Why Understanding Your Medicare and Insurance Options Is Critical for Retirees

The best insurance options for seniors on medicare and fixed income include a combination of Original Medicare or Medicare Advantage, supplemental Medigap coverage, prescription drug plans (Part D), and low-income assistance programs like Medicare Savings Programs and Extra Help. For complete financial protection, many seniors also add Final Expense Insurance to cover funeral costs that Medicare doesn’t pay.

Here’s what you need to know right now:

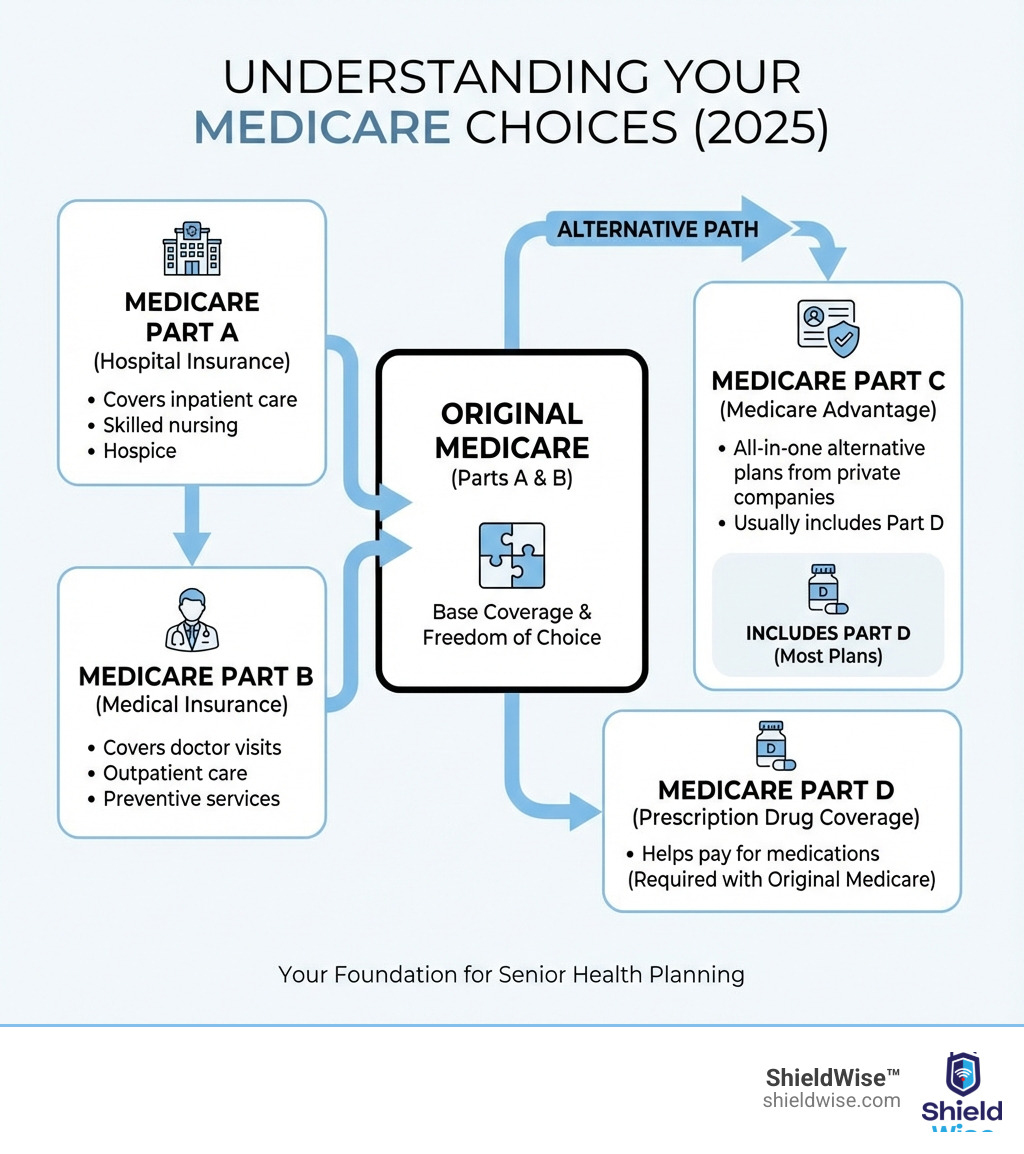

Your Core Medicare Choices:

