Why Understanding Final Expense Costs and Quotes Matters

Final expense – cost and quotes can feel overwhelming when you’re trying to protect your family from financial burden. Here’s what you need to know right now:

Quick Answer: What You’ll Pay

- Average monthly cost: $30-$70 for most seniors

- Coverage amounts: Typically $5,000-$25,000

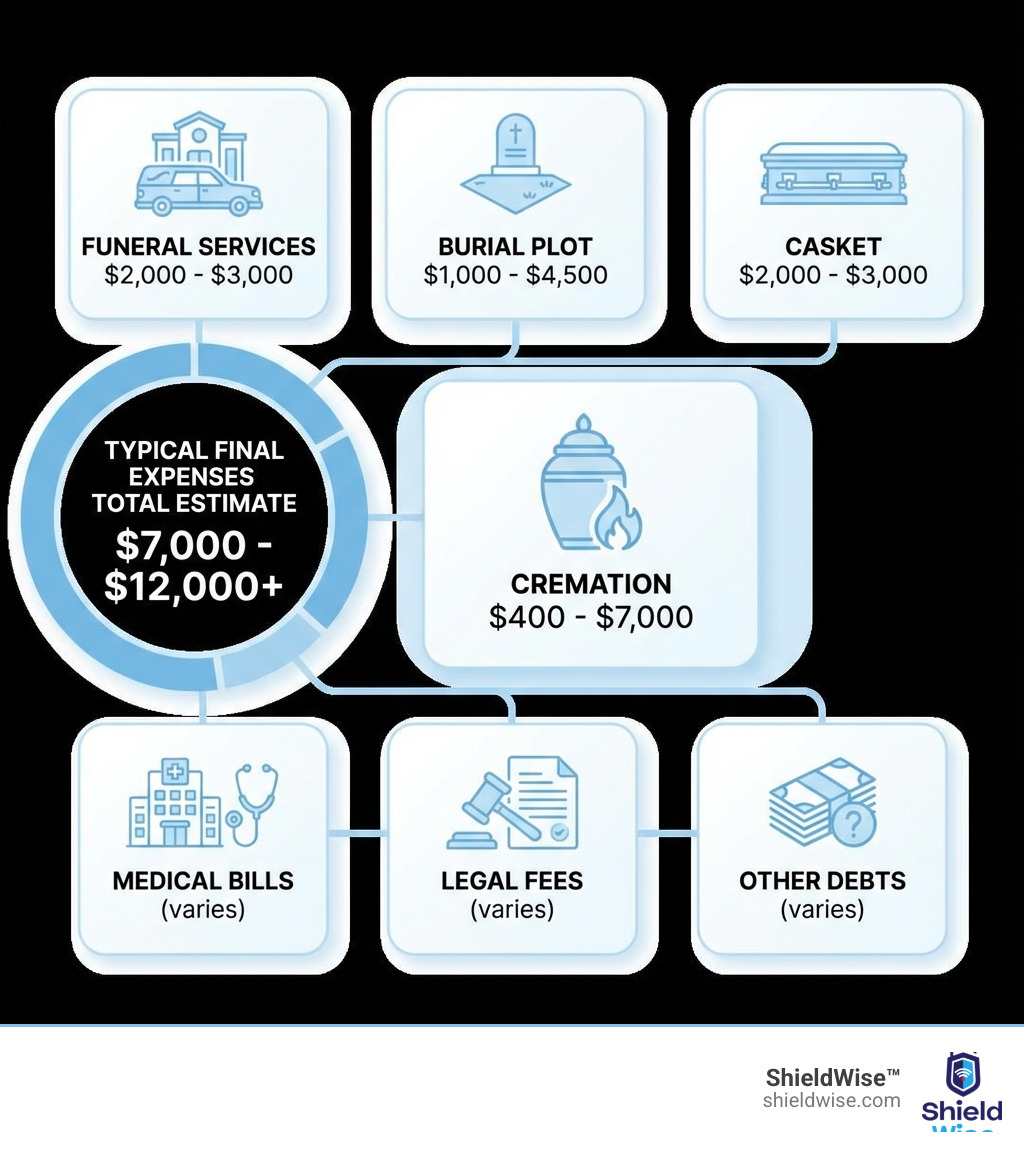

- Funeral costs covered: $7,000-$12,000 on average

- No medical exam: Most policies approved based on health questions only

- Fixed premiums: Your rate never increases once locked in

Planning for end-of-life expenses isn’t easy. Nobody wants to think about it. But the reality is stark: the median cost of a funeral can exceed $9,000, and more than 73% of Americans die with outstanding debt.

