Why Universal Life Insurance Matters for Your Family’s Long-Term Security

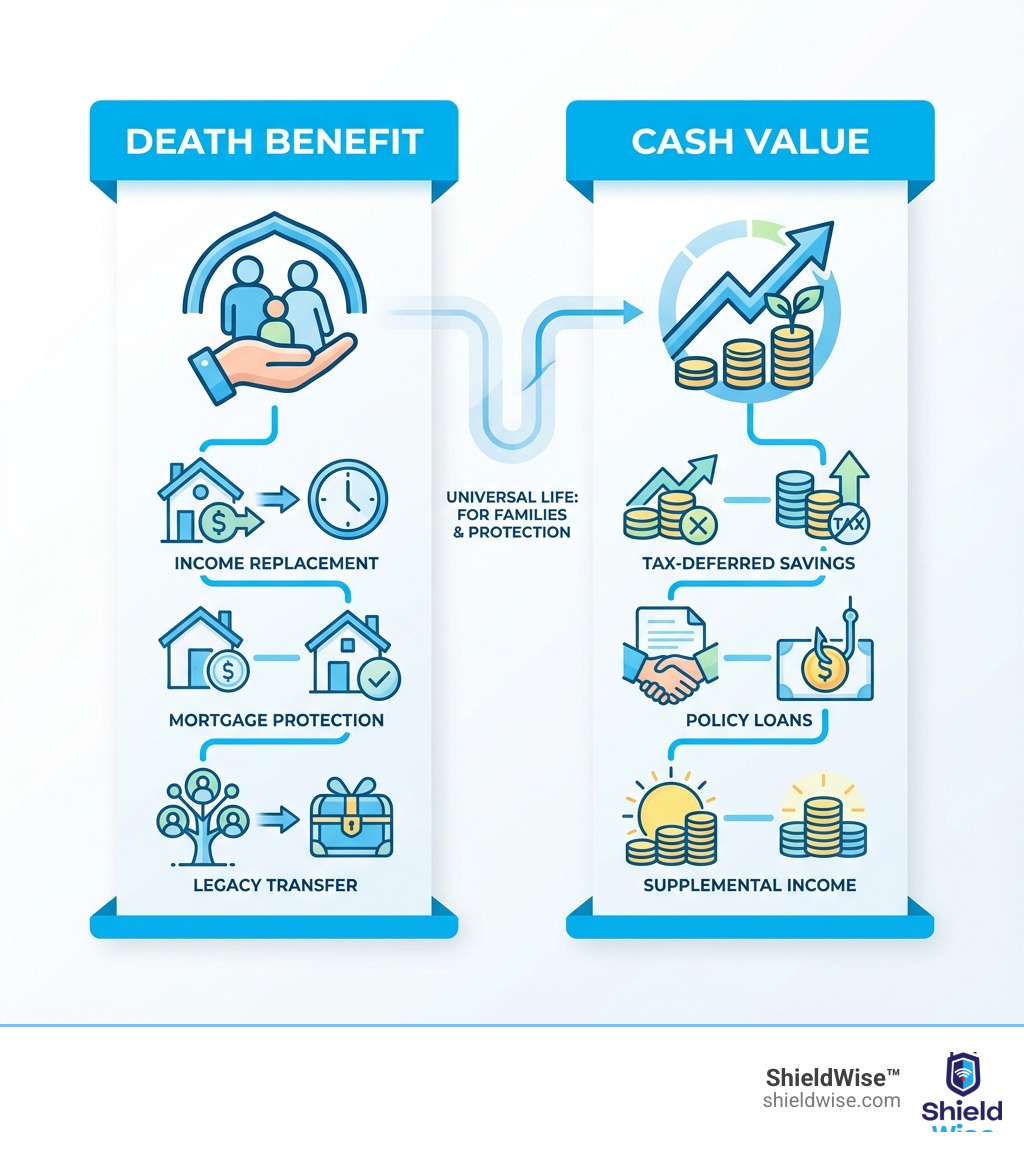

Universal life – for families and protection offers a unique blend of permanent death benefit coverage and flexible, tax-advantaged savings—making it one of the most adaptable tools for safeguarding your loved ones throughout every stage of life.