- Original Medicare (Parts A & B) – Freedom to see any doctor, but has coverage gaps

- Medicare Advantage (Part C) – All-in-one plans with low premiums, but network restrictions

- Part D – Prescription drug coverage (required with Original Medicare)

- Medigap – Fills coverage gaps in Original Medicare with predictable costs

Cost-Saving Programs for Fixed Incomes:

- Medicare Savings Programs (MSPs) – Help pay premiums and deductibles

- Extra Help – Reduces prescription drug costs

- Medicaid – Free coverage for qualifying low-income seniors

Protection Beyond Medicare:

- Final Expense Insurance – Covers funeral and burial costs Medicare doesn’t pay

Navigating Medicare can feel overwhelming. You’re 65 or nearing it, and suddenly you’re bombarded with mail about Part A, Part B, Medicare Advantage, Medigap, and a dozen other terms. Meanwhile, you’re living on a fixed income and every dollar counts.

The stakes are high. Choose the wrong plan and you could face thousands in unexpected medical bills. Miss an enrollment deadline and you might pay penalties for years. But here’s the good news: with clear information, you can build a healthcare safety net that protects both your health and your wallet.

This guide breaks down everything you need to know about Medicare and insurance options for seniors on fixed incomes. We’ll explain the parts of Medicare in plain English, compare your coverage choices, and show you cost-saving programs you might qualify for. We’ll also cover why Final Expense Insurance matters – because Medicare doesn’t pay for funerals, and the last thing you want is to leave your family with that burden.

Let’s get started.

Decoding Medicare: The Four Essential Parts

Medicare is a federal health insurance program for people aged 65 or older, plus some younger individuals with disabilities. It’s the foundation for your healthcare, and understanding its parts is the first step to finding the best insurance options for seniors on medicare and fixed income.

Medicare Part A (Hospital Insurance)

Think of Part A as your inpatient shield. It covers services you receive when admitted to a hospital. Most people don’t pay a monthly premium for Part A if they or their spouse paid Medicare taxes for at least 10 years.

Part A covers:

- Inpatient hospital care (room, meals, nursing services).

- Skilled nursing facility care (after a qualifying hospital stay).

- Hospice care.

- Home healthcare.

Crucially, Part A does not cover long-term custodial care (assistance with daily activities like bathing or dressing). This is a common misconception and a significant gap many seniors must plan for.

Medicare Part B (Medical Insurance)

Part B is your outpatient warrior, covering services outside of a hospital admission. Most people pay a monthly premium for Part B ($185 in 2025). You’ll also have an annual deductible ($257 in 2025), after which you typically pay 20% coinsurance for most services.

Part B covers:

- Doctor visits.

- Preventive services (like screenings and vaccines).

- Outpatient and emergency room care.

- Medical supplies (wheelchairs, oxygen).

- Ambulance services.

- Mental health services.

Part A and Part B form “Original Medicare,” but they don’t cover everything. The 20% coinsurance, deductibles, and lack of long-term care coverage can add up, especially on a fixed income.

Medicare Part D (Prescription Drug Coverage)

Part D helps with prescription drug costs and is offered by private insurers. If you have Original Medicare, you’ll need a separate Part D plan. Most Medicare Advantage plans include this coverage.

Part D plans vary widely in:

- Formularies: The list of drugs the plan covers.

- Tiers: Categories that determine your copay for a drug.

- Monthly premiums: These vary by plan and region, with some starting at $0 per month.

- Annual deductibles: The amount you pay before the plan pays. For 2025, the maximum deductible is $590.

- Copayments or coinsurance: Your share of the cost for each prescription.

Choosing the right Part D plan requires checking your specific medications against the plan’s formulary. A low premium might not be a good deal if your drugs aren’t covered or have high copays.

Choosing Your Path: Original Medicare vs. Medicare Advantage

Once you understand the basic parts of Medicare, your next big decision is whether to stick with Original Medicare (Parts A & B) or choose a Medicare Advantage (Part C) plan. This is a critical decision for seniors, especially those on a fixed income, as it balances cost, flexibility, and comprehensive coverage. We need to assess your healthcare needs and budget to find the path that’s right for you.

