The Real Cost of Funeral Insurance Explained

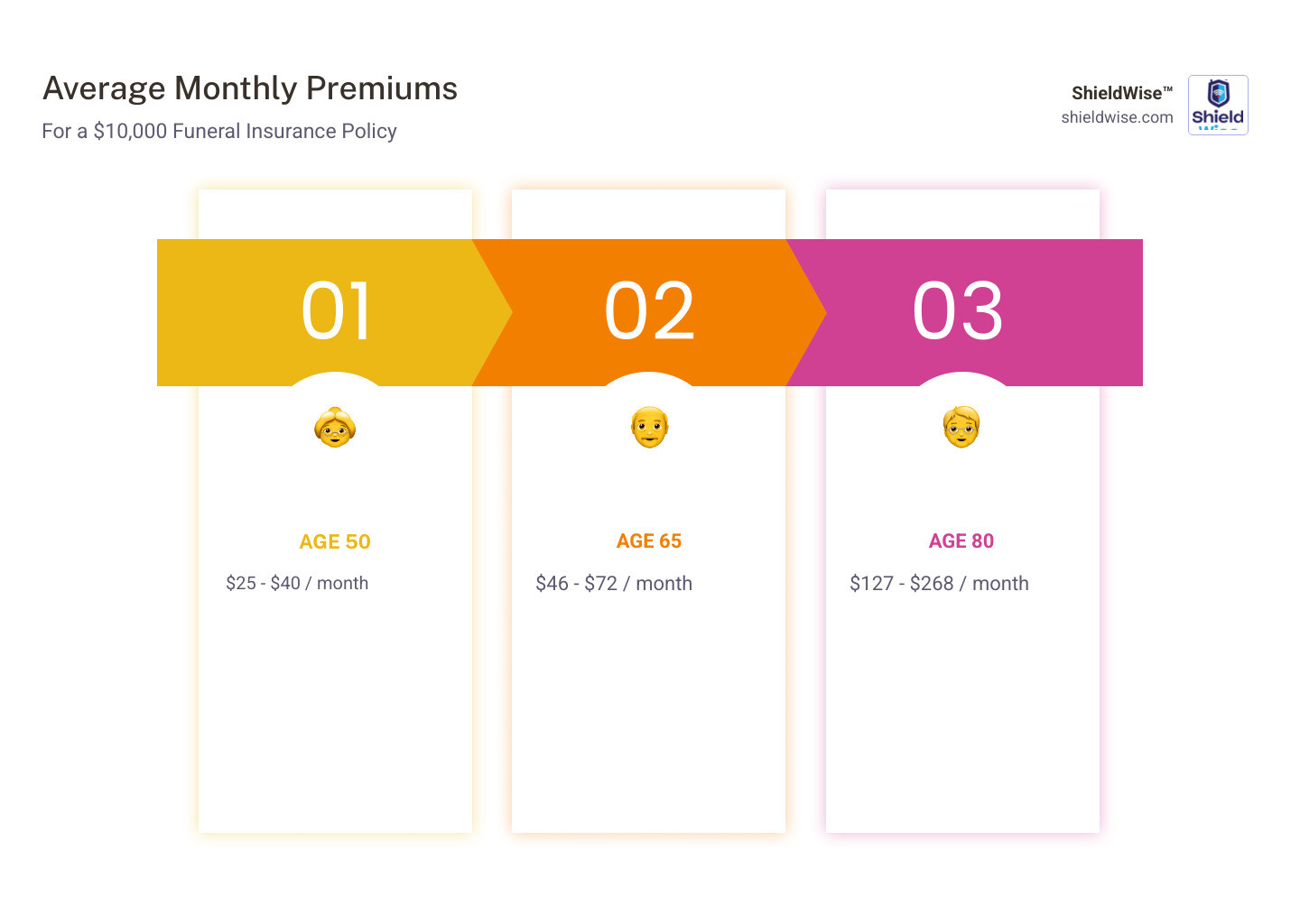

The cost of funeral insurance varies based on your personal situation. Here’s a quick overview:

- Average Monthly Premiums ($10,000 Policy):

- Age 50: $25-$40/month

- Age 65: $46-$72/month

- Age 80: $127-$268/month

- Coverage Amounts: Typically $5,000 to $25,000, with some policies up to $50,000.

- Key Factors: Your premium is directly impacted by your age, gender, health, and coverage amount.

- Cost Comparison: Funeral insurance is often more costly per dollar of coverage than traditional life insurance but is easier to qualify for.

Planning for final expenses is a thoughtful gift that allows your family to focus on grieving, not bills. But understanding the options can be complex. You may be wondering what funeral insurance is and what it will really cost.

This guide from ShieldWise™ cuts through the confusion. We’ll explain how funeral insurance works, what it covers, and what you can expect to pay. Our goal is to give you clear answers so you can make the best choice for your family’s peace of mind.

What Is Funeral Insurance and What Does It Cover?

Funeral insurance—also known as final expense insurance or burial insurance—is a type of whole life insurance policy designed to cover the costs associated with your passing. It provides a financial safety net for your loved ones, ensuring they don’t face unexpected bills during a time of grief. You can learn more in our guide, What is Burial Insurance?.