Without a plan, your family could face thousands of dollars in unexpected bills during the most difficult time of their lives. They’ll be grieving while trying to figure out how to pay for funeral services, burial plots, medical bills, and legal fees.

That’s where final expense insurance comes in. It’s a type of whole life insurance designed specifically to cover these costs. Unlike traditional life insurance with large death benefits meant to replace income, final expense policies offer smaller, affordable coverage amounts—just enough to handle funeral expenses and other final bills.

The good news? Final expense insurance is easier to get than you might think. Most policies don’t require a medical exam. You answer a few health questions, choose your coverage amount, and you’re approved—often within days. Premiums stay the same for life, making it easy to budget on a fixed income.

In this guide, we’ll break down exactly what final expense insurance costs, what affects your premium, and how to get accurate quotes from trusted carriers. No jargon. No tricks. Just clear answers to help you make the right choice for your family.

What is Final Expense Insurance and What Does It Cover?

Final expense insurance, often referred to as burial insurance or funeral insurance, is a specialized type of whole life insurance. Its primary purpose is to cover the costs associated with end-of-life expenses, ensuring that your loved ones are not burdened financially during an already difficult time. Unlike traditional life insurance policies, which often aim to replace lost income for many years, final expense policies typically offer a smaller death benefit, usually ranging from $5,000 to $50,000. This makes them a more focused and affordable option for covering specific costs.

One of the most appealing aspects of final expense insurance is its simplified underwriting process. Most policies do not require a medical exam, making them accessible even for individuals with pre-existing health conditions. Instead, eligibility is often determined by answering a few health questions on the application. Once approved, the coverage is typically for your entire life, as long as premiums are paid.

To learn more about this essential coverage, check out our What is Burial Insurance? guide.

What Final Expenses Are Typically Covered?

The funds from a final expense insurance policy are designed to cover a wide range of costs that arise after someone passes away. These can include:

- Funeral and burial costs: This is the most common use, covering expenses like funeral home services, embalming, casket, viewing, memorial services, and transportation. According to the National Funeral Directors Association (NFDA), the median cost of a funeral with viewing and burial can be over $9,000.

- Cremation costs: If cremation is chosen, the policy can cover the cremation fee, urn, and associated services.

- Medical bills: Even with Medicare or private health insurance, significant out-of-pocket medical expenses can accumulate at the end of life. More than eighty percent of people who died in the U.S. in 2019 were on Medicare before they passed, yet government programs only cover about two-thirds of healthcare spending by the elderly. Final expense insurance can help bridge this gap, covering lingering bills.

- Legal fees and probate costs: The legal process of settling an estate can incur costs, which the policy can help address.

- Credit card debt and other outstanding debts: Unfortunately, 73% of American consumers die in debt, with the average total balance left roughly $61,554 (including mortgages). While some debts may not pass to heirs, others can become a burden. The payout can help beneficiaries settle these financial obligations.

For a comprehensive look at all the potential costs your family might face, explore our page on End of Life Expenses.

Understanding the True Cost of Final Expense – Cost and Quotes

Navigating final expense – cost and quotes can feel like deciphering a secret code. But we’re here to make it clear. The “true cost” isn’t just the monthly premium; it’s about finding a policy that adequately covers your anticipated expenses without breaking the bank.

