Understanding Final Expense – Health and Eligibility: Your Path to Coverage

Final expense – health and eligibility requirements are surprisingly accessible for most people, especially seniors and those with pre-existing conditions. Unlike traditional life insurance, final expense policies are specifically designed to be easier to qualify for.

Quick Answer: Final Expense Eligibility at a Glance

Basic Requirements:

- Age Range: Typically 50-85 years old (some carriers accept 40-90)

- Medical Exam: Usually not required

- Health Questions: Yes for simplified issue, none for guaranteed issue

- Pre-existing Conditions: Generally accepted

- Coverage Amounts: $2,000 to $50,000

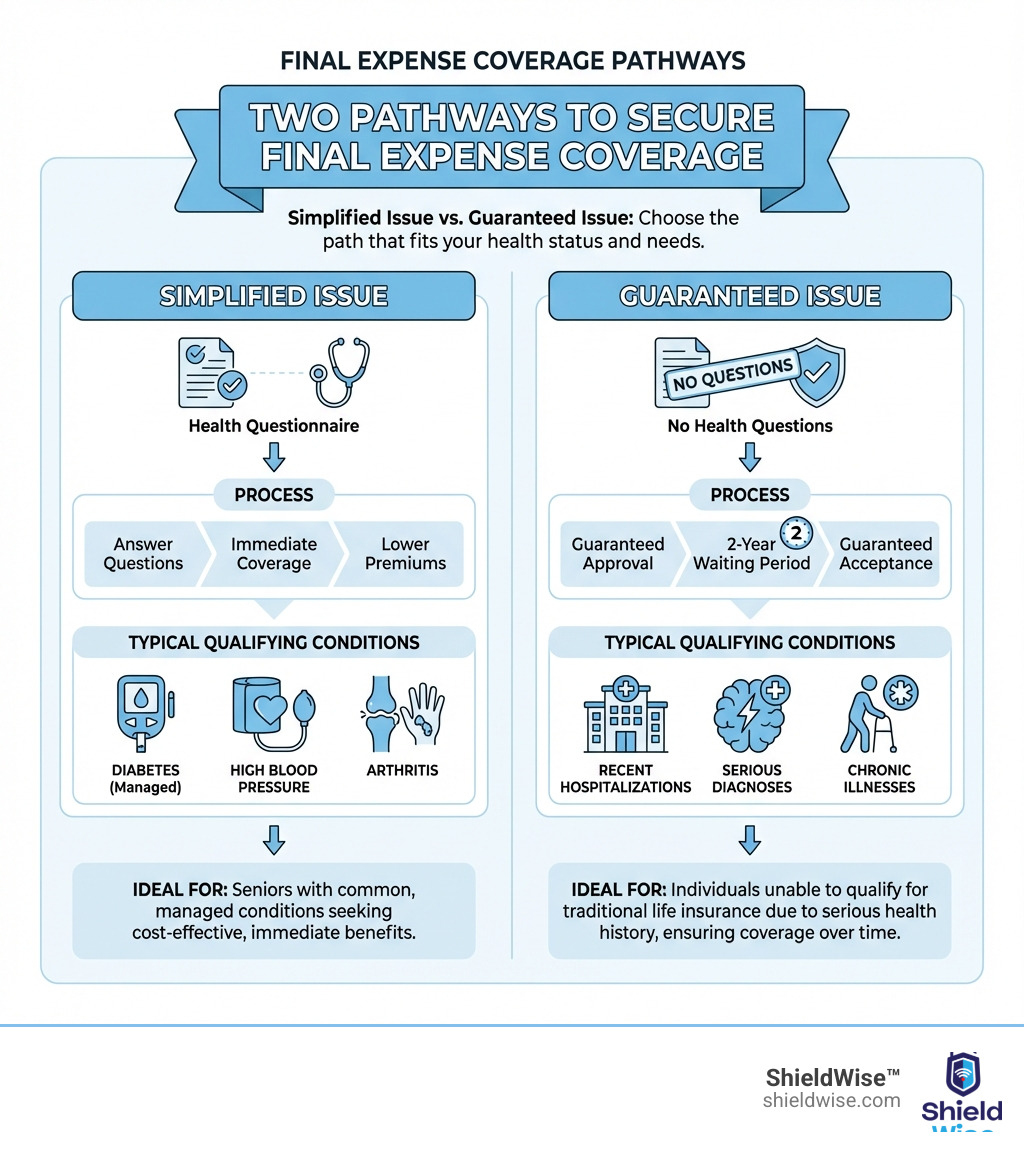

Two Main Policy Types:

- Simplified Issue – Answer health questions, get immediate coverage, lower premiums

- Guaranteed Issue – No health questions, guaranteed approval, 2-year waiting period

Who Typically Qualifies:

- Seniors with common conditions (diabetes, high blood pressure, arthritis)

- People who can’t get traditional life insurance

- Those wanting to skip medical exams

- Individuals with managed chronic illnesses

If you’ve been worrying that your health might prevent you from getting coverage, there’s good news. According to the research, “pretty much anyone can qualify” for final expense insurance because it’s designed with relaxed underwriting standards.

