Why Understanding Final Expense Insurance Matters

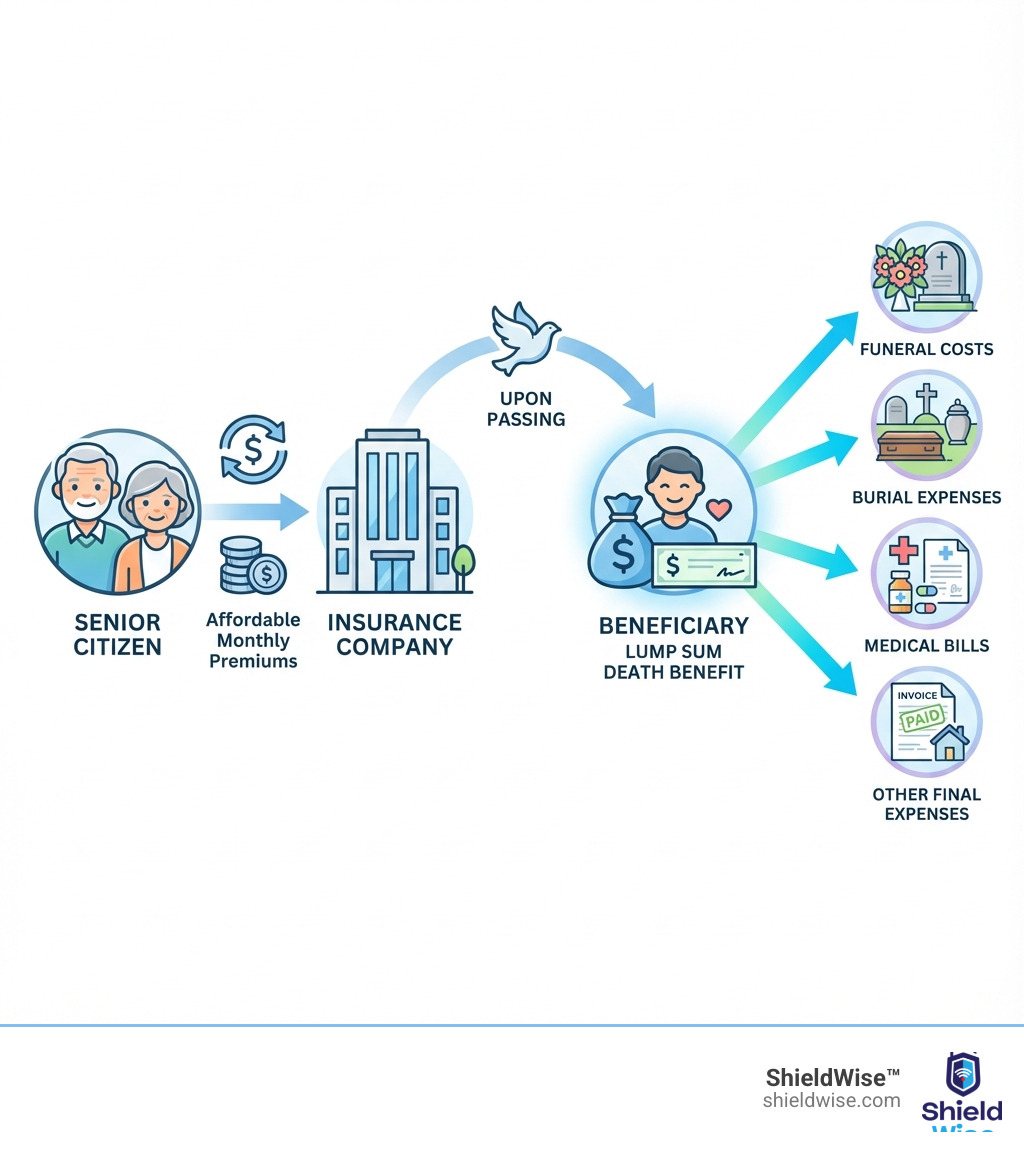

Final expense – basics and education is essential for anyone who wants to protect their loved ones from the financial burden of end-of-life costs. Burial insurance, also known as final expense insurance, is a type of small whole life insurance policy specifically designed to cover funeral expenses, medical bills, and other debts left behind after someone passes away.