The costs associated with end-of-life arrangements are significant and have been steadily rising. According to the National Funeral Directors Association, the median cost of a funeral can be over $9,000. This figure has seen substantial increases over the decades; for instance, in 1960, the average cost was just over $700, jumping to $7,848 in 2021, and $8,300 in 2023 for a funeral with casket and burial. These numbers suggest an increase of 991 percent in funeral costs over four decades!

Understanding these escalating costs is crucial when seeking Low Cost Final Expense options.

Factors That Influence Your Premium

Several factors come into play when insurance companies calculate your final expense insurance premiums. These elements help them assess the risk associated with insuring you, directly impacting your monthly or annual cost:

- Age: This is perhaps the most significant factor. Generally, the younger you are when you purchase a policy, the lower your premiums will be. As you age, the risk of death increases, leading to higher costs.

- Gender: Statistically, women tend to live longer than men. Because of this, women often pay less for life insurance products, including final expense policies.

- Health Status: Your current health and medical history play a critical role. If you’re in good health, you’ll likely qualify for lower premiums. Pre-existing conditions, especially serious ones, can lead to higher rates or may require you to opt for a guaranteed issue policy (which we’ll discuss shortly).

- Tobacco Use: Smoking cigarettes significantly reduces life expectancy. Consequently, individuals who use tobacco products (cigarettes, cigars, pipes, e-cigarettes, or chewing tobacco) will almost always pay higher premiums than non-smokers. Rates for smokers can be around 30% higher.

- Coverage Amount: Naturally, the more coverage you choose (e.g., a $20,000 policy versus a $10,000 policy), the higher your premium will be.

- Policy Type: As we’ll see, different types of final expense policies (simplified issue vs. guaranteed issue) have different pricing structures based on their underwriting requirements.

Average final expense – cost and quotes by age and gender

While exact premiums vary by individual health, lifestyle, and the specific insurance provider, we can provide general ranges to help you understand what to expect. Most final expense policies fall into a monthly cost range of $30-$70 for seniors. However, for those with significant health conditions or over 70, premiums might be $70-$120 a month or higher. Younger, healthier applicants might find rates in the $20-$50 range.

Here’s a sample table illustrating estimated monthly premiums for a $10,000 and $20,000 final expense policy, based on average rates:

| Age | Gender | $10,000 Coverage (Monthly) | $20,000 Coverage (Monthly) |

|---|---|---|---|

| 50 | Female | $25 – $35 | $45 – $65 |

| 50 | Male | $30 – $45 | $55 – $75 |

| 60 | Female | $35 – $50 | $65 – $90 |

| 60 | Male | $45 – $65 | $80 – $110 |

| 70 | Female | $50 – $75 | $90 – $130 |

| 70 | Male | $65 – $95 | $115 – $165 |

| 80 | Female | $80 – $120 | $140 – $200 |

| 80 | Male | $100 – $150 | $175 – $250 |

Please note: These are estimated ranges. Your actual final expense – cost and quotes will depend on your specific circumstances and the insurance company.

Common Misconceptions: The “$9.95/month” Myth

We’ve all seen those advertisements on TV or online: “Get burial insurance for just $9.95 a month!” or “Pennies a day!” While these ads grab attention, they often lead to significant misconceptions about the true final expense – cost and quotes.

The reality is that these advertised prices typically refer to very low coverage amounts—sometimes as little as $500 to $1,000—and are usually for very young, healthy individuals. A $1,000 policy, for example, is far from sufficient to cover the median funeral cost of over $9,000. These ads can be incredibly misleading, making people believe they can secure comprehensive coverage for an unrealistically low price.

It’s important to be wary of any offer that seems too good to be true. When it comes to something as important as protecting your family from end-of-life expenses, relying on generalized advertisements can leave your loved ones underinsured and facing financial strain.

Instead of falling for catchy slogans, the best approach is to get actual, personalized quotes. We help you Compare Final Expense Quotes from multiple trusted carriers, ensuring you see realistic prices for the coverage you truly need.

