Why Low Cost Final Expense Insurance Matters

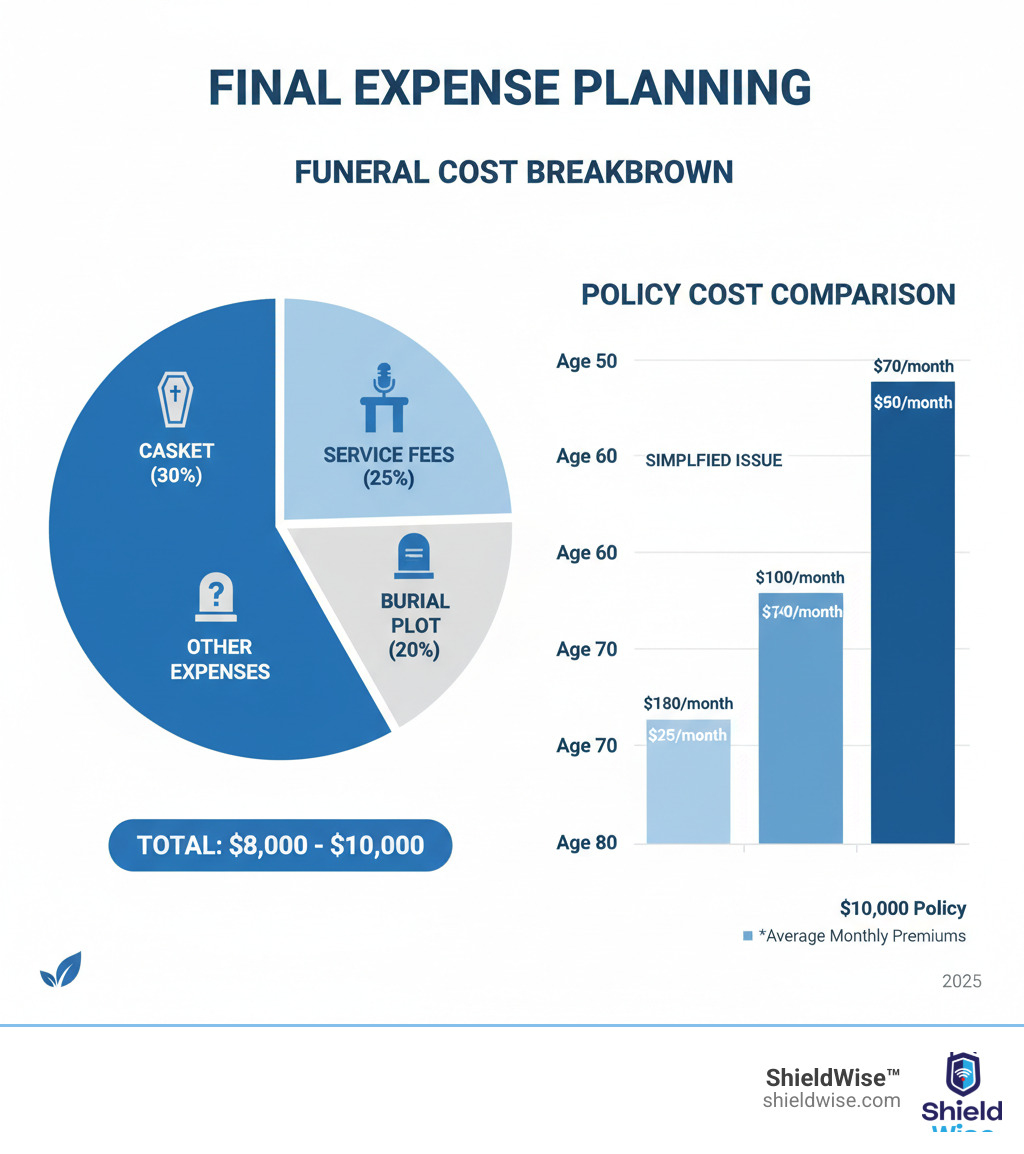

Low cost final expense insurance is a type of whole life insurance designed to cover end-of-life expenses without placing a financial burden on your family. With the average funeral costing between $7,000 and $12,000, many seniors on fixed incomes need an affordable way to ensure their final wishes are honored.