The Pros and Cons of Original Medicare

Original Medicare, consisting of Part A and Part B, is the traditional route.

Pros:

- Freedom of Choice: A key benefit is that you can see almost any doctor or hospital in the country that accepts Medicare, and 99% of doctors nationwide do.

- No Referrals for Specialists: You generally don’t need a referral to see a specialist, giving you direct access to the care you need.

- Nationwide Coverage: Your coverage travels with you, which is great if you spend winters in a warmer climate or have family across the country.

Cons:

- Gaps in Coverage: Original Medicare doesn’t cover everything. You’re responsible for deductibles, copayments, and coinsurance, which can add up quickly.

- No Annual Out-of-Pocket Limit: This is a big one. There’s no cap on how much you might have to pay out of your own pocket in a year, which can be a significant risk for seniors on a fixed income.

- No Prescription Drug Coverage: You’ll need to purchase a separate Part D plan for medication coverage.

- No Extra Benefits: Original Medicare typically doesn’t cover dental, vision, or hearing services.

The Pros and Cons of Medicare Advantage (Part C)

Medicare Advantage, also known as Part C, is an alternative to Original Medicare offered by private insurance companies approved by Medicare. These plans bundle your benefits into an all-in-one package.

Pros:

- All-in-One Bundled Plans: Most Medicare Advantage plans combine Part A, Part B, and often Part D prescription drug coverage. Many plans also include extra benefits like vision, dental, and hearing.

- Low or $0 Premiums: Many Medicare Advantage plans offer low or even $0 monthly premiums beyond your Part B premium. The average cost for a Medicare Advantage plan with prescription drug coverage is around $28 per month.

- Annual Out-of-Pocket Maximum: A significant advantage for those on a fixed income is that these plans have an annual cap on your out-of-pocket expenses. Once you reach this limit, the plan pays 100% of your covered medical costs for the rest of the year.

- Extra Benefits: Beyond dental, vision, and hearing, some plans offer fitness programs, transportation to appointments, or even healthy food allowances.

Cons:

- Network Restrictions: You usually need to choose doctors and hospitals within the plan’s network (HMOs/PPOs). If you go out of network, your costs could be higher, or services might not be covered. This can limit your options if you have preferred providers.

- May Require Referrals: Depending on the plan type (especially HMOs), you might need a referral from your primary care doctor to see a specialist.

- Geographic Limitations: Your plan may only cover services in your specific service area. If you travel frequently, this could be an issue.

Original Medicare vs. Medicare Advantage: Which is better for a fixed income?

Choosing between Original Medicare and Medicare Advantage is a deeply personal decision, especially when every dollar counts. Here’s a quick comparison to help you weigh your options:

| Feature | Original Medicare | Medicare Advantage (Part C) |

|---|---|---|

| Monthly Premiums | Part B premium ($185 in 2025) + Part D premium | Part B premium + (often low or $0) MA plan premium |

| Doctor Choice/Flexibility | Any doctor/hospital accepting Medicare (99% nationwide) | Usually limited to network doctors/hospitals; may require referrals |

| Out-of-Pocket Costs | Deductibles, coinsurance (20% Part B), no annual limit | Deductibles, copayments; has an annual out-of-pocket maximum |

| Prescription Drug Coverage | Requires separate Part D plan | Usually included |

| Extra Benefits | Generally none (dental, vision, hearing) | Often includes dental, vision, hearing, fitness, etc. |

For many seniors on a fixed income, the lower monthly premiums, predictable out-of-pocket maximums, and bundled extra benefits of Medicare Advantage plans can be very appealing. However, if having the freedom to choose any doctor and travel without network concerns is paramount, Original Medicare might be a better fit, especially if supplemented with a Medigap policy.

The Best Insurance Options for Seniors on Medicare and Fixed Income

Managing healthcare costs on a limited budget is challenging, but excellent strategies exist. The best insurance options for seniors on medicare and fixed income often combine core Medicare with supplemental plans and government assistance programs to create predictable, affordable coverage.