When you buy a policy, you select a death benefit (a predetermined sum of money) that is paid to your beneficiaries, usually tax-free. This money is flexible and is not tied to a specific funeral home. While its main purpose is to cover funeral-related costs, your beneficiaries can use the funds for any expenses they face, such as:

- Funeral director’s professional services

- Casket or urn

- Embalming and preparation for a viewing

- Funeral service, viewing, and venue rental

- Headstone or grave marker

- Cremation fees

- Outstanding medical bills or legal fees

- Credit card debt

In short, funeral insurance helps cover a wide range of costs that arise at the end of life. For more details on these expenditures, see our article on End of Life Expenses.

How It Differs from Traditional Life Insurance

While funeral insurance is a type of life insurance, it has key differences from traditional term or whole life policies.

-

Coverage Amount:

- Funeral Insurance: Offers smaller payouts, typically $5,000 to $25,000, designed for final expenses.

- Traditional Life Insurance: Provides much higher coverage, from $25,000 to millions, intended for income replacement, mortgage payments, and leaving an inheritance.

-

Purpose:

- Funeral Insurance: Its primary goal is to cover final expenses and ease the immediate financial burden on your family.

- Traditional Life Insurance: Its purpose is broader, focusing on long-term financial security for your dependents.

-

Cost per Dollar of Coverage:

- Funeral Insurance: Premiums can be more costly per dollar of coverage due to simpler underwriting.

- Traditional Life Insurance: Generally offers lower premiums per dollar of coverage, especially for younger, healthier applicants.

-

Underwriting & Medical Exams:

- Funeral Insurance: The approval process is much simpler. Most policies require no medical exam, only a few health questions (“simplified issue”) or none at all (“guaranteed issue”). This makes it highly accessible for seniors or those with health conditions.

- Traditional Life Insurance: Usually involves a thorough approval process, including a medical exam and detailed health questionnaires.

If your main goal is to cover final expenses and you may have trouble qualifying for traditional insurance, funeral insurance is an excellent option. If you have larger financial obligations, a traditional policy is likely a better fit.

The True Cost of a Funeral in 2024

Understanding the potential cost of a funeral is the first step in protecting your family from a financial burden. According to the National Funeral Directors Association (NFDA), the median cost of a funeral with a viewing and burial in 2023 was approximately $8,300. For a cremation with a viewing, the median cost was around $6,280. These are national averages, and costs can vary significantly based on your location and the services you choose.

Where does the money go? The total bill is composed of many different charges. The largest portion is often the basic service fee from the funeral director, which covers professional services, staff, and overhead. Other significant expenses include the casket, embalming (for a viewing), use of the funeral home for the service, and transportation like a hearse.

Smaller details also add up, such as printed materials, cosmetic services, and the urn for cremation. You can read more about these trends in the 2023 funeral cost data from the NFDA.

It’s also crucial to consider inflation. Like everything else, funeral costs rise over time. A funeral that costs $8,000 today could easily cost $10,000 or more in a decade. This is why planning ahead and choosing an adequate cost of funeral insurance coverage amount is so important—to ensure the policy you buy today will be sufficient down the road. Understanding these costs makes it clear why planning is not about being morbid; it’s about being practical and caring.

Breaking Down the Cost of Funeral Insurance

Now that we understand funeral costs, let’s look at the cost of funeral insurance. Your monthly premium depends on your age, gender, health, and chosen coverage amount. The table below provides a general look at average monthly premiums for guaranteed issue policies.

| Age | Gender | $10,000 Coverage (Avg. Monthly) | $25,000 Coverage (Avg. Monthly) |

|---|---|---|---|

| 50 | Female | $25 – $30 | $60 – $70 |

| Male | $40 – $47 | $79 – $90 | |

| 65 | Female | $43 – $55 | $100 – $130 |

| Male | $57 – $72 | $130 – $170 | |

| 80 | Female | $127 – $150 | $250 – $300 |

| Male | $157 – $268 | $313 – $400 |

Note: These are average estimates. For accurate pricing, getting a personalized quote is always best.

As the table shows, premiums increase with age, and men often pay slightly more than women due to differences in life expectancy.

Key Factors That Determine the Cost of Funeral Insurance

Insurance companies consider several elements when calculating your premium:

- Age: This is the biggest factor. The older you are when you apply, the higher your premium will be.

- Gender: Statistically, women have a longer life expectancy, which often results in lower premiums than men of the same age.

- Health Status: For policies with health questions, conditions like heart disease or diabetes can increase premiums. Tobacco use will also lead to higher rates.

- Coverage Amount: A higher death benefit (e.g., $25,000 vs. $10,000) will result in a higher premium.

- Policy Type: The type of policy you choose—simplified or guaranteed issue—directly impacts your cost and approval.

Understanding Policy Types and Their Impact on Cost

There are two main types of funeral insurance policies:

Simplified Issue Life Insurance: This type requires no medical exam, but you must answer a few health questions. If you’re in relatively good health, you can qualify for lower premiums and often get immediate coverage. This is a great option for those with minor health issues who want to skip a medical exam.