The key difference from traditional life insurance? Final expense policies recognize that older adults and those with health concerns still need affordable coverage to protect their families from burial and end-of-life costs. The median funeral cost exceeds $7,800, and that doesn’t include medical bills, legal fees, or other final expenses.

Your health history does matter, but it determines which type of policy you’ll get rather than whether you can get coverage at all. Even conditions that would disqualify you from standard life insurance—like recent hospitalizations or serious diagnoses—won’t necessarily prevent you from securing a final expense policy.

What is Final Expense Insurance and Who is it For?

Final expense insurance, often called burial insurance or funeral insurance, is a type of whole life insurance. This means it’s a permanent policy that won’t expire as long as premiums are paid. Unlike traditional life insurance policies designed to replace lost income for dependents, final expense insurance typically offers a smaller death benefit, usually ranging from $2,000 to $50,000. These policies are characterized by fixed premiums that never increase, and they build cash value over time, which the insured may be able to take out as a policy loan.

The primary purpose of final expense insurance is to cover end-of-life costs, alleviating the financial burden on your loved ones during an already difficult time. These costs can easily add up, as the National Funeral Directors Association reports that the median cost of a funeral can be over $9,000. This figure often doesn’t even account for other significant expenses your family might face.

Beyond funeral and burial costs, the death benefit from a final expense policy can be used for virtually anything your loved ones need. This flexibility is crucial because end-of-life expenses extend far beyond the funeral home. They can include:

- Medical Bills: Even with Medicare or private insurance, out-of-pocket medical expenses, hospice care, and lingering bills can be substantial. In less than 20 years, annual U.S. healthcare costs have more than doubled from nearly $1.4 trillion to over $3.6 trillion, leaving many seniors with significant financial obligations.

- Outstanding Debts: Unfortunately, 73% of American consumers die in debt, with the average total balance left roughly at $61,554 (including mortgages). This debt doesn’t just disappear; it often falls to the estate or, in some cases, surviving family members. Final expense insurance can help ensure these debts are paid without dipping into family savings or retirement funds.

- Legal and Administrative Costs: Settling an estate can involve legal fees, probate costs, and other administrative expenses.

- Everyday Living Expenses: The unexpected loss of a loved one can disrupt a household’s finances, making it difficult to cover routine bills like utilities, groceries, or mortgage payments.

By securing a final expense policy, you’re providing a compassionate way to ease this financial stress, allowing your family to focus on grieving and healing rather than worrying about unexpected bills. You can learn more about this type of coverage by visiting our guide on What is Burial Insurance?.

Who Typically Needs Final Expense Insurance?

Final expense insurance is uniquely designed for a specific demographic, primarily because of its accessible nature and the types of expenses it covers. It’s especially valuable for:

- Seniors: As we age, traditional life insurance can become prohibitively expensive or difficult to qualify for. Final expense policies bridge this gap, offering an affordable solution for those typically aged 50 to 85, though some plans may extend to applicants as old as 90.

- Individuals with Health Concerns: This is where final expense truly shines. Unlike other life insurance types that might require extensive medical underwriting, final expense policies are built to accept seniors with high-risk health issues. Many require only a simple health questionnaire rather than a full medical exam, making it a highly accessible option even for those with pre-existing conditions.

- People Who Can’t Qualify for Traditional Life Insurance: If you’ve been denied a traditional life insurance policy due to age or health, final expense insurance often provides a viable alternative. Its relaxed underwriting standards mean that many who were turned away elsewhere can find coverage here.

- Anyone Concerned About End-of-Life Costs: While geared towards seniors, anyone who wants to ensure their funeral and other final expenses won’t burden their loved ones can benefit. It’s about proactive planning and securing peace of mind.

Final expense insurance is for those who want to ensure their End of Life Expenses are covered, providing a safety net for their families. It’s a thoughtful way to plan for the inevitable, especially for those looking for End of Life Insurance for Seniors.