Quick Answer: How to Find Low Cost Final Expense Coverage

- Compare multiple carriers – Rates for the same $10,000 policy can vary from $30 to $125/month depending on age and health

- Choose the right policy type – Simplified issue policies cost 20-30% less than guaranteed issue

- Buy earlier – Premiums increase significantly with age (a 65-year-old pays roughly half what an 80-year-old pays)

- Consider your health – If you can answer basic health questions, avoid guaranteed issue policies that charge more

- Look for carriers with strong ratings – Financial stability matters when a policy needs to pay out years later

Planning for end-of-life expenses is a considerate gift to your loved ones. With funeral costs rising and Social Security’s $255 death benefit falling short, a dedicated plan is crucial.

Designed for people aged 50-85, final expense insurance protects families from funeral bills, medical costs, and other debts. Unlike traditional policies that replace income, it focuses on immediate end-of-life costs with smaller death benefits (typically $5,000 to $25,000) and affordable premiums.

The good news is that most policies require no medical exam, have fixed premiums, and pay out quickly (often within 24-72 hours). Understanding how to find affordable coverage can save thousands and provide genuine peace of mind.

Understanding Final Expense Insurance: What It Is and What It Covers

Final expense insurance is a financial safety net to ensure your family isn’t burdened by costs when you pass away. Also known as burial or funeral insurance, it’s a type of whole life insurance, meaning it lasts your entire life as long as premiums are paid.

How Final Expense Insurance Works

Unlike traditional life insurance designed for income replacement, low cost final expense insurance has a focused mission: covering immediate costs associated with your passing. This leads to several key features:

- Smaller Death Benefits: Coverage typically ranges from $5,000 to $40,000, aligning with funeral costs and other final debts.

- Simple Application: Most policies require no medical exam, just a few health questions. This makes it accessible for seniors or those with health issues.

- Fixed Premiums: Your premium is locked in and will never increase, providing predictable costs for life.

- Cash Value: The policy builds a modest cash value over time.

- Quick Payout: The death benefit is paid to your beneficiary as a tax-free lump sum, usually within 24-72 hours of a claim, providing funds when they’re needed most.

What Specific End-of-Life Expenses Can It Cover?

Your beneficiary receives the payout with no restrictions, allowing them to address the most urgent financial needs. According to the National Funeral Directors Association (NFDA), the median funeral cost was $7,848 in 2021. Common expenses include:

- Funeral service and viewing

- Cremation costs

- Casket or urn

- Burial plot and headstone

- Outstanding medical bills

- Legal or probate fees

- Credit card or other personal debts

- Travel for family members to attend the service

Who Is the Ideal Candidate for This Insurance?

Final expense insurance is a perfect fit if you are:

- A senior between ages 50 and 85.

- Dealing with health issues that may disqualify you from traditional insurance.

- Someone with limited savings who doesn’t have $10,000+ set aside for these costs.

- An individual who lacks other life insurance coverage.

- A person who wants to spare their family the financial stress of final expenses.

Finding Low Cost Final Expense Insurance: What Drives the Price?

Finding low cost final expense insurance is achievable, as these policies are designed to be affordable. However, prices for the same $10,000 policy can range from $30 to over $125 per month, so understanding the cost factors and shopping around is essential.

Factors That Influence the Cost of a Low Cost Final Expense Policy

Insurers assess several factors to determine your premium:

- Age: This is the biggest factor. The younger you are when you buy, the lower your locked-in rate will be.

- Gender: Women typically pay slightly less than men due to a longer life expectancy.

- Health Status: Better health qualifies you for lower-cost simplified issue policies. Serious conditions may require a higher-cost guaranteed issue plan.

- Tobacco Use: Smokers and tobacco users can expect to pay 30-50% more than non-users.

- Coverage Amount: A higher death benefit means a higher premium. It’s wise to calculate your expected costs, noting the National Funeral Directors Association median funeral cost of $7,848.

- Insurance Provider: Rates for the same coverage vary between companies, making comparison shopping critical.