Medigap (Medicare Supplement Insurance)

If you choose Original Medicare, a Medigap policy is your secret weapon against unexpected costs. Offered by private companies, Medigap is designed to “fill the gaps” by helping cover deductibles, copayments, and coinsurance.

Here’s why Medigap is so valuable:

- Predictable Costs: Medigap policies can pay your 20% Part B coinsurance and other cost-sharing, making your healthcare budget much more predictable.

- Standardized Plans: Plans are standardized by letters (A through N) in most states. A Plan G from one company offers the same basic benefits as a Plan G from another; only the price differs.

- No Network Restrictions: Medigap works with Original Medicare, so you retain the freedom to see any doctor or hospital that accepts Medicare.

For new enrollees, Plan G is a popular comprehensive option. While the Original Medicare + Medigap combination may have higher monthly premiums, it often results in the lowest out-of-pocket costs when you need care.

You can learn more about these supplemental plans directly from Medicare to make an informed decision: Learn about Medicare Supplement Insurance.

Finding the best insurance options for seniors on medicare and fixed income with low-income assistance

For seniors with limited income, several government programs can significantly reduce healthcare costs.

- Medicaid: A joint federal and state program providing free health insurance to people with low incomes. If you qualify for both Medicare and Medicaid (“dual-enrollment”), Medicaid covers most of your Medicare costs.

- Medicare Savings Programs (MSPs): These state-run programs help pay for Medicare Part A and/or Part B costs (premiums, deductibles, etc.). We encourage you to apply even if you think your income is slightly too high, as rules vary by state.

- Extra Help for Part D: This program helps pay for Medicare Part D prescription drug costs. If you qualify for an MSP, you automatically get Extra Help.

These programs can dramatically lower your out-of-pocket expenses. To learn more and see if you qualify, visit the official Medicare website: How to get help with your Medicare costs.

Key Factors to Consider When Choosing Your Plan

Making the right choice requires a thoughtful assessment of your personal situation:

- Budget: Analyze what you can afford for monthly premiums versus potential out-of-pocket costs. An out-of-pocket maximum provides predictability.

- Health Needs: Consider your current health. If you expect frequent medical care, a plan with lower cost-sharing (like Original Medicare with Medigap) may be better despite higher premiums.

- Prescription Drugs: Check that a plan’s formulary covers your medications with manageable copays. A low premium doesn’t help if drug costs are high.

- Preferred Providers: If you want to keep your current doctors, check if they are in-network for any Medicare Advantage plan you consider. Original Medicare with Medigap offers the most flexibility.

- Travel: If you travel often, Original Medicare with Medigap provides broader, nationwide coverage.

By evaluating these factors, you can align your insurance choice with your lifestyle and financial realities.

Securing Your Legacy: Why Final Expense Insurance Matters

While Medicare and supplemental insurance are vital for your health, they don’t cover everything. Specifically, Medicare does not pay for funeral and burial costs. This is where Final Expense Insurance steps in, offering a different kind of peace of mind for seniors on a fixed income. It’s about protecting your loved ones from the financial burden of your final arrangements.

Planning for your end-of-life expenses is a crucial part of holistic financial planning. It ensures that your family isn’t left with unexpected bills during an already difficult time. We understand the importance of this protection, and our goal is to help you secure your legacy: End of Life Coverage.

What is Final Expense Insurance?

Final Expense Insurance is a type of small whole life insurance policy specifically designed to cover end-of-life costs. It’s often called “burial insurance” or “funeral insurance” for good reason.

This policy typically covers:

- Funeral and burial costs: The primary purpose, ensuring your loved ones don’t have to shoulder this expense.

- Outstanding medical bills: Any medical costs not covered by Medicare or supplemental plans.

- Credit card debt or other small debts: Providing a small financial cushion for your beneficiaries.

Key features that make it suitable for seniors on fixed incomes:

- Affordable Premiums: Final Expense policies generally have lower face values (e.g., $5,000 – $25,000) than traditional life insurance, which translates to more manageable monthly premiums.

- No Medical Exam Options: Many policies offer simplified underwriting, meaning you can often qualify without a medical exam, just by answering a few health questions. Some even offer guaranteed acceptance, regardless of your health. This is particularly beneficial for seniors, especially those over 85, who might find it difficult to get traditional life insurance.