The Core of Final Expense – Health and Eligibility Requirements

When it comes to final expense insurance, the phrase “final expense – health and eligibility” is really about how your health status influences the type of policy you can get, rather than whether you can get one at all. Our goal at ShieldWise is to help almost anyone find coverage.

One of the most appealing aspects of final expense insurance is its simplified underwriting process. This means that, in most cases, you won’t need to undergo a full medical exam. Instead, the application typically involves answering a few straightforward health questions. This significantly speeds up the application and approval process, with coverage often issued in a matter of days.

While medical exams are largely absent, there are still some fundamental eligibility requirements:

- Age Limits: As mentioned, most final expense policies target individuals between 50 and 85 years old. However, some plans can accommodate applicants as young as 40 or as old as 90. Typically, age disqualification occurs when you are 90 or older, though some plans may set the limit at 80 or older. For those seeking Life Insurance Over 85 No Medical Exam, final expense is often the go-to solution.

- Residency Requirements: To apply for a final expense policy, you generally need to be a U.S. citizen or a permanent legal resident. Since we’re located in Illinois, we primarily serve residents within the state.

- High-Risk Occupations or Hobbies: While less common for final expense than for traditional life insurance, some insurers might consider certain professions (e.g., pilot, logger, structural steelworker) or hobbies (e.g., skydiving, mountain climbing, racing) as “dangerous” or “life-threatening.” If your plan deems your personal life too risky, it could lead to higher premiums or, in rare cases, rejection from certain policy types.

Understanding Your Final Expense – Health and Eligibility with Pre-Existing Conditions

A common concern we hear is, “Can I get final expense insurance with my health conditions?” The resounding answer is usually yes! Final expense plans are specifically designed to be accessible even if you have pre-existing conditions.

Instead of a medical exam, you’ll typically complete a health questionnaire. Insurers use this, along with checking databases like pharmacy reports (your prescribed medications), motor vehicle reports (driving behavior), and the Medical Information Bureau (MIB) report (if you’ve previously applied for life insurance), to assess your health and risk factors.

Many common conditions are readily accepted under simplified issue plans, often without affecting your ability to get immediate coverage. These include:

- High blood pressure

- Controlled diabetes

- Arthritis

- Mild heart issues (depending on recentness and severity)

Our research consistently shows that you will typically not be turned away from a final expense plan if you have a pre-existing condition. Funeral insurance plans, by their very nature, are built to accept seniors with various health challenges. The key is that your health history helps determine which type of final expense policy you qualify for, not necessarily if you qualify.

Documentation and Other Factors for Your Application

Applying for final expense insurance is designed to be a straightforward process. To ensure a smooth experience, you’ll generally need:

- Basic Personal Information: Your full legal name, date of birth, and contact information.

- Social Security Number (SSN) or Tax Identification Number (TIN): This is standard for identification and verification purposes.

- Proof of Residency: To confirm you meet the state-specific requirements.

Beyond these basic documents, other factors can influence your final expense – health and eligibility and, importantly, your premium rates:

- Lifestyle Habits:

- Smoking/Tobacco Use: This is one of the most significant factors affecting insurance premiums. If you use tobacco products, your rates will likely be higher—often around 30% more than non-tobacco users. The older you are, the more pronounced this difference can be.

- Alcohol Use: While moderate alcohol consumption typically won’t impact your eligibility, excessive or problematic alcohol use could lead to higher premiums or limited policy options, as it’s considered a health risk.

Being truthful and transparent about these factors during the application process is crucial. It ensures that the policy you receive accurately reflects your situation and that your loved ones won’t face complications when they need to make a claim.

Simplified Issue vs. Guaranteed Issue: Your Health Determines Your Path

When exploring final expense – health and eligibility, you’ll primarily encounter two main types of policies: Simplified Issue and Guaranteed Issue. Your health profile will guide you toward the most suitable option. Here’s a quick comparison:

| Feature | Simplified Issue | Guaranteed Issue |

|---|---|---|

| Health Questions | Yes (short questionnaire) | No |

| Medical Exam | No | No |

| Approval | Based on answers to health questions | Guaranteed (no health review) |

| Waiting Period | No (immediate full coverage) | Yes (typically 2 years for non-accidental death) |

| Premiums | Generally lower | Generally higher |

| Best For | Most seniors, manageable health conditions | Severe health issues, terminal illness, hospice |

| Coverage | Can be higher ($5,000 – $50,000) | Often lower ($2,000 – $25,000) |

Simplified Issue: Coverage with a Health Review

Simplified issue final expense policies are the most common type and offer immediate, full coverage from day one. The “simplified” part refers to the underwriting process: you won’t need a medical exam, but you will need to answer a short health questionnaire.