Quick Answer: Final Expense Insurance Basics

- What it is: A small life insurance policy (typically $5,000-$25,000) designed to cover end-of-life costs

- How it works: You pay affordable monthly premiums; upon your death, your beneficiary receives a tax-free lump sum

- Who needs it: Seniors ages 50-85, especially those on fixed incomes or with health issues

- What it covers: Funeral services, burial/cremation, medical bills, outstanding debts, legal fees

- Cost: Usually $30-$70 per month for a $10,000 policy

- Key benefit: No medical exam often required; easy approval process

Here’s a sobering reality: the average funeral can easily add up to $10,000 or more. For many families, especially those on fixed incomes, this unexpected expense creates tremendous stress during an already difficult time. Over 60% of seniors still lack proper final expense coverage, leaving their children and loved ones scrambling to cover costs.

Final expense insurance works simply. You pay a fixed monthly premium that never increases. When you pass away, the insurance company pays your chosen beneficiary a lump-sum cash benefit—usually within days. Your family can then use these funds however they need: funeral home services, burial plot, cremation, outstanding medical bills, or even everyday expenses while they take time to grieve.

The best part? Most policies don’t require a medical exam. Even if you have diabetes, heart disease, or other health conditions, you can likely qualify for coverage. The application takes just minutes, premiums stay locked in for life, and your family gets guaranteed financial protection.

Let’s explore everything you need to know to make an informed decision about protecting your family’s future.

What is Final Expense Insurance and How Does It Work?

At its core, final expense insurance is a type of whole life insurance policy designed to ease the financial burden of end-of-life costs on your loved ones. Unlike traditional life insurance with large death benefits for income replacement, final expense policies offer smaller benefits to cover specific costs like funerals. This focus makes it valuable for seniors or anyone wanting to ensure their final wishes don’t create a financial strain. You can find more details in our guides on What Is Final Expense Insurance? and our Burial Insurance Complete Guide.

The primary purpose of final expense insurance is to prevent your family from having to scramble for funds to pay for a funeral or other immediate expenses after your passing. It’s about securing peace of mind, knowing that when the time comes, the financial aspects are taken care of, allowing your loved ones to focus on grieving and healing.

How a Policy Functions

A final expense policy operates on a straightforward principle. You, as the policyholder, pay a regular, fixed monthly premium to the insurance company. This premium amount is determined at the time of application and, importantly, it will never increase throughout the life of the policy. This predictability is a huge advantage, especially for those on a fixed income.

Over time, these policies also build cash value, which grows at a guaranteed minimum rate. While the cash value accumulation in final expense policies is usually minimal compared to larger traditional whole life policies, it does provide an additional layer of financial flexibility. In some cases, you may be able to borrow against this cash value if an urgent need arises, though doing so would reduce the death benefit.

Upon your passing, the insurance company pays a tax-free death benefit directly to your named beneficiary. This payout is typically made quickly, often within days or weeks, which is crucial for covering immediate expenses. A key benefit of final expense insurance is that the funds can be used for any purpose your beneficiary deems necessary. While intended for final expenses, if there are funds remaining after those costs are covered, your beneficiary can use them for anything from settling other debts to covering living expenses.

What Costs Are Typically Covered?

When we talk about “final expenses,” we’re referring to a range of costs that arise after someone dies. These can be substantial and often include more than just the funeral itself. For a deeper dive, explore What are Final Expenses?.

Here’s a list of expenses that final expense insurance typically covers:

- Funeral home services: Basic service fees, use of facilities, and staff assistance.

