interest. This structure is at the heart of what is universal life insurance.

- Flexible Premiums: Unlike the rigid payment schedules of whole life, you can adjust your premium payments. You can pay more to build cash value faster or pay less (even skipping payments) during lean times, as long as your cash value can cover the policy’s costs. This is ideal for those with fluctuating incomes.

- Cost of Insurance (COI): This is what the insurer charges for the death benefit. The COI increases as you age. Each month, the COI and other fees are deducted from your cash value.

- Cash Value Growth: The money left in your account after deductions is the cash value, which grows with interest. If your cash value is robust, it can absorb the rising COI, but if it dwindles, you may need to pay higher premiums to prevent the policy from lapsing.

This delicate balance between premiums, cash value, and the COI is why active policy management is so important. You can also access your cash value through policy loans and withdrawals, though this will reduce your death benefit if not repaid.

The Role of Cash Value and Interest Rates

The cash value component is a key feature of universal life, growing on a tax-deferred basis. This means you don’t pay taxes on the interest earnings as they accumulate.

Most UL policies have a minimum guaranteed interest rate (e.g., 2%), providing a safety net. However, the actual interest credited often fluctuates with market conditions or the insurer’s performance. Higher interest rates can accelerate your cash value growth, while lower rates can slow it down.

The performance of your cash value directly impacts your policy’s longevity. Strong growth can cover the increasing cost of insurance in later years, keeping your premiums stable. Poor growth may lead to higher premium requirements to prevent a policy lapse.

For those seeking more market exposure, variations like Indexed Universal Life (IUL) link cash value growth to a stock market index. You can learn more by exploring our guide on How Does IUL Work?.

The Main Advantages and Disadvantages of Universal Life

Universal life insurance offers a unique blend of permanent coverage and flexibility. However, it’s important to weigh its advantages and disadvantages to see if it aligns with your financial goals.

Key Advantages of a UL Policy

- Flexible Premiums: You can adjust premium payments, paying more to build cash value or less (even skipping payments) if money is tight, as long as costs are covered. This is ideal for those with variable income.

- Adjustable Death Benefit: You can typically request to increase or decrease your death benefit as your life circumstances change (an increase usually requires new medical underwriting).

- Potential for Cash Value Growth: A portion of your premium grows as cash value on a tax-deferred basis, earning interest that can accumulate significantly over time.

- Access to Cash Value: You can access the accumulated cash value during your lifetime through tax-free policy loans or withdrawals to supplement income or cover major expenses.

- Lifetime Coverage: As a permanent policy, it provides coverage for your entire life, as long as it remains funded, ensuring your beneficiaries receive a death benefit.

- Can be Cheaper than Whole Life: Its flexible structure can make it a more affordable permanent coverage option than whole life, especially in the early years.

Key Disadvantages and Risks to Consider

- Policy Management Required: UL policies require active monitoring of cash value, interest rates, and policy costs to ensure they remain adequately funded and don’t lapse. It is not a “set it and forget it” product.

- Risk of Lapse from Underfunding: If you underpay premiums or cash value growth is poor, the policy can run out of funds and lapse, terminating your coverage. This can lead to unexpected premium hikes later in life.

- Returns Are Not Guaranteed: Beyond a minimum rate, the interest credited to your cash value can fluctuate. Low interest rates can slow growth and may require you to pay higher premiums.

- Increasing Cost of Insurance (COI) Over Time: The internal cost for the death benefit rises as you age. If cash value growth doesn’t keep pace, your out-of-pocket premium payments may need to increase to keep the policy active.

- Surrender Charges: Canceling the policy in the early years (often the first 10-15) will likely result in surrender fees, which reduce the cash value you get back.

- Cash Value Lost at Policyholder’s Death: In most standard policies, beneficiaries receive the death benefit, but the insurance company retains the policy’s cash value.

Universal Life vs. Term vs. Whole Life Insurance

Universal life, term life, and whole life are three primary types of life insurance. While all provide a death benefit, they differ in structure, flexibility, and cost. This breakdown shows how what is universal life insurance compares to its counterparts.

| Feature | Universal Life Insurance | Whole Life Insurance | Term Life Insurance |

|---|---|---|---|

| Coverage Duration | Permanent (lifelong, as long as funded) | Permanent (lifelong, guaranteed) | Temporary (set period: 10, 20, 30 years) |

| Premium Structure | Flexible; can adjust payments within limits; can vary over time | Fixed; guaranteed level payments for life | Fixed; level payments for the term duration |

| Cash Value | Yes; grows based on interest rates (variable, but with a minimum guarantee); accessible | Yes; guaranteed growth rate; accessible | No cash value component |

| Flexibility | High; adjustable premiums and death benefit | Low; fixed premiums and death benefit | Low; fixed terms and death benefit (can’t adjust mid-term) |

| Typical Cost | Moderate to High (can be cheaper than whole life initially, but costs can rise later) | High (generally highest among the three due to guarantees) | Low (generally lowest, especially for younger individuals) |

| Policy Management | Required (monitoring cash value, COI) | Minimal (once established, generally self-sustaining) | Minimal (pay premiums, coverage exists) |

How Universal Life Differs from Whole Life

Both are permanent policies, but the key difference is flexibility vs. guarantees. Whole life offers fixed premiums, a guaranteed death benefit, and guaranteed cash value growth. It’s predictable but more expensive and rigid. Universal life prioritizes flexibility, allowing you to adjust premiums and death benefits. Its cash value growth is less predictable and depends on interest rates, requiring more active management from the policyholder.