Types of Policies and Key Features

Final expense insurance is a type of whole life insurance, meaning it provides coverage for your entire life, as long as premiums are paid. This differs from term life insurance, which only covers you for a specific period (e.g., 10, 20, or 30 years) and typically expires around age 80. While term life insurance can be cheaper initially, its price often increases every five years, and you could outlive the policy, leaving you without coverage when you need it most.

Key features of final expense policies include:

- Fixed Premiums: Once your policy is issued, your monthly or annual premium amount is locked in and will never increase, making it easy to budget.

- Lifetime Coverage: As long as you pay your premiums, your policy remains in force, providing peace of mind that your loved ones will receive the death benefit whenever you pass away.

- Cash Value Accumulation: Final expense policies build cash value over time. This cash value grows on a tax-deferred basis and can be accessed during your lifetime through policy loans or withdrawals, or used as a non-forfeiture benefit if you stop paying premiums.

These features make final expense insurance a reliable choice for End of Life Insurance for Seniors seeking stable, lifelong protection.

Simplified Issue vs. Guaranteed Issue (Graded Benefit)

When exploring final expense insurance, you’ll generally encounter two main types of policies based on their underwriting process:

-

Simplified Issue Final Expense Insurance:

- Health Questions: You’ll answer a series of health-related questions on the application. There is no medical exam required.

- Immediate Coverage: If you qualify based on your answers, you can receive full death benefit coverage starting from day one. This means your beneficiaries would receive the full payout even if you passed away shortly after the policy was issued.

- Cost: Generally offers more favorable premiums for those in relatively good health, as the insurer takes on less risk.

-

Guaranteed Issue Final Expense Insurance (Often with a Graded Benefit):

- No Health Questions, Guaranteed Acceptance: As the name suggests, acceptance is guaranteed regardless of your health history. You won’t be asked any medical questions. This is an excellent option for individuals with significant health issues who might not qualify for simplified issue policies.

- Waiting Period (Graded Benefit): The trade-off for guaranteed acceptance is typically a waiting period, often 2-3 years, before the full death benefit becomes available for non-accidental deaths. This feature is known as a graded benefit. If death occurs during this waiting period, beneficiaries usually receive a return of the premiums paid, plus a small amount of interest (e.g., 10%).

- Cost: Premiums for guaranteed issue policies are generally higher than simplified issue policies due to the increased risk the insurer assumes by not assessing health.

When to Choose Each Type:

- If you’re in decent health and can answer a few health questions favorably, a simplified issue policy will likely offer you lower premiums and immediate full coverage.

- If you have serious health conditions that might prevent you from qualifying for other types of insurance, a guaranteed issue policy ensures you can still secure some coverage, providing a safety net for your family, even with the waiting period.

The Process: From Application to Payout

Getting final expense insurance is designed to be straightforward and hassle-free, especially compared to traditional life insurance.

The application process is simplified, often requiring only a few health questions and no medical exam. This means approvals can be very quick, sometimes even within days of applying. We work to make the process as smooth as possible for our clients in Illinois and beyond.

Once a claim is filed, the payout process is also typically efficient. The death benefit is paid directly to your named beneficiary (or beneficiaries) as a tax-free cash payment. This means they receive the funds quickly, allowing them to cover immediate expenses without delay. Most companies aim to process claims within days, sometimes as quickly as 24-48 hours, once all necessary documentation is submitted. This speed is crucial during a time when your loved ones need financial support the most.

For a comprehensive understanding of the entire process, refer to our Burial Insurance Complete Guide. Your beneficiaries have full discretion over how the funds are used, whether for funeral costs, medical bills, or other financial needs.

How to get the best final expense – cost and quotes

Finding the best final expense – cost and quotes involves a few key steps to ensure you get the right coverage at an affordable price:

- Gather Your Information: You’ll need basic details like your age, gender, and state of residence (for our Illinois clients, we factor in local regulations and costs). Be prepared to honestly answer questions about your health and tobacco use. The more accurate information you provide, the more precise your quotes will be.

- Use an Online Marketplace: This is where we come in! Our digital insurance marketplace allows you to compare plans from trusted carriers side-by-side. You can get instant online quotes, making it easy to see different options custom to your needs.

