Why Planning for End-of-Life Coverage Matters

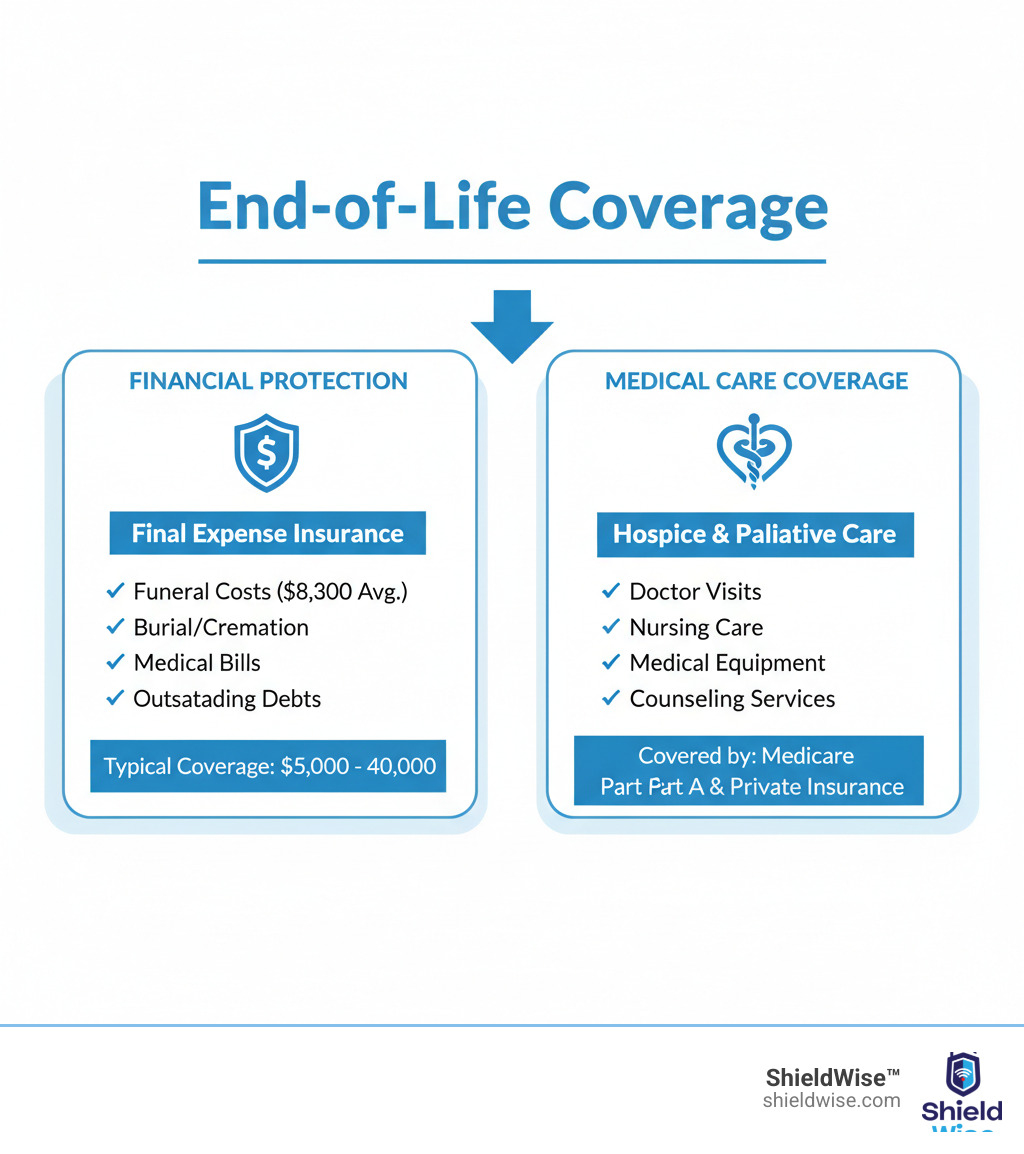

End of life coverage helps families pay for funeral, burial, and final medical expenses when someone passes away. It generally falls into two categories:

- Final Expense Insurance – A small life insurance policy (typically $5,000-$40,000) that pays cash to your family to cover funeral costs, medical bills, and other end-of-life expenses.

- Medical End-of-Life Care – Health insurance coverage for hospice and palliative care services during a terminal illness.

Key Coverage Options at a Glance:

| Coverage Type | What It Pays For | Average Cost |

|---|---|---|

| Final Expense Insurance | Funeral, burial, debts | $30-$70/month |

| Health Insurance (Hospice) | Medical care, pain management | Covered by Medicare/insurance |

| Pre-Need Funeral Plan | Specific funeral services | Varies by funeral home |

Nobody likes thinking about death, but the reality is that the average funeral costs between $8,300 and $10,000. Add in medical bills and legal fees, and your family could face a significant financial burden during an already difficult time. That’s where planning ahead makes all the difference.