These questions are designed to identify major health risks that might make you ineligible for immediate coverage. They are often “knockout” questions, meaning a “yes” answer to certain questions could lead to denial for a simplified issue policy, but would likely point you towards a guaranteed issue option. Examples of such questions might include:

- Are you currently in a hospital, hospice, or nursing home?

- Have you been diagnosed with a terminal illness with a life expectancy of less than 12-24 months?

- Do you have AIDS or HIV?

If you can answer “no” to these critical questions and your other health conditions are manageable (e.g., controlled high blood pressure, diabetes without severe complications, mild arthritis), you’re very likely to qualify for a simplified issue policy. This option offers lower premiums because the insurer takes on less risk, and critically, there’s no waiting period—your beneficiaries receive the full death benefit immediately upon your passing.

Guaranteed Issue: Coverage with No Health Questions

For individuals with more significant health challenges, or those who simply prefer to avoid any health questions whatsoever, guaranteed issue final expense policies are a lifesaver. As the name suggests, approval is guaranteed. There are no health questions, no medical exams, and typically, no denial based on health.

This type of policy is ideal for those who:

- Have severe health issues, such as recent cancer diagnoses, congestive heart failure, or are receiving hospice care.

- Are living with conditions like AIDS or HIV.

- Are concerned about being denied due to multiple health conditions or recent medical events.

The trade-off for this guaranteed approval is typically higher premiums and a mandatory waiting period, usually two years. This waiting period means that if you pass away from non-accidental causes during the first two years of the policy, your beneficiaries will not receive the full death benefit. Instead, they will receive a return of the premiums paid, often with a small percentage of interest (e.g., 10%). If death occurs due to an accident during this period, the full death benefit is usually paid. This waiting period is a mechanism for insurers to manage risk, preventing individuals from purchasing a policy when they are already terminally ill and expecting an immediate payout.

Navigating the Application and Ensuring Your Policy is Secure

The application process for final expense insurance is designed to be as easy as possible, often completed online or over the phone with the help of a ShieldWise agent. We guide you through each step, from answering health questions to submitting your application. Approval can be surprisingly fast, sometimes within minutes or days, allowing you to secure coverage quickly.

The Impact of Health on Final Expense – Health and Eligibility

When it comes to final expense – health and eligibility, honesty is not just the best policy; it’s the only policy. Providing truthful and accurate information on your application is paramount.

Consequences of Misrepresentation:

Every life insurance policy, including final expense, has what’s called a “contestability period,” which typically lasts for the first two years the policy is in force. During this time, if the insurer finds that you misrepresented your health information on the application, they have the right to investigate the claim. The consequences can be severe:

- Claim Denial: Your beneficiaries may not receive the death benefit, leaving them without the financial protection you intended.

- Policy Cancellation (Rescission): The insurer could void the policy entirely, returning the premiums paid but canceling the coverage.

Imagine the stress and heartache this could cause your loved ones during an already difficult time. That’s why we emphasize complete honesty. Your health history determines which type of final expense policy is available to you, not whether you can get coverage at all. Our team at ShieldWise is dedicated to helping you determine your eligibility for a specific final expense insurance plan by matching your health profile with the best available carriers and policies. We work to find you the most suitable and affordable option, ensuring peace of mind for you and your family. We can help you Compare Final Expense Quotes from various carriers to find the right fit.

What if You Don’t Qualify for a Simplified Plan?

Even if your health profile prevents you from qualifying for a simplified issue policy, don’t despair. The guaranteed issue option is specifically designed for these situations. It ensures that coverage is still an option, regardless of your health conditions.

However, there are extremely rare circumstances where someone might not qualify for any final expense insurance, even a guaranteed issue policy. These typically involve individuals who are:

- Currently in hospice care.

- Hospitalized with a terminal illness.

- Diagnosed with a terminal illness and have a very short life expectancy (e.g., less than 6 months), especially if they are trying to obtain a policy for immediate payout.

While these instances are uncommon, they highlight the importance of planning ahead. For nearly everyone else, especially those aged 50-85, some form of final expense coverage is almost always available. Our commitment at ShieldWise is to explore all available options to find you the End of Life Coverage you need, regardless of initial eligibility challenges.

Frequently Asked Questions about Final Expense Health & Eligibility

We understand you might have more specific questions about how your health impacts your final expense insurance options. Here are some common inquiries:

Can I get final expense insurance if I have serious health problems like cancer or heart disease?

Yes, you absolutely can, though the type of policy and its terms will depend on the specifics of your condition.