- Compare Multiple Carriers: Don’t settle for the first quote you receive. Different insurance companies have varying underwriting guidelines and pricing structures. By comparing multiple offers, you can find the most competitive rates for the coverage you need.

- Speak with a Licensed Agent: While online tools are great for initial comparisons, a licensed agent can provide personalized guidance. They can help you understand policy nuances, answer specific questions about your health, and ensure you’re choosing a policy that truly fits your situation. Our experts offer clear, jargon-free advice to help you secure the right coverage in just a few clicks.

Benefits and Potential Drawbacks

Like any financial product, final expense insurance comes with its own set of advantages and considerations.

Benefits (Pros):

- Affordability: Compared to traditional life insurance, final expense policies offer smaller coverage amounts, making them more budget-friendly.

- Accessibility: The simplified underwriting process, often with no medical exam, makes it easier for many people, especially seniors or those with health issues, to qualify for coverage.

- Fixed Premiums: Your premiums are locked in for the life of the policy and will never increase, providing predictable budgeting.

- Peace of Mind: Knowing that your final expenses are covered can alleviate a significant financial burden from your loved ones during a difficult time.

- Cash Value: Most policies build cash value over time, which you can access through loans or withdrawals if needed.

- Quick Payout: Claims are typically processed quickly, ensuring funds are available when your family needs them most.

- Flexible Use of Funds: Beneficiaries receive a cash payout that they can use for any purpose, not just funeral costs.

Potential Drawbacks (Cons):

- Lower Death Benefit: The coverage amounts are generally smaller than traditional life insurance, so it’s not designed for income replacement or large estate planning.

- Higher Cost Per Thousand: For healthier, younger individuals, the cost per thousand dollars of coverage might be higher than for a traditional, fully underwritten life insurance policy.

- Potential Waiting Periods: If you opt for a guaranteed issue policy, there will typically be a 2-3 year waiting period before the full death benefit is paid for non-accidental deaths.

Frequently Asked Questions about Final Expense Insurance

We understand you likely have more questions about final expense – cost and quotes. Here are answers to some of the most common inquiries we receive:

What is the maximum age to get final expense insurance?

Most insurance companies offer final expense insurance to individuals up to age 85. Some specialized providers may even extend coverage to applicants in their early 90s. However, it’s important to note that the older you are when you apply, the higher your premiums will be due to increased risk. We always recommend securing coverage as early as possible to lock in lower rates.

Do premiums for final expense insurance increase over time?

No, one of the significant advantages of final expense insurance is that its premiums are typically fixed and guaranteed never to increase. Since it’s a type of whole life insurance, your rate is locked in at the time of purchase and will remain level for the entire life of the policy, as long as you continue to pay your premiums. This provides stability and predictability for your budget.

Can beneficiaries use the payout for things other than funeral costs?

Yes, absolutely! The death benefit from a final expense insurance policy is paid as a tax-free cash payment directly to your named beneficiary or beneficiaries. They have complete discretion over how to use these funds. While the policy is designed to cover funeral and burial costs, beneficiaries can use the money for any financial need they have, such as outstanding medical bills, legal fees, credit card debt, or even everyday living expenses. This flexibility ensures your loved ones can use the funds where they are most needed during a challenging time.

Conclusion

Understanding final expense – cost and quotes is a crucial step in securing peace of mind for both yourself and your loved ones. We’ve seen that final expense insurance offers an affordable, accessible solution to cover the rising costs associated with end-of-life expenses, protecting your family from unexpected financial burdens. With fixed premiums, lifetime coverage, and no medical exam for most policies, it’s a straightforward way to plan ahead.

At ShieldWise™, we’re dedicated to simplifying this process for you. We help you compare plans from trusted carriers, providing instant online quotes and clear, jargon-free guidance. Our goal is to empower you to protect your family, control costs, and secure the right coverage with just a few clicks. Don’t leave your loved ones to steer financial stress during a time of grief. Take the proactive step today to secure your Final Expense Insurance and ensure your final wishes are honored without compromise.