How Universal Life Differs from Term Life

The main difference here is permanent vs. temporary coverage. Term life is simple, affordable protection for a specific period (e.g., 20 years). If you outlive the term, the coverage ends with no payout. It has no cash value component. Universal life is designed to last your entire life and includes a cash value savings element that you can access. While UL premiums are higher than term, it provides lifelong protection and a way to build wealth.

What is Universal Life Insurance and Its Variations?

What is universal life insurance is not a single product but a category with several variations. Each type offers a different approach to cash value growth and risk, allowing you to tailor a policy to your financial goals.

The Different Types of UL Policies

The main types of universal life policies include:

- Guaranteed Universal Life (GUL): This is the most predictable UL policy, focused on providing a guaranteed death benefit with fixed premiums at a lower cost than whole life. Cash value growth is minimal, making it ideal for those who prioritize affordable, permanent coverage over cash accumulation.

- Indexed Universal Life (IUL): IUL links cash value growth to a market index (like the S&P 500). It offers growth potential with downside protection via a “floor” (often 0%) that prevents losses, but also has a “cap” that limits gains. It balances risk and reward. For a deeper dive, explore our guide on What is IUL?.

- Variable Universal Life (VUL): VUL offers the highest growth potential and the most risk. You invest your cash value in sub-accounts similar to mutual funds. Your returns are tied to market performance, meaning you could see significant gains or substantial losses. VUL policies are securities and require a licensed representative.

Customizing Your Policy with Common Riders

Riders are optional add-ons that improve your coverage for an extra cost. Common options include:

- Accelerated Death Benefit Rider: Access a portion of your death benefit if diagnosed with a terminal, critical, or chronic illness.

- Waiver of Premium Rider: Waives your premiums if you become totally disabled and cannot work, keeping your policy active.

- Guaranteed Insurability Rider: Lets you buy more coverage at future dates without a new medical exam.

- Long-Term Care Rider: Allows you to use part of your death benefit to pay for long-term care services.

- Accidental Death & Dismemberment (AD&D) Rider: Pays an extra benefit if death is caused by an accident.

These riders help personalize your policy to fit your unique needs.

Your Guide to Managing a UL Policy

Owning a universal life policy requires active management. Unlike “set and forget” products, you must monitor your policy’s performance by reviewing annual statements to avoid unexpected premium increases or a potential lapse.

How to Access Your Policy’s Cash Value

You can access your policy’s accumulated cash value in three primary ways:

- Policy Loans: Borrow against your cash value, generally tax-free and without a credit check. Unpaid loans, plus interest, are deducted from the death benefit.

- Withdrawals (Partial Surrenders): Take money out, which permanently reduces your cash value and death benefit. Withdrawals are tax-free up to your cost basis (total premiums paid); gains above that may be taxed.

- Surrendering the Policy: Terminate the policy to receive its cash surrender value (cash value minus fees and loans). This ends your coverage, and any gains are taxable.

Consult a financial professional before accessing cash value, as each method has different consequences for your policy.

Understanding the Tax Implications

Universal life insurance offers several tax advantages:

- Tax-Deferred Growth: Your cash value grows without being taxed annually.

- Tax-Free Policy Loans: Loans are generally not considered taxable income.

- Tax-Free Death Benefit: The payout to your beneficiaries is typically free from income tax.

- Modified Endowment Contract (MEC): Be aware of MEC rules. If you fund your policy too quickly (exceeding IRS limits), it can be reclassified as a MEC. Per the U.S. tax code information, loans and withdrawals from a MEC are taxed less favorably and may incur penalties. Working with an advisor can help you avoid this status.

Who is Universal Life Insurance Best Suited For?

Universal life is an excellent fit for certain financial situations:

- Individuals with Fluctuating Income: Business owners, freelancers, or commission-based workers benefit from flexible premium payments.

- Those with Long-Term Financial Goals: It serves as both permanent insurance and a long-term savings vehicle for retirement or other major expenses.

- People with Estate Planning Needs: The death benefit can provide liquidity for heirs to cover taxes or to leave a financial legacy.

- Anyone Desiring Flexible Permanent Coverage: It offers adaptability in premiums and death benefits that rigid whole life policies lack.

- Individuals Comfortable with Active Policy Management: It’s best for those willing to monitor their policy to ensure its long-term health.

If you’re in Illinois and these descriptions resonate with you, universal life insurance might be a valuable part of your financial plan.

Conclusion: Is Universal Life the Right Choice for You?

We’ve explored what is universal life insurance, how it works, its advantages, disadvantages, and how it compares to other life insurance options. It’s a powerful and flexible financial tool that can provide lifelong protection and a growing cash value. However, its flexibility also comes with the responsibility of active management to ensure the policy remains adequately funded and performs as expected.

For our clients in Illinois and across the US, universal life insurance can be an excellent choice if you value the ability to adjust your premiums and death benefit to match your changing life circumstances. It offers a permanent solution that can adapt to fluctuating incomes, provide a source of accessible cash value, and serve as a cornerstone of your long-term financial and estate planning.

The best life insurance policy is one that aligns perfectly with your individual needs, budget, and long-term financial goals. We at ShieldWise are dedicated to providing clear, jargon-free guidance to help you steer these complex decisions. We invite you to assess your personal needs and consider how a universal life policy could fit into your financial strategy.

Ready to explore your options and find the right coverage for your family?