- Casket or urn: The container for burial or cremation.

- Embalming: A process that can be avoided with cremation or immediate burial.

- Cemetery plot, headstone, and burial service: Costs for the plot, grave marker, and interment. A burial vault may also be required.

- Cremation costs: The cremation process, an urn, and a memorial service.

- Outstanding medical bills and hospice care: Medical expenses not covered by health insurance.

- Credit card debt, legal fees, and probate costs: Other debts and administrative costs that arise during estate settlement.

It’s worth noting the significant impact of cremation trends on final expense planning. Cremation rates have been rising consistently over the past 10 years and are projected to continue increasing for the next two decades, according to the National Funeral Directors Association (NFDA). This trend often means lower overall funeral costs compared to a traditional burial, which can influence the amount of final expense coverage individuals choose. The 2023 NFDA General Price List Study provides valuable insights into these evolving costs.

Understanding Coverage Limits and Payouts

Final expense insurance policies are designed to cover specific, immediate costs, so their coverage limits are generally lower than traditional life insurance. Typical coverage amounts for final expense policies usually range between $5,000 and $25,000, though some policies can offer up to $50,000 in coverage. The exact amount you choose depends on your estimated final expenses and budget.

It’s important to understand two key terms related to payouts: graded death benefits and the contestability period. Many final expense policies, especially those with very easy approval, come with a graded death benefit. This means that if the policyholder dies within the first two or three years of the policy (often referred to as the waiting period), the full death benefit may not be paid. Instead, beneficiaries might receive a refund of premiums paid plus a small percentage (e.g., 10% or 110% of premiums paid). After this waiting period, the full death benefit is paid for any cause of death. For accidental deaths, the full benefit is usually paid immediately, even within the waiting period.

The contestability period is a standard clause in most life insurance policies, typically lasting two years. During this time, the insurance company can investigate claims and deny a payout if they find material misrepresentations on the application. After this period, the policy generally cannot be contested, ensuring the death benefit is paid.

Final expense policies often fall into two main underwriting categories:

- Simplified Issue Policies: These require you to answer a few health questions on the application, but no medical exam is necessary. Approval is often quick, and these policies generally offer the most competitive premiums for final expense coverage.

- Guaranteed Issue Policies: These policies ask no health questions and guarantee acceptance regardless of your health condition. They are ideal for individuals with serious health issues who might not qualify for simplified issue. However, they typically have higher premiums and almost always include a graded death benefit period.

Understanding these distinctions is crucial for choosing the right Final Expense Coverage for your needs.

Final Expense vs. Other End-of-Life Planning

Navigating the landscape of end-of-life planning can feel like standing at a crossroads. There are several paths you can take, and understanding the differences between them is key to making an informed decision that best suits your family’s needs. There’s no one-size-fits-all solution, which is why we emphasize comparing your options carefully.

Final Expense Insurance vs. Life Insurance

While final expense insurance is technically a type of life insurance, it has distinct characteristics that set it apart from traditional life insurance policies. Here’s a table to help us compare:

| Feature | Final Expense Insurance | Life Insurance (Traditional) |

|---|---|---|

| Primary Purpose | Covering end-of-life costs (funeral, medical, debt) | Income replacement, wealth transfer, large debts, education |

| Death Benefit Size | Smaller (typically $5,000 – $50,000) | Larger (often $100,000+) |

| Premiums | Higher per dollar of coverage; generally affordable | Lower per dollar of coverage; can be substantial for large policies |

| Underwriting | Simplified (health questions, no exam) or Guaranteed Issue (no health questions) | Full medical exam or simplified underwriting; stricter health requirements |

| Target Age | Primarily seniors (50-85 years old) | Adults of various ages |

As you can see, the death benefit for a final expense insurance policy might be much smaller than the death benefit for other kinds of life insurance. A typical payout might be anywhere from $5,000 to $20,000. Traditional life insurance policies, such as term life or larger whole life policies, are often designed to replace income, pay off a mortgage, or fund future needs like a child’s education. They require more extensive medical underwriting, which can be challenging for older individuals or those with health conditions.