- For Cancer: If it’s been more than 24 months since your last treatment or diagnosis (or 12 months for partial coverage with some carriers), you may qualify for a simplified issue plan with immediate full coverage. For active cancer or recent diagnosis/treatment, a guaranteed issue policy is typically available, though it will come with a waiting period. Basal or squamous cell skin cancers are often not a concern for insurers and may not affect simplified issue eligibility.

- For Heart Disease: Many heart conditions (e.g., heart attack, heart surgery, pacemaker installation, circulatory surgery) typically require a waiting period of 12 months since the event for immediate coverage under a simplified issue policy. If it’s been less than 12 months, a guaranteed issue policy would be the alternative. Conditions like Congestive Heart Failure (CHF) usually lead to a waiting period.

- Other Serious Conditions:

- Diabetes: Controlled diabetes often qualifies for simplified issue. However, if you’ve had diabetic coma or insulin shock within the last 24 months, it might push you to a guaranteed issue policy.

- COPD: If you have COPD and are prescribed home oxygen, it often results in a waiting period, unless the oxygen is specifically for sleep apnea.

- Stroke: If it was a full stroke, most simplified issue policies require 12 months since the event for immediate coverage. However, a TIA (mini-stroke) may qualify for immediate coverage regardless of how recently it occurred with certain carriers.

- AIDS/HIV, Dementia, Dialysis: These conditions typically lead to eligibility for guaranteed issue policies, which will include a two-year waiting period.

The key is the timing and severity of the condition. Our team can help you steer these nuances to find the best policy for your specific health situation.

What is the “waiting period” for final expense insurance?

The “waiting period” is a common feature, primarily associated with guaranteed issue final expense policies. It typically means that if the insured person passes away from non-accidental causes within the first two years (sometimes three years) of the policy, the beneficiaries will not receive the full death benefit. Instead, they will receive a refund of all premiums paid, often with an additional percentage of interest (e.g., 10%). If death occurs due to an accident during this period, the full death benefit is usually paid.

The purpose of the waiting period is to protect the insurance company from adverse selection. Without it, individuals who know they are terminally ill could purchase a policy and make an immediate claim, which would make the product unsustainable. The waiting period ensures that the policy is used for its intended long-term purpose of covering future final expenses. For simplified issue policies, because they involve health questions and a review, there is typically no waiting period, and full coverage begins immediately.

What happens if I am not truthful about my health on the application?

As we discussed earlier, being completely truthful on your final expense application is critical. If you are not truthful about your health information, especially during the policy’s contestability period (typically the first two years), there can be severe consequences:

- Claim Denial: If your beneficiaries file a claim and the insurer finds a material misrepresentation of your health history, they have the right to deny the claim. This means the death benefit will not be paid out, leaving your family to cover expenses out-of-pocket.

- Policy Rescission (Cancellation): The insurance company may choose to void or cancel the policy entirely, often returning the premiums paid but terminating all coverage. This means you would have paid into a policy that ultimately offers no protection.

- Legal Action: In extreme cases of fraud, there could be legal repercussions, though this is less common for minor omissions.

The insurer has the right to investigate claims during the contestability period, and they often do so by reviewing medical records, prescription histories, and other databases. It’s always best to be transparent. Our ShieldWise agents are here to help you understand every question and ensure your application is accurate, securing a policy that will truly protect your loved ones.

Conclusion: Securing Your Peace of Mind

Navigating insurance can feel overwhelming, but when it comes to final expense – health and eligibility, we hope this guide has brought you clarity and reassurance. The good news is that final expense insurance is designed to be accessible, especially for seniors and those with pre-existing conditions who might find traditional life insurance out of reach.

The key takeaways are simple:

- Accessibility is High: Most individuals, even with health concerns, can qualify for a final expense policy.

- Health Dictates Policy Type: Your health profile will primarily determine whether you qualify for a simplified issue policy (immediate coverage, lower premiums) or a guaranteed issue policy (no health questions, guaranteed approval, but a waiting period).

- Honesty is Crucial: Being truthful on your application protects your loved ones from potential claim denials during the contestability period.

- Peace of Mind: Final expense insurance is about securing financial peace of mind for your family, ensuring they won’t face unexpected burdens during a time of grief.

At ShieldWise, we understand the unique needs of individuals in Illinois and beyond. We are committed to providing clear, jargon-free guidance and helping you compare plans from trusted carriers to find the right Final Expense Insurance for your specific final expense – health and eligibility situation. Don’t let worries about your health prevent you from protecting your loved ones. We’re here to help you secure that crucial coverage.