Many seniors on fixed incomes worry about becoming a burden to their children. The good news is that end-of-life coverage is more accessible than you might think. Many policies don’t require a medical exam, offer guaranteed acceptance, and feature affordable monthly payments that fit a retirement budget.

This guide walks you through everything you need to know—from final expense insurance to Medicare’s role in hospice care—so you can make an informed decision that protects your family and provides true peace of mind.

Decoding Final Expense Insurance

Think of final expense insurance as a safety net for your final chapter. It’s a type of whole life insurance, but with smaller coverage amounts—typically $5,000 to $40,000—designed to cover funeral costs and other final bills, not replace income. It’s also called burial insurance, though it can be used for much more.

What is final expense insurance for end-of-life coverage?

End of life coverage through final expense insurance is permanent. Unlike term insurance, it never expires as long as premiums are paid. The death benefit is purpose-built for final expenses, so you don’t pay for more insurance than necessary.

Because it’s whole life insurance, your policy builds cash value over time, creating a savings component you can borrow against if needed. Plus, your premiums are fixed from day one and will never increase, regardless of age or health changes.

Expenses Covered by the Payout

One of the best features of final expense insurance is its flexibility. Your beneficiary receives a lump-sum cash payment to use wherever it’s needed most. Common expenses include:

- Funeral Costs: The average funeral runs $8,300 to $10,000. Cremation is also a significant expense.

- Outstanding Medical Bills: Co-pays, deductibles, and uncovered treatments.

- Legal Fees: Costs for probate or settling an estate.

- Household Debts: Credit card balances, personal loans, and utility bills.

If money is left over after immediate expenses are paid, your family can use it for living expenses, providing crucial financial breathing room during a difficult time.

Key Benefits vs. Potential Drawbacks

The biggest benefit is peace of mind, knowing your family won’t face a financial struggle. The application is simple, often with no medical exam, and premiums are locked in for life. For those with health issues, guaranteed acceptance options are available.

The main drawbacks are a smaller death benefit ($5,000-$40,000) and a higher cost per dollar of coverage compared to medically underwritten plans. Some policies, particularly guaranteed issue plans, also have graded death benefits. This means if you die from natural causes in the first 2-3 years, your beneficiary receives a refund of premiums plus interest, not the full benefit.

Types of Final Expense Insurance Policies

When shopping for end of life coverage, you’ll encounter two main policy types:

Simplified Issue policies require you to answer a few health questions but have no medical exam. If you’re in reasonably good health, this is often the best option, as it offers lower premiums and immediate full coverage.

Guaranteed Issue policies ask no health questions and guarantee acceptance for eligible ages (typically 50-85). As Joe Bogardus, a financial services executive, puts it: “Since burial insurance is typically a guaranteed approval policy, it can be a good option for an older person with health issues who might not pass a medical exam.”

This accessibility comes with higher premiums and usually a 2-3 year graded benefit period for natural death. After that period, the full benefit is paid. For those who might otherwise be uninsurable, it provides a valuable path to coverage.

The Role of Health Insurance in End-of-Life Care

While final expense insurance covers costs after you’re gone, health insurance covers medical care during your final months. Healthcare costs spike dramatically in the last year of life, with Medicare spending accounting for a large portion of this for most Americans. Understanding how your health insurance works during this time can save your family from stress and confusion.

Health Insurance’s Role in Providing End-of-Life Coverage for Hospice

Hospice care focuses on comfort, not cure, for those with a terminal illness and a life expectancy of six months or less. To qualify, you must accept comfort care over curative treatments.

Original Medicare Part A provides a comprehensive hospice benefit, typically at no cost to you. It covers a wide range of services, including doctor and nursing care, medical equipment, supplies, and drugs for pain management. It also provides support for families, like grief counseling and short-term respite care. If you have a Medicare Advantage plan, traditional Medicare typically remains the primary payer for hospice. For details, visit the official information on hospice care from Medicare.gov.

Palliative Care and Supportive Services

Palliative care is often confused with hospice but is different. It focuses on improving quality of life for anyone with a serious illness, at any stage, even while pursuing curative treatments. Medicare Parts A and B generally cover palliative care services when medically necessary. Talk with your doctor or plan provider to understand your options. You can learn more about palliative care coverage.

Understanding Health Insurance Considerations for End-of-Life Care

Navigating health insurance for end of life coverage depends on your plan.

- Original Medicare (Parts A & B) offers freedom to see any doctor who accepts Medicare. You’ll have deductibles and coinsurance, which a Medigap plan can help cover. Hospice coverage is comprehensive.

- Medicare Advantage (Part C) plans from private insurers often have lower premiums but use provider networks (HMOs/PPOs), limiting your choice of doctors. Costs can be less predictable, and plans can change annually.

When reviewing your plan, ask about out-of-pocket costs, doctor networks, and coverage for home health services to prevent confusion later.