Final expense insurance, on the other hand, is specifically geared toward people 50 to 85 years old, offering easier qualification with no medical exam often required. This makes it an accessible option for seniors, including those seeking Life Insurance Over 85 No Medical Exam.

Pre-Planning for Funeral Arrangements vs. Final Expense Insurance

Many people consider pre-planning their funeral arrangements as a way to alleviate future burdens on their families. This often involves working directly with a funeral home to make specific arrangements and, in some cases, prepaying for services. While this can provide comfort in knowing your wishes are documented, it comes with certain limitations:

- Tied to specific providers: Pre-paid funeral plans are typically tied to a specific funeral home. If that funeral home goes out of business, changes ownership, or if you move to a different area, your arrangements and funds might be complicated or even lost.

- Less flexibility: The funds are usually earmarked for specific services and products. If your family decides on different arrangements after your passing, or if costs change, there might be complications.

- Risk of changes over time: Funeral costs can fluctuate, and the value of pre-paid services might not keep pace with inflation.

Final expense insurance offers a distinct advantage in terms of flexibility. The death benefit is paid directly to your chosen beneficiary, not to a funeral home. This means your beneficiary has complete control over how the funds are used. They can shop around for funeral services, choose cremation if that becomes the preferred option, or use the money for other pressing needs like medical bills or outstanding debts. This flexibility ensures the funds serve your family’s most immediate and critical needs at the time of your passing.

When considering any funeral arrangement, it’s wise to be aware of your consumer rights. The Federal Trade Commission’s Funeral Rule entitles you to several rights and disclosures, including an itemized list of expenses, whether you’re pre-planning or not.

Weighing the Pros and Cons of Final Expense Insurance

Like any financial product, final expense insurance has its advantages and disadvantages. Understanding these can help you determine if it’s the right choice for your situation. We’ve compiled a list of pros and cons based on common experiences and expert opinions.

-

Pros:

- Easy to qualify: Often requires no medical exam, making it accessible for seniors and those with health issues. Many policies only ask a few health questions.

- Fixed premiums: Your monthly payments are locked in and will never increase, providing budget stability.

- Quick payout: Beneficiaries typically receive the death benefit quickly, often within days, providing immediate financial relief.

- Provides peace of mind: Knowing your final expenses are covered alleviates a significant burden from your loved ones during a difficult time.

- Cash value accumulation: Policies build a small cash value over time, offering a potential source of funds if needed.

- Flexible use of funds: The death benefit can be used for any purpose, not just funeral costs.

-

Cons:

- Lower death benefit: The coverage amounts are generally smaller than traditional life insurance, typically maxing out around $50,000, which may not be enough for larger financial obligations.

- Higher cost per dollar of coverage: Due to the easier underwriting and guaranteed nature, final expense policies can be more expensive per dollar of coverage compared to fully underwritten traditional life insurance.

- Potential waiting periods: Many policies, especially guaranteed issue ones, include a graded death benefit period (e.g., 2 years) where the full benefit isn’t paid for non-accidental death.

- May not be necessary if you have adequate savings: If you have substantial liquid savings specifically earmarked for final expenses, or a large traditional life insurance policy, final expense insurance might be redundant.

Final Expense – Basics and Education: Costs, Eligibility, and Application

Now that we’ve covered the fundamentals, let’s get practical. Understanding the costs, eligibility requirements, and application process for final expense – basics and education is crucial for making an informed decision. Our goal is to empower you to take the necessary steps to secure your family’s future with confidence.

How Much Does Final Expense Insurance Cost?

The cost of final expense insurance is influenced by several factors, which is why premiums can vary from person to person. Here are the key elements that determine your monthly payment:

- Age: This is the most significant factor. The younger you are when you apply, the lower your premiums will typically be, as the insurance company has a longer time to collect payments.