Policy Types: Simplified Issue vs. Guaranteed Issue

When seeking a policy with no medical exam, you’ll encounter two main types. The one you choose significantly impacts your cost.

| Feature | Simplified Issue | Guaranteed Issue |

|---|---|---|

| Medical Questions | Yes (a few health questions on the application) | No (no health questions asked) |

| Medical Exam | No | No |

| Waiting Period | Typically none (immediate full coverage) | Yes (usually 2 years for natural death) |

| Premium Cost | More affordable | Generally higher |

| Ideal Candidate | People with some health issues who can answer health questions favorably and want immediate coverage | People with serious health conditions who need guaranteed acceptance |

If you can answer a few health questions favorably, a simplified issue policy is your most affordable path to low cost final expense coverage. Guaranteed issue is a vital alternative for those with serious health conditions who would otherwise be denied.

The Pros and Cons of Final Expense Insurance

This insurance is an excellent tool for a specific job, but it’s important to understand its strengths and limitations.

Pros:

- Accessible: Designed for seniors and those with health issues.

- No Medical Exam: Most policies are approved quickly without a doctor’s visit.

- Fixed Premiums: Your rate is locked in for life.

- Builds Cash Value: The policy accumulates a modest cash value over time.

- Quick Payout: Claims are typically paid in 24-72 hours, providing immediate funds.

Cons:

- Modest Coverage: Benefits are smaller ($5,000-$25,000) and not meant for income replacement.

- Higher Cost-Per-Dollar: Compared to term life for a younger person, the cost is higher.

- Waiting Periods: Guaranteed issue policies have a 2-year graded death benefit for natural causes.

- Slow Growth: Cash value growth is slower than dedicated investment vehicles.

How Final Expense Insurance Offers Flexibility and Control

One of the most powerful aspects of low cost final expense insurance is the control and flexibility it offers both you and your beneficiaries. It’s not just about covering costs; it’s about honoring your wishes and easing the burden on your family.

Insurance Payout Flexibility

Unlike prepaid funeral plans, final expense insurance provides a flexible cash payout. Your named beneficiary receives the death benefit directly, which means:

- Beneficiary choice: Your loved ones decide how to allocate the funds based on what’s most needed.

- Any funeral home: There are no restrictions on which funeral provider they must use.

- Leftover funds: If the final expenses cost less than the death benefit, the remaining money belongs to your beneficiaries to use as they see fit. This is a major advantage over restrictive pre-need plans.

Cost and Security

When you choose a final expense policy, you’re securing financial stability for your loved ones.

- Protection from rising costs: Having a guaranteed sum available protects your family from future inflation in funeral costs.

- Fixed premiums: Premiums on whole life final expense policies are fixed for life, providing long-term budget stability.

- Cash value access: As your policy builds cash value, you may be able to access it through policy loans for unexpected financial needs.

- Security for your loved ones: The ultimate security is knowing your family won’t face a financial crisis during a time of grief. It allows them to focus on healing, not bills.

Your Step-by-Step Guide to Applying and Comparing Policies

Finding the right low cost final expense policy doesn’t have to be complicated. The application and comparison process is designed to be straightforward, empowering you to make an informed decision.

How Can One Compare Quotes From Different Final Expense Insurance Providers?

Comparing quotes is the best way to find an affordable policy. Here’s how:

- Work with an independent agent: An independent agent or digital marketplace like ShieldWise can access quotes from multiple carriers, giving you a broad view of your options.

- Use a digital marketplace: Our platform helps you compare plans, get instant online quotes, and receive clear guidance.

- Compare multiple carriers: Don’t settle for the first quote. Different companies price policies differently based on health and age.

- Review financial strength ratings: Look for companies with high ratings from agencies like A.M. Best to ensure they can pay future claims.

- Consider policy specifics: Beyond price, compare waiting periods, coverage amounts, and available riders.

What Is the Process for Applying for Final Expense Insurance?

The application for low cost final expense insurance is much simpler than for traditional life insurance.

- Get a Quote: Provide your age, gender, and desired coverage online or with an agent.

- Answer Health Questions: For simplified issue policies, answer a few health questions honestly.

- Skip Health Questions: For guaranteed issue policies, no health questions are asked.

- Verification: The insurer may quickly verify your information using industry databases (for simplified issue).