Community-Based Care Resources

Most people prefer to stay home during a serious illness. Programs like PACE (Programs of All-inclusive Care for the Elderly) are designed to support this preference. PACE is a Medicare and Medicaid program that helps seniors with chronic conditions receive comprehensive care at home instead of in a nursing facility.

A dedicated care team coordinates everything from primary care and prescriptions to therapy and transportation. To qualify, you must be 55 or older, live in a PACE service area, be certified as needing nursing home-level care, and be able to live safely in the community. You can visit the PACE website to see if there’s a program in your area.

Planning and Comparing Your Financial Options

Choosing the right end of life coverage means understanding your family’s future needs and comparing the tools available. A little planning now prevents your loved ones from scrambling during a time of grief. This doesn’t have to be complicated, and a thoughtful plan can protect your family’s financial future.

How to Calculate Your Coverage Needs

To determine how much end of life coverage you need, calculate these key areas:

- Funeral & Burial Costs: The average is $8,300-$10,000. Even cremation is a major expense.

- Debts & Expenses: Unpaid medical bills, legal fees for probate, credit card balances, and personal loans.

- Inflation: Build in a buffer, as costs will rise over time.

Online calculators can provide a helpful estimate. Also, consider creating a final wishes document to outline your preferences for your service, which removes a huge burden from your family.

Final Expense Insurance vs. Pre-Planning with a Funeral Home

When it comes to paying for your funeral, you have two main options:

- Pre-planning with a Funeral Home: You pay a specific funeral home in advance, locking in today’s prices. However, these plans lack flexibility. If you move or the business closes, your family could face complications.

- Final Expense Insurance: You buy a life insurance policy. Your beneficiary receives a tax-free cash payout to use for any expense—funeral, medical bills, or other debts. This provides maximum flexibility and control, as the money isn’t tied to one provider or location. While it doesn’t lock in funeral prices, it offers a versatile financial safety net for end of life coverage.

Factors That Influence Your Premiums

Premiums for final expense insurance, often between $30 and $70 per month, are based on several factors:

- Age: Younger applicants get lower, locked-in rates.

- Gender: Women statistically live longer and typically pay less than men.

- Health Status: Better health means lower rates on simplified issue plans.

- Coverage Amount: A $20,000 policy will cost more than a $5,000 one.

- Policy Type: Guaranteed issue policies cost more than simplified issue.

- Tobacco Use: Smokers almost always pay higher premiums.

Understanding these factors helps you find a policy that fits your budget.

The Application Process

One of the best things about final expense insurance is the simple application process. Here’s how it works:

- Get Quotes: Use a service like ShieldWise to compare plans online.

- Answer Questions: For a simplified issue policy, you’ll answer a few health questions. For guaranteed issue, there are none. No medical exam is required.

- Choose Your Benefit & Beneficiary: Select a coverage amount and name the person who will receive the funds.

- Get Approved: Approval is often instant or within a few days. Coverage begins after your first premium payment.

Frequently Asked Questions about End-of-Life Coverage

We understand that navigating insurance can bring up many questions. Here, we address some of the most common inquiries about end of life coverage to provide you with clarity and confidence.

Can I be denied final expense insurance?

It depends on the policy type. For simplified issue policies, which ask health questions, denial is possible for certain severe conditions, though underwriting is lenient. For guaranteed issue policies, you cannot be denied for health reasons as long as you are within the eligible age range (e.g., 50-85). These policies are designed for individuals who may not qualify for other insurance.

Is the death benefit from final expense insurance taxable?

Generally, no. Life insurance death benefits are paid to beneficiaries income-tax-free. This allows your family to use the full amount for expenses without worrying about taxes. However, for complex estates or unique circumstances, it’s always wise to consult a tax professional.

What happens if I outlive my term life insurance policy?

Term life insurance expires after a set period (e.g., 10, 20, or 30 years). If you outlive it, the coverage simply ends. Final expense insurance is a type of whole life insurance, which means it provides lifetime coverage. As long as you continue paying your premiums, the policy will not expire, ensuring your family receives a benefit no matter when you pass away. This makes it a reliable tool for end of life coverage.

At ShieldWise™, we can help you compare different options and find the right fit for your needs and budget, ensuring you have the peace of mind that comes with knowing your loved ones are protected.

Secure Your Legacy and Protect Your Loved Ones

Planning for end of life coverage is a thoughtful act of love that protects your family from financial stress during a difficult time. The decisions you make today can provide them with security and peace of mind.

We’ve covered two key parts of this plan: final expense insurance for financial protection and health insurance (like Medicare) for medical comfort care. Having a plan in place gives you control and allows your loved ones to focus on healing, not bills.

Comparing insurance can be confusing, which is why ShieldWise exists. We help you compare final expense plans from trusted carriers in one place. Get instant online quotes and find the right fit for your needs and budget without the pressure or jargon.

You deserve peace of mind, and your family deserves financial security. It all starts with taking that first step today.

Ready to explore your options? Compare final expense insurance quotes online and see how easy it can be to protect the people who matter most.