- Gender: Historically, women have slightly lower premiums due to longer life expectancies.

- Health Status: While no medical exam is required for most final expense policies, simplified issue policies do ask health questions. Better health can lead to lower premiums. Guaranteed issue policies, which ask no health questions, generally have higher premiums.

- Coverage Amount: Naturally, a higher death benefit (e.g., $25,000 vs. $10,000) will result in a higher premium.

- Policy Type: Simplified issue policies are generally more affordable than guaranteed issue policies for the same coverage amount.

For a $10,000 policy, the average monthly premium is usually between $30 to $70. For example, a 50-year-old might pay $25-$30 a month for $10,000 coverage, while an 80-year-old could pay $187-$268 per month for the same coverage. While these figures provide a general idea, individual quotes can vary significantly. To explore affordable options, check out our Low Cost Final Expense information. We can help you find out how much a policy for a specific amount, like $25,000, might cost.

Who is the Ideal Candidate for Final Expense Insurance?

Final expense insurance is not for everyone, but it is an invaluable tool for specific demographics and situations. The target demographic for final expense insurance is typically individuals aged 50 to 85.

You might be an ideal candidate if you fall into one of these categories:

- Seniors on a fixed income: If you’re managing your finances carefully in retirement, final expense insurance provides an affordable way to cover future costs without dipping into essential savings.

- Individuals with pre-existing health issues: If health conditions have made it difficult to qualify for traditional life insurance, final expense policies, especially simplified or guaranteed issue, offer an accessible solution.

- Those without sufficient savings: If you don’t have a dedicated savings fund of $10,000 or more to cover funeral and related expenses, this insurance ensures those costs won’t fall on your family.

- People whose term life policies are expiring: Many term life policies end as you get older, leaving a gap in coverage. Final expense insurance can fill this gap, offering permanent protection.

- Anyone who wants to avoid burdening loved ones: The peace of mind knowing your family won’t face financial stress during a time of grief is priceless.

For more custom information, especially for older adults, visit our page on End of Life Insurance for Seniors.

Is Final Expense Insurance a Worthwhile Investment?

The question of whether final expense insurance is a “worthwhile investment” truly depends on your unique personal situation, existing financial planning, and desired outcomes. It’s an investment in peace of mind and financial protection for your loved ones, rather than a traditional investment for financial growth.

When it makes sense:

- You don’t have sufficient liquid savings (e.g., $10,000+) specifically earmarked for end-of-life costs.

- You have health conditions that prevent you from qualifying for more comprehensive, lower-cost traditional life insurance.

- You want to guarantee that your funeral and immediate final expenses are paid for, without your family having to worry about finding the money.

- You wish to leave a small, immediate financial cushion for your loved ones, separate from your main estate which might take time to settle.

When it might not be necessary:

- You have substantial savings or investments that are easily accessible and specifically designated to cover all end-of-life costs.

- You already have a traditional life insurance policy with a death benefit large enough to cover final expenses and other financial needs.

- You are comfortable with your family potentially covering these costs or believe other assets will suffice.

The value of final expense insurance lies in its guaranteed protection and accessibility. It’s about ensuring a difficult time isn’t made harder by financial stress. It can be the right choice if you’re looking for a policy that covers end-of-life costs, typically comes with a low premium, and usually doesn’t require a medical exam.

How to Apply: A Simple Step-by-Step Guide

Applying for final expense insurance is designed to be a straightforward process, especially compared to traditional life insurance. We aim to make it as simple as possible for you.

Step 1: Assess your needs and budget.

Before you apply, take a moment to estimate your potential final expenses. Consider funeral costs (burial vs. cremation), any outstanding medical bills, and other debts. Think about how much you can comfortably afford to pay in monthly premiums. This will help you determine the appropriate coverage amount.