Quick Answer: What Universal Life Means for Family Protection

- Lifetime Coverage: Protects your family for as long as you live (when premiums are maintained), not just for a set term

- Flexible Premiums: Adjust payment amounts up or down as your income and needs change

- Cash Value Growth: Builds tax-deferred savings you can access for emergencies, retirement, or major expenses

- Adjustable Death Benefit: Increase or decrease coverage as your family grows or financial obligations shift

- Tax Advantages: Death benefit typically paid income-tax-free to beneficiaries; cash value grows without annual taxes

When you’re thinking about protecting your family’s future, you want a financial tool that can grow with you. Universal life insurance was designed for this purpose. Unlike term insurance that expires or whole life with its rigid premiums, universal life offers permanent coverage with built-in control. You can adjust payments to fit your budget, making it highly adaptable.

This flexibility is valuable for families facing changing circumstances—a new baby, a mortgage, or planning for retirement. The policy’s cash value component grows tax-deferred and can be accessed during your lifetime through loans or withdrawals, providing a financial cushion for education, healthcare, or supplemental retirement income.

From day one, your policy provides an income-tax-free death benefit to protect your family. Over time, it also builds a living benefit you can use while you’re still here.

What is Universal Life Insurance? A Flexible Foundation for Family Protection

Universal life (UL) insurance is a type of permanent life insurance offering lifelong protection and a cash value savings component. It’s an adaptable financial tool, providing a death benefit for your loved ones and a resource you can access during your lifetime. For families in Illinois and across the country, universal life – for families and protection is a smart choice for long-term security.

Unlike term life insurance, which provides coverage for a specific period and then expires, universal life insurance offers permanent coverage. As long as the required premiums are maintained, your policy stays in force for your entire life, ensuring your beneficiaries will receive a tax-free death benefit whenever you pass away. This permanent protection is a cornerstone of solid family financial planning.

The beauty of universal life insurance lies in its dual function: it acts as a permanent financial safety net for your family and a tax-advantaged savings vehicle for your long-term goals.

The Core Components: Death Benefit and Cash Value

Every universal life policy is built on two fundamental components:

-

The Death Benefit: This is the primary purpose of any life insurance policy. It’s the sum of money paid to your designated beneficiaries upon your passing. For families, this death benefit is crucial. It can provide:

- Income replacement: Ensuring your family maintains their lifestyle without your income.

- Mortgage protection: Allowing your loved ones to pay off the home.

- College funding: Securing educational opportunities for your children or grandchildren.

- Debt repayment: Covering outstanding loans, medical bills, or other financial obligations.

Importantly, the death benefit from a universal life policy is typically received by your beneficiaries free from federal income tax.

-

The Cash Value Account: This is where universal life truly shines as a flexible financial tool. A portion of your premium payments goes into this account, where it grows on a tax-deferred basis. This means you won’t pay annual taxes on the earnings as they accumulate. This cash value acts as a living benefit, a financial resource you can access during your lifetime for various needs.

Universal Life vs. Other Policies: Finding the Right Fit

To truly understand the value of universal life, it helps to see how it compares to its life insurance cousins: term life and whole life.

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Coverage Period | Specific term (e.g., 10, 20 yrs) | Lifetime (permanent) | Lifetime (permanent) |

| Premium Flexibility | Fixed | Fixed | Flexible (adjustable within limits) |

| Cash Value Growth | None | Guaranteed, fixed rate | Flexible, market-linked or fixed |

| Primary Purpose | Temporary needs, income protection | Guaranteed protection & savings | Flexible protection & savings |

-

Term Life Insurance: The most affordable option for temporary needs, like covering a mortgage while your children are young. It provides coverage for a set period (e.g., 10-30 years) but has no cash value and expires at the end of the term.

-

Whole Life Insurance: A permanent policy with guaranteed premiums and cash value growth. It provides a predictable, stable foundation but lacks the flexibility of universal life, as premiums are fixed and cannot be adjusted.

Universal life strikes a balance, offering the permanent protection of whole life with the adaptability of a policy that can change as your life does. For families seeking lasting security with the freedom to adjust their financial strategy, universal life often proves to be the ideal choice.

The Power of Flexibility: Tailoring Your Universal Life Policy

The defining feature of universal life insurance is its flexibility. Life is unpredictable, and your financial plan should be too. Universal life allows you to adjust your policy to match your evolving needs and financial situation.