- Get Approved: Approval is often instant or within a few days. Pay your first premium to start coverage.

Are There Any Waiting Periods Associated with Final Expense Insurance Policies?

Waiting periods are a key feature, especially for guaranteed issue policies.

- Graded death benefit: Most guaranteed issue policies have a two-year waiting period. If you die of natural causes during this time, your beneficiaries receive a refund of premiums paid, often with interest (e.g., 10%), instead of the full death benefit.

- Accidental death coverage: Accidental death is typically covered in full from day one, even during the waiting period.

- Simplified issue policies: Most simplified issue policies offer full, immediate coverage with no waiting period.

- What is the typical payout timeline for final expense insurance claims? Claims are known for rapid payouts. Once the death certificate is submitted, most are paid within 24 to 72 hours, providing vital funds for immediate expenses.

What Are the Benefits of a Guaranteed Acceptance or Guaranteed Issue Policy?

If you’ve been turned down for coverage due to a serious health condition, guaranteed acceptance (or guaranteed issue) policies are your solution. They do exactly what the name implies: guarantee your acceptance if you’re within the age range (typically 50-85), with no health questions or medical exams.

This makes them a lifeline for individuals with cancer, heart disease, or other chronic illnesses. The primary benefit is certainty—knowing you have a plan in place to protect your family from funeral costs. For many people, this peace of mind is priceless.

While premiums are higher and there’s a two-year waiting period for non-accidental death (where premiums are returned, usually with interest), it provides protection you couldn’t get otherwise. Accidental death is covered from day one. For many, a low cost final expense guaranteed issue policy is the only path to securing protection, and it’s a far better alternative than leaving your family with no coverage at all.

At ShieldWise, we understand that everyone’s health journey is different. For some, guaranteed issue is the right path to securing protection for their loved ones, and that’s perfectly okay. The important thing is taking action to ensure your family won’t bear the financial burden of your final expenses.

Frequently Asked Questions about Affordable Final Expense Coverage

We’re here to provide clear answers to common questions about planning for your family’s future.

Can you get burial insurance with pre-existing health conditions?

Yes. This is a primary reason low cost final expense insurance exists. Most policies do not require a medical exam.

- Simplified issue policies ask a few health questions and are ideal for those with minor or managed conditions, often with immediate coverage.

- Guaranteed issue policies ensure acceptance for those with more serious health challenges, with no health questions asked. These typically have a two-year graded death benefit for natural causes, but they guarantee you can get coverage.

It is always crucial to answer all application questions honestly.

Is the death benefit from a final expense policy tax-free?

Yes, in nearly all cases, the death benefit your beneficiaries receive is completely tax-free. The IRS does not consider it taxable income, so your loved ones get the full policy amount without any tax surprises.

Can I buy a final expense policy for my parents?

Yes, you can buy a policy for your parents. This is a common and thoughtful way to help them plan. You will need to have an “insurable interest” (meaning you’d be financially affected by their passing, such as by paying for the funeral) and, most importantly, your parent must consent to the policy. You can be the policy owner, pay the premiums, and name yourself as the beneficiary to handle their final expenses.

Secure Your Legacy with an Affordable Plan

Thinking about the future, especially our final goodbyes, can feel daunting. But taking the time to plan for end-of-life expenses is truly one of the most loving and responsible things you can do for your family. By exploring low cost final expense insurance, you’re not just crossing an item off a checklist; you’re securing invaluable peace of mind for everyone involved.

We’ve seen how these thoughtful policies can make an enormous difference. They prevent your loved ones from facing unexpected financial burdens during what is already an incredibly difficult time of grief and healing. Imagine them being able to focus on remembering you, rather than scrambling to pay bills. That’s the powerful gift of planning ahead.

At ShieldWise™, we believe this process should be simple, clear, and stress-free. Our goal is to empower you with jargon-free guidance and easy access to genuinely affordable options. We make it straightforward to compare plans from trusted carriers, get instant online quotes, and quickly secure the right coverage that fits both your wishes and your budget.

You don’t have to leave your family to bear this burden alone. Take that proactive step today to ensure your final wishes are honored, your legacy is protected, and your loved ones are cared for, just as you’ve always cared for them.