- Cash Value Growth: As a whole life policy, it builds cash value over time that you can borrow against if needed.

We believe in making these decisions as clear as possible. You can learn more about what these policies cover here: What are Final Expenses?. Even for those over 85, options exist: Life Insurance Over 85 No Medical Exam.

How Final Expense complements the best insurance options for seniors on medicare and fixed income

While Medicare provides essential health coverage, it explicitly does not cover funeral expenses. This is a critical gap that Final Expense Insurance fills, especially for seniors on a fixed income.

- Protects Your Fixed-Income Savings: Without Final Expense Insurance, your loved ones might have to dip into your savings, retirement funds, or even their own money to cover funeral costs. A Final Expense policy ensures your hard-earned savings remain intact.

- Provides Immediate Cash to Beneficiaries: Upon your passing, the death benefit is paid directly to your beneficiaries, typically within a few days, providing them with the funds needed promptly.

- Guaranteed Acceptance Policies: For those with health concerns, guaranteed acceptance options ensure coverage is available, regardless of medical history.

By adding Final Expense Insurance to your overall plan, you’re not just securing your health, but also ensuring your legacy is one of care and foresight, not financial burden. We offer low-cost options to fit your budget: Low Cost Final Expense Insurance.

Frequently Asked Questions about Medicare and Senior Insurance

Here are answers to some of the most common questions from seniors navigating their insurance options.

What is the difference between Medigap and Medicare Advantage?

This is a key distinction:

- Medigap (Medicare Supplement Insurance): Works with Original Medicare (Parts A & B). It helps pay for out-of-pocket costs like deductibles and coinsurance. You cannot have Medigap if you have a Medicare Advantage plan.

- Medicare Advantage (Part C): Is an alternative to Original Medicare. It’s an all-in-one plan from a private company that bundles Part A, Part B, and often Part D, plus extra benefits like dental and vision.

In short, you choose one path: either Original Medicare + Medigap + Part D, OR a Medicare Advantage plan. You can’t have both. The decision balances the flexibility of Original Medicare against the lower upfront costs and bundled benefits of Medicare Advantage.

How much should I expect to pay for health insurance as a senior on Medicare?

Costs vary widely depending on your plan choice:

- Medicare Part B Premium: The standard premium is $185 per month in 2025. Most seniors pay this unless they qualify for assistance.

- Medicare Part D Premium: If you have Original Medicare, you’ll pay a separate premium for a drug plan, which varies but averages around $43 per month.

- Medigap Premium: This premium varies by plan, company, and your age. A comprehensive plan for a new enrollee might cost around $150-$200 per month.

- Medicare Advantage Premium: Many plans have low or $0 monthly premiums (beyond your Part B premium). The average is about $28 per month.

Remember to also factor in deductibles, copayments, and coinsurance.

Where can I get help choosing a Medicare plan?

You don’t have to do this alone. Excellent resources are available:

- Official Medicare Website: Medicare.gov is the definitive source to compare plans and get detailed information.

- State Health Insurance Assistance Programs (SHIP): These programs offer free, unbiased counseling to help you understand your options.

- Licensed Insurance Agents: Agents specializing in Medicare can provide personalized guidance, compare plans from multiple carriers, and help you find the best fit for your needs, usually at no cost to you.

- Trusted Online Resources: Reputable websites can provide clear, up-to-date information.

Conclusion: Take Control of Your Health and Financial Future

Choosing the right insurance options as a senior on Medicare and a fixed income is one of the most important decisions you’ll make for your health and financial well-being. We’ve explored the core components of Medicare, the trade-offs between Original Medicare and Medicare Advantage, the crucial role of Medigap, and the invaluable support offered by low-income assistance programs. We also highlighted why Final Expense Insurance is essential for protecting your loved ones from end-of-life costs.

The key takeaway is the importance of a personalized approach. Your ideal plan will depend on your unique health needs, financial situation, and lifestyle. Proactive planning is key – don’t wait until you’re facing a medical bill to understand your coverage.

We are dedicated to providing clear, jargon-free guidance to help you make informed decisions. Take the next step to protect your family and secure your peace of mind with the right Final Expense Insurance. Compare plans from trusted carriers, get instant online quotes, and ensure your loved ones are cared for, no matter what tomorrow brings.