This adaptability gives you significant financial control, ensuring your coverage remains relevant whether you’re navigating job changes, expanding your family, or planning for retirement.

Adjustable Premium Payments

With universal life, you’re not locked into rigid premium payments. You can adjust your payments within certain limits set by the insurance company. This means:

- Paying more when you can: When you have extra income, you can pay more than the minimum premium. This accelerates your cash value growth and builds a larger financial cushion for the future.

- Paying less when times are lean: If you face a temporary dip in income, you can reduce or even skip premium payments. As long as your cash value is sufficient to cover the policy’s monthly charges, your coverage remains in force.

- Strategic funding: Some policyholders “overfund” their policy in the early years by paying maximum premiums. This builds a substantial cash value that can cover rising insurance costs in later years, potentially reducing future out-of-pocket payments.

This ability to tailor your premium payments makes universal life an excellent option for individuals and families with fluctuating incomes, such as freelancers, small business owners, or those in commission-based roles.

Modifying Your Death Benefit

Your family’s protection needs aren’t static. A young couple with a new baby might need significant coverage, while an empty-nest couple might find their needs have changed. Universal life allows us to modify your death benefit to reflect these shifts:

- Increasing coverage: If you have more children or buy a larger home, you can apply to increase your death benefit. This usually requires going through a new underwriting process, which may include a medical exam, to qualify for the additional coverage.

- Decreasing coverage: If your financial obligations lessen—perhaps your mortgage is paid off or your children are financially independent—you can typically decrease your death benefit. This can also lower your premium payments or allow your cash value to grow more efficiently.

This flexibility ensures that your universal life – for families and protection policy is always aligned with your current life stage and financial goals, providing peace of mind that your family is adequately protected.

Understanding the Cash Value: A Tool for Wealth Building and Security

Beyond the crucial death benefit, the cash value component of universal life insurance is a powerful tool for wealth building and financial security. It’s an asset that grows over time and can be accessed to support your family’s major life events.

How Tax-Deferred Growth Works for You

The cash value in your universal life policy grows on a tax-deferred basis. This means earnings are not taxed annually, allowing your money to compound more efficiently than in a taxable account. Taxes are postponed until you withdraw the funds.

When it comes to accessing your funds, universal life offers flexible options:

- Tax-free policy loans: You can borrow against your cash value. These loans are generally not considered taxable income as long as the policy remains in force. Interest is charged on the loan, but you can often repay it on your own schedule, or the outstanding loan balance will simply reduce the death benefit.

- Tax-free withdrawals (up to basis): You can make partial withdrawals from your cash value, which are typically tax-free up to the amount you’ve paid in premiums (your “cost basis”). Withdrawals exceeding your cost basis would be subject to income tax.

- Modified Endowment Contract (MEC): Be aware that if you pay too much premium too quickly, your policy could be reclassified by the IRS as a Modified Endowment Contract (MEC). MECs lose some favorable tax treatment, as loans and withdrawals can become taxable and subject to penalties if taken before age 59½. Our financial professionals can help you structure your policy to avoid MEC status.

Using Cash Value for Your Family’s Goals

The accumulated cash value in your universal life policy can serve as a versatile financial resource for your family:

- Supplemental retirement income: Use policy loans or withdrawals to create an additional stream of tax-advantaged funds in retirement.

- College education funding: Access cash value to help pay for a child’s or grandchild’s education, easing the burden of student loans.

- Emergency fund: Your cash value can act as an accessible emergency fund for unexpected healthcare costs, home repairs, or other financial shocks.

- Business planning: For entrepreneurs, the cash value can provide liquidity to fund a business venture, expand operations, or serve as collateral for a business loan.

- Estate planning: The death benefit can help cover estate taxes, provide liquidity to heirs, or fund a trust, ensuring your legacy is transferred efficiently.

- Legacy creation: The cash value can be used to create a charitable legacy, perhaps through a Charitable Giving Benefit Rider, leaving a lasting impact on causes you care about.

The cash value component transforms your life insurance from just a death benefit into a dynamic, living asset that supports your family’s financial journey.