Step 2: Research and compare providers.

While the process is simple, comparing options is crucial. We encourage you to research various providers and their offerings. At ShieldWise™, we make it easy to Compare Final Expense Quotes from trusted carriers, ensuring you find a plan that fits your needs and budget.

Step 3: Complete the application (online or with an agent).

Most final expense applications are quick and can often be completed online or over the phone with a licensed agent. For simplified issue policies, you’ll answer a few basic health questions. For guaranteed issue, there are no health questions at all. The process is generally non-invasive and doesn’t require a medical exam.

Step 4: Choose a trusted beneficiary.

This is a critical step. Your beneficiary is the person or people who will receive the death benefit. Choose someone you trust implicitly to handle the funds according to your wishes. It’s often a spouse, adult child, or another close family member. You can also name contingent beneficiaries.

Step 5: Policy approval and first payment.

Once your application is reviewed and approved (often within minutes for simplified issue, or guaranteed for guaranteed issue), you’ll make your first premium payment. Your coverage typically begins once this payment is processed, providing you with immediate peace of mind.

Frequently Asked Questions about Burial Insurance

We understand you might have more questions about final expense insurance. Here are some of the most common ones we hear:

Can I get a policy if I have health problems?

Yes, absolutely! This is one of the biggest advantages of final expense insurance. Many people turn to these policies precisely because health issues have made it difficult to qualify for traditional life insurance.

- Simplified issue policies will ask a few health questions, but they typically don’t require a medical exam. Many common conditions like diabetes, heart disease, or high blood pressure can still lead to approval, often with competitive rates.

- Guaranteed issue policies are designed for individuals with more serious health concerns. They ask no health questions and cannot deny coverage based on your health. While these policies usually come with a graded death benefit (meaning a waiting period before the full benefit is paid for non-accidental death), they ensure that virtually everyone can secure some level of coverage.

What happens if I can no longer afford the premiums?

If you stop paying your premiums, your final expense policy will typically lapse, and your coverage will end. This means your beneficiaries would not receive a death benefit upon your passing. Most policies have a grace period (often 30 or 31 days) after a missed payment, allowing you to catch up without losing coverage.

If the policy has accumulated cash value and you’ve paid premiums for a significant period, there might be a small cash surrender value that you could receive if you cancel the policy. However, taking the cash surrender value means forfeiting the death benefit, which is the primary purpose of the insurance. It’s always best to contact your insurer or agent if you anticipate payment difficulties to explore any available options.

Is burial insurance the same as final expense insurance?

Yes, these terms are used interchangeably! Whether you hear “burial insurance,” “funeral insurance,” or “final expense insurance,” they all refer to the same type of small whole life insurance policy designed to cover end-of-life costs. We dig deeper into this on our page What is Burial Insurance?. The goal is always the same: to provide your loved ones with a cash benefit to handle immediate expenses after your passing, without adding financial stress to their grief.

Conclusion: Secure Your Legacy with Confidence

We’ve covered a lot of ground on final expense – basics and education, from what it is and how it works to its costs, eligibility, and how it compares to other planning options. The core message remains clear: final expense insurance offers a powerful, accessible way to provide financial protection for your loved ones and ensure your final wishes are honored.

The benefits are compelling:

- Financial security: Your family won’t have to bear the burden of unexpected funeral and other end-of-life costs.

- Peace of mind: You gain the comfort of knowing you’ve planned ahead and taken care of those you cherish.

- Simplicity and accessibility: With easy qualification and fixed premiums, it’s a straightforward solution for many.

Empower yourself with this knowledge to make the right choice for your family’s future. At ShieldWise™, we believe in clear, jargon-free guidance. We’re here to help you steer your options with clarity and confidence, allowing you to protect your family, control costs, and secure the right coverage.

Don’t leave your loved ones to face unnecessary financial strain during an already difficult time. Take the next step to protect your family from financial hardship.