Guaranteed Issue Life Insurance: This is the “no questions asked” option. There is no medical exam and no health questions. Approval is virtually guaranteed if you meet the age requirements (typically 50-80). Because the insurer takes on unknown risk, these policies have the highest premiums. They also typically include a graded death benefit, which is a waiting period of two to three years. If you pass away from natural causes during this period, your beneficiaries receive a refund of premiums paid (often with interest) instead of the full death benefit. Accidental death is usually covered from day one. This policy is a lifeline for those with significant health issues who cannot qualify for other insurance. You can explore these options in our guide on End of Life Insurance for Seniors.

Is Funeral Insurance a Worthwhile Investment?

Whether funeral insurance is worth it depends on your personal situation. It offers significant advantages for some, but it’s important to weigh the pros and cons.

Pros: The primary benefits are easy approval (often with no medical exam) and the peace of mind that comes from knowing your loved ones are protected from financial strain. Premiums are also typically fixed, meaning they won’t increase over time.

Cons: The cost of funeral insurance can be higher per dollar of coverage compared to traditional life insurance. Coverage amounts are lower (usually under $50,000), and it’s possible to pay more in premiums than the death benefit if you live for many years. Guaranteed issue policies also have a waiting period for the full benefit to take effect.

For a cost-benefit analysis, consider your needs. If you’re older, have health issues, or want a simple way to cover final expenses without a medical exam, the peace of mind from funeral insurance can be invaluable. For a deeper dive, see our Burial Insurance Complete Guide.

Who Benefits Most from Funeral Insurance?

This coverage is particularly well-suited for:

- Seniors who may find other insurance difficult or expensive to obtain.

- Individuals with pre-existing health conditions who may not qualify for traditional policies.

- People who have been denied traditional life insurance.

- Those with no other savings or financial plan for final expenses.

- Individuals needing only a small coverage amount ($5,000 to $25,000) to cover basic funeral costs.

Other Ways to Prepare for Final Expenses

Funeral insurance isn’t the only option. Consider these alternatives:

- Using Existing Life Insurance: If you have a term or whole life policy, its death benefit can be used for funeral costs.

- Social Security Death Benefit: Eligible surviving spouses or children can receive a one-time payment of $255 from the SSA.

- Personal Savings: A dedicated savings account gives you control, but it requires discipline and may be subject to probate, delaying access.

- Pre-paid Funeral Plans: You pay a funeral home directly in advance, locking in prices. However, funds are tied to that specific provider, which can be restrictive if you move.

Frequently Asked Questions about the Cost of Funeral Insurance

Here are answers to some of the most common questions about the cost of funeral insurance.

Do I need a medical exam to get funeral insurance?

No, most funeral insurance policies do not require a medical exam. This accessibility is a key benefit.

- Simplified issue policies require you to answer a few health questions on the application but have no physical exam.

- Guaranteed issue policies have no medical exam and no health questions at all. Approval is nearly certain if you meet the age requirements (typically 50-80).

This makes funeral insurance an excellent option for seniors or those with health concerns. Learn more in our guide to End of Life Insurance for Seniors.

What happens if my premiums paid exceed the death benefit?

It is possible to pay more in premiums over a long lifetime than the policy’s death benefit. This is because funeral insurance is insurance, not a savings or investment account. You are paying for a guarantee that a specific amount of money will be available for your loved ones whenever you pass away, whether it’s next year or 30 years from now.

Think of it as paying for protection and peace of mind. The policy ensures funds are available immediately to cover final expenses. If you stop making payments, the policy will lapse, and you will lose the coverage and all premiums paid. Insurance companies do not offer refunds for excess premiums.

Can I use a regular life insurance policy for funeral costs?

Yes, absolutely. The death benefit from any life insurance policy (term, whole, etc.) can be used for any purpose, including funeral costs. The payout is a tax-free lump sum paid to your beneficiaries, who have complete death benefit flexibility.

They can use the funds for the funeral, medical bills, mortgage payments, or any other need. This is entirely the beneficiary’s choice. While you can name a funeral home as a beneficiary, it’s generally better to name a trusted person to manage the funds.

If you are healthy enough to qualify, traditional life insurance may offer a larger death benefit and better value. However, if you only need a smaller amount for final expenses or have health issues, funeral insurance is a perfect fit. Our article on Final Expense Insurance can help you decide which is best for you.

Conclusion

Planning for the end of life is one of the most caring things you can do for your family. It ensures they can grieve without the added stress of figuring out how to pay for a funeral, which can cost $8,000 or more.

As we’ve covered, the cost of funeral insurance depends on your age, health, and desired coverage. While it may not be the cheapest option per dollar, it offers something invaluable: accessibility. With options for no medical exams and guaranteed approval, it provides a path to peace of mind for seniors and those with health challenges.

Whether you choose funeral insurance, traditional life insurance, or another method, the most important step is to have a plan. ShieldWise™ is here to help you make that choice with confidence. We provide clear, jargon-free guidance and allow you to compare plans from trusted carriers to find coverage that fits your life and budget.

Your legacy should be one of love and memories, not financial burdens. Take the next step today.

Compare plans and get your free quote for final expense insurance