Exploring the Types of Universal Life for Families and Protection

Just as there are different flavors of ice cream, there are different types of universal life insurance, each designed to cater to varying risk appetites and financial goals. Understanding these distinctions is key to choosing the right universal life – for families and protection policy for your unique situation.

Indexed Universal Life (IUL)

Indexed Universal Life (IUL) policies offer a unique blend of cash value growth potential tied to market performance, combined with protection against market losses.

- How it works: Cash value growth is linked to a stock market index (e.g., S&P 500). Interest is credited based on the index’s performance, without direct investment.

- Downside protection: A key feature of IUL is its “floor,” often 0%. This means your cash value will not lose money due to market downturns.

- Upside potential: To balance this protection, IUL policies typically have a “cap rate” or “participation rate” that limits the maximum interest you can earn in a given year.

- Learn more: Curious about the specifics? Dive deeper into What is IUL? and understand How Does IUL Work?.

IUL is ideal for those who want market-linked growth potential with a built-in safety net against market losses.

Variable Universal Life (VUL)

Variable Universal Life (VUL) policies offer the highest potential for cash value growth, but also carry the most risk.

- How it works: With VUL, you directly control how your cash value is invested by allocating premiums among various “sub-accounts,” which are similar to mutual funds.

- Higher growth potential: Because your cash value is directly invested, VUL offers the potential for significantly higher returns if the investments perform well.

- Market risk: The flip side is that VUL carries market risk. If your chosen sub-accounts perform poorly, your cash value can decrease, and you could even lose principal.

VUL is a good fit for experienced investors seeking aggressive cash value growth who are comfortable with market risk and active management.

Guaranteed Universal Life (GUL)

Guaranteed Universal Life (GUL) policies prioritize a guaranteed death benefit over cash value accumulation.

- How it works: GUL policies are designed to provide a guaranteed death benefit for your entire life (often up to age 95, 100, or 120), as long as you pay the scheduled premiums.

- Lower premiums: Because the focus is on the death benefit guarantee rather than cash value growth, GUL policies typically have lower premiums than other types of permanent insurance.

- Minimal cash value: GUL policies have minimal cash value growth; the primary feature is ensuring the death benefit is there when your family needs it.

GUL is an excellent choice for those who want affordable, permanent protection without the complexities of cash value growth. It provides straightforward lifelong coverage.

Potential Risks and How to Choose the Right Policy

While universal life – for families and protection offers incredible advantages, approach it with a clear understanding of its complexities and potential risks. Like any powerful financial tool, it requires informed decision-making and ongoing management.

What to Watch Out For: Risks and Downsides

- Policy Lapse Risk: The most significant risk. If you stop paying premiums and the cash value is insufficient to cover monthly costs, your policy can lapse and coverage will end. Regular monitoring is crucial to keep your policy funded.

- Rising Cost of Insurance (COI): The internal cost of insurance increases as you age. If cash value growth doesn’t keep pace, you may need to pay higher premiums later in life to maintain coverage.

- Policy Fees and Charges: Universal life policies come with various fees, including administrative charges, mortality and expense charges, and surrender charges if you cancel the policy in its early years. These fees can impact your cash value growth.

- Interest Rate Fluctuations: For traditional UL policies, the interest rate credited to your cash value can change. If rates fall, your cash value might grow slower than projected, potentially requiring higher premiums to maintain the policy.

- Underfunding: Consistently paying only the minimum premium can put your policy at risk of lapsing, especially if interest rates are low or COI charges rise.

The flexibility of universal life means it demands more attention than a simpler policy. It’s not a “set it and forget it” product.

Who is the Ideal Candidate for universal life – for families and protection?

Despite the complexities, universal life insurance is an excellent fit for many families in Illinois and beyond, particularly those who:

- Need permanent coverage: You have lifelong financial obligations, such as supporting a dependent.

- Value flexibility: Your income or insurance needs may change, and you want the ability to adjust your policy.

- Seek tax-advantaged savings: You’ve maxed out other retirement accounts and want an additional vehicle for tax-deferred growth.

- Are planning for an estate: High-net-worth individuals often use universal life for estate planning and tax liquidity.

- Own a business: It can be used for business succession planning, funding buy-sell agreements, or key person insurance.

- Are comfortable with managing a policy: You understand the need to periodically review and adjust your policy to keep it on track.

Choosing a Provider and Policy for universal life – for families and protection

Selecting the right universal life policy and provider is a critical decision. Here’s what we recommend considering:

- Insurer Financial Strength: Your policy is only as strong as the company backing it. We recommend choosing a provider with high financial strength ratings from agencies like AM Best. You can check these ratings directly at AM Best Financial strength.

- Policy Illustrations: Ask for detailed illustrations that project performance under various scenarios to understand how your policy might perform over time.

- Fee Transparency: Understand all the fees and charges associated with the policy. A transparent provider will clearly outline these costs.

- Customer Service and Support: Choose a company known for excellent customer service, as you’ll likely have questions or need adjustments over the policy’s lifetime.

- State-Specific Information: For our Illinois clients, it’s wise to consult resources like the Buying Life Insurance – Illinois Department of Insurance for state-specific regulations.

We are here to help you steer these choices, providing clear, jargon-free guidance to find the best universal life – for families and protection solution.

Enhancing Your Coverage with Policy Riders

You can customize your universal life policy with riders—optional features you can add for an additional cost. Riders tailor your coverage to your family’s specific needs, making your policy even more robust.

Riders can provide added security and peace of mind, ensuring your policy responds to a wider range of circumstances than just the death benefit alone.

Common Riders to Bolster Your Protection

- Accelerated Death Benefit Rider: Also known as a “living benefits” rider, this allows you to access a portion of your death benefit while you’re still alive if you’re diagnosed with a chronic, critical, or terminal illness. This can be incredibly helpful for covering medical expenses or in-home care.

- Waiver of Premium Rider: If you become totally disabled and can no longer work, this rider will waive your premium payments, keeping your policy in force without you having to pay. This is a crucial layer of protection.

- Guaranteed Insurability Rider: This rider allows you to purchase additional coverage at specific future dates (e.g., after the birth of a child) without a new medical exam. This is invaluable if your health declines but your coverage needs increase.

- Children’s Term Rider: This affordable rider provides a small amount of term life insurance coverage for all of your children, often convertible to a permanent policy later without a medical exam.

- Overloan Protection Rider: For policies with significant cash value and outstanding loans, this rider can prevent the policy from lapsing due to an outstanding loan balance that exceeds the policy’s value, protecting you from potential tax liabilities.

By carefully considering and selecting the right riders, we can help you build a universal life – for families and protection policy that is truly comprehensive and customized for your family’s unique journey.

Frequently Asked Questions about Universal Life Insurance

We understand that universal life insurance can be complex, and you likely have many questions. Here are answers to some of the most common ones we hear:

What happens to the cash value when I die?

Typically, the insurer pays the death benefit to your beneficiaries and the cash value reverts to the company. However, some policies offer a rider (for an additional cost) that pays out both the death benefit and the accumulated cash value. It’s crucial to understand which option your policy includes.

Is universal life insurance a good investment?

Universal life insurance is a protection tool first and a savings vehicle second. While its tax-deferred cash value growth is a powerful feature, it’s not a replacement for dedicated retirement accounts like a 401(k) or IRA. It serves best as a supplemental savings tool, especially after you’ve maxed out other retirement accounts.

Can my universal life policy lapse?

Yes. A universal life policy can lapse if you stop paying premiums and the cash value is insufficient to cover monthly policy costs. Regular monitoring and proper funding are essential to keep your policy active and ensure lifelong protection for your family. We can help you understand the funding requirements to avoid this scenario.

Conclusion: Securing a Lasting Legacy for Your Family

Universal life – for families and protection offers a unique combination of lifelong protection for your loved ones, the flexibility to adapt to life’s changes, and the potential to build a tax-advantaged financial asset. By understanding its features and choosing the right policy, you can create a robust foundation for your family’s long-term security and peace of mind. From ensuring income replacement for dependents to funding college education or supplementing retirement income, universal life is a versatile tool designed to grow and evolve with your family.

At ShieldWise™, we believe in empowering you with clear, jargon-free guidance. As a digital insurance marketplace, we make it easy to compare plans from trusted carriers, get instant online quotes, and secure the right coverage in just a few clicks. We’re here to help you protect your family, control costs, and build a lasting legacy.

Explore your Universal Life Insurance options today and take the first step towards a more secure future for your family.